CONSHOHOCKEN, Pa., Aug. 2 /PRNewswire-FirstCall/ -- Quaker Chemical

Corporation (NYSE:KWR) today announced record quarterly sales of

$118.7 million in the second quarter of 2006 and a 67% improvement

in net income to $3.0 million, compared to second quarter 2005

sales of $107.0 million and net income of $1.8 million. Diluted

earnings per share increased to $0.30 for the second quarter of

2006 versus $0.18 in the second quarter of last year. Second

Quarter 2006 Summary Net sales for the second quarter of 2006 were

$118.7 million, up 10.9% from $107.0 million for the second quarter

of 2005. The increase in net sales was driven by a combination of

higher selling prices and volume growth. Volume growth was mainly

attributable to market share growth and increased demand in both

the U.S. and China. Selling price increases continue to be broadly

implemented across all regions and market segments to offset

significantly higher raw material costs. Gross margin as a

percentage of sales was 30.4% for the second quarter of 2006

compared to 30.6% for the second quarter of 2005. Higher selling

prices and a stronger performance from the Company's CMS business

helped maintain margins notwithstanding continued increases in raw

material prices, as crude oil prices have spiked from the low fifty

dollar per barrel range in the second quarter of 2005 to the low

seventy dollar per barrel range in the second quarter of 2006.

Sequentially, the second quarter 2006 gross margin as a percentage

of sales represents an improvement over the first quarter 2006

gross margin percentage of 29.6%. Selling, general and

administrative expenses for the quarter increased $0.7 million

compared to the second quarter of 2005. Cost savings from

restructuring efforts completed in 2005 substantially offset

increased spending in higher growth areas, higher variable

compensation, higher professional fees and inflationary increases.

The increase in net interest expense is attributable to higher

average borrowings and higher interest rates. The decrease in

minority interest expense is due to lower financial performance

from the Company's minority affiliates. Year-to-Date Summary Net

sales for the first half of 2006 were $228.5 million, up 8.2% from

$211.2 million for the first half of 2005. The same factors

discussed above, volume growth in U.S. and China and selling price

increases implemented across all regions and market segments, were

the primary reasons for the increase in net sales. Net income for

the first half of 2006 was $5.5 million compared to $4.9 million

for the first half of 2005, which included a $4.2 million pre-tax

gain from the Company's real estate joint venture, partially offset

by a $1.2 million pre-tax restructuring charge. Gross margin as a

percentage of sales was 30.0% for the first half of 2006 compared

to 30.1% for the first half of 2005. Higher selling prices and a

stronger performance from the Company's CMS business helped

maintain margin percentage despite continued increases in raw

material prices, particularly crude oil derivatives. Selling,

general and administrative expenses for the first half of 2006

decreased $0.2 million compared to the first half of 2005. Cost

savings from restructuring efforts completed in 2005 substantially

offset increased spending in higher growth areas, higher variable

compensation, higher professional fees and inflationary increases.

The Company recorded a pension gain in the first quarter of 2006 of

$0.9 million relating to legislative changes to one of its European

pension plans. During the first quarter of 2005, the Company took a

net pre-tax charge of $1.2 million related to a reduction in its

workforce. The decrease in other income is largely due to $4.2

million of pre-tax gain relating to the Company's real estate joint

venture recorded in 2005. The remainder of the decrease was the

result of foreign exchange losses in the first half of 2006

compared to gains in the first half of 2005. The increase in net

interest expense is attributable to higher average borrowings and

higher interest rates. The decease in minority interest expense for

the year is due to the acquisition of the remaining 40% interest in

the Company's Brazilian affiliate in March of 2005 and lower

financial performance from the Company's minority affiliates.

Balance Sheet and Cash Flow Items The Company's net debt increased

from December 2005, primarily to fund working capital needs, as

well as the restructuring actions taken in the fourth quarter of

2005. The Company's net debt-to-total capital ratio was 39% at June

30, 2006, compared to 40% at March 31, 2006 and 35% at December 31,

2005. Ronald J. Naples, Chairman and Chief Executive Officer,

commented, "We continue to make solid progress towards restoring

our profitability to historical levels. On sequential and prior

year comparisons, we had a fine second quarter. Our earnings

momentum is driven by persistent pricing actions, firming of steel

demand, and strong progress in such key initiatives as Asia/Pacific

growth and chemical management services. While gross margin

percentage improvement remains elusive due to higher raw material

costs, higher revenues are driving absolute dollar improvement in

gross margin. Further, the restructuring actions taken in 2005 have

enabled this gross margin improvement to substantially flow to net

income while allowing for continued investment in business building

initiatives. For the remainder of 2006, we are cautiously

optimistic that we will continue to generate year- over-year

improvement in core earnings, although, of course, we are concerned

about the recent events in the Middle East and the unpredictable

impact they may have on our business environment and costs." Quaker

Chemical Corporation, headquartered in Conshohocken, Pennsylvania,

is a worldwide developer, producer, and marketer of

custom-formulated chemical specialty products and a provider of

chemical management services for manufacturers around the globe,

primarily in the steel and automotive industries. This release

contains forward-looking statements that are subject to certain

risks and uncertainties that could cause actual results to differ

materially from those projected in such statements. A major risk is

that the Company's demand is largely derived from the demand for

its customers' products, which subjects the Company to downturns in

a customer's business and unanticipated customer production

shutdowns. Other major risks and uncertainties include, but are not

limited to, significant increases in raw material costs, customer

financial stability, worldwide economic and political conditions,

foreign currency fluctuations, and future terrorist attacks such as

those that occurred on September 11, 2001. Other factors could also

adversely affect us. Therefore, we caution you not to place undue

reliance on our forward-looking statements. This discussion is

provided as permitted by the Private Securities Litigation Reform

Act of 1995. As previously announced, Quaker Chemical's investor

conference call to discuss second quarter results is scheduled for

August 3, 2006 at 2:30 p.m. (EDT). Access the conference by calling

877-269-7756 or visit Quaker's Web site at

http://www.quakerchem.com/ for a live webcast. Quaker Chemical

Corporation Condensed Consolidated Statement of Income (Dollars in

thousands, except per share data and share amounts) (Unaudited)

(Unaudited) Three Months Ended Six Months Ended June 30, June 30,

2006 2005 2006 2005 Net sales $118,683 $107,042 $228,499 $211,203

Cost of goods sold 82,618 74,333 159,949 147,567 Gross margin

36,065 32,709 68,550 63,636 % 30.4% 30.6% 30.0% 30.1% Selling,

general and administrative 29,789 29,120 57,151 57,337

Restructuring and related activities, net - - - 1,232 Operating

income 6,276 3,589 11,399 5,067 % 5.3% 3.4% 5.0% 2.4% Other income,

net 387 648 515 5,516 Interest expense, net (1,252) (740) (2,217)

(1,174) Income before taxes 5,411 3,497 9,697 9,409 Taxes on income

2,127 1,136 3,680 3,057 3,284 2,361 6,017 6,352 Equity in net

income of associated companies 125 153 238 206 Minority interest in

net income of subsidiaries (417) (719) (721) (1,637) Net income

$2,992 $1,795 $5,534 $4,921 % 2.5% 1.7% 2.4% 2.3% Per share data:

Net income - basic $0.31 $0.19 $0.57 $0.51 Net income - diluted

$0.30 $0.18 $0.56 $0.50 Shares Outstanding: Basic 9,769,682

9,676,463 9,746,685 9,660,163 Diluted 9,833,117 9,795,798 9,824,968

9,826,166 Quaker Chemical Corporation Condensed Consolidated

Balance Sheet (Dollars in thousands, except par value and share

amounts) (Unaudited) June 30, December 31, 2006 2005* ASSETS

Current assets Cash and cash equivalents $12,111 $16,121 Accounts

receivable, net 105,341 93,943 Inventories, net 48,934 45,818

Prepaid expenses and other current assets 12,775 10,111 Total

current assets 179,161 165,993 Property, plant and equipment

150,400 140,903 Less accumulated depreciation 91,623 84,006 Net

property, plant and equipment 58,777 56,897 Goodwill 37,999 35,418

Other intangible assets, net 8,192 8,703 Investments in associated

companies 6,607 6,624 Deferred income taxes 24,284 24,385 Other

assets 35,564 33,975 Total assets $350,584 $331,995 LIABILITIES AND

SHAREHOLDERS' EQUITY Current liabilities Short-term borrowings and

current portion of long-term debt $2,393 $5,094 Accounts and other

payables 55,917 52,923 Accrued compensation 8,964 9,818 Other

current liabilities 16,944 19,053 Total current liabilities 84,218

86,888 Long-term debt 82,684 67,410 Deferred income taxes 4,930

4,608 Other non-current liabilities 58,274 60,573 Total liabilities

230,106 219,479 Minority interest in equity of subsidiaries 7,201

6,609 Shareholders' equity Common stock, $1 par value; authorized

30,000,000 shares; issued 2006 - 9,866,005, 2005 - 9,726,385 shares

9,866 9,726 Capital in excess of par value 4,154 3,574 Retained

earnings 112,622 111,317 Accumulated other comprehensive loss

(13,365) (18,710) Total shareholders' equity 113,277 105,907 Total

liabilities and shareholders' equity $350,584 $331,995 * Condensed

from audited financial statements. Quaker Chemical Corporation

Condensed Consolidated Statement of Cash Flows For the six months

ended June 30, (Dollars in thousands) (Unaudited) 2006 2005* Cash

flows from operating activities Net income $5,534 $4,921

Adjustments to reconcile net income to net cash (used in) provided

by operating activities: Depreciation 4,893 4,548 Amortization 708

646 Equity in undistributed earnings of associated companies, net

of dividends (33) 28 Minority interest in earnings of subsidiaries

721 1,637 Deferred income taxes 334 - Deferred compensation and

other, net 61 27 Stock-based compensation 385 271 Restructuring and

related activities, net - 1,232 Gain on sale of partnership assets

- (2,989) Gain on disposal of property, plant and equipment (8) -

Insurance settlement realized (157) - Pension and other

postretirement benefits (2,752) (368) Increase (decrease) in cash

from changes in current assets and current liabilities, net of

acquisitions: Accounts receivable (8,746) (2,481) Inventories

(2,011) (721) Prepaid expenses and other current assets (2,449)

(171) Accounts payable and accrued liabilities 1,475 2,718 Change

in restructuring liabilities (3,411) (1,382) Net cash (used in)

provided by operating activities (5,456) 7,916 Cash flows from

investing activities Capital expenditures (4,863) (3,196) Payments

related to acquisitions (1,069) (6,700) Proceeds from partnership

disposition of assets - 2,989 Proceeds from disposition of assets

46 670 Interest received on insurance settlement 154 - Change in

restricted cash, net 3 - Net cash used in investing activities

(5,729) (6,237) Cash flows from financing activities Net decrease

in short-term borrowings (2,813) (5,217) Long-term debt borrowings

14,340 - Repayments of long-term debt (474) (518) Dividends paid

(4,199) (4,163) Issuance of common stock 335 181 Distributions to

minority shareholders (350) (2,205) Net cash provided by (used in)

financing activities 6,839 (11,922) Effect of exchange rate changes

on cash 336 (1,728) Net decrease in cash and cash equivalents

(4,010) (11,971) Cash and cash equivalents at the beginning of the

period 16,121 29,078 Cash and cash equivalents at the end of the

period $12,111 $17,107 * Certain reclassifications of prior year

data have been made to improve comparability. DATASOURCE: Quaker

Chemical Corporation CONTACT: Neal E. Murphy, Vice President and

Chief Financial Officer, Quaker Chemical Corporation,

+1-610-832-4189 Web site: http://www.quakerchem.com/

Copyright

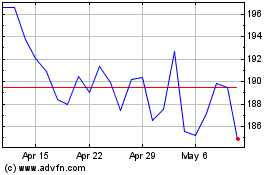

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Oct 2024 to Nov 2024

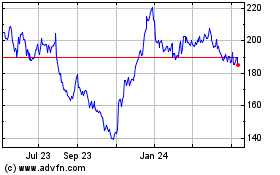

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Nov 2023 to Nov 2024