Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

September 09 2024 - 5:15PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus dated September 9, 2024

Filed Pursuant to Rule 433

Registration No. 333-277286

(Supplementing the Preliminary Prospectus Supplement

dated September 9, 2024 to the Prospectus dated February 22, 2024)

PRICING TERM SHEET

PG&E Corporation

September 9, 2024

$1,000,000,000 7.375% Fixed-to-Fixed Reset Rate Junior Subordinated Notes due 2055 (the

“Notes”)

The information in this pricing term sheet relates to PG&E Corporation’s offering of Notes listed above and should be

read together with the preliminary prospectus supplement dated September 9, 2024 (the “Preliminary Prospectus Supplement”) relating to such offering and the accompanying prospectus dated February 22, 2024, including the documents

incorporated by reference therein, each filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended, included in the Registration Statement No. 333-277286 (as supplemented by such

Preliminary Prospectus Supplement, the “Preliminary Prospectus”). The information in this pricing term sheet supplements the Preliminary Prospectus and supersedes the information in the Preliminary Prospectus to the extent inconsistent

with the information in the Preliminary Prospectus.

|

|

|

| Issuer: |

|

PG&E Corporation (the “Company”) |

|

|

| Anticipated Ratings

(Moody’s/S&P/Fitch):* |

|

Ba3 (Positive) / B (Stable) / BB- (Positive) |

|

|

| Aggregate Principal Amount

Offered: |

|

$1,000,000,000 |

|

|

| Issue Price: |

|

100.000%, plus accrued interest, if any, from September 11, 2024 |

|

|

| Trade Date: |

|

September 9, 2024 |

|

|

| Settlement Date:** |

|

September 11, 2024 (T+2) |

|

|

| Maturity Date: |

|

March 15, 2055 |

|

|

| Interest Rate: |

|

The Notes will bear interest (i) from and including September 11, 2024 (“original issue date”) to, but excluding, March 15, 2030 (the “First Reset Date”) at the rate of 7.375% per annum (the

“Initial Interest Rate”) and (ii) from and including the First Reset Date, during each Reset Period (as defined in the Preliminary Prospectus) at a rate per annum equal to the Five-year U.S. Treasury Rate (as defined in the

Preliminary Prospectus) as of the most recent Reset Interest Determination Date (as defined in the Preliminary Prospectus) plus a spread of 3.883%, to be reset on each Reset Date (as defined in the Preliminary Prospectus); provided, that the

interest rate during any Reset Period will not reset below 7.375% (which equals the initial interest rate on the Notes). |

|

|

|

|

|

For the definitions of the terms “Reset Period,” “Five-year U.S. Treasury Rate,” “Reset Interest Determination Date” and “Reset Date,” and for other important information concerning the

calculation of interest on the Notes, see “Description of the Notes—Interest Rate and Maturity” in the Preliminary Prospectus. |

|

|

| Interest Payment Dates: |

|

Interest will be payable semi-annually in arrears on March 15 and September 15 of each year, beginning on March 15, 2025 (subject to the Company’s right to defer interest payments as described under

“Optional Interest Deferral” below). |

|

|

| Regular Record Dates: |

|

The close of business on the record date for the applicable interest payment date, which will be (i) the business day immediately preceding such interest payment date so long as all of the Notes remain in book-entry only form

or (ii) the 15th calendar day preceding such interest payment date (whether or not a business day) if any of the Notes do not remain in book-entry only form. |

|

|

| Optional Interest Deferral: |

|

So long as no event of default (as defined in the Preliminary Prospectus) with respect to the Notes has occurred and is continuing, the

Company may, at its option, defer interest payments on the Notes, from time to time, for one or more deferral periods of up to 20 consecutive semi-annual Interest Payment Periods (as defined in the Preliminary Prospectus) each, except that no such

Optional Deferral Period (as defined in the Preliminary Prospectus) may extend beyond the final maturity date of the Notes or end on a day other than the day immediately preceding an interest payment date. During any Optional Deferral Period,

interest on the Notes will continue to accrue at the then-applicable interest rate on the Notes (as reset from time to time on any Reset Date occurring during such Optional Deferral Period in accordance with the terms of the Notes). In addition,

during any Optional Deferral Period, interest on the deferred interest (“compound interest”) will accrue at the then-applicable interest rate on the Notes (as reset from time to time on any Reset Date occurring during such Optional

Deferral Period in accordance with the terms of the Notes), compounded semi-annually, to the extent permitted by applicable law. No interest will be due or payable on the Notes during any such Optional Deferral Period unless the Company elects, at

its option, to redeem Notes during such Optional Deferral Period, in which case accrued and unpaid interest (including, to the extent permitted by law, any compound interest) to, but excluding, the redemption date will be due and payable on such

redemption date only on the Notes being redeemed, or unless the principal of and interest on the Notes shall have been declared due and payable as the result of an event of default with respect to the Notes, in which case all accrued and unpaid

interest (including, to the extent permitted by law, any compound interest) on the Notes shall become due and payable. The Company may elect, at its option, to extend the length of any Optional Deferral Period that is shorter than 20 consecutive

semi-annual Interest Payment Periods (so long as the entire Optional Deferral Period does not exceed 20 consecutive semi-annual Interest Payment Periods or extend beyond the final maturity date of the Notes) and to shorten the length of any Optional

Deferral Period. The Company cannot begin a new Optional Deferral Period until the Company has paid all accrued and unpaid interest on the Notes from any previous Optional Deferral Period.

For additional information and the definitions of the terms event of default, Optional

Deferral Period and Interest Payment Period, see “Description of the Notes—Events of Default” and “Description of the Notes—Option to Defer Interest Payments” in the Preliminary Prospectus. |

2

|

|

|

| Proceeds to the Company: |

|

$987,500,000 (after deducting the underwriting discount but before deducting estimated offering expenses payable by the Company). |

|

|

| Optional Redemption: |

|

At its option, the Company may redeem some or all of the Notes, as applicable, before their maturity, as follows:

• in whole or in part

(i) on any day in the period commencing on the date falling 90 days prior to the First Reset Date and ending on and including the First Reset Date and (ii) after the First Reset Date, on any interest payment date, at a redemption price in

cash equal to 100% of the principal amount of the Notes being redeemed, plus, subject to the terms described in the first paragraph under “Description of the Notes— Redemption—Redemption Procedures; Cancellation of Redemption” in

the Preliminary Prospectus, accrued and unpaid interest on the Notes to be redeemed to, but excluding, the redemption date;

• in whole but not in part, at any time following the occurrence and during the continuance of a Tax

Event (as defined in the Preliminary Prospectus) at a redemption price in cash equal to 100% of the principal amount of the Notes, plus, subject to the terms described in the first paragraph under “Description of the Notes—Redemption—

Redemption Procedures; Cancellation of Redemption” in the Preliminary Prospectus, accrued and unpaid interest on the Notes to, but excluding, the redemption date; and

• in whole but not in part, at any time following the occurrence and during the continuance of a

Rating Agency Event (as defined in the Preliminary Prospectus) at a redemption price in cash equal to 102% of the principal amount of the Notes, plus, subject to the terms described in the first paragraph under “Description of the

Notes—Redemption— Redemption Procedures; Cancellation of Redemption” in the Preliminary Prospectus, accrued and unpaid interest on the Notes to, but excluding, the redemption date.

For additional information and the definitions of the terms Tax Event and Rating Agency

Event, see “Description of the Notes—Redemption” in the Preliminary Prospectus. |

|

|

| Use of Proceeds: |

|

The Company expects to use the net proceeds from this offering for general corporate purposes, including to prepay $500,000,000 of the loans outstanding under the HoldCo Term Loan Facility (as defined in the Preliminary

Prospectus). |

|

|

| CUSIP / ISIN: |

|

69331C AM0 / US69331CAM01 |

|

|

| Joint Book-Running Managers: |

|

Barclays Capital Inc.

BofA Securities, Inc.

Mizuho Securities USA LLC

Wells Fargo Securities, LLC |

3

|

|

|

| Co-Managers: |

|

BMO Capital Markets Corp. BNP Paribas

Securities Corp. Guggenheim Securities, LLC MUFG Securities

Americas Inc. SMBC Nikko Securities America, Inc. BNY Mellon

Capital Markets, LLC |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time. |

| ** |

It is expected that delivery of the Notes will be made against payment for the Notes on or about

September 11, 2024, which is the second business day following the date hereof (such settlement cycle being referred to as “T+2”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as

amended, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on the date hereof will be required, by

virtue of the fact that the Notes initially will settle in T+2, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes during the period described

above should consult their own advisors. |

The issuer has filed a registration statement (including a prospectus) with the SEC for the

offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer

participating in the offering will arrange to send you the prospectus if you request it by contacting each of: Barclays Capital Inc. at

1-888-603-5847, BofA Securities, Inc. at 1-800-294-1322, Mizuho Securities USA LLC at 1-866-271-7403, or Wells Fargo

Securities, LLC at 1-800-645-3751.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS

OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

4

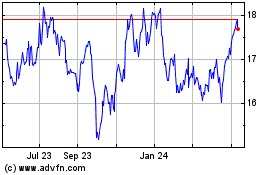

PG&E (NYSE:PCG)

Historical Stock Chart

From Nov 2024 to Dec 2024

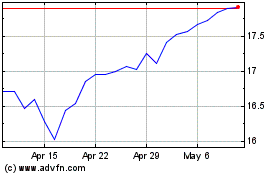

PG&E (NYSE:PCG)

Historical Stock Chart

From Dec 2023 to Dec 2024