Form SC 13D - General statement of acquisition of beneficial ownership

May 17 2024 - 8:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

NUVEEN ARIZONA QUALITY MUNICIPAL INCOME FUND

(Name of Issuer)

Common Shares, $0.01 par value

(Title of Class of Securities)

67061W104

(CUSIP Number)

Saba Capital Management, L.P.

405 Lexington Avenue

58th Floor

New York, NY 10174

Attention: Michael D'Angelo

(212) 542-4635

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 13, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1 of 10 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSON

Saba Capital Management, L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

598,308 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

598,308 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

598,308 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.16% |

| 14 |

TYPE OF REPORTING PERSON

PN; IA |

| |

|

|

|

The percentages used herein are calculated based upon 11,590,366 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/3/24

| 1 |

NAME OF REPORTING PERSON

Boaz R. Weinstein |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

598,308 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

598,308 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

598,308 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.16% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

The percentages used herein are calculated based upon 11,590,366 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/3/24

| 1 |

NAME OF REPORTING PERSON

Saba Capital Management GP, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

598,308 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

598,308 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

598,308 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.16% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

The percentages used herein are calculated based upon 11,590,366 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/3/24

| Item 1. |

SECURITY AND ISSUER |

| |

|

|

| |

This statement on Schedule 13D (the "Schedule 13D") relates to the common shares (the "Common Shares"), of NUVEEN ARIZONA QUALITY MUNICIPAL INCOME FUND (the "Issuer"). The Issuer's principal executive offices are located at 333 WEST WACKER DRIVE, CHICAGO, IL, 60606

The information set forth in response to each separate Item below shall be deemed to be a response to all Items where such information is relevant. |

| |

|

| Item 2. |

IDENTITY AND BACKGROUND |

| |

|

| (a) |

This Schedule 13D is being jointly filed by:

|

| |

(i) |

Saba Capital Management, L.P., a Delaware limited partnership ("Saba Capital");

|

| |

(ii) |

Saba Capital Management GP, LLC, a Delaware limited liability company ("Saba GP"); and

|

| |

(iii) |

Mr. Boaz R. Weinstein ("Mr. Weinstein"), |

| |

|

| |

(together, the "Reporting Persons"). Any disclosures herein with respect to persons other than the Reporting Persons are made on information and belief after making inquiry to the appropriate party. |

| |

|

| |

|

| |

|

| |

The filing of this statement should not be construed as an admission that any Reporting Person is, for the purposes of Sections 13 of the Securities Exchange Act of 1934, the beneficial owner of the Common Shares reported herein. |

| |

|

| (b) |

The address of the business office of each of the Reporting Persons is 405 Lexington Avenue, 58th Floor, New York, New York 10174. |

| |

|

| (c) |

The principal business of: (i) Saba Capital is to serve as investment manager to private and public investment funds and/or accounts, (ii) Saba GP is to serve as general partner of the Saba Capital and other affiliated entities, and (iii) Mr. Weinstein, an individual, is managing member of the general partner of Saba Capital and other affiliated entities. |

| |

|

| (d) |

The Reporting Persons have not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| |

|

| (e) |

The Reporting Persons have not, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws. |

| (f) |

Saba Capital is organized as a limited partnership under the laws of the State of Delaware. Saba GP is organized as a limited liability company under the laws of the State of Delaware. Mr. Weinstein is a citizen of the United States. |

| |

|

| |

The Reporting Persons have executed a Joint Filing Agreement, dated 5/17/24, with respect to the joint filing of this Schedule 13D, and any amendment or amendments hereto, a copy of which is attached hereto as Exhibit 1. |

| |

|

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| |

|

| |

Funds for the purchase of the Common Shares were derived from the subscription proceeds from investors and the capital appreciation thereon and margin account borrowings made in the ordinary course of business. In such instances, the positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the account, which may exist from time to time. Since other securities are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Common Shares reported herein. A total of approximately $6,237,733 was paid to acquire the Common Shares reported herein. |

| |

|

| Item 4. |

PURPOSE OF TRANSACTION |

| |

|

| |

The Reporting Persons acquired the Common Shares to which this Schedule 13D relates in the ordinary course of business for investment purposes because they believe that the Common Shares are undervalued and represent an attractive investment opportunity.

The Reporting Persons may engage in discussions with management, the Board of Trustees (the "Board"), other shareholders of the Issuer and other relevant parties, including representatives of any of the foregoing, concerning the Reporting Persons' investment in the Common Shares and the Issuer, including, without limitation, matters concerning the Issuer's business, operations, board appointments, governance, performance, management, capitalization, trading of the Common Shares at a discount to the Issuer's net asset value and strategic plans and matters relating to the open or closed end nature of the Issuer and timing of any potential liquidation of the Issuer. The Reporting Persons may exchange information with any persons pursuant to appropriate confidentiality or similar agreements or otherwise, work together with any persons pursuant to joint agreements or otherwise, propose changes in the Issuer's business, operations, board appointments, governance, management, capitalization, strategic plans or matters relating to the open or closed end nature of the Issuer or timing of any potential liquidation of the Issuer, or propose or engage in one or more other actions set forth herein. |

| |

The Reporting Persons may also propose or take one or more of the actions described in subsections (a) through (j) of Item 4 of Schedule 13D, including the solicitation of proxies, and may discuss such actions with the Issuer and Issuer's management and the board of directors, other stockholders of the Issuer and other interested parties. The Reporting Persons may make binding or non-binding shareholder proposals, or may nominate one or more individuals as nominees for election to the Board in connection with their investment in the Common Shares of the Issuer.

The Reporting Persons intend to review their investment in the Issuer on a continuing basis. Depending on various factors, including, without limitation, the outcome of any discussions referenced above, the Issuer's financial position and strategic direction, actions taken by management or the Board, price levels of the Common Shares, other investment opportunities available to the Reporting Persons, conditions in the securities market and general economic and industry conditions, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem appropriate, including, without limitation, purchasing additional Common Shares or selling some or all of their Common Shares, engaging in short selling of or any hedging or similar transactions with respect to the Common Shares and/or otherwise changing their intention with respect to any and all matters referred to in Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time to time, review or reconsider their position and/or change their purpose and/or formulate plans or additional proposals with respect to their investment in the Common Shares.

The Reporting Persons have not entered into any agreement with any third party to act together for the purpose of acquiring, holding, voting or disposing of the Common Shares reported herein. |

| |

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

|

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of Common Shares and percentages of the Common Shares beneficially owned by each of the Reporting Persons. The percentages used herein are calculated based upon 11,590,366 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/3/24

|

|

|

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of Common Shares as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

|

|

|

|

|

(c)

|

The transactions in the Common Shares effected within the past sixty days by the Reporting Persons, which were all in the open market, are set forth in Schedule A, and are incorporated herein by reference.

|

|

(d)

|

The funds and accounts advised by Saba Capital have the right to receive the dividends from and proceeds of sales from the Common Shares.

|

|

|

|

|

(e)

|

Not applicable.

|

| |

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

|

|

|

|

Other than the Joint Filing Agreement attached as Exhibit 1 hereto, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named in Item 2 hereof and between such persons and any person with respect to any securities of the Issuer, including but not limited to transfer or voting of any other securities, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, divisions of profits or loss, or the giving or withholding of proxies.

|

| |

|

|

Item 7.

|

MATERIAL TO BE FILED AS EXHIBITS

|

|

|

|

|

Exhibit 1:

|

Joint Filing Agreement as required by Rule 13d-1(k)(1) under the Act.

|

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: May 17, 2024

| |

SABA CAPITAL MANAGEMENT, L.P.

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo

Title: Chief Compliance Officer |

| |

|

| |

|

| |

SABA CAPITAL MANAGEMENT GP, LLC

By: /s/ Michael D'Angelo

Name: Michael D'Angelo

Title: Authorized Signatory |

| |

|

| |

|

| |

BOAZ R. WEINSTEIN

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo |

| |

Title: Attorney-in-fact* |

* Pursuant to a power of attorney dated as of November 16, 2015, which is incorporated herein by reference to Exhibit 2 to the Schedule 13G filed by the Reporting Persons on December 28, 2015, accession number: 0001062993-15-006823

|

|

Schedule A

This Schedule sets forth information with respect to each purchase and sale of Common Shares which were effectuated by Saba Capital during the past sixty days. All transactions were effectuated in the open market through a broker.

| Trade Date |

Buy/Sell |

Shares |

Price |

| 4/5/2024 |

Sell |

(10,000) |

10.89 |

| 5/1/2024 |

Buy |

694 |

10.61 |

| 5/7/2024 |

Buy |

600 |

10.81 |

| 5/10/2024 |

Buy |

1,754 |

10.80 |

| 5/13/2024 |

Buy |

42,966 |

10.87 |

| 5/15/2024 |

Buy |

3,806 |

10.89 |

| 5/16/2024 |

Buy |

1,335 |

10.87 |

EXHIBIT 1

JOINT FILING AGREEMENT

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to this statement on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional joint filing agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness and accuracy of the information concerning him or it contained herein and therein, but shall not be responsible for the completeness and accuracy of the information concerning the others, except to the extent that he or it knows or has reason to believe that such information is inaccurate.

DATE: May 17, 2024

| |

SABA CAPITAL MANAGEMENT, L.P.

/s/ Michael D'Angelo |

| |

Name: Michael D'Angelo

Title: Chief Compliance Officer |

| |

|

| |

|

| |

SABA CAPITAL MANAGEMENT GP, LLC

/s/ Michael D'Angelo

Name: Michael D'Angelo

Title: Authorized Signatory |

| |

|

| |

|

| |

BOAZ R. WEINSTEIN

/s/ Michael D'Angelo |

| |

Name: Michael D'Angelo |

| |

Title: Attorney-in-fact* |

| |

|

| |

Title: Attorney-in-fact* |

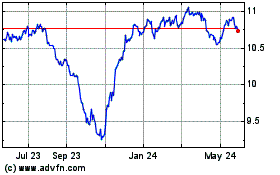

Nuveen Arizona Quality M... (NYSE:NAZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

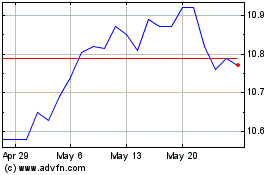

Nuveen Arizona Quality M... (NYSE:NAZ)

Historical Stock Chart

From Jan 2024 to Jan 2025