Offerpad Announces $90 Million Private Placement

February 01 2023 - 8:30AM

Business Wire

Offerpad Solutions Inc. (“Offerpad”, “Company”) (NYSE: OPAD), a

leading real estate tech company built to simplify home buying and

selling, announced today that it has entered into subscription

agreements with a group of private investors, together with CEO

Brian Bair and existing stockholders Roberto Sella and First

American Financial Corporation, to purchase an aggregate of

160,742,959 prefunded warrants to purchase Offerpad’s Class A

common stock. Each warrant was sold at a price of $0.5599 per

warrant, with an initial exercise price of $0.0001 per warrant,

subject to certain customary anti-dilution adjustment provisions,

and was calculated based on a 20% discount to the 5-day closing

price average on January 27, 2023.

The issuance of the shares of Class A common stock has been

approved by Offerpad stockholders representing more than a majority

of the voting power of the Company’s common stock, and Offerpad

will prepare and file a related information statement with the

Securities and Exchange Commission (“SEC”). The pre-funded warrants

will not be exercisable until at least 21 days after the definitive

information statement is filed with the SEC or such later time as

is necessary to comply with the listing requirements of the New

York Stock Exchange.

The Company plans to use the proceeds from the private placement

for general corporate purposes.

The pre-funded warrants and the shares of Offerpad’s Class A

common stock issuable upon exercise of the warrants are being

issued and sold pursuant to an exemption from registration provided

for under the Securities Act of 1933, as amended (the “Securities

Act”), and neither the pre-funded warrants nor the shares of

Offerpad’s Class A common stock issuable upon exercise of the

warrants have been registered under the Securities Act. The

securities may not be offered or sold in the United States, except

pursuant to an effective registration statement or an applicable

exemption from the registration requirements of the Securities Act.

Offerpad has agreed to file a registration statement with the SEC

registering the resale of the shares of its Class A common stock

issuable upon exercise of the pre-funded warrants issued and sold

in the private placement.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

About Offerpad

Offerpad’s mission is to deliver the best home buying and

selling experience so you can spend less time ‘real estat-ing’ and

more time living. From cash offers and flexible listing options to

mortgages and buyer services, Offerpad has been helping homeowners

since 2015. We pair our local expertise in residential real estate

with proprietary technology to put you in control of the process

and help find the right solution that fits your needs. Visit

Offerpad.com for more information.

Forward Looking Statements

Certain statements in this press release may be considered

forward-looking statements. Forward-looking statements generally

relate to future events or Offerpad’s future financial or operating

performance. For example, statements regarding the closing of

Offerpad’s private placement and Offerpad’s use of proceeds from

the private placement, are forward-looking statements. In some

cases, you can identify forward-looking statements by terminology

such as “pro forma,” “may,” “should,” “could,” “might,” “plan,”

“possible,” “project,” “strive,” “budget,” “forecast,” “expect,”

“intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,”

“potential” or “continue,” or the negatives of these terms or

variations of them or similar terminology. Such forward-looking

statements are subject to risks, uncertainties, and other factors

which could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. These

forward-looking statements are based upon estimates and assumptions

that, while considered reasonable by Offerpad and its management,

are inherently uncertain. Nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Offerpad

does not undertake any duty to update these forward-looking

statements.

#OPAD_IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230201005391/en/

Investors Stefanie Layton Investors@offerpad.com

Media Press@Offerpad.com

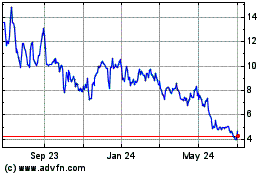

Offerpad Solutions (NYSE:OPAD)

Historical Stock Chart

From Aug 2024 to Sep 2024

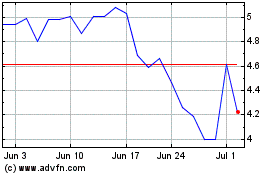

Offerpad Solutions (NYSE:OPAD)

Historical Stock Chart

From Sep 2023 to Sep 2024