Lowe's, Oracle, American Airlines: Stocks That Defined the Week

August 21 2020 - 7:34PM

Dow Jones News

By Francesca Fontana

Lowe's Cos.

Americans are turning into fixer-uppers during the pandemic as

they spend less on vacations and gyms, giving Lowe's and Home Depot

a boost. Revenue surged at the home-improvement retailers as sales

to do-it-yourself consumers outpaced demand from professional

contractors. The DIY trend played to Lowe's advantage in the

quarter, as it relies less on sales to contractors than Home Depot

does. Lowe's shares added 0.2% Wednesday.

McDonald's Corp.

The McFight between the fast-food-food giant and its former boss

escalated this week when former Chief Executive Officer Steve

Easterbrook said his former employer had information about his

relationships with other employees when it negotiated his

multimillion-dollar severance package. McDonald's sued Mr.

Easterbrook on Aug. 10, saying he lied to investigators and its

board to cover up those relationships to secure the payout.

McDonald's has taken the unusual move of seeking to claw back Mr.

Easterbrook's severance in court after firing him in November,

exposing the company and its board to a rare public fight over

compensation awarded to a former executive. McDonald's shares rose

0.8% Monday.

Oracle Corp.

A company with close ties to the White House is President

Trump's new favorite bidder for TikTok. Oracle has entered the

running to buy the U.S. operations of TikTok, adding a fresh

wrinkle to the bidding for the Chinese-owned video-sharing app, and

the president offered his endorsement Tuesday. TikTok's owner,

ByteDance Ltd., is facing a fall deadline from the Trump

administration to divest itself of its U.S. operations. Oracle has

closer ties to the White House than most other parties involved in

the bidding. Larry Ellison, the company's co-founder, chairman and

largest shareholder, earlier this year threw a fundraiser at his

house for the president. Oracle shares gained 2.2% Tuesday.

Apple Inc.

Apple became the first U.S. public company to join the $2

trillion club. It surpassed that market value for the first time

Wednesday, highlighting the iPhone maker's commanding role in the

world economy. The stock has more than doubled from its March 23

low, boosted by steady demand for the company's devices and

better-than-feared results in its core iPhone business as millions

of Americans work from home. The milestone is the latest for Apple

under Chief Executive Tim Cook, who succeeded late co-founder and

product inventor Steve Jobs in 2011. Shares of Apple rose as much

as 1.4% to $468.65, eclipsing the $467.77 mark needed to reach the

milestone, and ended up 0.1% Wednesday.

Target Corp.

Target hit the bull's-eye during this pandemic. The big-box

retailer reported the strongest quarterly sales growth in its

history on Wednesday, citing broad gains across categories such as

food, electronics and home goods and a rebound in clothing sales.

The pandemic has boosted the fortunes of big U.S. chains like

Target that were able to stay open and feed America's basic needs.

The company has benefited as coronavirus concerns fueled demand for

services that let shoppers pick up goods in parking lots or skip

trips to the store. Target also sells groceries and other household

staples that have been in demand as Americans cook and clean more

in their homes. Target shares jumped 13% Wednesday.

American Airlines Group Inc.

It just got more difficult to fly from here to there if you live

in certain parts of the U.S. American Airlines said it would stop

flights to 15 cities once the federal aid for airlines expires in

October, an announcement that could escalate pressure on lawmakers

to extend another round of aid. The $25 billion bailout required

airlines to maintain a certain level of flying to cities in their

networks so that no city was cut off entirely. The cuts will affect

airports in cities including New Haven, Conn., and Stillwater,

Okla.; some aren't served by any other airline. American struck the

cities from its schedule from Oct. 7 through Nov. 3, saying it was

the first step in re-evaluating its network in the coming weeks.

American Airlines shares fell 1.4% Thursday.

Lyft Inc.

You're still able to get a Lyft in California -- for now. A

state appeals court on Thursday paused a lower-court ruling that

required the ride-hailing company and its rival Uber Technologies

Inc. to reclassify their drivers as employees. The reprieve means

both companies can continue operating while they fight a

high-stakes legal battle with their home state. California sued

Lyft and Uber in May for allegedly violating the law, which would

require the companies to treat workers as employees rather than

independent contractors. As employees, drivers would be eligible

for sick days and other benefits, issues that have become more

pressing during the coronavirus pandemic. The San Francisco

companies have argued that they are technology platforms, not

transportation companies, so the drivers aren't part of their usual

course of business. Lyft shares gained 5.8% Thursday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

August 21, 2020 19:19 ET (23:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

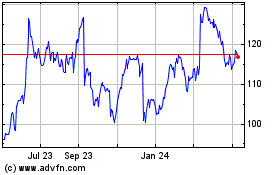

Oracle (NYSE:ORCL)

Historical Stock Chart

From Dec 2024 to Jan 2025

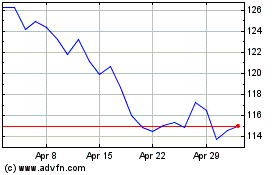

Oracle (NYSE:ORCL)

Historical Stock Chart

From Jan 2024 to Jan 2025