Myriad Genetics, Inc. (NASDAQ: MYGN), a leader in genetic testing

and precision medicine, today announced financial results for its

second quarter ended June 30, 2024 and raised its previously

issued financial guidance on business performance for the full-year

2024.

“We are very proud to have delivered another quarter of strong

double digit year-over-year revenue growth in the second quarter of

2024. Our year-to-date 2024 revenue growth of 13% year-over-year,

following our 11% year-over-year revenue growth in calendar year

2023, and our 15% year-over-year revenue growth in the second

quarter 2024, demonstrate the sustainability of our organic growth

and gives us the confidence to raise our long-term revenue growth

target to 12%,” said Paul J. Diaz, President and CEO of Myriad

Genetics. “In the second quarter, we saw strong performance across

our portfolio, highlighted by increasing evidence of market share

gains in prenatal testing. We anticipate these trends to continue

as we move through the year and into 2025. In addition, second

quarter average revenue per test improved across our product

portfolio, benefiting from expanded coverage and our ongoing

efforts in revenue cycle management. We remain optimistic about the

evolution of our product portfolio as we continue to publish

additional clinical validation studies and launch new products. At

the same time, we continue to improve access and ease of use for

our customers, as we accelerate electronic medical record (EMR)

integrations for new customers and make meaningful progress in our

Labs of the Future initiative. Myriad Genetics is growing

profitably and delivering improved financial results, including a

17% year-over-year increase in gross profit of $147.1 million, cash

flow from operations of $2.6 million, and $16.4 million of adjusted

operating cash flow. All while continuing to invest in the

innovation required to achieve our mission and vision to reach more

patients with life-saving precision medicine.”

Financial and Operational Highlights

- Test volumes of 389,000 in the second quarter of 2024 increased

9% year-over-year.

- The following table summarizes year-over-year testing volume

changes in the company's core product categories:

| |

Three months ended |

|

|

|

Six months ended |

|

|

| (in thousands) |

June 30, 2024 |

|

June 30, 2023 |

|

% Change |

|

June 30, 2024 |

|

June 30, 2023 |

|

% Change |

|

Product volumes: |

|

|

|

|

|

|

|

|

|

|

|

|

Hereditary cancer |

73 |

|

71 |

|

3 |

% |

|

144 |

|

136 |

|

6 |

% |

|

Tumor profiling |

14 |

|

16 |

|

(13 |

)% |

|

28 |

|

32 |

|

(13 |

)% |

|

Prenatal |

173 |

|

154 |

|

12 |

% |

|

345 |

|

312 |

|

11 |

% |

|

Pharmacogenomics |

129 |

|

117 |

|

10 |

% |

|

253 |

|

227 |

|

11 |

% |

|

Total |

389 |

|

358 |

|

9 |

% |

|

770 |

|

707 |

|

9 |

% |

| |

|

|

|

|

|

|

- The following table summarizes year-over-year revenue changes

in the company's core product categories:

| |

Three months ended |

|

Six months ended |

| (in millions) |

June 30, 2024 |

|

June 30, 2023 |

|

% Change |

|

June 30, 2024 |

|

June 30, 2023 |

|

% Change |

|

Product revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Hereditary cancer |

$ |

91.5 |

|

$ |

76.7 |

|

19 |

% |

|

$ |

179.6 |

|

$ |

152.4 |

|

18 |

% |

|

Tumor profiling |

|

32.6 |

|

|

36.0 |

|

(9 |

)% |

|

|

63.5 |

|

|

73.3 |

|

(13 |

)% |

|

Prenatal |

|

44.4 |

|

|

35.6 |

|

25 |

% |

|

|

88.7 |

|

|

71.8 |

|

24 |

% |

|

Pharmacogenomics |

|

43.0 |

|

|

35.2 |

|

22 |

% |

|

|

81.9 |

|

|

67.2 |

|

22 |

% |

|

Total |

$ |

211.5 |

|

$ |

183.5 |

|

15 |

% |

|

$ |

413.7 |

|

$ |

364.7 |

|

13 |

% |

| |

|

|

|

|

|

|

- Gross margin of 69.6% in the second quarter of 2024 increased

110 basis points year-over-year, reflecting operating leverage and

improved average revenue per test. Adjusted gross margin in the

second quarter of 2024 was 70.1%, an increase of 110 basis points

year-over-year as the company's revenue cycle, Labs of the Future

and supply chain initiatives begin to take hold.

- Second quarter of 2024 operating expenses were $183.6 million.

Adjusted operating expenses were $140.8 million, increasing 6% over

the year ago period. This increase was driven by investments in

technology, product development and R&D. Adjusted operating

expenses accounted for 67% of total revenue in the second quarter

of 2024, down from 73% of total revenue in the second quarter of

2023.

- Operating loss in the second quarter of 2024 was $36.5 million,

improving $77.2 million year-over-year; adjusted operating income

in the second quarter of 2024 was $7.4 million, improving $14.2

million year-over-year.

Business Performance and Highlights

Oncology

The Oncology business delivered revenue of $82.2 million in the

second quarter of 2024.

- Second quarter 2024 hereditary cancer testing revenue in

Oncology grew 11% year-over-year, reflecting ongoing initiatives to

improve average revenue per test through payer coverage expansion

and revenue cycle process improvements that are reducing the

company's no pay rate.

- Second quarter 2024 tumor profiling revenue of $32.6 million

grew 5% compared to first quarter 2024 but decreased 10%

year-over-year, reflecting the ongoing challenging biopharma

environment, slow ramp of biopharma contracts executed in 2023, and

challenges in the international business.

- In July 2024, Myriad Genetics received a patent relating to

detecting circulating tumor DNA in patient fluid samples, which is

complementary to a patent granted earlier in the year for the

company’s methods of preparing cell-free DNA. Both of these patents

support advancing commercialization of the company's high

sensitivity tumor informed Molecular Residual Disease (MRD)

assay.

- In July 2024, Myriad Genetics entered into an agreement with

Personalis, Inc. (Nasdaq: PSNL) to cross-license patent estates

covering tumor-informed approaches to detect MRD. The agreement

helps solidify each company’s freedom to operate in the MRD market

and broadens patient access to the benefits of MRD testing.

- Announced a collaboration with GSK (NYSE: GSK) aimed at

improving access to homologous recombination deficiency (HRD)

diagnostic testing for high-grade serous ovarian cancer (HGSOC)

patients, leveraging Myriad Genetics' MyChoice HRD Plus and

MyChoice CDx Plus tests in nine countries outside the United

States.

- Myriad Genetics and QIAGEN (NYSE: QGEN) agreed to develop a

globally distributable kit-based test for analyzing HRD status to

support research into personalized medicine in multiple solid tumor

types, including ovarian cancer.

- In August 2024, Myriad Genetics announced that it further

advanced its international reorganization efforts, including the

closing of the sale of its EndoPredict business to Eurobio

Scientific. The reorganization of its international operations

better aligns company resources to its domestic opportunities while

continuing to serve key biopharma partners and patients globally

and builds on Myriad Genetics' efforts this year to accelerate

profitable business growth across its portfolio.

Women’s Health

The Women’s Health business delivered revenue of $86.3 million

in the second quarter of 2024.

- Second quarter 2024 hereditary cancer testing revenue in

Women's Health grew 31% year-over-year as more practitioners see

the benefit of incorporating MyRisk with RiskScore as part of a

comprehensive breast cancer risk assessment program.

- Prenatal testing revenue in the second quarter of 2024 grew 25%

year-over-year, reflecting market share gains, expanded coverage by

payers, and ongoing initiatives to improve average revenue per

test.

- Myriad Genetics launched the Universal Plus Panel for

Foresight® Carrier Screen, which includes 39 new conditions and

screens up to 272 genes associated with serious inherited

conditions.

- Ten abstracts, including four on FirstGene, have been accepted

to be showcased at the National Society of Genetic Counselors' 43rd

annual meeting, which begins on September 17, 2024, in New Orleans,

LA.

Pharmacogenomics

In the pharmacogenomics category, GeneSight test revenue was

$43.0 million in the second quarter of 2024.

- Second quarter 2024 GeneSight testing revenue grew 22%

year-over-year, reflecting ongoing initiatives to improve average

revenue per test.

- Currently, biomarker legislation for state-regulated plans has

passed in 15 states. In many of these states, commercial and

managed Medicaid payers have modified their coverage policies to

include GeneSight and Prolaris. Additionally, there are a number of

states that have legislation in process. Myriad Genetics continues

to see an increasing number of payors incorporating, or planning to

incorporate, GeneSight into their coverage. Notably, this includes

Blue Shield of California, a major commercial and managed Medicaid

plan, effective July 1, 2024.

Financial GuidanceMyriad Genetics does not

provide forward-looking guidance on a GAAP basis for the measures

on which it provides forward-looking non-GAAP guidance as the

company is unable to provide a quantitative reconciliation of

forward-looking non-GAAP measures to the most directly comparable

forward-looking GAAP measure, without unreasonable effort, because

of the inherent difficulty in accurately forecasting the occurrence

and financial impact of the various adjusting items necessary for

such reconciliations that have not yet occurred, are dependent on

various factors, are out of the company's control, or cannot be

reasonably predicted. Such adjustments include, but are not limited

to, real estate optimization and transformation initiatives,

certain litigation charges and loss contingencies, costs related to

acquisitions/divestitures and the related amortization, impairment

and related charges, and other adjustments. For example,

stock-based compensation may fluctuate based on the timing of

employee stock transactions and unpredictable fluctuations in the

company's stock price. Any associated estimate of these items and

its impact on GAAP performance could vary materially.

Below is a table summarizing Myriad Genetics' fiscal year 2024

financial guidance*:

| (in

millions, except per share amounts) |

PRIORFY 2024 |

CURRENT FY 2024 |

|

Expected Year-Over-Year Change |

|

|

|

|

|

|

|

|

Revenue |

$820 - $840 |

$835 - $845 |

|

11% - 12% |

|

Gross margin % |

69.5% - 70.5% |

70.0% - 70.5% |

|

100 - 150 bps |

|

Adjusted OPEX |

$572 - $582 |

$575 - $585 |

|

6% - 8% |

|

Adjusted EBITDA** |

$20 - $30 |

$25 - $35 |

|

$36 - $46 |

|

Adjusted EPS*** |

$0.00 - $0.05 |

$0.08 - $0.12 |

|

$0.35 - $0.39 |

| |

|

|

|

|

|

|

* |

Assumes currency

rates as of August 6, 2024. |

|

** |

Adjusted EBITDA is

defined as Net Income (loss) plus income tax expense (benefit),

total other income (expense), non-cash operating expenses, such as

amortization of intangible assets, depreciation, impairment of

long-lived assets, and share-based compensation expense, and

one-time expenses such as expenses from real estate optimization

initiatives, transformation initiatives, legal settlements, and

divestitures and acquisitions. |

|

*** |

Full-year 2024

adjusted EPS is based on a 91 million share count. |

These projections are forward-looking statements and are subject

to the risks summarized in the safe harbor statement at the end of

this press release.

Conference Call and WebcastA conference call

will be held today, Tuesday, August 6, 2024, at 4:30 p.m. EDT to

discuss Myriad Genetics’ financial results and business

developments for the second quarter 2024. A live webcast of the

conference call can be accessed on Myriad Genetics' Investor

Relations website at investor.myriad.com. To participate in the

live conference call via telephone, please register at

https://register.vevent.com/register/BI620080625d0e42be9b313c17391abf61.

Upon registering, a dial-in number and unique PIN will be provided

to join the conference call. Following the conference call, an

archived webcast of the call will be available at

investor.myriad.com.

About Myriad GeneticsMyriad Genetics is a

leading genetic testing and precision medicine company dedicated to

advancing health and well-being for all. Myriad Genetics provides

insights that help people take control of their health and enable

healthcare providers to better detect, treat, and prevent disease.

Myriad Genetics develops and offers genetic tests that help assess

the risk of developing disease or disease progression and guide

treatment decisions across medical specialties where critical

genetic insights can significantly improve patient care and lower

healthcare costs. For more information, visit www.myriad.com.

Myriad, the Myriad logo, BRACAnalysis, BRACAnalysis CDx,

Colaris, ColarisAP, MyRisk, Myriad MyRisk, MyRisk Hereditary

Cancer, MyChoice, Tumor BRACAnalysis CDx, MyChoice CDx, Prequel,

Prequel with Amplify, Amplify, Foresight, Foresight Universal Plus,

Precise Tumor, Precise Oncology Solutions, Precise Liquid, Precise

MRD, FirstGene, SneakPeek, SneakPeek Early Gender DNA Test,

SneakPeek Snap, Urosuite, Mygenehistory, Health.Illuminated.,

RiskScore, Prolaris, GeneSight, and EndoPredict are registered

trademarks or trademarks of Myriad Genetics, Inc. All third-party

marks—® and ™—are the property of their respective owners. © 2024

Myriad Genetics, Inc. All rights reserved.

Revenue by Product (Unaudited)

| |

Three months ended June 30, |

|

|

| (in millions) |

|

2024 |

|

|

2023 |

|

|

| |

WH |

ONC |

PGx |

Total |

|

WH |

ONC |

PGx |

Total |

|

% |

|

Hereditary Cancer |

$ |

41.9 |

$ |

49.6 |

$ |

— |

$ |

91.5 |

|

$ |

32.1 |

$ |

44.6 |

$ |

— |

$ |

76.7 |

|

19 |

% |

| Tumor Profiling |

|

— |

|

32.6 |

|

— |

|

32.6 |

|

|

— |

|

36.1 |

|

— |

|

36.1 |

|

(10 |

)% |

| Prenatal |

|

44.4 |

|

— |

|

— |

|

44.4 |

|

|

35.5 |

|

— |

|

— |

|

35.5 |

|

25 |

% |

| Pharmacogenomics |

|

— |

|

— |

|

43.0 |

|

43.0 |

|

|

— |

|

— |

|

35.2 |

|

35.2 |

|

22 |

% |

| Total Revenue |

$ |

86.3 |

$ |

82.2 |

$ |

43.0 |

$ |

211.5 |

|

$ |

67.6 |

$ |

80.7 |

$ |

35.2 |

$ |

183.5 |

|

15 |

% |

| |

Six months ended June 30, |

|

|

| (in millions) |

|

2024 |

|

|

2023 |

|

|

| |

WH |

ONC |

PGx |

Total |

|

WH |

ONC |

PGx |

Total |

|

% |

|

Hereditary Cancer |

$ |

81.5 |

$ |

98.1 |

$ |

— |

$ |

179.6 |

|

$ |

67.4 |

$ |

85.0 |

$ |

— |

$ |

152.4 |

|

18 |

% |

| Tumor Profiling |

|

— |

|

63.5 |

|

— |

|

63.5 |

|

|

— |

|

73.4 |

|

— |

|

73.4 |

|

(13 |

)% |

| Prenatal |

|

88.7 |

|

— |

|

— |

|

88.7 |

|

|

71.7 |

|

— |

|

— |

|

71.7 |

|

24 |

% |

| Pharmacogenomics |

|

— |

|

— |

|

81.9 |

|

81.9 |

|

|

— |

|

— |

|

67.2 |

|

67.2 |

|

22 |

% |

| Total Revenue |

$ |

170.2 |

$ |

161.6 |

$ |

81.9 |

$ |

413.7 |

|

$ |

139.1 |

$ |

158.4 |

$ |

67.2 |

$ |

364.7 |

|

13 |

% |

| |

Business Units:WH = Women’s HealthONC =

OncologyPGx = Pharmacogenomics

Product Categories:Hereditary Cancer – MyRisk,

BRACAnalysis, BRACAnalysis CDxTumor Profiling – MyChoice CDx,

Prolaris, Precise Tumor, EndoPredictPrenatal – Foresight, Prequel,

SneakPeekPharmacogenomics – GeneSight

|

MYRIAD GENETICS, INC.AND

SUBSIDIARIESCondensed Consolidated Statements of

Operations (unaudited)(in millions, except per share amounts) |

| |

| |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Testing revenue |

$ |

211.5 |

|

|

$ |

183.5 |

|

|

$ |

413.7 |

|

|

$ |

364.7 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of testing revenue |

|

64.4 |

|

|

|

57.8 |

|

|

|

128.9 |

|

|

|

117.0 |

|

|

Research and development expense |

|

27.1 |

|

|

|

21.2 |

|

|

|

52.7 |

|

|

|

43.7 |

|

|

Selling, general, and administrative expense |

|

144.9 |

|

|

|

140.7 |

|

|

|

284.9 |

|

|

|

292.4 |

|

|

Legal settlements |

|

— |

|

|

|

77.5 |

|

|

|

— |

|

|

|

77.5 |

|

|

Goodwill and long-lived asset impairment charges |

|

11.6 |

|

|

|

— |

|

|

|

11.6 |

|

|

|

— |

|

|

Total costs and expenses |

|

248.0 |

|

|

|

297.2 |

|

|

|

478.1 |

|

|

|

530.6 |

|

|

Operating loss |

|

(36.5 |

) |

|

|

(113.7 |

) |

|

|

(64.4 |

) |

|

|

(165.9 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

0.4 |

|

|

|

0.5 |

|

|

|

1.0 |

|

|

|

1.2 |

|

|

Interest expense |

|

(0.8 |

) |

|

|

(0.5 |

) |

|

|

(1.3 |

) |

|

|

(1.0 |

) |

|

Other |

|

(0.3 |

) |

|

|

(2.4 |

) |

|

|

1.6 |

|

|

|

(3.0 |

) |

|

Total other income (expense), net |

|

(0.7 |

) |

|

|

(2.4 |

) |

|

|

1.3 |

|

|

|

(2.8 |

) |

|

Loss before income tax |

|

(37.2 |

) |

|

|

(116.1 |

) |

|

|

(63.1 |

) |

|

|

(168.7 |

) |

| Income tax (benefit)

expense |

|

(0.5 |

) |

|

|

— |

|

|

|

(0.4 |

) |

|

|

2.1 |

|

| Net loss |

$ |

(36.7 |

) |

|

$ |

(116.1 |

) |

|

$ |

(62.7 |

) |

|

$ |

(170.8 |

) |

| Net loss per share: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.41 |

) |

|

$ |

(1.42 |

) |

|

$ |

(0.69 |

) |

|

$ |

(2.10 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

90.6 |

|

|

|

81.7 |

|

|

|

90.3 |

|

|

|

81.5 |

|

|

|

|

MYRIAD GENETICS, INC.AND

SUBSIDIARIESCondensed Consolidated Balance Sheets

(unaudited)(in millions, except share information) |

|

|

|

|

June 30,2024 |

|

December 31,2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

92.4 |

|

|

$ |

132.1 |

|

|

Marketable investment securities |

|

4.9 |

|

|

|

8.8 |

|

|

Trade accounts receivable |

|

117.8 |

|

|

|

114.3 |

|

|

Inventory |

|

26.1 |

|

|

|

22.0 |

|

|

Prepaid taxes |

|

18.4 |

|

|

|

17.0 |

|

|

Prepaid expenses and other current assets |

|

21.6 |

|

|

|

19.4 |

|

|

Assets held for sale |

|

10.4 |

|

|

|

— |

|

|

Total current assets |

|

291.6 |

|

|

|

313.6 |

|

| Operating lease right-of-use

assets |

|

56.5 |

|

|

|

61.6 |

|

| Property, plant and equipment,

net |

|

116.3 |

|

|

|

119.0 |

|

| Intangibles, net |

|

319.5 |

|

|

|

349.5 |

|

| Goodwill |

|

286.3 |

|

|

|

287.4 |

|

| Other assets |

|

14.9 |

|

|

|

15.4 |

|

|

Total assets |

$ |

1,085.1 |

|

|

$ |

1,146.5 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

|

33.3 |

|

|

|

25.8 |

|

|

Accrued liabilities |

|

98.3 |

|

|

|

113.9 |

|

|

Current maturities of operating lease liabilities |

|

13.3 |

|

|

|

16.2 |

|

|

Liabilities held for sale |

|

4.0 |

|

|

|

— |

|

|

Total current liabilities |

|

148.9 |

|

|

|

155.9 |

|

| Unrecognized tax benefits |

|

31.1 |

|

|

|

30.2 |

|

| Long-term debt |

|

38.8 |

|

|

|

38.5 |

|

| Noncurrent operating lease

liabilities |

|

91.2 |

|

|

|

97.4 |

|

| Other long-term

liabilities |

|

34.6 |

|

|

|

41.3 |

|

|

Total liabilities |

|

344.6 |

|

|

|

363.3 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

| Common stock, 90.9 and 89.9

shares outstanding at June 30, 2024 and December 31, 2023,

respectively |

|

0.9 |

|

|

|

0.9 |

|

|

Additional paid-in capital |

|

1,435.8 |

|

|

|

1,415.5 |

|

|

Accumulated other comprehensive loss |

|

(4.0 |

) |

|

|

(3.7 |

) |

|

Accumulated deficit |

|

(692.2 |

) |

|

|

(629.5 |

) |

|

Total stockholders' equity |

|

740.5 |

|

|

|

783.2 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,085.1 |

|

|

$ |

1,146.5 |

|

|

|

|

MYRIAD GENETICS, INC.AND

SUBSIDIARIESCondensed Consolidated Statements of Cash

Flows (unaudited)(in millions) |

| |

| |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by (used in)

operating activities |

$ |

2.6 |

|

|

$ |

(0.9 |

) |

|

$ |

(16.0 |

) |

|

$ |

(34.1 |

) |

| Net cash (used in) provided by

investing activities |

|

(6.4 |

) |

|

|

11.8 |

|

|

|

(13.5 |

) |

|

|

46.4 |

|

| Net cash provided by (used in)

financing activities |

|

2.4 |

|

|

|

38.4 |

|

|

|

(6.4 |

) |

|

|

33.5 |

|

| Effect of foreign exchange

rates on cash, cash equivalents, and restricted cash |

|

(0.7 |

) |

|

|

0.3 |

|

|

|

(1.5 |

) |

|

|

0.5 |

|

| Change in cash and cash

equivalents classified as held for sale |

|

(2.3 |

) |

|

|

— |

|

|

|

(2.3 |

) |

|

|

— |

|

| Net (decrease) increase in

cash, cash equivalents, and restricted cash |

|

(4.4 |

) |

|

|

49.6 |

|

|

|

(39.7 |

) |

|

|

46.3 |

|

| Cash, cash equivalents, and

restricted cash at beginning of the period |

|

105.6 |

|

|

|

63.1 |

|

|

|

140.9 |

|

|

|

66.4 |

|

| Cash, cash equivalents, and

restricted cash at end of the period |

$ |

101.2 |

|

|

$ |

112.7 |

|

|

$ |

101.2 |

|

|

$ |

112.7 |

|

| |

Safe Harbor StatementThis press release

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including the

company's updated fiscal year 2024 financial guidance, the

expectations of trends in financial performance to continue through

the year and into 2025, the company's long-term revenue growth

target, the company's expectation of additional market share gains

in prenatal testing, the company's plans to continue to publish

additional clinical validation studies and launch new products,

statements relating to the company improving access and ease of use

for customers as the company accelerates EMR integrations for new

customers and makes progress in its Labs of the Future initiative,

and that the company is growing profitably, delivering improved

financial results, and continuing to invest in the innovation

required to achieve its mission and vision to reach more patients

with life-saving precision medicine. These “forward-looking

statements” are management’s present expectations of future events

as of the date hereof and are subject to a number of known and

unknown risks and uncertainties that could cause actual results,

conditions, and events to differ materially and adversely from

those anticipated.

These risks include, but are not limited to: the risk that sales

and profit margins of the company’s existing tests may decline; the

risk that the company may not be able to operate its business on a

profitable basis; risks related to the company’s ability to achieve

certain revenue growth targets and generate sufficient revenue from

its existing product portfolio or in launching and commercializing

new tests to be profitable; risks related to changes in

governmental or private insurers’ coverage and reimbursement levels

for the company’s tests or the company’s ability to obtain

reimbursement for its new tests at comparable levels to its

existing tests; risks related to increased competition and the

development of new competing tests; the risk that the company may

be unable to develop or achieve commercial success for additional

tests in a timely manner, or at all; the risk that the company may

not successfully develop new markets or channels for its tests; the

risk that licenses to the technology underlying the company’s tests

and any future tests are terminated or cannot be maintained on

satisfactory terms; risks related to delays or other problems with

operating the company’s laboratory testing facilities and the

transition of such facilities to the company's new laboratory

testing facilities; risks related to public concern over genetic

testing in general or the company’s tests in particular; risks

related to regulatory requirements or enforcement in the United

States and foreign countries and changes in the structure of the

healthcare system or healthcare payment systems; risks related to

the company’s ability to obtain new corporate collaborations or

licenses and acquire or develop new technologies or businesses on

satisfactory terms, if at all; risks related to the company’s

ability to successfully integrate and derive benefits from any

technologies or businesses that it licenses, acquires or develops;

the risk that the company is not able to secure additional

financing to fund its business, if needed, in a timely manner or on

favorable terms, if it all; risks related to the company’s

projections or estimates about the potential market opportunity for

the company’s current and future products; the risk that the

company or its licensors may be unable to protect or that third

parties will infringe the proprietary technologies underlying the

company’s tests; the risk of patent-infringement claims or

challenges to the validity of the company’s patents; risks related

to changes in intellectual property laws covering the company’s

tests, or patents or enforcement, in the United States and foreign

countries; risks related to security breaches, loss of data and

other disruptions, including from cyberattacks; risks of new,

changing and competitive technologies in the United States and

internationally and that the company may not be able to keep pace

with the rapid technology changes in its industry, or properly

leverage new technologies to achieve or sustain competitive

advantages in its products; the risk that the company may be unable

to comply with financial or operating covenants under the company’s

credit or lending agreements; the risk that the company may not be

able to maintain effective disclosure controls and procedures and

internal control over financial reporting; risks related to current

and future investigations, claims or lawsuits, including derivative

claims, product or professional liability claims, and risks related

to the amount of the company's insurance coverage limits and scope

of insurance coverage with respect thereto; and other factors

discussed under the heading “Risk Factors” contained in Item 1A of

the company’s Annual Report on Form 10-K filed with the U.S.

Securities and Exchange Commission (SEC) on February 28, 2024 as

updated in the company's Quarterly Report on Form 10-Q filed with

the SEC on May 8, 2024, as well as any further updates to those

risk factors filed from time to time in the company’s Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K. Myriad

Genetics is not under any obligation, and it expressly disclaims

any obligation, to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise

except as required by law.

Statement regarding use of non-GAAP

financial measuresIn this press release, the company’s

financial results and financial guidance are provided in accordance

with accounting principles generally accepted in the United States

(GAAP) and using certain non-GAAP financial measures. Management

believes that presentation of operating results using non-GAAP

financial measures provides useful supplemental information to

investors and facilitates the analysis of the company’s core

operating results and comparison of operating results across

reporting periods. Management also uses non-GAAP financial measures

to establish budgets and to manage the company’s business. A

reconciliation of the GAAP financial results to non-GAAP financial

results is included in the schedules below and a description of the

adjustments made to the GAAP financial measures is included at the

end of the schedules.

The company encourages investors to carefully consider its

results under GAAP, as well as its supplemental non-GAAP

information and the reconciliation between these presentations, to

more fully understand its business. Non-GAAP financial results are

reported in addition to, and not as a substitute for, or superior

to, financial measures calculated in accordance with

GAAP.

The company does not forecast GAAP operating expenses, net

income (loss) or earnings per share because it cannot predict

certain elements that are included in reported GAAP

results. Please see above under “Financial Guidance”

for a full explanation.

Reconciliation of GAAP to Non-GAAP Financial

Measuresfor the Three and Six Months Ended June

30, 2024 and 2023(unaudited data in millions, except per

share amounts)

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted Gross

Margin |

|

|

|

|

|

|

|

|

Gross Profit(1) |

$ |

147.1 |

|

|

$ |

125.7 |

|

|

$ |

284.8 |

|

|

$ |

247.7 |

|

|

Acquisition - amortization of intangible assets |

|

0.3 |

|

|

|

0.3 |

|

|

|

0.6 |

|

|

|

0.6 |

|

|

Equity compensation |

|

0.6 |

|

|

|

0.4 |

|

|

|

0.9 |

|

|

|

0.7 |

|

|

Transformation initiatives |

|

— |

|

|

|

0.2 |

|

|

|

— |

|

|

|

0.2 |

|

|

Other adjustments |

|

0.2 |

|

|

|

— |

|

|

|

0.4 |

|

|

|

— |

|

| Adjusted Gross Profit |

$ |

148.2 |

|

|

$ |

126.6 |

|

|

$ |

286.7 |

|

|

$ |

249.2 |

|

| Adjusted Gross Margin |

|

70.1 |

% |

|

|

69.0 |

% |

|

|

69.3 |

% |

|

|

68.3 |

% |

| (1) Consists of

total revenues less cost of testing revenue from the Condensed

Consolidated Statements of Operations. |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted Operating

Expenses |

|

|

|

|

|

|

|

| Operating Expenses(1) |

$ |

183.6 |

|

|

$ |

239.4 |

|

|

$ |

349.2 |

|

|

$ |

413.6 |

|

|

Acquisition - amortization of intangible assets |

|

(10.2 |

) |

|

|

(10.3 |

) |

|

|

(20.6 |

) |

|

|

(20.6 |

) |

|

Goodwill and long-lived asset impairment charges |

|

(11.6 |

) |

|

|

— |

|

|

|

(11.6 |

) |

|

|

— |

|

|

Equity compensation |

|

(14.0 |

) |

|

|

(10.8 |

) |

|

|

(25.6 |

) |

|

|

(17.9 |

) |

|

Real estate optimization |

|

(2.3 |

) |

|

|

(3.5 |

) |

|

|

(3.5 |

) |

|

|

(11.0 |

) |

|

Transformation initiatives |

|

(2.0 |

) |

|

|

(2.7 |

) |

|

|

(4.0 |

) |

|

|

(6.8 |

) |

|

Legal charges, net of insurance reimbursement |

|

(0.5 |

) |

|

|

(77.9 |

) |

|

|

(0.4 |

) |

|

|

(78.2 |

) |

|

Other adjustments |

|

(2.2 |

) |

|

|

(0.8 |

) |

|

|

(3.6 |

) |

|

|

(1.2 |

) |

| Adjusted Operating

Expenses |

$ |

140.8 |

|

|

$ |

133.4 |

|

|

$ |

279.9 |

|

|

$ |

277.9 |

|

| (1) Consists of

research and development expense and selling, general and

administrative expense, goodwill and lived-asset impairment

charges, and legal settlements from the Condensed Consolidated

Statements of Operations. |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted Operating

Income (Loss) |

|

|

|

|

|

|

|

| Operating Loss |

$ |

(36.5 |

) |

|

$ |

(113.7 |

) |

|

$ |

(64.4 |

) |

|

$ |

(165.9 |

) |

|

Acquisition - amortization of intangible assets |

|

10.4 |

|

|

|

10.7 |

|

|

|

21.1 |

|

|

|

21.3 |

|

|

Goodwill and long-lived asset impairment charges |

|

11.6 |

|

|

|

— |

|

|

|

11.6 |

|

|

|

— |

|

|

Equity compensation |

|

14.6 |

|

|

|

11.1 |

|

|

|

26.5 |

|

|

|

18.5 |

|

|

Real estate optimization |

|

2.3 |

|

|

|

3.5 |

|

|

|

3.5 |

|

|

|

11.0 |

|

|

Transformation initiatives |

|

2.1 |

|

|

|

2.9 |

|

|

|

4.0 |

|

|

|

7.0 |

|

|

Legal charges, net of insurance reimbursement |

|

0.6 |

|

|

|

77.9 |

|

|

|

0.5 |

|

|

|

78.2 |

|

|

Other adjustments |

|

2.3 |

|

|

|

0.8 |

|

|

|

4.0 |

|

|

|

1.2 |

|

| Adjusted Operating Income

(Loss) |

$ |

7.4 |

|

|

$ |

(6.8 |

) |

|

$ |

6.8 |

|

|

$ |

(28.7 |

) |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted Net Income

(Loss)(1) |

|

|

|

|

|

|

|

| Net Loss |

$ |

(36.7 |

) |

|

$ |

(116.1 |

) |

|

$ |

(62.7 |

) |

|

$ |

(170.8 |

) |

|

Acquisition - amortization of intangible assets |

|

10.4 |

|

|

|

10.7 |

|

|

|

21.1 |

|

|

|

21.3 |

|

|

Goodwill and long-lived asset impairment charges |

|

11.6 |

|

|

|

— |

|

|

|

11.6 |

|

|

|

— |

|

|

Equity compensation |

|

14.6 |

|

|

|

11.1 |

|

|

|

26.5 |

|

|

|

18.5 |

|

|

Real estate optimization |

|

2.3 |

|

|

|

3.5 |

|

|

|

3.5 |

|

|

|

11.0 |

|

|

Transformation initiatives |

|

2.1 |

|

|

|

2.9 |

|

|

|

4.0 |

|

|

|

7.0 |

|

|

Legal charges, net of insurance reimbursement |

|

0.6 |

|

|

|

77.9 |

|

|

|

0.5 |

|

|

|

78.2 |

|

|

Other adjustments |

|

2.3 |

|

|

|

0.8 |

|

|

|

2.5 |

|

|

|

1.2 |

|

|

Tax adjustments |

|

(2.7 |

) |

|

|

2.8 |

|

|

|

(3.0 |

) |

|

|

9.8 |

|

| Adjusted Net Income

(Loss) |

$ |

4.5 |

|

|

$ |

(6.4 |

) |

|

$ |

4.0 |

|

|

$ |

(23.8 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

90.6 |

|

|

|

81.7 |

|

|

|

90.3 |

|

|

|

81.5 |

|

|

Diluted |

|

91.5 |

|

|

|

81.7 |

|

|

|

91.5 |

|

|

|

81.5 |

|

| Adjusted Earnings (Loss) Per

Share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.05 |

|

|

$ |

(0.08 |

) |

|

$ |

0.04 |

|

|

$ |

(0.29 |

) |

|

Diluted |

$ |

0.05 |

|

|

$ |

(0.08 |

) |

|

$ |

0.04 |

|

|

$ |

(0.29 |

) |

| (1) To determine

Adjusted Earnings (Loss) Per Share, or adjusted EPS. |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted

EBITDA |

|

|

|

|

|

|

|

|

Net Loss |

$ |

(36.7 |

) |

|

$ |

(116.1 |

) |

|

$ |

(62.7 |

) |

|

$ |

(170.8 |

) |

|

Acquisition - amortization of intangible assets |

|

10.4 |

|

|

|

10.7 |

|

|

|

21.1 |

|

|

|

21.3 |

|

|

Depreciation expense |

|

4.3 |

|

|

|

2.7 |

|

|

|

8.8 |

|

|

|

5.6 |

|

|

Goodwill and long-lived asset impairment charges |

|

11.6 |

|

|

|

— |

|

|

|

11.6 |

|

|

|

— |

|

|

Equity compensation |

|

14.6 |

|

|

|

11.1 |

|

|

|

26.5 |

|

|

|

18.5 |

|

|

Real estate optimization(1) |

|

2.3 |

|

|

|

3.5 |

|

|

|

3.5 |

|

|

|

11.0 |

|

|

Transformation initiatives |

|

2.1 |

|

|

|

2.9 |

|

|

|

4.0 |

|

|

|

7.0 |

|

|

Legal charges, net of insurance reimbursement |

|

0.6 |

|

|

|

77.9 |

|

|

|

0.5 |

|

|

|

78.2 |

|

|

Interest expense, net of interest income(2) |

|

0.4 |

|

|

|

— |

|

|

|

0.3 |

|

|

|

(0.2 |

) |

|

Other adjustments |

|

2.6 |

|

|

|

3.2 |

|

|

|

2.5 |

|

|

|

4.2 |

|

|

Income tax (benefit) expense(3) |

|

(0.5 |

) |

|

|

— |

|

|

|

(0.4 |

) |

|

|

2.1 |

|

| Adjusted EBITDA |

$ |

11.7 |

|

|

$ |

(4.1 |

) |

|

$ |

15.7 |

|

|

$ |

(23.1 |

) |

| (1) Real estate

optimization includes $0.4 million and $0.9 million for the three

and six months ended June 30, 2024, respectively, and $5.8 million

of depreciation expense for the six months ended June 30, 2023. No

depreciation expense was included for the three months ended June

30, 2023. |

| (2) Derived from

interest expense and interest income from the Condensed

Consolidated Statements of Operations. |

| (3) Derived from

income tax (benefit) from the Condensed Consolidated Statement of

Operations. |

| |

Adjusted Free Cash Flow

Reconciliationfor the Three Months Ended June 30,

2024 and 2023(unaudited data in millions)

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flow from

operations |

$ |

2.6 |

|

|

$ |

(0.9 |

) |

|

$ |

(16.0 |

) |

|

$ |

(34.1 |

) |

|

Real estate optimization |

|

3.0 |

|

|

|

3.5 |

|

|

|

9.2 |

|

|

|

11.0 |

|

|

Transformation initiatives |

|

2.1 |

|

|

|

2.9 |

|

|

|

4.0 |

|

|

|

1.3 |

|

|

Legal charges, net of insurance reimbursement |

|

0.6 |

|

|

|

0.4 |

|

|

|

0.6 |

|

|

|

2.2 |

|

|

Contingent consideration payment |

|

5.8 |

|

|

|

— |

|

|

|

5.8 |

|

|

|

— |

|

|

Other adjustments |

|

2.3 |

|

|

|

— |

|

|

|

3.5 |

|

|

|

0.4 |

|

| Adjusted operating cash

flow |

$ |

16.4 |

|

|

$ |

5.9 |

|

|

$ |

7.1 |

|

|

$ |

(19.2 |

) |

|

Capital expenditures |

|

(5.2 |

) |

|

|

(18.8 |

) |

|

|

(11.9 |

) |

|

|

(42.3 |

) |

|

Capitalization of internal-use software costs |

|

(3.7 |

) |

|

|

— |

|

|

|

(5.6 |

) |

|

|

— |

|

| Adjusted free cash flow |

$ |

7.5 |

|

|

$ |

(12.9 |

) |

|

$ |

(10.4 |

) |

|

$ |

(61.5 |

) |

Following is a description of the adjustments made to GAAP

financial measures:

- Acquisition – amortization of intangible assets – represents

recurring amortization charges resulting from the acquisition of

intangible assets.

- Equity compensation – non-cash equity-based compensation

provided to Myriad Genetics employees and directors.

- Real estate optimization – costs related to real estate

initiatives. Prior to the fourth quarter 2023 reporting period,

these costs were included in the transformation initiatives

category. With respect to the adjusted free cash flow

reconciliation, the cash flow effect of real estate optimizations

excludes non-cash items such as accelerated depreciation. These

costs include the following:

- For the three months ended June 30, 2024, additional rent as a

result of the build-out of our new laboratories in Salt Lake City,

Utah, and South Francisco, California, while maintaining our

current laboratories in those locations and testing and set-up

costs for equipment in our new facilities.

- For the three months ended June 30, 2023, additional rent as a

result of the build-out of our new laboratories in Salt Lake City,

Utah, and South San Francisco, California, while maintaining our

current laboratories in those locations.

- For the six months ended June 30, 2024, additional rent as a

result of the build-out of our new laboratories in Salt Lake City,

Utah, and South Francisco, California, while maintaining our

current laboratories in those locations and testing and set-up

costs for equipment in our new facilities, lease terminations

gains, net of lease termination losses, impairment charges and

other abandonment costs.

- For the six months ended June 30, 2023, additional rent as a

result of the build-out of our new laboratories in Salt Lake City,

Utah, and South San Francisco, California, while maintaining our

current laboratories in those locations, and accelerated

depreciation in connection with our decision to cease the use of

our former corporate headquarters in Salt Lake City, Utah.

- Transformation initiatives – costs related to transformation

initiatives including:

- For the three and six months ended June 30, 2024, consulting

and professional fees.

- For the three and six months ended June 30, 2023, consulting

and professional fees and severance costs related to

restructuring.

- Legal charges, net of insurance reimbursement – one-time legal

expenses, net of insurance reimbursement. With respect to the

adjusted free cash flow reconciliation, the cash flow effect

includes cash paid for settlements in the related period.

- Other adjustments – other one-time non-recurring expenses

including:

- For the three months ended June 30, 2024, changes in the fair

value of contingent consideration related to acquisitions from

prior years, severance, and other consulting costs.

- For the three months ended June 30, 2023, primarily includes

changes in the fair value of contingent consideration related to

acquisitions from prior years.

- For the six months ended June 30, 2024, primarily includes a

gain recognized on acquisition, changes in the fair value of

contingent consideration related to acquisitions from prior years,

the reclassifications of cumulative translation adjustments to

income upon liquidation of an investment in a foreign entity,

severance, and costs incurred in connection with executive

personnel changes.

- For the six months ended June 30, 2023, consulting and

professional fees related to prior year acquisitions and changes in

the fair value of contingent consideration related to acquisitions

from prior years.

- For purposes of adjusted EBITDA, other adjustments include the

items listed above as well as amounts included in other

income/expense in the financial statements.

- Depreciation expense - depreciation expense recognized on our

fixed assets.

- Goodwill and long-lived asset impairment charges – for the

three and six months ended June 30, 2024, primarily the impairment

of assets held for sale related to the sale of the EndoPredict

business to Eurobio Scientific.

- Contingent consideration payment – for the three months ended

June 30, 2024, the payment of contingent consideration related to

the previous acquisition of Sividon Diagnostics GmbH.

- Tax adjustments – tax expense/(benefit) due to non-GAAP

adjustments, differences between stock compensation recorded for

book purposes as compared to the allowable tax deductions, and

valuation allowance recognized against federal and state deferred

tax assets in the United States.

- As of June 30, 2024, a valuation allowance of $63.3 million was

not recognized for non-GAAP purposes given our historical and

forecasted positive earnings performance.

- As of June 30, 2023, a valuation allowance of $37.2 million was

not recognized for non-GAAP purposes given our historical and

forecasted positive earnings performance.

- For purposes of adjusted EBITDA, the income tax expense

adjustment includes the income tax expense (benefit) recognized in

the financial statements.

|

Media Contact: |

Megan Manzari(385) 318-3718megan.manzari@myriad.com |

Investor Contact: |

Matt Scalo(801) 584-3532matt.scalo@myriad.com |

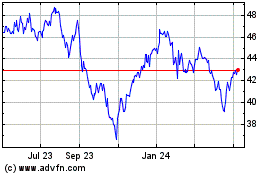

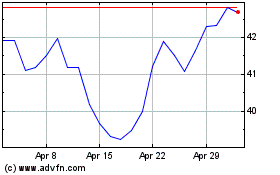

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Sep 2024 to Oct 2024

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Oct 2023 to Oct 2024