- Leading manufacturer of custom-engineered control building

solutions designed to protect critical infrastructure assets

- Expands nVent’s enclosures portfolio in new applications and

enhances systems protection capability

- Strengthens nVent’s position with the electrification of

everything in high-growth verticals including power utilities, data

centers and renewables

- Expect transaction to be accretive to adjusted EPS in the first

year after completing the transaction

nVent Electric plc (NYSE: NVT) (“nVent”), a global leader in

electrical connection and protection solutions, today announced

that it has entered into a definitive agreement to acquire the

parent of Trachte, LLC for a purchase price of $695 million,

subject to customary adjustments. Trachte is a leading manufacturer

of custom-engineered control building solutions designed to protect

critical infrastructure assets.

nVent Chair and CEO Beth Wozniak said, “Trachte will expand our

enclosures portfolio in new applications and enhance our system

protection capability. It further strengthens our solutions in

high-growth verticals, including power utilities, data centers and

renewables. With the macro trends of modernizing and upgrading

electrical infrastructure as well as the expansion of data centers,

Trachte provides us with a platform to accelerate our growth and

provide broader solutions for customers. We look forward to

welcoming the Trachte team to nVent, and together helping to build

a more sustainable and electrified world.”

Trachte has an established history of providing control building

solutions, and is headquartered in Madison, Wisconsin with more

than 500 employees. Trachte estimates 2024 revenues to be

approximately $250 million.

nVent expects the acquisition to be accretive to adjusted

earnings per share in the first year following completion of the

transaction. The effective enterprise value multiple is ~12x

anticipated Trachte 2024 adjusted EBITDA. The transaction is

expected to close in the third quarter of 2024, subject to

customary conditions, including regulatory approval. nVent expects

to fund the acquisition with a combination of available cash on

hand and new debt.

Upon closing of this transaction, nVent plans to operate Trachte

within its Enclosures segment.

Foley & Lardner LLP is providing legal counsel to nVent in

connection with the transaction. Citigroup Global Markets Inc. is

providing nVent with committed bridge financing for the

transaction.

About nVent

nVent is a leading global provider of electrical connection and

protection solutions. We believe our inventive electrical solutions

enable safer systems and ensure a more secure world. We design,

manufacture, market, install and service high performance products

and solutions that connect and protect some of the world's most

sensitive equipment, buildings and critical processes. We offer a

comprehensive range of enclosures, electrical connections and

fastening and thermal management solutions across industry-leading

brands that are recognized globally for quality, reliability and

innovation. Our principal office is in London and our management

office in the United States is in Minneapolis. Our robust portfolio

of leading electrical product brands dates back more than 100 years

and includes nVent CADDY, ERICO, HOFFMAN, ILSCO, RAYCHEM and

SCHROFF.

nVent CADDY, ERICO, HOFFMAN, ILSCO, RAYCHEM and SCHROFF are

trademarks owned or licensed by nVent Services GmbH or its

affiliates.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains statements that we believe to be

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements, other

than statements of historical fact are forward looking statements.

Without limitation, any statements preceded or followed by or that

include the words “targets,” “plans,” “believes,” “expects,”

“intends,” “will,” “likely,” “may,” “anticipates,” “estimates,”

“projects,” “forecasts,” “should,” “would,” “could,” “positioned,”

“strategy,” “future,” “are confident,” or words, phrases or terms

of similar substance or the negative thereof, are forward-looking

statements. All statements made about the anticipated acquisition,

including the anticipated time for completing the acquisition, the

expected financial results of the acquired business and the

anticipated benefits of the acquisition, are forward-looking

statements. These forward-looking statements are not guarantees of

future performance and are subject to risks, uncertainties,

assumptions and other factors, some of which are beyond our

control, which could cause actual results to differ materially from

those expressed or implied by such forward-looking statements.

Among these factors are our ability to close and fund the

acquisition on the expected terms and time schedule, including

obtaining regulatory approvals and satisfying other closing

conditions; our ability to integrate the acquisition successfully;

our ability to retain customers and employees of the acquired

business; adverse effects on our business operations or financial

results, including due to the overall global economic and business

conditions impacting our business; the ability to achieve the

benefits of our restructuring plans; the ability to successfully

identify, finance, complete and integrate acquisitions; competition

and pricing pressures in the markets we serve, including the

impacts of tariffs; volatility in currency exchange rates, interest

rates and commodity prices; inability to generate savings from

excellence in operations initiatives consisting of lean enterprise,

supply management and cash flow practices; inability to mitigate

material and other cost inflation; risks related to the

availability of, and cost inflation in, supply chain inputs,

including labor, raw materials, commodities, packaging and

transportation; increased risks associated with operating foreign

businesses, including risks associated with military conflicts,

such as that between Russia and Ukraine, and related sanctions; the

ability to deliver backlog and win future project work; failure of

markets to accept new product introductions and enhancements; the

impact of changes in laws and regulations, including those that

limit U.S. tax benefits; the outcome of litigation and governmental

proceedings; and the ability to achieve our long-term strategic

operating goals. Additional information concerning these and other

factors is contained in our filings with the U.S. Securities and

Exchange Commission, including our Annual Report on Form 10-K and

our Quarterly Reports on Form 10-Q. All forward-looking statements

speak only as of the date of this press release. nVent assumes no

obligation, and disclaims any obligation, to update the information

contained in this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240605277461/en/

Investor Contact Tony Riter Vice President, Investor

Relations nVent 763.204.7750 Tony.Riter@nVent.com

Media Contact Stacey Wempen Director, External

Communications nVent 763.204.7857 Stacey.Wempen@nVent.com

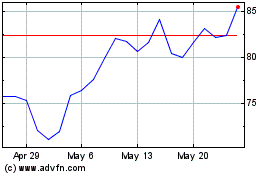

nVent Electric (NYSE:NVT)

Historical Stock Chart

From Oct 2024 to Nov 2024

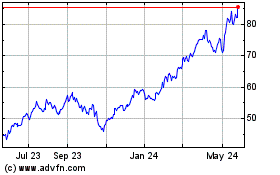

nVent Electric (NYSE:NVT)

Historical Stock Chart

From Nov 2023 to Nov 2024