Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 27 2024 - 10:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

December, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras informs about new law

for the oil and gas sector

—

Rio de Janeiro, December 27,

2024 – Petróleo Brasileiro S.A. - Petrobras informs that the Brazilian government enacted Law 15,075/2024, dated December

26, 2024, which addresses the possibility of transfer of local content surpluses among contracts in exploration and production of oil

and natural gas, in accordance with Article 2, main section, item X, of Law 9,478, dated August 6, 1997. Moreover, the new legislation

will allow for the extension of the Production Sharing Agreements terms to be requested under conditions that demonstrate advantages for

the Brazilian Federal Union.

The new legislation will take

effect as detailed below:

| i) | Admits the transfer of local content surpluses among

contracts in exploration and production of oil and natural gas, including the possibility of accounting for surpluses in contracts where

there is no minimum commitment, such as the "Round Zero" contracts. |

| ii) | Allows the Brazilian Executive Branch to reduce the

royalty rate of concession contracts for oil and natural gas exploration and production from the "Round Zero" by up to 5% as

an incentive for investments in local content, as per the regulations to be published. |

| iii) | Authorizes the granting of differentiated quotas

of accelerated depreciation for tankers exclusively employed in cabotage activities of oil and its derivatives, as well as for maritime

support vessels used to provide logistical support and services to fields, facilities, and offshore platforms, provided they are built

in national shipyards. |

| iv) | Possibility of extending production sharing contracts,

including ongoing contracts, as long as it is demonstrated that it is advantageous for the Federal Union of Brazil. |

| v) | Inclusion, in the amount to be deducted from the

Union's oil and natural gas commercialization expenses, of costs incurred by PPSA (Pré-Sal Petróleo S/A) in managing the

production sharing contracts and the contracts for the commercialization of the Union's oil and natural gas. |

Petrobras considers the new law

an important milestone for the oil and gas sector in Brazil, bringing benefits to the entire national industry and enabling new investments

in Production Sharing Agreements.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 27, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

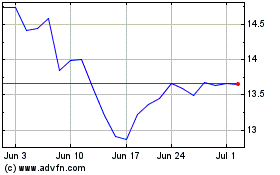

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Dec 2024 to Jan 2025

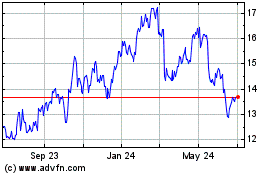

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Jan 2024 to Jan 2025