- Reaffirming 2024 non-GAAP adjusted EPS guidance

- Introducing 2025 non-GAAP adjusted EPS guidance and extending

expected annual 6-8% growth to 2025-2029

- Updating 5-year capital expenditure base plan to $19.3

billion

NiSource Inc. (NYSE: NI) today announced, on a GAAP basis, net

income available to common shareholders for the three months ended

September 30, 2024, of $85.7 million, or $0.19 of earnings per

diluted share, compared to net income available to common

shareholders of $77.0 million, or $0.17 of earnings per diluted

share, for the same period of 2023. For the nine months ended

September 30, 2024, on a GAAP basis NiSource's net income available

to common shareholders was $515.8 million, or $1.14 diluted earning

per share, compared to net income available to common shareholders

of $436.1 million, or $0.98 diluted earnings per share, for the

same period of 2023.

NiSource also reported third quarter 2024 non-GAAP adjusted net

income available to common shareholders of $89.9 million, or $0.20

of adjusted earnings per share ("EPS") compared to non-GAAP

adjusted net income available to common shareholders of $83.7

million, or $0.19 of adjusted EPS, for the same period of 2023. For

the nine months ended September 30, 2024, NiSource's non-GAAP

adjusted net income available to common shareholders of $567.4

million, or $1.26 adjusted EPS, compared to non-GAAP adjusted net

income available to common shareholders of $477.0 million, or $1.07

adjusted EPS, for the same period of 2023. Schedule 1 of this press

release contains a complete reconciliation of GAAP measures to

non-GAAP measures. **

NiSource is reaffirming 2024 non-GAAP adjusted EPS guidance of

$1.70-1.74. In 2025 non-GAAP adjusted EPS is expected to be in the

range of $1.84-1.88. NiSource is extending its plan to 2029 with

non-GAAP adjusted EPS growth expected to be 6-8% annually, driven

by $19.3 billion 2025-2029 base plan capital expenditures and 8-10%

2025-2029 rate base growth. The new base capital expenditure plan

is approximately $2.9 billion larger than the prior 5-year

plan.

“Over the last 3 months we saw several examples of the

constructive stakeholder partnerships that differentiate the

NiSource family of companies. We are making progress in our rate

cases, advanced NIPSCO Integrated Resource Plan (IRP) dialogue and

received approvals for several Indiana investments that will

improve reliability and lower costs to customers. These and future

partnerships are the foundation for our updated 5-year financial

plan and the extension of our elevated investment opportunity. I am

as proud as ever of our employees and contractors for their

continuing outstanding execution,” said NiSource President and CEO,

Lloyd Yates.

**Non-GAAP Disclosure Statement

Beginning with the first quarter of 2024, NiSource Inc. changed

its disclosure of non-GAAP results and guidance for net operating

earnings available to common shareholders to adjusted net income

available to common shareholders and for net operating EPS to

adjusted EPS to better align with the presentation used by many

companies to report their non-GAAP results. The change reflects a

name change only and the calculations of each of these non-GAAP

metrics remains consistent with the historical calculations.

This press release includes financial results and guidance for

NiSource with respect to adjusted net income available to common

shareholders and adjusted EPS, which are non-GAAP financial

measures as defined by the SEC. The company includes these measures

because management believes they permit investors to view the

company’s performance using the same tools that management uses and

to better evaluate the company’s ongoing business performance. With

respect to guidance on adjusted EPS, NiSource reminds investors

that it does not provide a GAAP equivalent of its guidance on

adjusted net income available to commons shareholders due to the

impact of unpredictable factors such as fluctuations in weather,

impact of asset sales and impairments and other unusual or

infrequent items included in the comparable GAAP measures. The

company is not able to estimate the impact of such factors on the

comparable GAAP measures and, as such, is not providing guidance on

a GAAP basis. In addition, the company is not able to provide a

reconciliation of its non-GAAP adjusted EPS guidance to the

comparable GAAP equivalents without unreasonable efforts.

Additional Information

Additional information for the quarter ended September 30, 2024,

is available on the Investors section of www.nisource.com,

including segment and financial information and a presentation, as

well as NiSource’s social media channels. The company alerts

investors that it intends to use the Investors section of its

website www.nisource.com and as well as the company’s social media

channels to disseminate important information about the company to

its investors. Investors are advised to look at NiSource’s website

and its social media channels for future important information

about the company.

About NiSource

NiSource Inc. (NYSE: NI) is one of the largest fully-regulated

utility companies in the United States, serving approximately 3.3

million natural gas customers and 500,000 electric customers across

six states through its local Columbia Gas and NIPSCO brands. The

mission of our approximately 7,400 employees is to deliver safe,

reliable energy that drives value to our customers. NiSource is a

member of the Dow Jones Sustainability - North America Index and is

on Forbes lists of America’s Best Employers for Women and

Diversity. Learn more about NiSource’s record of leadership in

sustainability, investments in the communities it serves and how we

live our vision to be an innovative and trusted energy partner at

www.NiSource.com. NI-F

The content of our website is not incorporated by reference into

this document or any other report or document NiSource files with

the Securities and Exchange Commission (“SEC”).

Forward-Looking Statements

This Press Release contains "forward-looking statements," within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the "Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"). Investors

and prospective investors should understand that many factors

govern whether any forward-looking statement contained herein will

be or can be realized. Any one of those factors could cause actual

results to differ materially from those projected. Forward-looking

statements in this press release include, but are not limited to,

statements concerning our 2024 guidance on adjusted EPS, plans,

strategies, objectives, expected performance, expenditures,

recovery of expenditures through rates, stated on either a

consolidated or segment basis, and any and all underlying

assumptions and other statements that are other than statements of

historical fact. Expressions of future goals and expectations and

similar expressions, including "may," "will," "should," "could,"

"would," "aims," "seeks," "expects," "plans," "anticipates,"

"intends," "believes," "estimates," "predicts," "potential,"

"targets," "forecast," and "continue," reflecting something other

than historical fact are intended to identify forward-looking

statements. All forward-looking statements are based on assumptions

that management believes to be reasonable; however, there can be no

assurance that actual results will not differ materially.

Factors that could cause actual results to differ materially

from the projections, forecasts, estimates and expectations

discussed in this Press Release include, among other things: our

ability to execute our business plan or growth strategy, including

utility infrastructure investments, or business opportunities, such

as data center development and related generation sources and

transmission capabilities to meet potential load growth; potential

incidents and other operating risks associated with our business;

our ability to work successfully with our third-party investors;

our ability to adapt to, and manage costs related to, advances in

technology, including alternative energy sources and changes in

laws and regulations; our increased dependency on technology;

impacts related to our aging infrastructure; our ability to obtain

sufficient insurance coverage and whether such coverage will

protect us against significant losses; the success of our electric

generation strategy; construction risks and supply risks;

fluctuations in demand from residential and commercial customers;

fluctuations in the price of energy commodities and related

transportation costs or an inability to obtain an adequate,

reliable and cost-effective fuel supply to meet customer demand;

our ability to attract, retain or re-skill a qualified, diverse

workforce and maintain good labor relations; our ability to manage

new initiatives and organizational changes; the actions of activist

stockholders; the performance and quality of third-party suppliers

and service providers; potential cybersecurity attacks or security

breaches; increased requirements and costs related to

cybersecurity; any damage to our reputation; the impacts of natural

disasters, potential terrorist attacks or other catastrophic

events; the physical impacts of climate change and the transition

to a lower carbon future; our ability to manage the financial and

operational risks related to achieving our carbon emission

reduction goals, including our Net Zero Goal, including any future

associated impact from business opportunities such as data center

development as those opportunities evolve; our debt obligations;

any changes to our credit rating or the credit rating of certain of

our subsidiaries; adverse economic and capital market conditions,

including increases in inflation or interest rates, recession, or

changes in investor sentiment; economic regulation and the impact

of regulatory rate reviews; our ability to obtain expected

financial or regulatory outcomes; economic conditions in certain

industries; the reliability of customers and suppliers to fulfill

their payment and contractual obligations; the ability of our

subsidiaries to generate cash; pension funding obligations;

potential impairments of goodwill; the outcome of legal and

regulatory proceedings, investigations, incidents, claims and

litigation; compliance with changes in, or new interpretations of

applicable laws, regulations and tariffs; the cost of compliance

with environmental laws and regulations and the costs of associated

liabilities; changes in tax laws or the interpretation thereof; and

other matters set forth in Item 1, "Business," Item 1A, "Risk

Factors" and Part II, Item 7, "Management’s Discussion and Analysis

of Financial Condition and Results of Operations," of our Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

matters set forth in our Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2024 and June 30, 2024, some of which

risks are beyond our control. In addition, the relative

contributions to profitability by each business segment, and the

assumptions underlying the forward-looking statements relating

thereto, may change over time.

All forward-looking statements are expressly qualified in their

entirety by the foregoing cautionary statements. We undertake no

obligation to, and expressly disclaim any such obligation to,

update or revise any forward-looking statements to reflect changed

assumptions, the occurrence of anticipated or unanticipated events

or changes to the future results over time or otherwise, except as

required by law.

Schedule 1 - Reconciliation of

Consolidated Net Income Available to Common Shareholders to

Adjusted Net Income Available to Common Shareholders (Non-GAAP)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions, except per share

amounts)

2024

2023

2024

2023

GAAP Net Income Available to Common

Shareholders

$

85.7

$

77.0

$

515.8

$

436.1

Adjustments to Operating Income

:

Operating Revenues:

Weather - compared to normal

5.6

9.0

50.6

47.2

Total adjustments to operating income

5.6

9.0

50.6

47.2

Income Taxes:

Tax effect of above items(1)

(1.4

)

(2.3

)

(13.0

)

(12.5

)

Preferred Dividends:

Preferred dividends redemption

premium(2)

—

—

14.0

6.2

Total adjustments to net income

4.2

6.7

51.6

40.9

Adjusted Net Income Available to Common

Shareholders

$

89.9

$

83.7

$

567.4

$

477.0

Diluted Average Common Shares

454.5

448.3

451.4

447.4

GAAP Diluted Earnings Per

Share(3)

$

0.19

$

0.17

$

1.14

$

0.98

Adjustments to diluted earnings per

share

0.01

0.02

0.12

0.09

Adjusted Earnings Per Share

$

0.20

$

0.19

$

1.26

$

1.07

(1)Represents income tax expense

calculated using the statutory tax rates for legal entity.

(2)Represents the difference between the

carrying value on the redemption date of the Series B Preferred

Stock and the total amount of consideration paid to redeem, net of

the fair value of common shares issued during the nine months ended

September 30, 2024 and the difference between the carrying value of

the Series A Preferred Stock and the total amount of consideration

paid to redeem in 2023.

(3) GAAP Diluted Earnings Per Share

includes the effects of income allocated to participating

securities and adds back the dilutive effect of Equity Units in the

prior year. Please refer to Note 5, "Earnings Per Share," within

the Company's Quarterly Report on Form 10-Q for the period ended

September 30, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030172251/en/

Media Kristen King Finance

Communications (419) 787-1314 kking@nisource.com

Investors Christopher

Turnure Investor Relations (614) 404-9426 cturnure@nisource.com

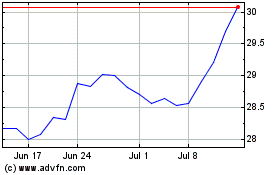

Nisource (NYSE:NI)

Historical Stock Chart

From Nov 2024 to Dec 2024

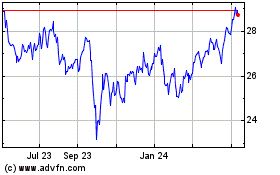

Nisource (NYSE:NI)

Historical Stock Chart

From Dec 2023 to Dec 2024