QIAGEN (NYSE: QGEN; Frankfurt Prime Standard: QIA) will announce

today at its Capital Markets Day a commitment to deliver solid

profitable growth through 2028 – led by about 7% compound annual

sales growth (CAGR) at constant exchange rates (CER) during the

four-year period and achieving at least a 31% CER adjusted

operating income margin in 2028.

The event, which starts at 12:00 New York time /

17:00 London time / 18:00 Frankfurt time at the New York Stock

Exchange, will feature presentations and a Q&A session with

Thierry Bernard, CEO of QIAGEN, along with Roland Sackers (CFO),

Nitin Sood (Head of Life Sciences), Fernando Beils (Head of

Molecular Diagnostics) and Jonathan Sheldon (Head of QIAGEN Digital

Insights).

A live webcast is available at

https://capitalmarketsday2024.qiagen.com/home/default.aspx. A

replay and related materials will be available at this link after

the event.

QIAGEN’s leadership team will present the new

2028 targets, highlighting QIAGEN’s vision and strategy to sharpen

its focus on growth pillars in the portfolio combined with

commitments to solid profitable growth and disciplined capital

allocation. This includes plans to return at least $1 billion to

shareholders from 2024-2028, absent value-creating M&A

opportunities, along with a high level of organic business

investments.

“QIAGEN is moving ahead with a reinvigorated

leadership team committed to stepping up with more focus and

delivering on our new targets. We are sharpening our focus on our

growth pillars, and this reflects our unwavering determination to

build and maintain profitable leadership positions in fast-growing

markets. We are creating ecosystems around these important pillars

as we announce important new product launches to maximize their

value to customers across the continuum from research to clinical

healthcare. This is combined with QIAGEN raising the bar on

profitability and a commitment to create greater value for our

shareholders and stakeholders,” Thierry Bernard will discuss in his

presentation.

“QIAGEN has developed a strong foundation for

continued financial success in delivering solid profitable growth

in recent years. We have announced new efficiency initiatives and

want to harness the power of digitization to free up resources to

enhance growth and profitability. Given our healthy balance sheet

and cash flow generation, we are announcing a commitment for

significant returns to shareholders while maintaining a high level

of investments into our business and seeking value-creating M&A

opportunities that strengthen our portfolio and create greater

value,” Roland Sackers will elaborate in his presentation.

The 2028 strategy involves the

following:

-

Sharpen focus on growth pillars to sustain profitable

growth

QIAGEN has set a goal for at least $2 billion of

combined annual sales in 2028 from its pillars amid plans for new

product launches and important investments:QIAcuity digital

PCR: QIAGEN is more than tripling the number of sales

specialists supporting QIAcuity to drive adoption as over 100 new

assays are launched. The QIAcuity-Dx version is also planned to

receive U.S. regulatory clearance in 2024 for clinical use, with

submission of an assay for detection of the BCR-ABL biomarker for

onco-hematology planned for 2025. QIAGEN also signed its first

companion diagnostic agreement for QIAcuity with an undisclosed

pharma partner.QIAstat-Dx: QIAGEN confirmed plans for the

U.S. regulatory submission of a new panel for syndromic diagnosis

of meningitis in 2024 to complement the European version, building

on the recent U.S. regulatory approval of the gastrointestinal

panel and upgraded respiratory panel. QIAGEN also plans for the

U.S. and European submissions of three panels by 2028 involving

blood culture, complicated urinary tract infections (cUTIs) and

pneumonia. Also in the U.S., new “mini panels” are planned to be

submitted for U.S. regulatory approval in 2024. These new panels

will enable the diagnosis of five pathogens causing respiratory or

gastrointestinal conditions, and are designed to address customer

demands.

QIAGEN Digital Insights: QIAGEN confirmed

plans to accelerate investments into this business with at least

nine new product launches planned by 2028. These plans also include

a 40% expansion in the commercial team to extend the global

presence into new geographic markets. QIAGEN intends to continue

investing about 20% of QDI sales into R&D to combine the power

of AI (artificial intelligence) and human-curated knowledge bases,

with plans to grow from the current 5 AI-enabled applications

across the portfolio to at least 14 by 2028.

Sample technologies: Two important new

instrument launches are planned along with several new consumables

kits to strengthen QIAGEN’s leadership in this important first step

of lab workflows. QIAsymphony Connect is planned for launch in 2025

as an upgrade of the flagship QIAsymphony automation system,

building on over 3,300 cumulative placements. QIAGEN also plans to

enter the high-throughput automation market with the launch of

QIAsprint Connect in 2026. New kits are planned for use on QIAGEN’s

full portfolio of instruments in high-growth applications including

liquid biopsy, microbiomes and pathogen detection.

QuantiFERON: QIAGEN is a key enabler of

the global initiative to eradicate tuberculosis, a potentially

fatal bacterial infection, through its QuantiFERON-TB Gold Plus

test. About 60% of the global market for annual latent TB testing

remains available for conversion from the tuberculin skin test, as

QIAGEN steps up commercialization initiatives backed by its

best-in-class test and top automation solution with partners

DiaSorin, Tecan and Hamilton. QIAGEN is also partnering with

DiaSorin on a test for detection of Lyme Disease, which is

available in Europe and has been submitted for U.S. regulatory

approval.

-

Drive efficiency and digitization to fuel growth and improve

profitability

QIAGEN announced plans to achieve at least a 31%

CER adjusted operating income margin in 2028. Key drivers involve a

series of new initiatives to free up resources for reallocation and

to expand operational margins.

These initiatives include streamlining the

portfolio, in particular the recent decision to discontinue the

NeuMoDx system. They also include initiatives to simplify the

organization, improve end-to-end processes, in particular through

an upgrade of QIAGEN’s SAP enterprise resource system; and optimize

the site network. QIAGEN is seeking to harness the power of

digitization to fuel growth and improve profitability, with about

30 AI initiatives under way.

-

Ensure disciplined capital allocation for growth and shareholder

value

QIAGEN plans to continue implementing its

disciplined capital allocation strategy anchored by strong cash

flow trends and a healthy balance sheet.

This strategy involves (1) profitable organic

investments into the business; (2) focused M&A through

value-creating transactions, and (3) a new plan to return at least

$1 billion to shareholders from 2024 to 2028 (absent M&A).

QIAGEN returned approximately $300 million to shareholders through

a synthetic share repurchase in January 2024, and shareholders will

be asked at the upcoming Annual General Meeting to approve a new

$300 million synthetic repurchase program.

-

Deliver strategy through responsibility, empowerment and

reinvigorated leadership

Achieving these 2028 targets can only be done by

creating an even stronger culture among QIAGEN’s 6,000 employees in

terms of empowerment, accountability and ownership. QIAGEN

reaffirmed its commitment to its ESG (Environment, Social,

Governance) goals, including a validated target to reach net zero

carbon emissions by 2050 and maximize contributions to more than 50

public health partnerships around the world.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding

company, is the leading global provider of Sample to Insight

solutions that enable customers to gain valuable molecular insights

from samples containing the building blocks of life. Our sample

technologies isolate and process DNA, RNA and proteins from blood,

tissue and other materials. Assay technologies make these

biomolecules visible and ready for analysis. Bioinformatics

software and knowledge bases interpret data to report relevant,

actionable insights. Automation solutions tie these together in

seamless and cost-effective workflows. QIAGEN provides solutions to

more than 500,000 customers around the world in the Life Sciences

(academia, pharma R&D and industrial applications, primarily

forensic) and Molecular Diagnostics (human healthcare). As of March

31, 2024, QIAGEN employed 6,000 people in over 35

locations worldwide. Further information can be found at

http://www.qiagen.com.Forward-Looking Statement

Certain statements contained in this press

release may be considered forward-looking statements within the

meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, and Section 21E of the U.S. Securities Exchange Act of

1934, as amended. To the extent that any of the statements

contained herein relating to QIAGEN's products, timing for launch

and development, marketing and/or regulatory approvals, financial

and operational outlook, growth and expansion, collaborations,

markets, strategy or operating results, including without

limitation its expected adjusted net sales and adjusted diluted

earnings results, are forward-looking, such statements are based on

current expectations and assumptions that involve a number of

uncertainties and risks. Such uncertainties and risks include, but

are not limited to, risks associated with management of growth and

international operations (including the effects of currency

fluctuations, regulatory processes and dependence on logistics),

variability of operating results and allocations between customer

classes, the commercial development of markets for our products to

customers in academia, pharma, applied testing and molecular

diagnostics; changing relationships with customers, suppliers and

strategic partners; competition; rapid or unexpected changes in

technologies; fluctuations in demand for QIAGEN's products

(including fluctuations due to general economic conditions, the

level and timing of customers' funding, budgets and other factors);

our ability to obtain regulatory approval of our products;

difficulties in successfully adapting QIAGEN's products to

integrated solutions and producing such products; the ability of

QIAGEN to identify and develop new products and to differentiate

and protect our products from competitors' products; market

acceptance of QIAGEN's new products and the integration of acquired

technologies and businesses; actions of governments, global or

regional economic developments, weather or transportation delays,

natural disasters, political or public health crises, and its

impact on the demand for our products and other aspects of our

business, or other force majeure events; as well as the possibility

that expected benefits related to recent or pending acquisitions

may not materialize as expected; and the other factors discussed in

our most recent Annual Report on Form 20-F. For further

information, please refer to the discussions in reports that QIAGEN

has filed with, or furnished to, the U.S. Securities and Exchange

Commission.

Source: QIAGEN N.V.Category: Financial

John Gilardi

QIAGEN N.V.

+49 2103 29 11711

ir@qiagen.com

Domenica Martorana

QIAGEN N.V.

+49 2103 11244

ir@qiagen.com

Thomas Theuringer

QIAGEN N.V.

+49 2103 29 11826

pr@qiagen.com

Lisa Mannagottera

QIAGEN N.V.

+49 2103 29 14181

pr@qiagen.com

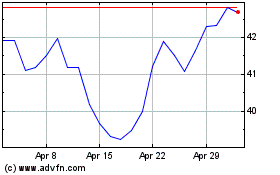

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

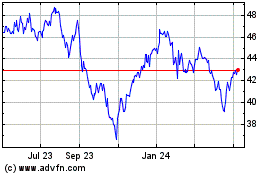

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Dec 2023 to Dec 2024