UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of August,

2024

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: PAMPA ENERGÍA S.A. COMMENCES TENDER OFFER FOR ANY AND ALL OF ITS OUTSTANDING SERIES 1 7.500% NOTES DUE 2027

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: August 24, 2024

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

PAMPA ENERGÍA S.A. COMMENCES TENDER OFFER

FOR ANY AND ALL OF ITS OUTSTANDING SERIES 1 7.500% NOTES DUE 2027

BUENOS AIRES, ARGENTINA (August 26, 2024) — Pampa Energía

S.A. (“Pampa”, the “Company”

or “we”) today announced that it has commenced a cash tender offer (the “Offer”), on the terms and subject to

the conditions set forth in the Company’s Offer to Purchase for Cash dated August 26, 2024 (the “Offer to Purchase”),

for any and all of its outstanding Series 1 7.500% Notes due 2027 (the “Notes”).

The Offer to Purchase more fully sets forth the terms of the Offer.

Principal terms relating to the Offer are listed in the table below:

|

Notes |

CUSIP / ISIN /

Common Code Numbers |

Outstanding Principal

Amount |

Offer Consideration(2)

(3) |

| Series 1 7.500% Notes due 2027 |

697660 AA6/ US697660AA69 / 155564636

P7464E AA4/ USP7464EAA49 / 155566132 |

U.S.$750,000,000(1) |

U.S.$1,000 |

| (1) | Including U.S.$153 million principal amount of Notes which are held by a third party lender of the Company as security for such financing. |

| (2) | Per U.S.$1,000 principal amount of Notes validly tendered and accepted for purchase. The Offer Consideration does not include accrued

interest. |

| (3) | Holders will also receive accrued interest from and including the last interest payment date for the Notes up to but not including

the Settlement Date (as defined below). |

The Offer will expire at 8:00 a.m., New York City time, on September

5, 2024, unless extended or terminated earlier at the sole discretion of the Company (such date and time, as it may be extended or terminated

earlier, the “Expiration Time”).

Subject to the satisfaction of the terms and conditions set forth

in the Offer to Purchase, holders validly tendering and not withdrawing their Notes pursuant to the Offer will be entitled to receive

U.S.$1,000 per U.S.$1,000 principal amount of the Notes tendered (the “Offer Consideration”), on a date promptly following

the Expiration Time (the “Settlement Date”) (which date is expected to occur within three business days of the Expiration

Time, but which may change without notice). The settlement date in respect of Notes for which a properly completed guaranteed delivery

instruction is submitted at or prior to the Expiration Time and which are validly tendered at or prior to the guaranteed delivery deadline

using the guaranteed delivery procedures set forth in the Offer to Purchase and that are accepted by the Company for purchase in the Offer

is expected to be the Settlement Date.

Tendered Notes may be validly withdrawn from the Offer at any time

(i) at or prior to the Expiration Time, unless extended by the Company in its sole discretion, and (ii) after the 60th business

day after commencement of the Offer if for any reason the Offer has not been consummated within 60 business days after commencement.

The Company’s obligation to accept for purchase and to pay for

Notes validly tendered and not withdrawn pursuant to the Offer is subject to the satisfaction or waiver, in the Company’s discretion,

of certain conditions, which are more fully described in the Offer, including (i) the financing condition requiring the successful completion of the Company’s

concurrent offering of notes (the “New Notes”) on terms and conditions satisfactory to the Company, and (ii) other general

conditions described in the Offer to Purchase.

The Company has retained Citigroup Global Markets Inc., Deutsche Bank Securities

Inc., J.P. Morgan Securities LLC and Santander US Capital Markets LLC. to serve as the dealer managers (the “Dealer Managers”)

for the Offer, and Banco Santander Argentina S.A. and Banco de Galicia de Buenos Aires S.A.U. to act as local information agents in Argentina

(the “Argentine Information Agents”). Questions regarding the Offer may be directed to Citigroup Global Markets Inc. at (212)

723-6106 (collect) or (800) 558-3785 (toll-free), Deutsche Bank Securities Inc. at (212) 250-2955 (collect) or (866) 627-0391 (toll-free),

J.P. Morgan Securities LLC at (212) 834-7279 (collect) or at (866) 846-2874 (toll-free) and/or to Santander US Capital Markets LLC at

(212) 350-0660 (collect) or at (855) 404-3636 (toll-free).

Requests for documents may be directed to Morrow Sodali International

LLC, trading as Sodali & Co, the information and tender agent for the Offer (the “Information and Tender Agent”), by e-mail

at pampa@investor.sodali.com, or by telephone in Stamford at +1 203 658 9457 or in London at +44 20 4513 6933.

Documents relating to

the Offer, including the Offer to Purchase and guaranteed delivery instruction, are also available at https://projects.sodali.com/pampa.

None of the Company, the Dealer Managers, the Argentine Information

Agents or the Information and Tender Agent make any recommendations as to whether holders should tender their Notes pursuant to the Offer,

and no one has been authorized by any of them to make such recommendations. Holders must make their own decisions as to whether to tender

their Notes, and, if so, the principal amount of Notes to tender.

This press release is for informational purposes only and is not a

recommendation and is not an offer to sell or a solicitation of an offer to buy any security. The Offer is being made solely pursuant

to the offer documents.

The Offer does not constitute, and may not be used in connection with,

an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not permitted by law or in which the person

making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

In any jurisdiction where the securities, blue sky or other laws require

tender offers to be made by a licensed broker or dealer and in which the dealer managers, or any affiliates thereof, are so licensed,

the Offer will be deemed to have been made by any such dealer managers, or such affiliates, on behalf of the Company.

The New Notes offered pursuant to the concurrent offering have not been

and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and may not be offered

or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act.

The New Notes are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”).

For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article

4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (as

amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined

in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended, the

“Prospectus Regulation”). Consequently no key information document required by Regulation (EU) No 1286/2014 (as amended,

the “PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in

the EEA has been prepared and therefore offering or selling the New Notes or otherwise making them available to any retail investor in

the EEA may be unlawful under the PRIIPs Regulation.

The New Notes are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom. For these purposes,

a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (8) of Article 2 of Regulation (EU)

No 2017/565 as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”);

or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended, the “FSMA”)

and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional

client as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law in the United Kingdom by

virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic

law in the United Kingdom by virtue of the EUWA (as amended, the “UK Prospectus Regulation”). Consequently no key information

document required by Regulation (EU) No 1286/2014 as it forms part of domestic law in the United Kingdom by virtue of the EUWA (the “UK

PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the United Kingdom

has been prepared and therefore offering or selling the New Notes or otherwise making them available to any retail investor in the United

Kingdom may be unlawful under the UK PRIIPs Regulation.

Forward Looking Statements

This press release contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform Act of 1995, as amended. Actual results may differ materially from those

reflected in the forward-looking statements. We undertake no obligation to update any forward-looking statement or other information contained

in this press release to reflect events or circumstances occurring after the date of this press release or to reflect the occurrence of

unanticipated events or circumstances, including, without limitation, changes in our business or acquisition strategy or planned capital

expenditures, or to reflect the occurrence of unanticipated events.

About Pampa

Pampa is an Argentine leading independent energy company, participating

in the electricity and gas businesses. We and our subsidiaries, joint ventures and affiliates are engaged in the generation and transmission

of electricity, exploration, production, commercialization and transportation of oil and gas, and production of petrochemical products.

Our shares are traded on the New York Stock Exchange and the Bolsas y Mercados Argentinos S.A.

For further information, see our website www.pampa.com or contact:

Investor Relations

Phone: +54-11-4344-6000

Email: investor@pampa.com

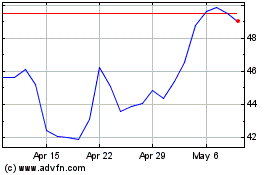

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

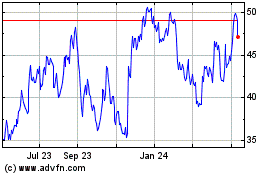

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Nov 2023 to Nov 2024