Phillips 66 Posts Revenue and Profit Decline

October 28 2016 - 8:55AM

Dow Jones News

By Austen Hufford

Phillips 66 on Friday said profit and revenue dropped in its

third quarter as low commodity prices continued to hurt

results.

The company said it lowered its forecast for annual capital

expenditures to about $3 billion. Last year, capital expenditures

and investments totaled $2.5 billion.

The energy manufacturing and logistics company posted a profit

of $511 million, or 96 cents a share, down from $1.58 billion, or

$2.90 a share, a year prior.

On an adjusted basis, earnings were 96 cents a share, down from

$2.90. Revenue fell 17% to $22.04 billion.

Analysts polled by Thomson Reuters had expected earnings per

share of 88 cents on revenue of $25.06 billion.

Earnings in its refining segment fell 82% to $177 million on

higher planned turnaround expenses, partially offset by lower

maintenance costs. In its chemicals segment, earnings declined 60%

to $101 million on unplanned downtime, which was partially offset

by improved polyethylene chain margins. In marketing and

specialties, earnings dropped 21% to $267 million. In the midstream

segment, earnings fell 26% to $75 million on lower volumes and

higher seasonal maintenance costs and scheduled refinery

downtime.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 28, 2016 08:40 ET (12:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

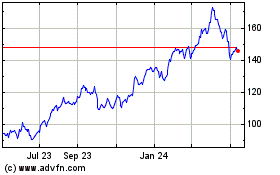

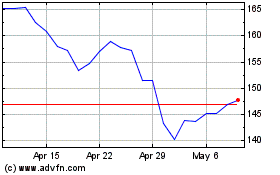

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Jul 2023 to Jul 2024