Revenue increased 24.6% year-over-year Adjusted

EBITDA rose 135.5%, reflecting a 28.6% adjusted EBITDA margin

Paymentus Holdings, Inc. (“Paymentus”) (NYSE: PAY), a leading

provider of cloud-based bill payment technology and solutions,

today announced its unaudited financial results for the quarter

ended March 31, 2024.

“Paymentus began this year with another outstanding quarter,

driven mainly by higher transaction activity from both new and

existing billers. Revenue, contribution profit and adjusted EBITDA

all grew year-over-year by 24.6%, 29.6% and 135.5%, respectively.

We continue to see strong momentum in our bookings and backlog,

supporting our positive outlook for the rest of 2024,” said

Dushyant Sharma, Founder and CEO.

First Quarter 2024 Financial and

Business Highlights

- Revenue was $184.9 million, an increase of 24.6%

year-over-year, driven largely by increased transactions.

- Gross profit was $52.7 million, an increase of 31.6%

year-over-year. Adjusted gross profit(1) was $57.6 million, up

31.9% year-over-year.

- Contribution profit(1) was $69.4 million, a year-over-year

increase of 29.6%.

- Net income was $7.2 million and GAAP earnings per share was

$0.06. Non-GAAP net income(1) was $12.2 million and non-GAAP

earnings per share(1) was $0.10. Prior year non-GAAP net income and

non-GAAP earnings per share have been recast to align with the

updated methodology described in the section "Use and Definitions

of Non-GAAP Financial Measures" below.

- Adjusted EBITDA(1) was $19.8 million for the first quarter of

2024, representing a 28.6% adjusted EBITDA margin(1), an increase

of 135.5% year-over-year.

- The Company processed 135.3 million transactions in the first

quarter of 2024, an increase of 24.7% from the first quarter of

2023.

(1) Descriptions of the non-GAAP financial

measures adjusted gross profit, contribution profit, non-GAAP net

income, non-GAAP earnings per share, adjusted EBITDA, and adjusted

EBITDA margin are provided below under “Use and Definitions of

Non-GAAP Financial Measures,” and reconciliations are provided in

the tables at the end of this release.

Financial Guidance

The statements in this section are forward-looking statements.

For additional information regarding the use and limitations of

such statements, refer to “Forward-Looking Statements” below and

the “Risk Factors” section of Paymentus’ most recent Form 10-K for

the fiscal year ended December 31, 2023 filed with the Securities

and Exchange Commission, or SEC on March 5, 2024.

Second Quarter 2024

Fiscal-Year 2024

Revenue

$178 million to $183 million

$737 million to $755 million

Contribution Profit

$68 million to $70 million

$281 million to $293 million

Adjusted EBITDA

$17 million to $19 million

$71 million to $79 million

Paymentus does not reconcile its forward-looking guidance for

non-GAAP measures because certain financial information, the

probable significance of which cannot be determined, is not

available and cannot be reasonably estimated due to potential

variability, complexity and uncertainty as to the items that would

be excluded from the GAAP measure in the relevant future period.

Refer to “Use of Forward-Looking Non-GAAP Measures” below for

additional explanation.

Conference Call Information

In conjunction with this announcement, Paymentus will host a

conference call for investors at 5:00 p.m. ET (2:00 p.m. PT) today

to discuss first quarter 2024 results and its outlook for the

remainder of 2024. The live webcast and replay will be available at

the Investor Relations section of Paymentus’ website at

ir.paymentus.com or click here. To participate via telephone, dial

1-833-470-1428 (U.S. Toll-Free) or 1-404-975-4839 (International),

access code 015923. A replay will be available after 5:00 p.m. PT

on the same web site.

About Paymentus

Paymentus is a leading provider of cloud-based bill payment

technology and solutions for more than 2,200 billers and financial

institutions across North America. Our omni-channel platform

provides consumers with easy-to-use, flexible and secure electronic

bill payment experiences through their preferred payment channel

and type. Paymentus’ proprietary Instant Payment Network™, or IPN,

extends our reach by connecting our IPN partners’ platforms and

tens of thousands of billers to our integrated billing, payment,

and reconciliation capabilities. For more information, please visit

www.paymentus.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of historical or current fact included in this press

release are forward-looking statements, including but not limited

to statements regarding demand, bookings and backlog, pipeline,

outlook for 2024, our future financial performance and our updated

second quarter and full-year 2024 financial guidance.

Forward-looking statements include statements containing words such

as “expect,” “anticipate,” “believe,” “project,” “will” and similar

expressions intended to identify forward-looking statements.

These forward-looking statements are based on our current

expectations. Forward-looking statements involve risks and

uncertainties. Our actual results and the timing of events could

differ materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties, which

include, without limitation, risks related to our ability to

effectively manage our growth and expand our operations, including

into new channels and industry verticals across different markets;

our ability to expand and retain our biller, financial institution,

partner and consumer base; our ability to timely implement new

bookings and recognize anticipated revenue therefrom, our ability

to manage economic challenges, including inflation; the impact of

future widespread health issues on our operating results, liquidity

and financial condition and on our employees, billers, financial

institutions, partners, consumers and other key stakeholders; our

ability to remain competitive; our ability to develop new product

features and enhance our platform and brand; our future

acquisitions and strategic investments; our ability to hire and

retain experienced and talented employees; the impact of any

cybersecurity incidents; and other risks and uncertainties included

under the caption “Risk Factors” and elsewhere in our filings with

the SEC, including, without limitation, our Annual Report on Form

10-K for the year ended December 31, 2023, filed with the SEC on

March 5, 2024, and our Quarterly Report on Form 10-Q for the

quarter ended March 31, 2024, which we expect to file with the SEC

shortly after the date of this release. You are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety

by this cautionary statement, and we undertake no obligation to

revise or update any forward-looking statements to reflect events

or circumstances after the date hereof.

Use of Forward-Looking Non-GAAP Measures

We do not meaningfully reconcile guidance for adjusted EBITDA

and adjusted EBITDA margin, because we cannot provide guidance for

the more significant reconciling items between net income and

adjusted EBITDA without unreasonable effort. This is due to the

fact that future period non-GAAP guidance includes adjustments for

items not indicative of our core operations, which may include,

without limitation, items included in the supplemental financial

information for reconciliation of reported GAAP results to non-GAAP

results. Such items include acquisition related amortization

expense for acquired intangibles, foreign exchange gains and

losses, adjustments to our income tax provision and certain other

items we believe to be non-indicative of our ongoing operations.

Such adjustments may be affected by changes in ongoing assumptions

and judgments, as well as nonrecurring, unusual or unanticipated

charges, expenses or gains/losses or other items that may not

directly correlate to the underlying performance of our business

operations. The exact amount of these adjustments is not currently

determinable but may be significant. In addition, we do not

meaningfully reconcile guidance for contribution profit, because

the determination of contribution is subject to variables outside

our control, such as an increase in the average payment amount,

changes in the payment mix, or the payment channel used by

consumers that can influence contribution profit, and cannot be

determined without unreasonable effort, if at all.

Use and Definitions of Non-GAAP Financial Measures

In addition to disclosing financial measures in accordance with

accounting principles generally accepted in the United States, or

GAAP, this press release and the accompanying tables contain

certain non-GAAP financial measures, including adjusted gross

profit, contribution profit, non-GAAP net income (including those

amounts as a percentage of revenue), non-GAAP earnings per share,

adjusted EBITDA, adjusted EBITDA margin, non-GAAP operating expense

and free cash flow. We use non-GAAP measures to supplement

financial information presented on a GAAP basis. We believe that

excluding certain items from our GAAP results allows management and

our board of directors to more fully understand our consolidated

financial performance from period to period and helps management

project our future consolidated financial performance as forecasts

are developed at a level of detail different from that used to

prepare GAAP-based financial measures.

Adjusted gross profit is defined as gross profit adjusted

for certain non-cash items, primarily stock-based compensation and

amortization of acquisition-related intangible assets and

capitalized software development costs.

Contribution profit is defined as gross profit plus other

cost of revenue. Other cost of revenue equals cost of revenue less

interchange and assessment fees paid by us to our payment

processors. Interchange and assessment fees paid by us to our

payment processors are excluded from contribution profit because we

believe inclusion is less directly reflective of our operating

performance as we do not control the payment channel used by

consumers, which is the primary determinant of the amount of

interchange and assessment fees. We use contribution profit to

measure the amount available to fund our operations after

interchange and assessment fees, which are directly linked to the

number of transactions we process and thus our revenue and gross

profit.

Adjusted EBITDA is defined as net income before other

income (expense) (which consists of interest income (expense), net,

other non-recurring income, and foreign exchange gain (loss)),

depreciation and amortization of acquisition related intangible

assets and capitalized software development costs, and income

taxes, adjusted to exclude the effects of stock-based compensation

expense and certain nonrecurring expenses that management believes

are not indicative of ongoing operations.

Adjusted EBITDA margin is defined as adjusted EBITDA as a

percentage of contribution profit.

Non-GAAP operating expense is defined as total operating

expense excluding amortization of acquisition-related intangibles,

stock-based compensation and other nonrecurring expenses.

Management believes that the adjustment of acquisition-related

intangibles amortization supplements the GAAP information with a

measure that can be used to assess the comparability of operating

performance. Although we exclude amortization from

acquisition-related intangible assets from our non-GAAP expenses,

management believes that it is important for investors to

understand that such intangible assets were recorded as part of

purchase accounting and contribute to revenue generation.

Amortization of intangible assets that relate to past acquisitions

will recur in future periods until such intangible assets have been

fully amortized. Any future acquisitions may result in the

amortization of additional intangible assets.

Non-GAAP net income and non-GAAP EPS are defined

as net income and net income per share, respectively, excluding

certain nonrecurring items such as discrete tax items, one-time

expenses or other non-cash items, including amortization of

acquisition-related intangibles. Beginning with the quarter ended

June 30, 2023, we have excluded stock-based compensation from the

calculation of our non-GAAP net income and non-GAAP EPS to be

consistent with our methodology for non-GAAP operating expenses,

which we believe enhances the understanding of our operating

performance and enables more meaningful period-to-period

comparisons. Our non-GAAP net income and non-GAAP EPS for the three

months ended March 31, 2023 were recast to conform to the updated

methodology and are reflected herein for comparison purposes.

We believe non-GAAP net income and non-GAAP EPS enhance the

understanding of our operating performance and enable more

meaningful period-to-period comparisons.

Free cash flow is defined as net cash provided by (used

in) operating activities less capital expenditures and capitalized

internal-use software development costs.

We believe these non-GAAP measures provide our investors with

useful information to help them evaluate our operating results by

facilitating an enhanced understanding of our operating performance

and enabling them to make more meaningful period-to-period

comparisons.

We use these non-GAAP measures in conjunction with GAAP measures

as part of our overall assessment of our performance and liquidity,

including the preparation of our annual operating budget and

quarterly forecasts, to evaluate the effectiveness of our business

strategies, and to communicate with our board of directors

concerning our financial performance and liquidity. There are

limitations to the use of the non-GAAP measures presented in this

press release. Our non-GAAP measures may not be comparable to

similarly titled measures of other companies; other companies,

including companies in our industry, may calculate non-GAAP

measures differently than we do, limiting the usefulness of those

measures for comparative purposes. These non-GAAP measures should

not be considered in isolation from or as a substitute for

financial measures prepared in accordance with GAAP.

We encourage investors and others to review our financial

information in its entirety, not to rely on any single financial

measure, and to view our non-GAAP measures in conjunction with GAAP

financial measures. For a reconciliation of these non-GAAP

financial measures to GAAP measures, please see the tables for the

reconciliation of GAAP to non-GAAP results included at the end of

this release.

PAYMENTUS HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE INCOME (Unaudited)

(In thousands, except share and

per share data)

Three Months Ended March

31,

2024

2023

Revenue

$

184,875

$

148,328

Cost of revenue

132,150

108,250

Gross profit

52,725

40,078

Operating expenses

Research and development

12,051

11,653

Sales and marketing

23,239

20,264

General and administrative

9,092

9,145

Total operating expenses

44,382

41,062

Income (loss) from operations

8,343

(984

)

Other income (expense)

Interest income, net

2,186

1,440

Other non-recurring income

213

--

Foreign exchange gain (loss)

18

(8

)

Income before income taxes

10,760

448

(Provision for) benefit from income

taxes

(3,534

)

256

Net income

$

7,226

$

704

Net income per share

Basic

$

0.06

$

0.01

Diluted

$

0.06

$

0.01

Weighted-average number of shares used to

compute net income per share

Basic

123,945,778

123,289,584

Diluted

126,917,654

123,792,741

PAYMENTUS HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

(In thousands, except share and

per share data)

March 31,

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

180,138

$

179,361

Restricted cash and cash equivalents

4,014

3,834

Accounts and other receivables, net of

allowance for expected credit losses of $399 and $435,

respectively

84,178

76,389

Income tax receivable

20

259

Prepaid expenses and other current

assets

11,293

10,505

Total current assets

279,643

270,348

Property and equipment, net

1,575

1,558

Capitalized internal-use software

development costs, net

61,767

58,787

Intangible assets, net

25,137

27,158

Goodwill

131,850

131,860

Operating lease right-of-use assets

9,477

10,027

Deferred tax asset

91

94

Other long-term assets

4,435

5,031

Total assets

$

513,975

$

504,863

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

41,097

$

35,182

Accrued liabilities

12,334

21,301

Current portion of operating lease

liabilities

1,966

1,853

Contract liabilities

4,097

4,089

Income tax payable

3,132

363

Total current liabilities

62,626

62,788

Deferred tax liability

1,159

1,067

Operating lease liabilities, less current

portion

8,054

8,661

Contract liabilities, less current

portion

2,752

2,731

Total liabilities

74,591

75,247

Stockholders’ equity

Preferred stock, $0.0001 par value per

share, 5,000,000 shares authorized as of March 31, 2024 and

December 31, 2023, respectively; none issued and outstanding as of

March 31, 2024 and December 31, 2023

—

—

Class A common stock, $0.0001 par value

per share, 883,950,000 shares authorized as of March 31, 2024 and

December 31, 2023, respectively; 21,744,165 and 20,758,603 shares

issued and outstanding as of March 31, 2024 and December 31, 2023,

respectively

2

2

Class B common stock, $0.0001 par value

per share, 111,050,000 shares authorized as of March 31, 2024 and

December 31, 2023, respectively; 102,381,811 and 103,062,508 shares

issued and outstanding as of March 31, 2024 and December 31, 2023,

respectively

10

10

Additional paid-in capital

380,357

377,773

Accumulated other comprehensive income

45

87

Retained earnings

58,970

51,744

Total stockholders’ equity

439,384

429,616

Total liabilities and stockholders'

equity

$

513,975

$

504,863

PAYMENTUS HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS (Unaudited)

(In thousands)

Three Months Ended March

31,

2024

2023

Cash flows from operating

activities

Net income

$

7,226

$

704

Adjustments to reconcile net income to net

cash provided by operating activities

Depreciation and amortization

8,537

7,239

Deferred income taxes

92

92

Stock-based compensation

2,933

2,159

Non-cash lease expense

506

462

Amortization of contract asset

451

696

Provision for (benefit from) expected

credit losses

48

(239

)

Other non-recurring income

(213

)

—

Change in operating assets and

liabilities

Accounts and other receivables

(7,850

)

(8,333

)

Prepaid expenses and other current and

long-term assets

(993

)

861

Accounts payable

5,793

3,297

Accrued liabilities

(8,166

)

(2,749

)

Operating lease liabilities

(446

)

(469

)

Contract liabilities

28

2,061

Income taxes receivable, net of

payable

3,008

(1,018

)

Net cash provided by operating

activities

10,954

4,763

Cash flows from investing

activities

Purchases of property and equipment

(116

)

(67

)

Purchase of interest-bearing deposits

(723

)

—

Proceeds from matured interest-bearing

deposits

602

—

Capitalized internal-use software

development costs

(9,276

)

(8,219

)

Net cash used in investing activities

(9,513

)

(8,286

)

Cash flows from financing

activities

Proceeds from exercise of stock-based

awards

100

5

Settlement of holdback liability related

to prior acquisitions

(506

)

—

Payments on other financing

obligations

—

(1,025

)

Payments on finance leases

—

(102

)

Net cash used in financing activities

(406

)

(1,122

)

Effect of exchange rate changes on Cash

and cash equivalents and Restricted cash

(78

)

(17

)

Net increase (decrease) in cash, cash

equivalents and Restricted cash

957

(4,662

)

Cash and cash equivalents and Restricted

cash at the beginning of period

183,195

149,685

Cash and cash equivalents and Restricted

cash at the end of period

$

184,152

$

145,023

Reconciliation of Cash and cash

equivalents and Restricted Cash:

Cash and cash equivalents at the beginning

of period

179,361

147,334

Restricted cash at the beginning of

period

3,834

2,351

Cash and cash equivalents and Restricted

cash at the beginning of period

$

183,195

$

149,685

Cash and cash equivalents at the end of

period

180,138

143,637

Restricted cash at the end of period

4,014

1,386

Cash and cash equivalents and Restricted

cash at the end of period

$

184,152

$

145,023

PAYMENTUS HOLDINGS, INC. GAAP to Non-GAAP

Reconciliations (Unaudited) (in thousands, except percentages and

per share data)

The following tables set forth our non-GAAP financial measures

with reconciliations to the most directly comparable GAAP financial

measures.

Adjusted Gross Profit

Three Months Ended March

31,

2024

2023

(in thousands)

Gross profit

$

52,725

$

40,078

Stock-based compensation

51

45

Amortization of capitalized software

development costs

4,029

2,738

Amortization of acquisition-related

intangibles

829

829

Adjusted gross profit

$

57,634

$

43,690

Contribution Profit

Three Months Ended March

31,

2024

2023

(in thousands)

Gross profit

$

52,725

$

40,078

Plus: other cost of revenue

16,642

13,453

Contribution profit

$

69,367

$

53,531

Adjusted EBITDA and Adjusted EBITDA Margin

Three Months Ended March

31,

2024

2023

(in thousands)

Net income (loss) — GAAP

$

7,226

$

704

Interest income, net

(2,186

)

(1,440

)

Other non-recurring income (1)

(213

)

--

Provision for (benefit from) income

taxes

3,534

(256

)

Amortization of capitalized software

development costs

6,311

4,693

Amortization of acquisition-related

intangibles

2,021

2,224

Depreciation

205

322

EBITDA

$

16,898

$

6,247

Adjustments

Foreign exchange (gain) loss

(18

)

8

Stock-based compensation

2,933

2,159

Adjusted EBITDA

$

19,813

$

8,414

Adjusted EBITDA margin

28.6

%

15.7

%

(1) Other non-recurring income consists of

a remeasurement adjustment relating to the purchase price of a

prior acquisition.

PAYMENTUS HOLDINGS, INC. GAAP to Non-GAAP

Reconciliations (Unaudited) (in thousands, except percentages and

per share data)

Non-GAAP Operating Expenses

Three Months Ended March

31,

2024

2023

(in thousands)

Operating expenses - GAAP

$

44,382

$

41,062

Stock-based compensation

(2,882

)

(2,114

)

Amortization of acquisition-related

intangibles

(1,191

)

(1,395

)

Non-GAAP operating expense

$

40,309

$

37,553

Non-GAAP Net Income & Non-GAAP EPS

Revised Methodology:

The prior year and most recent quarter non-GAAP net income and

non-GAAP earnings per share have been recast to align with the

updated methodology.

Three Months Ended March

31,

2024

2023

(in thousands)

Net income — GAAP

$

7,226

$

704

Stock-based compensation

2,933

2,159

Amortization of acquisition-related

intangibles

2,021

2,224

Non-GAAP net income

$

12,180

$

5,087

Weighted-average shares of common stock —

diluted

126,917,654

123,792,741

Non-GAAP earnings per share —

diluted

$

0.10

$

0.04

Previous Methodology:

The following tables set forth our non-GAAP financial measures

using the previous methodology with reconciliations to the most

directly comparable GAAP financial measures:

Three Months Ended March

31,

2024

2023

(in thousands)

Net income — GAAP

$

7,226

$

704

Amortization of acquisition-related

intangibles

2,021

2,224

Non-GAAP net income

$

9,247

$

2,928

Weighted-average shares of common stock —

diluted

126,917,654

123,792,741

Non-GAAP earnings per share —

diluted

$

0.07

$

0.02

Free Cash Flow

Three Months Ended March

31,

2024

2023

(in thousands)

Net cash provided by operating

activities

$

10,954

$

4,763

Purchases of property and equipment and

software

(116

)

(67

)

Capitalized software development costs

(9,276

)

(8,219

)

Free cash flow

$

1,562

$

(3,523

)

Net cash used in investing activities

$

(9,513

)

$

(8,286

)

Net cash used in financing activities

$

(406

)

$

(1,122

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506029270/en/

At the Company Sanjay Kalra Chief Financial Officer

Paymentus Holdings, Inc. ir@paymentus.com

Investor Relations David Hanover paymentus@kcsa.com

Media Relations Tony Labriola

media-relations@paymentus.com

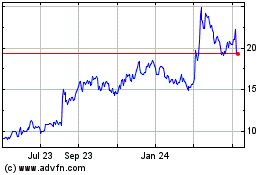

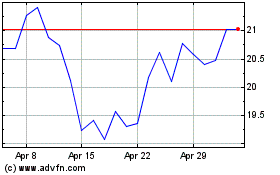

Paymentus (NYSE:PAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Paymentus (NYSE:PAY)

Historical Stock Chart

From Nov 2023 to Nov 2024