Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 05 2023 - 5:17PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of April,

2023

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

MATERIAL FACT

Grand Cayman, Cayman Islands, April 5, 2023 –

Nu Holdings Ltd. (NYSE: NU, B3: NUBR33) ("Nu" or the "Company"), in continuity with the Material Fact

disclosed on September 15, 2022 and the Notice to the Market disclosed on December 22, 2022, in relation to the procedures for the Discontinuance

of the Level III BDRs Program, communicates to its shareholders and the market in general that the Board of Directors of the Company has

decided, on this date, to resubmit the plan for the Discontinuity of its Level III BDRs Program, having approved the following for implementation

of such process:

| a. | presentation of a new plan for

the voluntary discontinuance of the Level III BDR Program ("New Plan"), with its consequent cancellation with the CVM;

and |

b.

after the conclusion of the Discontinuance of the Level

III BDRs Program, the cancellation of the Company's registration with the CVM as a foreign public issuer of category "A" securities.

The New Plan will be submitted to B3 for approval,

and then to CVM. If approved in the proposed format, the New Plan provides that, during a 30-day period ("Settlement Period"),

all holders of Level III BDRs, including participants in the NuSócios Client Program, will be given a choice to:

i. remain as Company’s shareholder

through the receipt of class A ordinary shares traded on the NYSE ("Class A Ordinary Shares"), in the proportion of Level

III BDRs held by each holder, with each Level III BDR representing one-sixth (1/6) of a Class A ordinary Share ("Receipt of Class

A Ordinary Shares"). In order for a holder of Level III BDRs to be able to choose this option, the investor must hold a sufficient

number of Level III BDRs to make up Class A Ordinary Shares, that is, more than six (6) Level III BDRs and an active account with a brokerage

house in the United States of America; or

ii. remain as holders of the Company's

BDRs through the receipt of Unsponsored Level I BDRs, in the proportion of 1:1 for the Level III BDRs held by each holder, with both having

the same composition and NuSócios Client Program participants receiving their Unsponsored Level I BDRs through the Comissário

Mercantil, under the same terms and conditions currently applied to the ownership Level III BDRs (“Receipt of Unsponsored

Level I BDRs"); or iii. if no declaration during the Settlement

Period is made, the Company will sell on NYSE all the underlying shares of its Level III BDRs, and the resulting dollar amount will be

converted into Brazilian Reais by the depositary institution of the Level III BDR Program (converted at the current USD/BRL exchange rate)

and the former holders of such Level III BDRs will receive, for each Level III BDR, an amount equivalent to the average price per share

at which the shares were sold, after deduction of all taxes which may be due in accordance with applicable legislation ("Sales

Facility").

The New Plan, therefore, provides for the possibility

of delivering Unsponsored Level I BDRs as one of the alternatives that current Level III BDR holders may voluntarily opt for in the context

of the Discontinuance of the Level III BDRs Program. The Company understands that this adjustment in the structure of Discontinuance of

the Level III BDRs Program does not bring any harm to current and future holders of the Company's BDRs, including participants of the

NuSócios Client Program, and at the same time, will allow the Company to further optimize processes and costs, and continue to

offer Brazilian investors a direct and simplified way to be exposed to the Company's securities.

Finally, the Company informs that Banco Bradesco

S.A. ("Bradesco") will request the registration of the Unsponsored Level I BDR Program as soon as the Company presents the New

Plan to B3.

The Company will keep the market, its shareholders

and the NuSócios Client Program informed about the subject of this material fact, and will disclose to BDR holders, after approval

by B3 and CVM, the details of the procedures for the Discontinuance of the Level III BDR Program.

Contacts:

Investor Relations

Jörg Friedemann

investors@nubank.com.br

Media Relations

Leila Suwwan

press@nubank.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Jorg

Friedemann |

| |

|

Jorg

Friedemann

Investor

Relations Officer |

Date: April

05, 2023

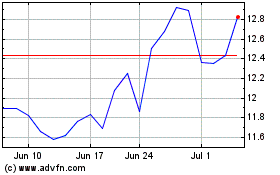

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2024 to Nov 2024

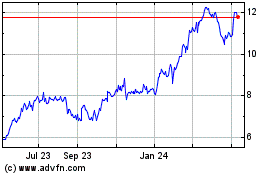

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2023 to Nov 2024