Court Ruling Paves Way For Chinese Investment in Chilean Lithium Producer

October 04 2018 - 8:16PM

Dow Jones News

By Micah Maidenberg

China's biggest lithium company, Tianqi Lithium Corp., won a

favorable court ruling, moving it closer to becoming the

second-largest shareholder in a major producer of the metal used in

electric-vehicle batteries.

On Thursday, a Chilean court signed off on an agreement that

Tianqi struck with the country's competition regulator over its

proposed $4.1 billion acquisition of about 24% of shares in

Sociedad Quimica y Minera de Chile SA, or SQM.

The court said the agreement was "proportional and sufficient to

mitigate" risks of Tianqi's acquisition of the SQM stake. Under the

deal, which lasts up to six years, Tianqi agreed it wouldn't

appoint its directors or employees to the SQM board and promised

that its appointees wouldn't disclose SQM's confidential

information, among other measures.

Earlier this year, Tianqi struck a deal to buy the SQM stake for

close to $4.1 billion from fertilizer company Nutrien Ltd., which

needs to sell it to meet requirements from Indian and Chinese

regulators related to a separate transaction.

A former government official in Chile, however, challenged the

deal earlier this year, asking for an antitrust review.

SQM currently controls about 18% of global lithium production

capacity, while Tianqi controls 10%, making the companies the

second-largest and third-largest players in the market, according

to data from IHS Markit. U.S.-based Albemarle Corp. is the largest,

controlling 25% of production capacity.

Should Tianqi complete the deal as planned, the

lithium-production industry would become more intertwined. Tianqi

and Albemarle, for example, also operate a mine together in

Australia in a joint venture.

SQM had asked the court to reject the agreement, stating that

the deal between Tianqi and the competition regulator didn't

provide enough safeguards against potential harm to its business

from a having a significant competitor as a major shareholder. SQM

said in a statement Thursday it is analyzing the court's

decision.

Tianqi said it welcomed the court's decision on a deal that

"safeguards competition and ensures the highest level of corporate

governance practices are put in place at SQM after our minority

investment is completed."

"We are confident that all stakeholders will benefit from

Tianqi's contributions to SQM's long-term development," Tianqi

said.

Tianqi and Nutrien both said Thursday they expect the deal for

the SQM stake to close in the fourth quarter this year.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 04, 2018 20:01 ET (00:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

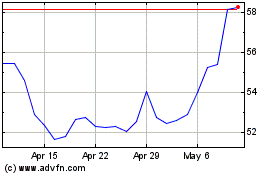

Nutrien (NYSE:NTR)

Historical Stock Chart

From Aug 2024 to Sep 2024

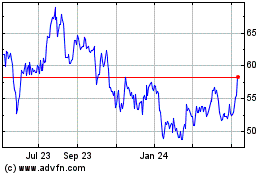

Nutrien (NYSE:NTR)

Historical Stock Chart

From Sep 2023 to Sep 2024