Terrafina (”TERRA”) (BMV: TERRA13), a leading

Mexican industrial real estate investment trust (“FIBRA”),

externally advised by PGIM Real Estate and dedicated to the

acquisition, ownership, development, lease and management of

industrial real estate properties in Mexico, announced the

following:

Pursuant to articles 64 Bis 1 and 68 of the

Securities Market Law and article 218 of the General Law of

Negotiable Instruments and Credit Transactions, and in accordance

with Clause 4.1 of the Irrevocable Trust Agreement number F/00939

dated January 29, 2013 (as the same has been and is amended, the

“Trust Agreement”) and the global certificate with ticker “TERRA

13” (the "Certificates") issued by CIBanco, S.A., Institución de

Banca Múltiple, as trustee of the Trust, PLA Administradora

Industrial, S. de R.L. de C.V., as settlor and advisor, TF

Administradora, S. de R.L. de C.V., as subsidiary manager and Monex

Casa de Bolsa, Monex Grupo Financiero as common representative (the

“Common Representative”) of the holders of the Certificates (the

“Holders”), such Holders are called to participate in the Ordinary

and Extraordinary Holders’ Meeting, to be held on April 15, 2020 at

11:00 A.M. (the “Holders’ Meetings”) remotely, as provided in the

last part of paragraph (b) of the section "Provisions related to

the Holders’ Meeting" of the Global Certificate, considering that,

due to the current situation in Mexico derived from the COVID-19

pandemic, the offices of the Common Representative are not

available for meetings as part of the efforts to prevent the

concentration of people and limit the spread of the virus, in order

to protect the health of participants. These Holders’ Meetings

shall address the following agenda:

AGENDA

ORDINARY HOLDERS´MEETING

I. Proposal, discussion and, if applicable,

approval of the audited annual financial statements of the Trust

for the fiscal year ended 2019, pursuant to the provisions set

forth in Clause 4.3, section (a), subsection (i) of the Trust

Agreement.

II. Proposal, discussion and, if applicable,

approval of the Annual Report as of December 31, 2019, pursuant to

the provisions set forth in Clause 4.3, section (a), subsection

(ii) of the Trust Agreement.

III. Appointment, ratification and/or removal of

members of the Technical Committee of the Trust, pursuant to the

provisions set forth in Clause 4.3, section (a), subsection (iii)

of the Trust Agreement, and, if applicable, the qualification of

independence by the Holders

Meeting.

EXTRAORDINARY

HOLDERS´MEETING

VI. Proposal, discussion and, if applicable,

approval of certain amendment to the Trust Agreement, and if

applicable, any other Issuance Document in order to amend Clause VI

“Common Representative” of the Trust. Actions and resolutions in

connection with such regard.

ORDINARY AND EXTRAORDINARY

HOLDERS´MEETING

Appointment of the delegate or delegates to

formalize, and if applicable, comply with the resolutions adopted

in the Holders’ Meetings.

Holders that intend to participate in the

Holders’ Meetings, shall submit no later than the business day

prior to the date of such Meetings: (i) the deposit certificate

issued by S.D. Indeval Institución para el Depósito de Valores,

S.A. de C.V., (ii) the list that for such purposes is issued by the

corresponding custodian, if applicable, and (iii) the proxy letter

duly signed before two witnesses or, if applicable, the power of

attorney for the representation at the Holders´ Meetings granted

under the terms of the applicable law, at the offices of the Common

Representative addressed to José Roberto Flores Coutiño, Rebeca

Erives Sepúlveda and/or Martha Corona Benavides from 9:00 to 15:00

and 16:30 to 17:30 hours, from Monday to Friday, as from the date

of the publication of this call. Upon delivery of the documentation

referred to in this paragraph, the Common Representative shall

provide the Holders with the necessary information regarding the

telephone and/or digital platform to be used for the Holders’

Meetings so that they can connect remotely to such Holders´

Meetings Likewise, the Holders are free to contact the Common

Representative, either via email (jfloresc@monex.com.mx) or by

telephone (+52-55) 5231-0141 with any questions related to the

scope of this agenda.

Mexico City, March 25, 2020CIBanco, S.A.,

Institución de Banca Múltiple,in its capacity as trustee of the

Trust F/00939

Antonio Rangel Fernández McGregorTrustee

Delegate

Gerardo Ibarrola SamaniegoTrustee Delegate

Contacts:

Francisco Martínez, IROTerrafinaTel: +52 (55) 5279-8107E-mail:

francisco.martinez@terrafina.mx

Ana María YbarraMiranda IRTel: +52 1 553-660-4037E-mail:

ana.ybarra@miranda-ir.com

About TerrafinaTerrafina

(BMV:TERRA13) is a Mexican real estate investment trust formed

primarily to acquire, develop, lease and manage industrial real

estate properties in Mexico. Terrafina’s portfolio consists of

attractive, strategically located warehouses and other light

manufacturing properties throughout the Central, Bajio and Northern

regions of Mexico. It is internally managed by highly-qualified

industry specialists and externally advised by PGIM Real

Estate.

Terrafina owns 300 real estate properties,

including 289 developed industrial facilities with a collective GLA

of approximately 42.3 million square feet and 11 land reserve

parcels, designed to preserve the organic growth capability of the

portfolio.

Terrafina’s objective is to provide attractive

risk-adjusted returns for the holders of its certificates through

stable distributions and capital appreciations. Terrafina aims to

achieve this objective through a successful performance of its

industrial real estate and complementary properties, strategic

acquisitions, access to a high level of institutional support, and

to its management and corporate governance structure. For more

information, please visit www.terrafina.mx

About PGIM Real Estate PGIM,

the global investment management business of Prudential Financial,

Inc. (NYSE), is one of largest real estate investment managers in

the world, with more than $179.2 billion1 in gross real estate

assets under management and administration, as of December 31,

2019. Through its PGIM Real Estate and PGIM Real Estate Finance

businesses, PGIM leverages a 140-year history of real estate

lending on behalf of institutional and middle-market borrowers, a

49-year legacy of investing in commercial real estate on behalf of

institutional investors, and the deep local knowledge and expertise

of professionals in 31 cities around the world.

PGIM Real Estate, the real estate investment

management business of PGIM, has been redefining the real estate

investing landscape since 1970. Combining insights into

macroeconomic trends and global real estate markets with excellence

of execution and risk management, PGIM Real Estate’s tenured team

offers to its global clients a broad range of real estate equity,

debt, and securities investment strategies that span the

risk-return spectrum and geographies. For more information, visit

www.pgimrealestate.com.

(1) AUA equals $US37.1 billion.(2) Includes legacy lending

through PGIM’s parent company, Prudential Financial, Inc.

About Prudential Financial,

Inc.Prudential Financial, Inc. (NYSE:PRU), a financial

services leader with more than US$1.6 trillion of assets under

management as of December 31, 2019, has operations in the United

States, Asia, Europe, and Latin America. Prudential’s diverse and

talented employees are committed to helping individual and

institutional customers grow and protect their wealth through a

variety of products and services, including life insurance,

annuities, retirement-related services, mutual funds and investment

management. In the U.S., Prudential’s iconic Rock symbol has stood

for strength, stability, expertise and innovation for more than a

century. For more information, please visit

www.news.prudential.com

Forward Looking StatementsThis

document may include forward-looking statements that may imply

risks and uncertainties. Terms such as "estimate", "project",

"plan", "believe", "expect", "anticipate", "intend", and other

similar expressions could be construed as previsions or estimates.

Terrafina warns readers that declarations and estimates mentioned

in this document, or realized by Terrafina’s management imply risks

and uncertainties that could change in function of various factors

that are out of Terrafina’s control. Future expectations reflect

Terrafina’s judgment at the date of this document. Terrafina

reserves the right or obligation to update the information

contained in this document or derived from this document. Past or

present performance is not an indicator to anticipate future

performance.

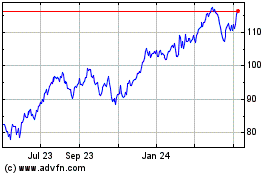

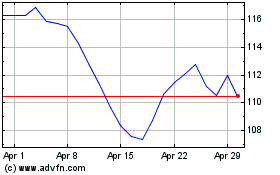

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Dec 2023 to Dec 2024