0000791963false00007919632025-02-272025-02-27

As filed with the Securities and Exchange Commission on February 27, 2025

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

| | | | | | | | |

| Delaware | | 98-0080034 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation) | | Identification No.) |

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A non-voting common stock | OPY | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 5 -- Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 27, 2025, Oppenheimer Holdings, Inc. (the “Company”) announced that Albert G. Lowenthal, Chairman of the Board of Directors (“Board”) and Chief Executive Officer (“CEO”), would step down as CEO of the Company and its primary operating subsidiary, Oppenheimer & Co. Inc. (“Opco”), effective at the close of the Annual Shareholders Meeting of the Company to be held on May 5, 2025. Mr. Lowenthal will continue in his role as Chairman of the Company and also will serve as Executive Chairman of Opco. Paul Friedman will continue to serve as Lead Independent Director of the Company.

In addition, on February 27, 2025, the Board unanimously appointed President and Director Mr. Robert S. Lowenthal (48) to serve as CEO of the Company and Opco, effective simultaneously with Mr. Albert Lowenthal’s transition. Mr. Robert Lowenthal will continue to serve as Chairman of the Management Committee and Co-Chair of the Risk Management Committees of Opco as well as a director of the Company, a position he has held since 2013.

Mr. Robert Lowenthal was appointed President of the Company and Opco in October of 2021. He retained his prior role as Head of Investment Banking of Opco. In his role as President and Head of Investment Banking, Mr. Robert Lowenthal has been working closely with each of the Company’s business unit heads and members of the Management Committee on various strategic and operational matters. From December 2016 to October 2021, Mr. Lowenthal in his role as Head of Investment Banking was responsible for all transactional activity including Mergers and Acquisitions, Restructuring, Private Placements and Equity and Debt Capital Markets. From September 2007 until December 2016, Mr. Lowenthal was Opco’s Global Head of Fixed Income responsible for all taxable and non-taxable fixed income sales and trading. Mr. Lowenthal joined the Company in January 1999 as Senior Vice President and Chief Information Officer where he was responsible for all information systems used throughout the Company.

Mr. Lowenthal graduated with a bachelor’s degree from the John M. Olin School of Business at Washington University in St. Louis. He also holds an MBA from Columbia University.

No arrangements or understandings exist between Mr. Robert Lowenthal and any other person pursuant to which he was selected as an officer. Mr. Robert Lowenthal is the son of Mr. Albert Lowenthal. Outside of this relationship, Mr. Robert Lowenthal does not have any family relationship with any director or other executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer.

The Compensation Committee of the Board will approve the compensation arrangements for Mr. Albert G. Lowenthal and Mr. Robert S. Lowenthal in connection with their respective new roles at a later date.

A copy of the press release issued by the Company in connection with the above is attached to this Current Report as Exhibit 99.1 and is incorporated herein by reference.

SECTION 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits: The following are filed as exhibits to this report:

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Oppenheimer Holdings Inc.

| | |

Date: February 27, 2025

By: /s/ Albert G. Lowenthal

Chairman and Chief Executive Officer

|

OPPENHEIMER HOLDINGS INC. ANNOUNCES CEO SUCCESSION

ALBERT G. LOWENTHAL TRANSITIONS TO EXECUTIVE CHAIRMAN

ROBERT S. LOWENTHAL APPOINTED CEO & PRESIDENT

NEW YORK, February 27, 2025 – Oppenheimer Holdings Inc. today announced that Albert G. Lowenthal, Chairman of the Board of Directors and Chief Executive Officer (CEO), would step down as CEO of the Company and its primary operating subsidiary, Oppenheimer & Co. Inc. (Opco), effective at the close of the Annual Shareholders Meeting of the Company to be held on May 5, 2025. Mr. Lowenthal will continue in his role as Chairman of the Company and also will serve as Executive Chairman of Opco. He will be succeeded by Robert S. Lowenthal, currently serving as President and Head of Investment Banking, who will become CEO and President.

Bud Lowenthal has been leading Oppenheimer and its predecessors for 40 years and has spent 60 years in the financial services industry. During his tenure, he made fifteen strategic acquisitions, positioned the firm for growth, and built a resilient and well-capitalized balance sheet through disciplined investments. Under his leadership, the Company was transformed from a $5 million revenue and capital base entity in 1985 into a global firm, recently reporting record results including $1.4 billion in revenue and $71.5 million in earnings ($6.91 per share) for 2024.

The Company’s capital has expanded from $5 million to over $850 million, significantly enhancing shareholder value through consistent returns and long-term appreciation. The stock price has risen from $1.10 in 1985 per share to $64.09 at year-end, an over 5,726% increase (nearly 11% per year). Additionally, the Company has paid quarterly dividends to shareholders for 113 consecutive quarters. This growth has driven the firm’s expansion from 125 employees to over 3,000 across 90 locations, including London, Tel Aviv, and Hong Kong. As one of the few independent, non-bank broker-dealers with full-service capabilities, the firm has built a resilient culture, a recognizable brand, and a strong position in navigating market shifts.

“It has been my personal honor and professional privilege to lead Oppenheimer. For over 140 years, our firm has put capital to work for companies, entrepreneurs, individuals, and families—driving economic growth across America and beyond,” said Bud Lowenthal. “The Company continues to operate energetically and competes across a broad spectrum of capabilities, including Wealth Management, Capital Markets, and Investment Banking. The transition in leadership will serve all of our constituencies for many years to come.”

Rob Lowenthal has been a driving force at the Company for over 25 years, serving in diverse leadership roles that span revenue generation, infrastructure development, and corporate governance. As a member of the Board of Directors since 2013 and Chair of the Management Committee and Co-Chair of the Risk Management Committee, he has played a critical role in shaping the firm’s strategic direction. Since his appointment as President of the Company and Opco, he has led growth initiatives alongside business

leaders, strategically aligning capital investments to drive operational efficiency, digital transformation, process improvement, and the strengthening of brand and culture.

Throughout his tenure, Rob has held pivotal leadership positions across the organization. As Head of Investment Banking, he oversaw all banking activities, including Mergers and Acquisitions, Restructuring, Private Placements, and Equity and Debt Capital Markets. Prior to that, he served as Opco’s Global Head of Fixed Income, where he was responsible for all taxable and non-taxable fixed income sales and trading. His career at the Company began as Senior Vice President and Chief Information Officer, overseeing the firm’s information systems and modernization of its core infrastructure. His breadth of experience and leadership have been instrumental in driving the Company’s growth and evolution.

Rob earned a Bachelor’s degree from the John M. Olin School of Business at Washington University in St. Louis and an MBA from Columbia University.

“We are grateful to Bud Lowenthal for his outstanding leadership and his many contributions,” said Paul Friedman, Lead Independent Director. “He is a remarkable leader and entrepreneur. He built a Company that helped clients, employees, and shareholders achieve their most important goals. He embodies the American spirit, knowing how to invest in ideas and businesses that count. We are confident that Rob Lowenthal is the right person to lead the Company into its next phase of growth.”

“I am honored to be appointed CEO of Oppenheimer,” said Rob Lowenthal. “The Company has a storied history and a legacy of providing generations of clients with exceptional service and valuable insights into their investments. I am excited by the opportunities ahead and the ways in which we can continue to deliver value to our shareholders, employees, and clients.”

Oppenheimer Holdings Inc.

Oppenheimer Holdings Inc., through its operating subsidiaries, is a leading middle market investment bank and full service broker-dealer that is engaged in a broad range of activities in the financial services industry, including retail securities brokerage, institutional sales and trading, investment banking (corporate and public finance), equity and fixed income research, market-making, trust services, and investment advisory and asset management services. With roots tracing back to 1881, the Company is headquartered in New York and has 90 locations across the United States and institutional businesses located in London, Tel Aviv, and Hong Kong.

Media Contact:

Joan Khoury

Senior Managing Director & Chief Marketing Officer

212. 825.4351

Joan.khoury@opco.com

Joseph Kuo / Michael Dugan

Haven Tower Group LLC

424.317.4851 or 424.317.4852

jkuo@haventower.com or mdugan@haventower.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

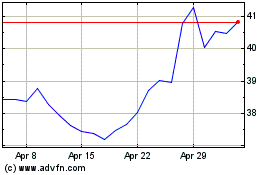

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Mar 2024 to Mar 2025