BOK Financial Expands in Kansas - Analyst Blog

October 04 2013 - 11:00AM

Zacks

On Wednesday, BOK Financial Corporation (BOKF)

announced a deal for the acquisition of Kansas-based GTRUST

Financial Corporation, an independent trust and asset management

company. Though the share price of BOK Financial was expected to

get a boost after the announcement, it declined slightly based on

market dynamics and stood at $62.71.

Financial terms of the agreement were not disclosed. Further, the

acquisition is anticipated to be completed before the end of the

fourth quarter 2013, subject to certain customary regulatory

approval.

The acquisition by BOK Financial demonstrates its aim of

diversifying its revenue opportunities by increasing its fee-based

business. This is the first acquisition of a fee-only financial

planner by the company. Moreover, BOK Financial expects to leverage

the new wealth management potential of GTRUST across its geographic

footprints. Further, following the acquisition, the company’s

assets under management would increase by $600 million.

Previously, the company had purchased United Banks of Colorado in

2007 and Colorado State Bank and Trust in 2003. Last year, BOK

Financial completed the acquisition of Denver-based The Milestone

Group Inc., a wealth management firm. Notably, over the period of

one year, The Milestone Group has increased its discretionary

assets by 19%.

GTRUST Financial, which provides varied financial services in

Topeka, Wichita, Marysville, Larned and Overland Park, was founded

in 1991. The services provided by the firm includes asset and risk

management, tax planning, fee-only financial planning, debt

management, estate planning and charitable capital strategy.

Having strengthened its foothold over the years, through its local

bank brand, Colorado State Bank and Trust, BOK Financial has a

robust presence in Denver. Therefore, with the acquisition of

GTRUST Financial, the company will expand in Kansas with the help

of the acquired firm’s wealth management brand and proficiency.

With the aim of providing a wide array of investment products to

its clients, BOK Financial has become enthusiastic in making

acquisitions and preparing a platform for growth. Moreover, this

acquisition depicts the company’s efforts toward providing quality

investment services and advice to clients.

On the other hand, the deal widens GTRUST Financial’s scope and

will help its expansion efforts with the commitment of providing

investment decisions to its clients. Moreover, there will be no

change in the company’s current client teams.

Overall, the clients of GTRUST Financial will have access to the

additional services and products provided by Colorado State Bank

and Trust, while BOK Financial will take advantage of GTRUST

Financial’s investment management potencies.

Our Viewpoint

The acquisitions of such asset management companies are welcome as

they play a major role in preserving investor confidence in the

stock. We also believe that BOK Financial’s diverse revenue stream,

sturdy capital position and expense control initiatives augur well

for investors.

Capital deployment efforts also bode well and boost investors’

confidence. Nevertheless, a protracted economic recovery and its

exposure to the energy sector and risky assets remain our

concerns.

BOK Financial currently carries a Zacks Rank #3 (Hold).Some

companies in the same sector that are worth considering include

BofI Holding, Inc. (BOFI) and Central

Pacific Financial Corp. (CPF) with a Zacks Rank #1 (Strong

Buy), while Prosperity Bancshares Inc. (PB)

carries a Zacks Rank #2 (Buy).

BOFI HLDG INC (BOFI): Free Stock Analysis Report

BOK FINL CORP (BOKF): Free Stock Analysis Report

CENTRAL PAC FIN (CPF): Free Stock Analysis Report

PROSPERITY BCSH (PB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

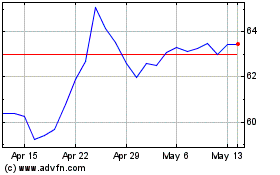

Prosperity Bancshares (NYSE:PB)

Historical Stock Chart

From Jun 2024 to Jul 2024

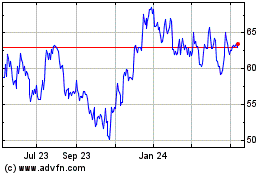

Prosperity Bancshares (NYSE:PB)

Historical Stock Chart

From Jul 2023 to Jul 2024