Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 20 2019 - 4:55PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration No. 333-223355

Prudential Financial, Inc.

$1,000,000,000 4.350% Medium-Term Notes, Series E

Due February 25, 2050

Final

Term Sheet, February 20, 2019

|

|

|

|

|

Issuer:

|

|

Prudential Financial, Inc.

|

|

|

|

|

Ratings*:

|

|

Baa1 (Moody’s) / A (S&P)

|

|

|

|

|

Security:

|

|

Medium-Term Notes, Series E

|

|

|

|

|

Trade Date:

|

|

February 20, 2019

|

|

|

|

|

Settlement Date:

|

|

February 25, 2019 (T+3 days*)

|

|

|

|

|

Maturity Date:

|

|

February 25, 2050

|

|

|

|

|

Principal Amount:

|

|

$1,000,000,000

|

|

|

|

|

Price to Investors:

|

|

99.763%

|

|

|

|

|

Net Proceeds (before expenses):

|

|

$988,880,000

|

|

|

|

|

Pricing Benchmark:

|

|

3.375% due November 15, 2048

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

107-15/2.994%

|

|

|

|

|

Spread to Benchmark:

|

|

+ 137 basis points

|

|

|

|

|

Re-offer

Yield:

|

|

4.364%

|

|

|

|

|

Coupon:

|

|

4.350% per annum

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on the 25th day of each February and August, starting August 25, 2019.

|

|

|

|

|

Regular Record Dates:

|

|

The business day preceding an Interest Payment Date

|

|

|

|

|

Day Count Fraction:

|

|

30/360

|

|

|

|

|

Business Day Convention:

|

|

Following unadjusted

|

|

|

|

|

Business days, if different from those

specified in the Prospectus Supplement,

that apply:

|

|

Not applicable

|

|

|

|

|

Denominations:

|

|

$1,000 x $1,000

|

|

|

|

|

Make-Whole Redemption:

|

|

Prior to August 25, 2049, redeemable at a redemption price equal to the greater of (a) 100% of the principal amount of the Notes and (b) the discounted value at CMT rate plus 25 basis points, plus accrued and unpaid

interest to but excluding the redemption date.

|

|

|

|

|

Optional Redemption:

|

|

On or after August 25, 2049, redeemable at a redemption price equal to 100% of the principal amount of the Notes, plus accrued and unpaid interest to the redemption

date.

|

|

|

|

|

|

Joint Bookrunners:

|

|

Morgan Stanley & Co. LLC

BNP Paribas Securities Corp.

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

U.S. Bancorp Investments, Inc.

|

|

|

|

|

Billing and Delivery Agent:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

Co-Managers:

|

|

ICBC Standard Bank Plc

Santander Investment Securities Inc.

SMBC Nikko Securities America, Inc.

Standard Chartered Bank

CastleOak Securities, L.P.

Drexel Hamilton, LLC

Mischler Financial Group, Inc.

Samuel A. Ramirez & Company, Inc.

Siebert Cisneros Shank & Co., L.L.C.

The Williams Capital Group, L.P.

|

|

|

|

|

CUSIP Number:

|

|

74432QCE3

|

* Prudential Financial, Inc. expects that delivery of the Notes will be made against payment therefor on or about the third

business day following the date of confirmation of orders with respect to the Notes (this settlement cycle being referred to as “T+3”). Pursuant to Rule

15c6-1

under the United States Securities

Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes on the date of

pricing will be required, by virtue of the fact that the Notes initially will settle in T+3, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes should consult their own

advisors.

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating agencies base their ratings on such

material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The rating of the notes should be evaluated independently from similar ratings of other securities. A credit rating of a security is

not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

Investing in the Notes involves a number of risks. See “Risk Factors” included or incorporated by reference in the prospectus supplement dated

March 1, 2018 and the related prospectus dated March 1, 2018.

Prudential Financial, Inc. has filed a registration statement (including a

prospectus) and a prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents Prudential

Financial, Inc. has filed with the SEC for more complete information about the issuer and this offering. You should rely on the prospectus, prospectus supplement and any relevant free writing prospectus or pricing supplement for complete details.

You may get these documents for free by visiting the SEC Web site at www.sec.gov. Alternatively, copies of the prospectus and the prospectus supplement may be obtained by contacting Morgan Stanley & Co. LLC toll free at

1-888-454-3965,

BNP Paribas Securities Corp. toll-free at

1-800-854-5674,

Deutsche Bank Securities Inc. toll-free at

1-800-503-4611,

HSBC

Securities (USA) Inc. toll-free at

1-866-811-8049,

Merrill Lynch, Pierce, Fenner & Smith Incorporated toll free at

1-800-294-1322

or U.S. Bancorp Investments, Inc. toll free at

1-877-558-2607.

2

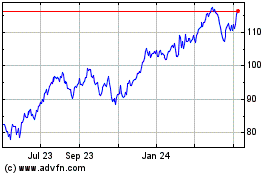

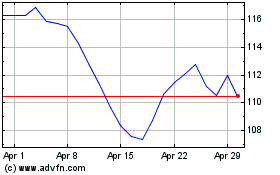

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025