NOTICE OF EXEMPT SOLICITATION

NAME OF REGISTRANT: Procter & Gamble

NAME OF PERSON RELYING ON EXEMPTION: James R. Epstein

ADDRESS OF PERSON RELYING ON EXEMPTION: 21 Dupont Circle NW, Suite

410, Washington, DC 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934.

————————————

Procter & Gamble [NYSE:PG]:

Due to the Company’s aggressive and inconsistent communications

regarding forest degradation and deforestation in the supply chain, its continued operational and regulatory risk, and its negative optics

regarding the Company’s reputation including fulfillment of its pledge to be a Force for Good we recommend

| ● | Vote AGAINST CEO and Board Chair Jon Moeller (Item 1.k) |

| ● | Vote AGAINST Lead Director, Joe Jimenez (Item 1.f) |

| ● | Vote AGAINST Angela Braly (Item 1.d) |

| ● | Vote AGAINST Patricia Woertz (Item 1.n) |

September 28, 2023

Dear fellow Procter & Gamble shareholders–

Procter & Gamble’s response to our Exempt Solicitation urging

shareholders to oppose the re-election of Jon Moeller, Joe Jimenez, Angela Braly, and Patricia Woertz to the company’s board

necessitates additional expansion on and clarification of why it is necessary for shareholders to support our recommendation.1

Before that, however, we wish to note that we are not simply small individual shareholders, as P&G seems to imply; we are descendants

of James Gamble and William Procter, the company’s founders, and are significant shareholders in our own right. Building on

our original cohort, 30 more descendants have joined the nine who filed the solicitation on September 11th in signing this letter.

We also wish to underscore that it is the board’s responsibility

to represent shareholders. It is in our interest to assess the performance of the company’s board and executive leadership regarding

how they have managed risk and responded to shareholder concerns, and to hold the board accountable when the company has failed to deliver

meaningful action to mitigate risk. In 2020, we were part of the 67% of P&G shareholders who supported a proposal filed by Green Century

Capital Management that called on the company to increase the scale, pace, and rigor of its efforts to eliminate deforestation and forest

degradation from its supply chains.2

Now, we are urging our fellow shareholders to revisit this issue and

assess whether P&G’s actions have been sufficient. Ultimately, shareholders’ decisions as to whether to vote against these

four members of the board should rest on three questions: 1) Is P&G’s overall response to this issue a matter worthy of shareholder

consideration?; 2) Has P&G had enough time to effectively respond to the 2020 proposal?; and 3) Does P&G still endure significant

material risk associated with the company’s palm oil and pulp sourcing?

Investors will recognize that the answer to all three of these questions

is yes, and P&G’s September 20th solicitation only further solidifies how intertwined the company’s leadership is with

its ineffective response.

_____________________________

1 Procter & Gamble. September 20, 2023. “Additional

definitive proxy soliciting materials and Rule 14(a)(12) material.” https://www.sec.gov/Archives/edgar/data/80424/000008042423000078/pgcommitrespforestry.htm.

2 Green Century Capital Management. October 13, 2020. “P&G

Shareholders Resoundingly Support Deforestation Proposal.” https://www.greencentury.com/pg-shareholders-resoundingly-support-deforestation-proposal/.

P&G’s palm oil and wood pulp sourcing has significant and

outsized impact on the company’s revenue, according to its own disclosures. In P&G’s 2022 CDP Forests report, P&G

discloses that between 51-60% of its revenue is dependent on palm oil, while 21-30% of its revenue is dependent on pulp.3

In its solicitation, P&G diminishes the significance of the company’s palm oil and pulp sourcing in the context of our recommendation,

saying that they do not wish to “give outsized weight or influence to a shareholder group focused on a single issue that is only

one aspect of our larger global supply chain, compliance, and risk management approach.” But with such a large portion of the company’s

business admittedly dependent on these commodities, this focus undoubtedly merits consideration by shareholders.

In the nearly three years since the 2020 resolution, the risks to

P&G from its palm oil and wood pulp sourcing practices have only grown and will continue to grow in the coming years, and extend far

beyond reputational risk. Multiple governments have advanced policies that restrict trade in or hold companies accountable for their

role in deforestation and forest degradation, indicating that the regulatory environment is quickly catching up to shareholder sentiment

and creating additional risk for P&G.4 In fact, under the Glasgow Leaders’ Declaration on Forests and Land Use, signed

in 2021, 145 countries have committed to halt and reverse deforestation and land degradation by 2030, indicating the potential for a groundswell

of new regulations in the coming years.5 Furthermore, both the palm oil and wood pulp sectors are expected to grow significantly

in the coming years, adding even more strain to the geographies from which these commodities are sourced.6

At the same time, the company’s operational risk has grown as

the very forests it relies on to make its single-use tissue products face unprecedented threats, including record-breaking wildfires.

In fact, as we write this letter, more than 200 wildfires in Canada are both active and uncontrolled, fueled by climate change and pervasive

logging industry practices across the areas from which P&G sources.7 And yet P&G’s plan to address its role

in the climate crisis is both weaker than its peers’ and out of alignment with climate science.8

Instead of meaningful action, the company has made misleading statements

to investors that it prohibits forest degradation in its supply chain, when in fact it continues to source both from primary forests and

threatened boreal caribou habitat.9 This led the Natural Resources Defense Council to file a complaint with the U.S. Securities

and Exchange Commission in November 2022.10 After NRDC challenged the company on the inaccuracy of its claim that it prohibits

degradation, P&G removed any mention of forest degradation in its May 2023 policy update. In our opinion, P&G has yet to issue

a credible, consistent justification for that decision–instead using the jargon of “streamlining” to explain the new

policy.11 While they claim the updated language was issued for the sake of “helping promote clarity and consistency for

[their] stakeholders,” it in fact does just the opposite because their policy and expectations are now neither clear nor internally

consistent. The SEC has yet to issue a response to the complaint, meaning P&G can still be at risk of enforcement actions.

_____________________________

3 Procter & Gamble. December 2022. “P&G CDP

Forestry Response.” https://s1.q4cdn.com/695946674/files/doc_downloads/2022/12/Forestry-2022_ProcterGamble.pdf. These figures reflect

a response to the CDP question (F1.2) indicating “the percentage of your organization’s revenue that was dependent on your

disclosed forest risk commodity(ies) in the reporting year.”

4 Governor Jared Polis. April 22, 2022. “Executive

Order D 2022 016: Amending and Restating Executive Order D 2019 016 Concerning the Greening of State Government.” https://drive.google.com/file/d/1ip_uhAXPAJYmZ9zGysJLR0ZlFJO8ynlA/view.

European Union. June 29, 2023. “Regulation on deforestation-free products.” https://environment.ec.europa.eu/topics/forests/deforestation/regulation-deforestation-free-products_en.

5 Governments of Albania, Andorra, Angola, et al. February

11, 2021. “Glasgow Leaders’ Declaration on Forests and Land Use.” https://webarchive.nationalarchives.gov.uk/ukgwa/20230418175226/https://ukcop26.org/glasgow-leaders-declaration-on-forests-and-land-use/.

6 Grand View Research. May 15, 2022. https://www.grandviewresearch.com/industry-analysis/palm-oil-market.

Precision Reports. August 16, 2023. “Paper and Pulp Market Size, Trends and Outlook for 2023-2030.” https://www.linkedin.com/pulse/paper-pulp-market-size-trends-outlook-2023-2030-1f/.

7 Natural Resources Canada. September 22, 2023. “National

Wildfire Situation Report.” https://cwfis.cfs.nrcan.gc.ca/report.

8 Visinovschi, Ion. Planet Tracker. August 2023. “Climate

Transition - Unilever Leads; Colgate and P&G Lag.” https://planet-tracker.org/wp-content/uploads/2023/08/FMCG-climate-transition.pdf.

9 Procter & Gamble. July 2022. “Forestry Practices

Update July 2022.” https://s1.q4cdn.com/695946674/files/doc_downloads/2022/07/Forestry-Practices-Update-July-2022.pdf.

10 Skene, Jennifer. Natural Resources Defense Council. November

30, 2022. “Letter to SEC regarding certain public disclosures by Procter & Gamble.” https://www.nrdc.org/sites/default/files/media-uploads/pg_complaint_11.30.22.pdf.

11 P&G. September 20, 2023. “Additional definitive

proxy soliciting materials.”

The board’s response to shareholder concern on this issue raises

even larger questions about the company’s environmental claims, the board’s judgment in investor communications, and overall

ability to assess and address financial risk. For example, last April, Green Century Capital Management filed another shareholder proposal

further pressing P&G to deliver meaningful action to address its forest sourcing risk.12 In June, P&G filed a “no

action” request with the SEC, claiming that they should not be required to publish the proposal in their proxy statement because,

in part, it “has already established a policy that prohibits deforestation and the degradation of intact forests,” even though

the company still maintained its sourcing from intact forests and caribou habitat.13 That P&G’s board sanctioned

such a brazen mischaracterization of its actions and expectations in service of preventing an opportunity for further shareholder engagement

deeply concerns us, as it should all shareholders.

Finally, we want to note that P&G’s reputation risks damage

because of the company’s practices, not because we have given interviews. In fact, many news outlets, including CBS Mornings,

Reuters, and the Financial Times, covered the problems in the company’s supply chain before any of us spoke publicly

of our concerns.14

P&G says they don’t know what they could do to satisfy us,

so we would like to make it quite clear: P&G could deliver a credible policy and time-bound plan to eliminate deforestation, primary

forest degradation, and human rights violations from its supply chains, applied at the corporate group level, and paired with a robust

non-compliance protocol.

In their September 20th filing, P&G quite clearly laid out the

extent to which the board and executive leadership have engaged and sanctioned the company’s response to the 2020 shareholder proposal.

Their subsequent activities and shareholder communications have demonstrated how fundamentally ill-positioned P&G’s leadership

currently is to address the myriad operational, regulatory, and reputational risks within its palm oil and wood pulp supply chains, on

which a substantial portion of the business is dependent. The risk will only grow in the coming years.

We believe then, that P&G’s board and executive leadership

are the ones that need to be held to account.

James R. Epstein

Aran Ansari

Gabriella Ansari

Leili Ansari

Amelie Carey

Julianna Childs

Fred Draper

Matthew Draper

Justine Epstein

Richard Epstein

Jules Feeney

_____________________________

12 Green Century Capital Management. April 29, 2022. “Shareholder

Proposal for 2022 Annual Shareholder Meeting.” https://www.sec.gov/divisions/corpfin/cf-noaction/14a-8/2022/greenp&g071822-14a8.pdf.

13 Procter & Gamble. June 7, 2022. “Letter to

U.S. Securities and Exchange Commission recommending no action re: shareholder proposal submitted by Green Century Equity Fund.”

https://www.sec.gov/divisions/corpfin/cf-noaction/14a-8/2022/greenp&g071822-14a8.pdf. Notably, the proponent withdrew the proposal

after receipt of the no action request.

14 Ivanova, Irina. October 10, 2019. “Environmentalists

have a new target: Charmin toilet paper.” https://www.cbsnews.com/news/charmin-toilet-paper-puts-procter-gamble-p-g-in-environmentalists-crosshairs/.

Naidu, Richa. September 27, 2019. “Nestle, P&G say they will miss 2020 deforestation goals.” https://www.reuters.com/article/consumer-goods-deforestation-idAFL2N26I0WC.

Gray, Alistair and Patrick Temple-West. October 13, 2020. “Investor rebellion at Procter & Gamble over environmental concerns.”

https://www.ft.com/content/1dd92502-e95b-4c21-be1c-c18a598acf1a.

Ian Gamble

Maya Golowasch

Devon Greenwood

Ben Kahrl

Judy Kahrl

Hunter Knight

Salley Knight

Samsun Knight

Angela Laignel

Caty Laignel

Aurora Matthews

Christopher Matthews

Jill Matthews

John Potter Cuyler Matthews

Rhys Matthews

Ellen Dooling Reynard

Christopher L. Thatcher

Evelyn Dorothea Thatcher

John H. Thatcher, II

Michael Thatcher

Benjamin van Buren

Eleanor Ariane van Buren

Kyla van Buren

Peter van Buren

Philip van Buren

Thomas van Buren

Zoe van Buren

Linda Draper Yantz

THIS IS NOT A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. PLEASE

DO NOT SEND YOUR PROXY TO THE SIGNATORIES. TO VOTE YOUR PROXY, FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

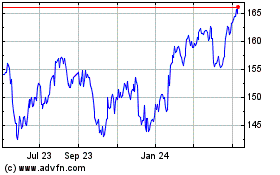

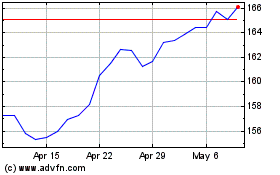

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Jul 2024 to Jul 2024

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Jul 2023 to Jul 2024