Paragon 28, Inc. (NYSE: FNA) (“Paragon 28” or "Company”), a

leading medical device company exclusively focused on the foot and

ankle orthopedic market, today announced that Chadi Chahine has

been appointed Chief Financial Officer and Executive Vice-President

of Supply Chain Operations, effective August 5, 2024. The Company

also reported financial results for the quarter ended June 30,

2024, and narrowed its 2024 net revenue guidance.

Recent Business Updates

- Strengthened executive leadership team with appointment of

Chadi Chahine as CFO & EVP Supply Chain Operations, effective

August 5, 2024

- Recorded global revenue of $61.0 million in the second quarter,

representing 19.6% and 19.7% reported and constant currency growth

compared to the prior year period, respectively

- Drove 840 basis point improvement in operating expense as a

percent of revenue in the second quarter compared to the prior year

period

- Initiated an operational efficiency strategy targeted at

optimizing the organizational structure, minimizing costs and

preserving cash without compromising revenue growth

opportunities

- Narrowed 2024 net revenue guidance of $249 million to $255

million, representing 15.1% to 17.8% reported growth compared to

2023

- Filed an amended Form 10-K/A for the 2023 fiscal year and an

amended Form 10-Q/A for the quarter ended March 31, 2024 in

connection with the financial restatement detailed in the Form 8-K

filed July 30, 2024

Appointment of Chadi Chahine as Chief Financial

Officer

The appointment of Chadi Chahine concludes an extensive search

process conducted by the Company. Mr. Chahine will succeed Kristina

“Krissy” Wright who has been serving as Interim CFO since April 3,

2024.

“We are thrilled to welcome Chadi to our executive team,” said

Albert DaCosta, CEO and Chairman of Paragon 28. “Chadi's extensive

experience in orthopedics and finance combined with his strategic

vision and proven ability to drive growth and operational

efficiency will be invaluable as we continue to expand our presence

in the foot and ankle market and further scale our business

operations. We also extend our sincere gratitude to Krissy Wright

for her exceptional leadership as interim CFO and look forward to

her continued contributions on our Board.”

Chadi Chahine brings over 25 years of extensive global

experience in finance and business operations, including a proven

track record in the orthopedic industry, to Paragon 28. Before

joining Paragon 28, Mr. Chahine served as Group CFO of the Global

Business Group for Zimmer Biomet Holdings Inc. (“Zimmer Biomet”),

where he oversaw $7 billion in revenue and had full P&L,

balance sheet, and commercial finance responsibilities, across all

geographic regions. During his tenure at Zimmer Biomet, Mr. Chahine

helped drive record revenue and profit in 2022 and 2023 and

identified additional efficiencies in inventory and research &

development investments.

Prior to his tenure at Zimmer Biomet, Mr. Chahine served as COO

and CFO of Global Stanley Security at Stanley Black & Decker

prior to the business’s $4.1 billion sale. He also previously

served as CFO at CIRCOR International, leading takeover defense

efforts and implementing significant cost-saving measures. Earlier

in his career, he held divisional CFO roles at Smith+Nephew

responsible for International Markets and the US where he led

initiatives to accelerate sustainable growth. Mr. Chahine holds a

Bachelor of Commerce in Accounting from Université du Québec à

Montréal and a Bachelor of Science in Math and Economics from

Université de Montréal.

“Paragon 28 is a truly unique business in the world of

orthopedics. The Company’s commitment to innovation and excellence

in foot and ankle aligns perfectly with my professional values and

goals,” said Chadi Chahine, CFO. “I am excited to join Paragon 28

at such a critical time and look forward to contributing to its

continued growth and success.”

Chadi Chahine's appointment as CFO & EVP Supply Chain

Operations marks a significant step forward for Paragon 28 as it

strengthens its leadership team and positions the Company for

continued growth and success in the foot and ankle market.

Second Quarter 2024 and Six Months Ended June 30, 2024

Financial Results

- Consolidated net revenue for the second quarter of 2024 was

$61.0 million, representing 19.6% and 19.7% reported and constant

currency growth, respectively, compared to the second quarter of

2023. Consolidated net revenue for the six months ended June 30,

2024 was $122.1 million, representing 18.5% reported and constant

currency growth compared to the six months ended June 30, 2023.

- U.S. net revenue for the second quarter of 2024 and six months

ended June 30, 2024 was $49.7 million and $100.8 million,

respectively, representing 17.6% and 15.5% reported growth,

respectively, compared to the prior year periods.

- International net revenue for the second quarter of 2024 and

six months ended June 30, 2024 was $11.3 million and $21.3 million,

respectively, representing 29.4% and 35.1% reported growth

respectively, compared to the prior year periods.

- Gross margin was 75.0% for the second quarter of 2024 compared

to 77.3% in the second quarter of 2023. Gross margin was 76.2% for

the six months ended June 30, 2024 compared to 78.8% for the six

months ended June 30, 2023.

- Operating expenses were $56.5 million for the second quarter of

2024, an increase of 9.7%, compared to $51.5 million for the second

quarter of 2023. Operating expenses were $118.9 million for the six

months ended June 30, 2024, an increase of 16.1%, compared to

$102.4 million for the six months ended June 30, 2023.

- Net loss was $13.8 million for the second quarter of 2024, a

$0.6 million increase, compared to a net loss of $13.2 million for

the second quarter of 2023. Net loss was $31.2 million for the six

months ended June 30, 2024, a $7.1 million increase, compared to

net a loss of $24.1 million for the six months ended June 30,

2023.

- Adjusted EBITDA was a $3.0 million loss for the second quarter

of 2024, a $2.4 million improvement, compared to a $5.4 million

loss in the second quarter of 2023. Adjusted EBITDA was a $10.7

million loss for the six months ended June 30, 2024, a $2.6 million

decrease compared to a $8.1 million loss for the six months ended

June 30, 2023.

“We are pleased with our results this quarter and continue to

see strong momentum in the U.S. driven in part by the energy around

our recent new product launches,” said Albert DaCosta, Chairman and

Chief Executive Officer. “Further, we have made significant

progress on our cost optimization plans resulting in an 840 basis

point year-over-year improvement to operating expenses in the

quarter, with more planned in the second half of 2024 and into

2025.”

Operational Efficiency Strategy

The Company also announced an operational efficiency strategy

targeted at optimizing the organizational structure, minimizing

costs and preserving cash without compromising revenue growth

opportunities. This strategy was initiated in the second quarter of

2024 and is expected to result in durable savings for the rest of

2024 and in 2025. Management has determined that this operational

efficiency strategy will not result in the Company incurring

material charges. This operational efficiency strategy

includes:

- An approximately 7% reduction in work force expected to take

place in August of 2024, and is intended to result in up to $8

million in annualized savings offset by approximately $1 million in

severance costs;

- Detailed review and optimization of functional costs and

controls;

- An inventory burn-down plan; and

- One-time realignment of executive compensation for 2024

“Our company has consistently demonstrated strong growth and we

remain committed to sustaining that momentum by making thoughtful

strategic adjustments,” said Albert DaCosta, Chairman and Chief

Executive Officer. “Although these processes are never easy, this

initiative is critical to enhance efficiency, minimize costs and

preserve cash without compromising our growth initiatives or our

high-quality product portfolio.”

2024 Net Revenue Guidance

The Company narrows its prior 2024 net revenue guidance and

expects net revenue to be $249 million to $255 million,

representing 15.1% to 17.8% reported growth compared to 2023.

The Company’s 2024 net revenue guidance assumes foreign currency

translation rates remain consistent with current foreign currency

translation rates.

Restatement

As previously announced in our Current Report on Form 8-K filed

with the Securities and Exchange Commission (the “SEC”) on July 30,

2024, on July 30, 2024, the Audit Committee (the “Audit Committee”)

of the Board of Directors and in consultation with management,

concluded that its audited consolidated financial statements for

the fiscal year ended December 31, 2023 and its unaudited condensed

consolidated financial statements for the periods ended March 31,

2023, June 30, 2023, September 30, 2023, and March 31, 2024 could

no longer be relied upon as a result of material accounting errors

identified by management. Accordingly, the consolidated financial

statements as of and for the fiscal year ended December 31, 2023

have been restated in the Company’s Annual Report on Form 10-K/A

filed on August 8, 2024 to reflect the correction of identified

errors in the calculation of excess and obsolete inventory, as well

as its accounting for inventory variances, which resulted in a net

overstatement of inventory as of March 31, 2023, June 30, 2023,

September 30, 2023, and December 31, 2023, and a net understatement

in cost of goods sold for the respective interim periods ended on

such dates and for the fiscal year ended December 31, 2023.

Additionally, the unaudited interim condensed consolidated

financial statements as of and for the three months ended March 31,

2024 have been restated in the Company’s Quarterly Report on Form

10-Q/A filed on August 8, 2024 to reflect the correction of

identified errors in the calculation of excess and obsolete

inventory, as well as its accounting for inventory variances, which

resulted in a net overstatement of inventory as of March 31, 2024

and a net understatement in cost of goods sold for the three months

ended March 31, 2024. In connection with the presentation of

comparative prior period financial statements in the amended Form

10-K/A for the fiscal year ended December 31, 2023, the Company

revised the consolidated financial statements for the year ended

December 31, 2022 and the condensed consolidated financial

statements for the interim periods for such year, each as presented

in the amended Form 10-K/A for the fiscal year ended December 31,

2023, to correct errors identified that were determined to be

immaterial both individually and in the aggregate.

Webcast and Conference Call Information

Paragon 28 will host a conference call to discuss second quarter

2024 financial results on Thursday, August 8, 2024, at 2:30 p.m.

Mountain Time / 4:30 p.m. Eastern Time. Investors interested in

listening to the conference call may do so by dialing

(833-470-1428) for domestic callers or (404-975-4839) for

international callers, using conference ID: 389675. Live audio of

the webcast will be available on the “Investors” section of the

company’s website at ir.paragon28.com. The webcast will be archived

and available for replay for at least 90 days after the event.

About Paragon 28, Inc.

Based in Englewood, CO., Paragon 28, is a leading medical device

company exclusively focused on the foot and ankle orthopedic market

and is dedicated to improving patient lives. From the onset,

Paragon 28® has provided innovative orthopedic solutions,

procedural approaches and instrumentation that cover a wide range

of foot and ankle ailments including fracture fixation, forefoot,

ankle, progressive collapsing foot deformity (PCFD) or flatfoot,

Charcot foot and orthobiologics. The Company designs products with

both the patient and surgeon in mind, with the goal of improving

outcomes, reducing ailment recurrence and complication rates, and

making the procedures simpler, consistent, and reproducible.

Forward Looking Statements

Except for the historical information contained herein, the

matters set forth in this press release are forward-looking

statements within the meaning of the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995, including,

but not limited to: Paragon 28’s potential to shape a better future

for foot and ankle patients; the Company’s preliminary financial

results for the quarter ended June 30, 2024; statements about the

Company’s 2024 net revenue guidance; reaffirming the Company’s 2024

net revenue guidance ranges; the anticipated timing of the filing

of the restated filings; the financial statements to be restated

and the filings in which such restated financial statements will

appear; the Company's intent to report material weaknesses in its

internal control over financial reporting; and the Company’s

operational efficiency strategy. You are cautioned not to place

undue reliance on these forward-looking statements. Forward-looking

statements are only predictions based on our current expectations,

estimates, and assumptions, valid only as of the date they are

made, and subject to risks and uncertainties, some of which we are

not currently aware. Forward‐looking statements should not be read

as a guarantee of future performance or results and may not

necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. These forward‐looking

statements are based on Paragon 28’s current expectations and

inherently involve significant risks and uncertainties and are

subject to numerous risks, including, among other things, risks

related to the timely and correct completion of the restatement and

restated filings; the risk that additional information may become

known prior to the expected filing with the SEC of the restated

filings or that other subsequent events may occur that would

require the Company to make additional adjustments to its financial

statements, which could be material, or delay the filing of the

corrected or future periodic reports with the SEC; risks related to

the timing and results of the Company’s review of the effectiveness

of internal control over financial reporting and related disclosure

controls and procedures, remediation of the control deficiencies

identified and our ability to implement and maintain effective

internal control over financial reporting in the future, which may

adversely affect the accuracy and timeliness of our financial

reporting; identification of errors in our financial reporting in

the future that require us to restate previously issued financial

statements, which may subject us to unanticipated costs or

regulatory penalties and could cause investors to lose confidence

in the accuracy and completeness of our financial statements;

factors relating to uncertainties as to any difficulties with

respect to the Company's operational efficiency strategy, including

expenses associated such strategy; the effect of the announcement

of the Company's operational efficiency strategy on the Company's

ability to retain and hire key personnel and to maintain

relationships with customers, suppliers and other business

partners; risks related to the possible diversion of management’s

attention as a result of the Company's operational efficiency

strategy; uncertainties as to the Company's ability and the amount

of time necessary to realize the expected benefits of the Company's

operational efficiency strategy; and those set forth under the

caption “Risk Factors” in the Company’s most recent filings with

the Securities and Exchange Commission. Actual results and the

timing of events could differ materially from those anticipated in

such forward‐looking statements as a result of these risks and

uncertainties. For a further description of the risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to Paragon 28’s business in general, see Paragon 28’s

current and future reports filed with the Securities and Exchange

Commission, including its Annual Report on Form 10-K/A for the

fiscal year ended December 31, 2023, as updated periodically with

its other filings with the SEC. These forward-looking statements

are made as of the date of this press release, and Paragon 28

assumes no obligation to update the forward-looking statements, or

to update the reasons why actual results could differ from those

projected in the forward-looking statements, except as required by

law. Paragon 28’s net revenue guidance for 2024 is not necessarily

indicative of our operating results for any future periods.

Use of Non-GAAP Financial Measures and Their

Limitations

In addition to our results and measures of performance

determined in accordance with U.S. GAAP presented in this press

release, we believe that certain non-GAAP financial measures are

useful in evaluating and comparing our financial and operational

performance over multiple periods, identifying trends affecting our

business, formulating business plans, and making strategic

decisions.

Adjusted EBITDA is a key performance measure that our management

uses to assess our financial performance and is also used for

internal planning and forecasting purposes. We define Adjusted

EBITDA as earnings (loss) before interest expense, income tax

expense (benefit), depreciation and amortization, stock-based

compensation expense, employee stock purchase plan expense,

non-recurring expenses, and certain other non-cash expenses.

We believe that Adjusted EBITDA, together with a reconciliation

to net income, helps identify underlying trends in our business and

helps investors make comparisons between our company and other

companies that may have different capital structures, tax rates, or

different forms of employee compensation. Accordingly, we believe

that Adjusted EBITDA provides useful information to investors and

others in understanding and evaluating our operating results,

enhancing the overall understanding of our past performance and

future prospects, and allowing for greater transparency with

respect to a key financial metric used by our management in its

financial and operational decision-making. Our use of Adjusted

EBITDA has limitations as an analytical tool, and you should not

consider these measures in isolation or as a substitute for

analysis of our financial results as reported under U.S. GAAP. Some

of these potential limitations include:

- other companies, including companies in our industry which have

similar business arrangements, may report Adjusted EBITDA, or

similarly titled measures but calculate them differently, which

reduces their usefulness as comparative measures;

- although depreciation and amortization expenses are non-cash

charges, the assets being depreciated and amortized may have to be

replaced in the future, and Adjusted EBITDA does not reflect cash

capital expenditures for such replacements or for new capital

expenditure requirements;

- Adjusted EBITDA also does not reflect changes in, or cash

requirements for, our working capital needs or the potentially

dilutive impact of stock-based compensation; and

- Adjusted EBITDA does not reflect the interest expense, or the

cash requirements necessary to service interest or principal

payments on our debt that we may incur.

Additionally, we report revenue growth on a constant-currency

basis in order to facilitate period-to-period comparisons of

results without regard to the impact of fluctuating foreign

currency exchange rates. The term foreign currency exchange rates

refers to the exchange rates used to translate the company's

operating results for all countries where the functional currency

is not the U.S. dollar into U.S. dollars. Because we are a global

company, foreign currency exchange rates used for translation may

have a significant effect on our reported results. References to

revenue growth on a constant-currency basis means without the

impact of foreign currency exchange rate fluctuations.

The company believes disclosure of constant-currency revenue

growth rates is helpful to investors because it facilitates

period-to-period comparisons. However, constant-currency revenue

growth rates are non-GAAP financial measures and are not meant to

be considered as an alternative or substitute for comparable

measures prepared in accordance with GAAP. Constant-currency growth

has no standardized meaning prescribed by GAAP and should be read

in conjunction with our consolidated financial statements prepared

in accordance with GAAP. We calculate constant-currency growth

rates by translating local currency amounts in the current period

at actual foreign exchange rates for the prior period.

Because of these and other limitations, you should consider our

non-GAAP measures only as supplemental to other GAAP-based

financial measures.

PARAGON 28, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands,

unaudited)

June 30, 2024

December 31, 2023

(As Restated)

ASSETS

Current assets:

Cash and cash equivalents

$

46,741

$

75,639

Trade receivables, net of allowance for

doubtful accounts of $931 and $1,339, respectively

36,708

37,323

Inventories, net

96,406

90,046

Income taxes receivable

1,018

794

Other current assets

3,575

3,997

Total current assets

184,448

207,799

Property and equipment, net

74,904

74,122

Intangible assets, net

20,977

21,674

Goodwill

25,465

25,465

Deferred income taxes

714

705

Other assets

3,959

2,918

Total assets

$

310,467

$

332,683

LIABILITIES &

STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

23,136

$

21,696

Accrued expenses

26,531

27,781

Other current liabilities

962

883

Current maturities of long-term debt

640

640

Income taxes payable

422

243

Total current liabilities

51,691

51,243

Long-term liabilities:

Long-term debt net, less current

maturities

109,913

109,799

Other long-term liabilities

1,159

1,048

Deferred income taxes

231

233

Income taxes payable

638

635

Total liabilities

163,632

162,958

Stockholders' equity:

Common stock, $0.01 par value, 300,000,000

shares authorized; 84,417,725 and 83,738,974 shares issued, and

83,504,206 and 82,825,455 shares outstanding as of June 30, 2024

and December 31, 2023, respectively

833

827

Additional paid in capital

307,524

298,394

Accumulated deficit

(154,827

)

(123,646

)

Accumulated other comprehensive loss

(713

)

132

Treasury stock, at cost; 913,519 shares as

of June 30, 2024 and December 31, 2023

(5,982

)

(5,982

)

Total stockholders' equity

146,835

169,725

Total liabilities & stockholders'

equity

$

310,467

$

332,683

PARAGON 28, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands,

unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(As Restated)

(As Restated)

Net revenue

$

61,016

$

51,009

$

122,098

$

103,045

Cost of goods sold

15,261

11,599

29,103

21,828

Gross profit

45,755

39,410

92,995

81,217

Operating expenses:

Research and development costs

7,083

7,683

14,667

14,732

Selling, general, and administrative

49,439

43,827

104,221

87,647

Total operating expenses

56,522

51,510

118,888

102,379

Operating loss

(10,767

)

(12,100

)

(25,893

)

(21,162

)

Other income (expense):

Other income (expense), net

132

(76

)

647

(692

)

Interest expense, net

(2,917

)

(803

)

(5,539

)

(2,008

)

Total other expense, net

(2,785

)

(879

)

(4,892

)

(2,700

)

Loss before income taxes

(13,552

)

(12,979

)

(30,785

)

(23,862

)

Income tax expense

230

269

396

198

Net loss

$

(13,782

)

$

(13,248

)

$

(31,181

)

$

(24,060

)

Foreign currency translation

adjustment

252

(283

)

(845

)

(382

)

Comprehensive loss

$

(13,530

)

$

(13,531

)

$

(32,026

)

$

(24,442

)

Weighted average number of shares of

common stock outstanding:

Basic

83,115,861

82,373,441

82,984,878

81,536,607

Diluted

83,115,861

82,373,441

82,984,878

81,536,607

Net loss per share attributable to common

stockholders:

Basic

$

(0.17

)

$

(0.16

)

$

(0.38

)

$

(0.30

)

Diluted

$

(0.17

)

$

(0.16

)

$

(0.38

)

$

(0.30

)

PARAGON 28, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands,

unaudited)

Six Months Ended June

30,

2024

2023

(As Restated)

Cash flows from operating activities

Net loss

$

(31,181

)

$

(24,060

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

8,868

6,414

Allowance for doubtful accounts

785

147

Provision for excess and obsolete

inventories

5,932

923

Stock-based compensation

6,112

6,782

Change in fair value of financial

instruments

(601

)

366

Other

(581

)

394

Changes in other assets and liabilities,

net of acquisitions:

Accounts receivable

(360

)

3,138

Inventories

(12,631

)

(20,959

)

Accounts payable

1,456

14,745

Accrued expenses

809

1,845

Accrued legal settlement

—

(22,000

)

Income tax receivable/payable

(23

)

(359

)

Other assets and liabilities

211

(779

)

Net cash used in operating activities

(21,204

)

(33,403

)

Cash flows from investing activities

Purchases of property and equipment

(9,491

)

(15,354

)

Proceeds from sale of property and

equipment

724

635

Purchases of intangible assets

(462

)

(544

)

Net cash used in investing activities

(9,229

)

(15,263

)

Cash flows from financing activities

Payments on long-term debt

(320

)

(396

)

Payments of debt issuance costs

(18

)

—

Proceeds from issuance of common stock,

net of issuance costs

—

68,453

Options exercised

2,878

2,464

RSU vesting, taxes paid

(424

)

—

Proceeds from employee stock purchase

plan

403

560

Payments on earnout liability

(2,000

)

(4,250

)

Net cash provided by financing

activities

519

66,831

Effect of exchange rate changes on cash

and cash equivalents

1,016

114

Net (decrease) increase in cash and cash

equivalents

(28,898

)

18,279

Cash and cash equivalents at beginning of

period

75,639

38,468

Cash and cash equivalents at end of

period

$

46,741

$

56,747

PARAGON 28, INC. AND

SUBSIDIARIES

RECONCILIATION OF NET LOSS TO

NON-GAAP ADJUSTED EBITDA

(in thousands,

unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(As Restated)

(As Restated)

Net loss

$

(13,782

)

$

(13,248

)

$

(31,181

)

$

(24,060

)

Interest expense, net

2,917

803

5,539

2,008

Income tax expense

230

269

396

198

Depreciation and amortization expense

4,610

3,297

8,868

6,414

Stock based compensation expense

3,024

3,600

6,112

6,782

Employee stock purchase plan expense

88

60

168

182

Change in fair value of financial

instruments(1)

(82

)

(151

)

(601

)

366

Adjusted EBITDA

$

(2,995

)

$

(5,370

)

$

(10,699

)

$

(8,110

)

________________________________________

(1)

Represents non-cash change in the fair

value of our interest rate swap contract for all periods presented

and earnout liabilities for the three and six months ended June 30,

2023.

PARAGON 28, INC. AND

SUBSIDIARIES

Constant-Currency Revenue

Growth

(in thousands,

unaudited)

Three Months Ended June

30,

Change

Six Months Ended June

30,

Change

2024

2023

%

2024

2023

%

Total Consolidated Revenues

As Reported

$

61,016

$

51,009

19.6%

$

122,098

$

103,045

18.5%

Impact of foreign currency exchange

rates

24

—

*

47

—

*

Constant-currency net revenues

$

61,040

$

51,009

19.7%

$

122,145

$

103,045

18.5%

Total International Revenues

As Reported

$

11,313

$

8,745

29.4%

$

21,345

$

15,800

35.1%

Impact of foreign currency exchange

rates

24

—

*

47

—

*

Constant-currency net revenues

$

11,337

$

8,745

29.6%

$

21,392

$

15,800

35.4%

________________________________________

* Not meaningful

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808238306/en/

Investor Contact: Matt Brinckman Senior Vice President,

Strategy and Investor Relations mbrinckman@paragon28.com

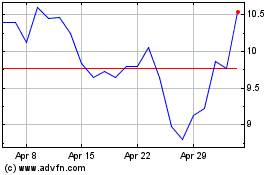

Paragon 28 (NYSE:FNA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Paragon 28 (NYSE:FNA)

Historical Stock Chart

From Nov 2023 to Nov 2024