0000753308false00007533082025-02-062025-02-060000753308us-gaap:CommonStockMember2025-02-062025-02-060000753308nee:CorporateUnits6.926Member2025-02-062025-02-060000753308nee:CorporateUnits7.299Member2025-02-062025-02-060000753308nee:CorporateUnits7.234Member2025-02-062025-02-06

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of earliest event reported: February 6, 2025

| | | | | | | | | | | | | | |

Commission

File

Number | | Exact name of registrant as specified in its

charter, address of principal executive offices and

registrant's telephone number | | IRS Employer

Identification

Number |

| 1-8841 | | NEXTERA ENERGY, INC. | | 59-2449419 |

700 Universe Boulevard

Juno Beach, Florida 33408

(561) 694-4000

State or other jurisdiction of incorporation or organization: Florida

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, $0.01 Par Value | | NEE | | New York Stock Exchange |

6.926% Corporate Units | | NEE.PRR | | New York Stock Exchange |

7.299% Corporate Units | | NEE.PRS | | New York Stock Exchange |

7.234% Corporate Units | | NEE.PRT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 8 - OTHER EVENTS

Item 8.01 Other Events

On February 6, 2025, NextEra Energy Capital Holdings, Inc. (NEECH), a wholly-owned subsidiary of NextEra Energy, Inc. (NEE), sold $1.5 billion principal amount of its Series S Junior Subordinated Debentures due August 15, 2055 (Series S Junior Subordinated Debentures) and $1 billion principal amount of its Series T Junior Subordinated Debenture due August 15, 2055 (Series T Junior Subordinated Debentures and together with the Series S Junior Subordinated Debentures, Junior Subordinated Debentures). The Series S Junior Subordinated Debentures bear interest at a rate of 6.375% to August 15, 2030 and thereafter will bear interest at a rate equal to the Five-Year Treasury Rate (as specified in the Junior Subordinated Debentures) plus 2.053%, reset every five years, and the Series T Junior Subordinated Debentures bear interest at a rate of 6.50% to August 15, 2035 and thereafter will bear interest at a rate equal to the Five-Year Treasury Rate plus 1.979%, reset every five years, provided that the interest rate for each series of Junior Subordinated Debentures will not reset below the initial interest rate specified above for such series of Junior Subordinated Debentures. NEECH, at its option, may redeem some or all of the Series S Junior Subordinated Debentures and Series T Junior Subordinated Debentures during specified periods beginning in May 2030 and May 2035, respectively.

The Junior Subordinated Debentures are guaranteed on a subordinated basis by NEE. The Junior Subordinated Debentures were registered under the Securities Act of 1933 pursuant to Registration Statement Nos. 333-278184, 333-278184-01 and 333-278184-02. In connection with the sale of the Junior Subordinated Debentures, this Current Report on Form 8-K is being filed to report certain documents as exhibits.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

| Exhibit

Number | | Description |

| 5(a) | | |

| 5(b) and 8 | | |

| 101 | | Interactive data files for this Form 8-K formatted in Inline XBRL |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: February 6, 2025

NEXTERA ENERGY, INC.

(Registrant)

| | |

JAMES M. MAY |

James M. May

Vice President, Controller and Chief Accounting Officer |

| | | | | | | | |

| | Squire Patton Boggs (US) LLP

1000 Key Tower

127 Public Square

Cleveland, Ohio 44114

O +1 216 479 8500

F +1 216 479 8780

squirepattonboggs.com |

February 6, 2025

NextEra Energy, Inc.

NextEra Energy Capital Holdings, Inc.

700 Universe Boulevard

Juno Beach, Florida 33408

To the Addressees:

We have acted as counsel to NextEra Energy, Inc., a Florida corporation (“NEE”), and NextEra Energy Capital Holdings, Inc., a Florida corporation (“NEE Capital”), in connection with the issuance and sale by NEE Capital of $1,500,000,000 aggregate principal amount of its Series S Junior Subordinated Debentures due August 15, 2055 (the “Series S Subordinated Debentures”) and $1,000,000,000 aggregate principal amount of its Series T Junior Subordinated Debentures due August 15, 2055 (the “Series T Subordinated Debentures” and, together with the Series S Subordinated Debentures, the “Subordinated Debentures”), issued under the Indenture (For Unsecured Subordinated Debt Securities), dated as of September 1, 2006, as amended (the “Subordinated Indenture”), among NEE Capital, as issuer, NEE, as guarantor, and The Bank of New York Mellon, as Subordinated Trustee (the “Subordinated Trustee”), which Subordinated Debentures are unconditionally and irrevocably guaranteed on a subordinated basis (the “Subordinated Guarantee”) by NEE, as guarantor, included in the Subordinated Indenture.

We have participated in the preparation of or reviewed (1) Registration Statement Nos. 333-278184, 333-278184-01 and 333-278184-02 (the “Registration Statement”), which Registration Statement was filed jointly by NEE, NEE Capital and Florida Power & Light Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”); (2) the prospectus dated March 22, 2024 (the “Base Prospectus”) forming a part of the Registration Statement, as supplemented by a prospectus supplement dated February 4, 2025 (the “Prospectus Supplement”) relating to the Subordinated Debentures, both such Base Prospectus and Prospectus Supplement filed with the Commission pursuant to Rule 424 under the Securities Act; (3) the Subordinated Indenture; (4) the corporate proceedings of NEE Capital with respect to the Registration Statement, the Subordinated Indenture and the Subordinated Debentures; (5) the corporate proceedings of NEE with respect to the Registration Statement and the Subordinated Guarantee; and (6) such other corporate records, certificates and other documents (including a receipt executed on behalf of NEE Capital acknowledging receipt of the aggregate purchase price for the Subordinated Debentures) and such questions of law as we have considered necessary or appropriate for the purposes of this opinion.

Over 40 Offices across 4 Continents

Squire Patton Boggs (US) LLP is part of the international legal practice Squire Patton Boggs, which operates worldwide through a number of separate

legal entities.

Please visit squirepattonboggs.com for more information.

1103771733\3\AMERICAS

| | | | | | | | |

| Squire Patton Boggs (US) LLP | | February 6, 2025 |

Based on the foregoing, we are of the opinion that the Subordinated Debentures and the Subordinated Guarantee, as it relates to the Subordinated Debentures, are legally issued, valid, and binding obligations of NEE Capital and NEE, respectively, except as limited or affected by bankruptcy, insolvency, reorganization, receivership, moratorium, fraudulent conveyance or other laws affecting creditors’ rights and remedies generally and general principles of equity and to concepts of materiality, reasonableness, good faith and fair dealing and the discretion of the court before which any matter is brought.

In rendering the foregoing opinion, we have assumed that the certificates representing the Subordinated Debentures conform to specimens examined by us and that the Subordinated Debentures have been duly authenticated, in accordance with the Subordinated Indenture, by the Subordinated Trustee under the Subordinated Indenture and that the signatures on all documents examined by us are genuine, assumptions which we have not independently verified.

We hereby consent to the reference to us in the Base Prospectus under the heading “Legal Opinions,” to the references to us in the Registration Statement and to the filing of this opinion as an exhibit to a Current Report on Form 8-K to be filed with the Commission by NEE on or about February 6, 2025, which will be incorporated by reference in the Registration Statement. In giving the foregoing consents, we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

This opinion is limited to the laws of the States of Florida and New York and the federal laws of the United States insofar as they bear on matters covered hereby. As to all matters of New York law, we have relied, with your consent, upon an opinion of even date herewith addressed to you by Morgan, Lewis & Bockius LLP, New York, New York. As to all matters of Florida law, Morgan, Lewis & Bockius LLP is hereby authorized to rely upon this opinion as though it were rendered to Morgan, Lewis & Bockius LLP.

Very truly yours,

/s/ Squire Patton Boggs (US) LLP

SQUIRE PATTON BOGGS (US) LLP

NextEra Energy, Inc.

NextEra Energy Capital Holdings, Inc.

700 Universe Boulevard

Juno Beach, Florida 33408

To the Addressees:

We have acted as counsel to NextEra Energy, Inc., a Florida corporation (“NEE”), and NextEra Energy Capital Holdings, Inc., a Florida corporation (“NEE Capital”), in connection with the issuance and sale by NEE Capital of its $1,500,000,000 aggregate principal amount of Series S Junior Subordinated Debentures due August 15, 2055 (the “Series S Subordinated Debentures”) and $1,000,000,000 aggregate principal amount of its Series T Junior Subordinated Debentures due August 15, 2055 (the “Series T Subordinated Debentures” and, together with the Series S Subordinated Debentures, the “Subordinated Debentures”), issued under the Indenture (For Unsecured Subordinated Debt Securities), dated as of September 1, 2006, as amended (the “Subordinated Indenture”), among NEE Capital, as issuer, NEE, as guarantor, and The Bank of New York Mellon, as Subordinated Trustee (the “Subordinated Trustee”), which Subordinated Debentures are unconditionally and irrevocably guaranteed on a subordinated basis (the “Subordinated Guarantee”) by NEE, as guarantor, included in the Subordinated Indenture.

We have participated in the preparation of or reviewed (1) Registration Statement Nos. 333-278184, 333-278184-01 and 333-278184-02 (the “Registration Statement”), which Registration Statement was filed jointly by NEE, NEE Capital and Florida Power & Light Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”); (2) the prospectus dated March 22, 2024 (the “Base Prospectus”) forming a part of the Registration Statement, as supplemented by a prospectus supplement dated February 4, 2025 (the “Prospectus Supplement”) relating to the Subordinated Debentures, both such Base Prospectus and Prospectus Supplement filed with the Commission pursuant to Rule 424 under the Securities Act; (3) the Subordinated Indenture; (4) the corporate proceedings of NEE Capital with respect to the Registration Statement, the Subordinated Indenture and the Subordinated Debentures; (5) the corporate proceedings of NEE with respect to the Registration Statement and the Subordinated Guarantee; and (6) such other corporate records, certificates and other documents (including a receipt executed on behalf of NEE Capital acknowledging receipt of the aggregate purchase price for the Subordinated Debentures) and such questions of law as we have considered necessary or appropriate for the purposes of this opinion.

NextEra Energy, Inc.

NextEra Energy Capital Holdings, Inc.

February 6, 2025

Page 2

Based on the foregoing, we are of the opinion that the Subordinated Debentures and the Subordinated Guarantee, as it relates to the Subordinated Debentures, are legally issued, valid, and binding obligations of NEE Capital and NEE, respectively, except as limited or affected by bankruptcy, insolvency, reorganization, receivership, moratorium, fraudulent conveyance or other laws affecting creditors’ rights and remedies generally and general principles of equity and to concepts of materiality, reasonableness, good faith and fair dealing and the discretion of the court before which any matter is brought.

In rendering the foregoing opinion, we have assumed that the certificates representing the Subordinated Debentures conform to specimens examined by us and that the Subordinated Debentures have been duly authenticated, in accordance with the Subordinated Indenture, by the Subordinated Trustee under the Subordinated Indenture and that the signatures on all documents examined by us are genuine, assumptions which we have not independently verified.

Our opinions as to United States federal income tax matters are as set forth in the Prospectus Supplement under the heading “Material United States Federal Income Tax Consequences,” subject to the qualifications set forth therein.

We hereby consent to the references to us in the Base Prospectus under the heading “Legal Opinions” and in the Prospectus Supplement under the heading “Material United States Federal Income Tax Consequences,” to the references to us in the Registration Statement and to the filing of this opinion as an exhibit to a Current Report on Form 8-K to be filed with the Commission by NEE on or about February 6, 2025, which will be incorporated by reference in the Registration Statement. In giving the foregoing consents, we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

This opinion is limited to the laws of the States of New York and Florida and the federal laws of the United States insofar as they bear on matters covered hereby. As to all matters of Florida law, we have relied, with your consent, upon an opinion of even date herewith addressed to you by Squire Patton Boggs (US) LLP. As to all matters of New York law, Squire Patton Boggs (US) LLP is hereby authorized to rely upon this opinion as though it were rendered to Squire Patton Boggs (US) LLP.

Very truly yours,

/s/ Morgan, Lewis & Bockius LLP

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nee_CorporateUnits6.926Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nee_CorporateUnits7.299Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nee_CorporateUnits7.234Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

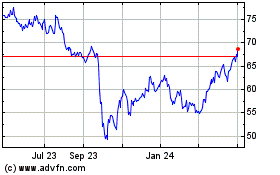

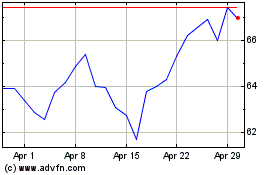

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Jan 2025 to Feb 2025

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Feb 2024 to Feb 2025