false000091007300009100732024-06-042024-06-040000910073us-gaap:CommonStockMember2024-06-042024-06-040000910073nycb:BifurcatedOptionNotesUnitSecuritiesMember2024-06-042024-06-040000910073nycb:FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember2024-06-042024-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2024

NEW YORK COMMUNITY BANCORP, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-31565 | | 06-1377322 |

(State or Other Jurisdiction

of Incorporation) | | Commission File Number | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 102 Duffy Avenue, | Hicksville, | New York | 11801 |

| (Address of principal executive offices) |

(516) 683-4100

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | NYCB | | New York Stock Exchange |

| Bifurcated Option Note Unit Securities SM | | NYCB PU | | New York Stock Exchange |

| Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value | | NYCB PA | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 3, 2024, the Board of Directors of New York Community Bancorp, Inc. (NYSE: NYCB) (the “Company”) named President and Chief Executive Officer, Joseph M. Otting, to the additional role of Executive Chairman of the Board of Directors of both the Company and Flagstar Bank, N.A. (the “Bank”), effective as of close of business on June 5, 2024. Mr. Otting’s appointment will better facilitate his ability, alongside the new senior executive leadership team, to continue to improve all aspects of the Company’s operations and execute on its strategic initiatives.

In conjunction with Mr. Otting’s appointment, Alessandro P. DiNello will step down from his role as Non-Executive Chairman of the Company and the Bank as of the close of business on June 5, 2024. He will continue to serve as a member of the Boards of the Company and Bank and as a senior advisor to the CEO, where his strong banking knowledge will support Mr. Otting, and the rest of the Company’s senior executive leadership team.

On June 4, 2024, the Company issued a press release announcing the appointment of Joseph M. Otting as Executive Chairman of the Boards of both the Company and the Bank. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description of Exhibit |

| No. | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Cautionary Note Regarding Forward-Looking Statements

The foregoing disclosures may include forward-looking statements within the meaning of the federal securities laws by the Company pertaining to such matters as our goals, intentions, and expectations regarding (a) revenues, earnings, loan production, asset quality, liquidity position, capital levels, risk analysis, divestitures, acquisitions, and other material transactions, among other matters; (b) the future costs and benefits of the actions we may take; (c) our assessments of credit risk and probable losses on loans and associated allowances and reserves; (d) our assessments of interest rate and other market risks; (e) our ability to execute on our strategic plan, including the sufficiency of our internal resources, procedures and systems; (f) our ability to attract and retain key personnel; (g) our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, and our ability to fully and timely implement the risk management programs institutions greater than $100 billion is assets must maintain; (h) matters to be presented to, voted on and approved by the Company’s stockholders; (i) the conversion or exchange of shares of the Company’s preferred stock; and (j) the payment of dividends on shares of the Company’s capital stock, including adjustments to the amount of dividends payable on shares of the Company’s Series B preferred stock.

Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore,

because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results.

Our forward‐looking statements are subject to, among others, the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities, credit and financial markets; changes in interest rates; the inability of the Bank and JPMC to execute the definitive documentation contemplated by the commitment letter or satisfy customary closing conditions; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios, including associated allowances and reserves; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in our strategic plan, including changes in our internal resources, procedures and systems, and our ability to successfully implement such plan; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K/A for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this Amendment, during investor presentations, or in our other SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: | June 4, 2024 | | NEW YORK COMMUNITY BANCORP, INC. |

| | |

| | | /s/ Salvatore DiMartino |

| | | Salvatore DiMartino |

| | | Executive Vice President and Director of Investor Relations |

102 Duffy Avenue, Hicksville, NY 11801 ● Phone: (516) 683‐4420 ● flagstar.com NEWS RELEASE Investor Contact: FOR IMMEDIATE RELEASE Salvatore J. DiMartino (516) 683‐4286 Media Contact: Steven Bodakowski (248) 312‐5872 NEW YORK COMMUNITY BANCORP, INC. APPOINTS PRESIDENT AND CHIEF EXECUTIVE OFFICER JOSEPH M. OTTING TO ADDITIONAL ROLE OF EXECUTIVE CHAIRMAN EFFECTIVE CLOSE OF BUSINESS JUNE 5, 2024 HICKSVILLE, N.Y., June 4, 2024 – New York Community Bancorp, Inc. (NYSE: NYCB) (the “Company”), the parent company of Flagstar Bank, N.A. (the “Bank”) announced that on June 3, 2024, the Board of Directors appointed President and Chief Executive Officer, Joseph M. Otting, to the additional role of Executive Chairman of the Board of both the Company and the Bank, effective as of the close of business on June 5, 2024. Mr. Otting’s appointment will better facilitate his ability, alongside the new senior executive leadership team, to continue to improve all aspects of the Company’s operations and execute on its strategic initiatives. In conjunction with Mr. Otting’s appointment, Alessandro P. DiNello will step down from his role as Non‐ Executive Chairman of the Company and the Bank as of the close of business on June 5, 2024. He will continue to serve as a Board director and a senior advisor to the CEO, where his strong banking knowledge will support Mr. Otting, and the rest of the senior executive leadership team as they continue to turn the Bank around following the March 2024 capital raise. Mr. Otting has had a long, distinguished career in banking including having served as CEO of OneWest Bank from 2010 to 2015, as the 31st Comptroller of the Currency from 2017 to 2020, and as Acting Director of the Federal Housing Finance Agency in 2018. He was named President and CEO of the Company on April 1, 2024. About New York Community Bancorp, Inc. New York Community Bancorp, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered in Hicksville, New York. At March 31, 2024, the Company had $112.9 billion of assets, $83.3 billion of loans, deposits of $74.9 billion, and total stockholders' equity of $8.4 billion. Flagstar Bank, N.A. operates 419 branches, including strong footholds in the Northeast and Midwest and exposure to high‐growth markets in the Southeast and West Coast. Flagstar Mortgage operates nationally through a wholesale network of approximately 3,000 third‐party mortgage originators. In addition, the Bank has approximately 100 private banking teams located in over ten cities in the metropolitan New York City region and on the West Coast, which serve the needs of high‐net worth individuals and their businesses. New York Community Bancorp, Inc. has market‐leading positions in several national businesses, including multi‐family lending, mortgage origination and servicing, and warehouse lending. Flagstar Mortgage is the seventh largest bank originator of residential mortgages for the 12‐months ending March 31, 2024, and the

industry's fifth largest sub‐servicer of residential mortgage loans nationwide, servicing 1.4 million accounts with $367 billion in unpaid principal balances. Cautionary Note Regarding Forward‐Looking Statements The foregoing disclosures may include forward-looking statements within the meaning of the federal securities laws by the Company pertaining to such matters as our goals, intentions, and expectations regarding (a) revenues, earnings, loan production, asset quality, liquidity position, capital levels, risk analysis, divestitures, acquisitions, and other material transactions, among other matters; (b) the ability of the Bank to complete the proposed transaction in a timely manner, or at all; (c) the future costs and benefits of the actions we may take; (d) our assessments of credit risk and probable losses on loans and associated allowances and reserves; (e) our assessments of interest rate and other market risks; (f) our ability to execute on our strategic plan, including the sufficiency of our internal resources, procedures and systems; (g) our ability to attract and retain key personnel; (h) our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC‐assisted transaction, and our ability to fully and timely implement the risk management programs institutions greater than $100 billion is assets must maintain; (i) matters to be presented to, voted on and approved by the Company’s stockholders; (j) the conversion or exchange of shares of the Company’s preferred stock; and (k) the payment of dividends on shares of the Company’s capital stock, including adjustments to the amount of dividends payable on shares of the Company’s Series B preferred stock. Forward-looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements. Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward-looking statements are subject to, among others, the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities, credit and financial markets; changes in interest rates; the inability of the Bank and JPMC to execute the definitive documentation contemplated by the commitment letter or satisfy customary closing conditions; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios, including associated allowances and reserves; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in our strategic plan, including changes in our internal resources, procedures and systems, and our ability to successfully implement such plan; changes in competitive pressures among financial institutions or from non-financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of

natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward‐looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC‐assisted transaction: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations). More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10-K/A for the year ended December 31, 2023, Quarterly Report on Form 10‐Q for the quarter ended March 31, 2024, and in other SEC reports we file. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this Amendment, during investor presentations, or in our other SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

v3.24.1.1.u2

Document and Entity Information

|

Jun. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 04, 2024

|

| Entity Registrant Name |

NEW YORK COMMUNITY BANCORP, INC.

|

| Entity Central Index Key |

0000910073

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

06-1377322

|

| Entity Address, City or Town |

Hicksville,

|

| Entity Address, Postal Zip Code |

11801

|

| City Area Code |

516

|

| Local Phone Number |

683-4100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-31565

|

| Entity Address, Address Line One |

102 Duffy Avenue,

|

| Entity Address, State or Province |

NY

|

| Document Information [Line Items] |

|

| Document Period End Date |

Jun. 04, 2024

|

| Document Type |

8-K

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

NYCB

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

NYCB

|

| Bifurcated Option Note Unit Securities [Member] |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Bifurcated Option Note Unit Securities SM

|

| Trading Symbol |

NYCB PU

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Bifurcated Option Note Unit Securities SM

|

| Trading Symbol |

NYCB PU

|

| Fixed To Floating Rate Series A Noncumulative Perpetual Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value

|

| Trading Symbol |

NYCB PA

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value

|

| Trading Symbol |

NYCB PA

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_BifurcatedOptionNotesUnitSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

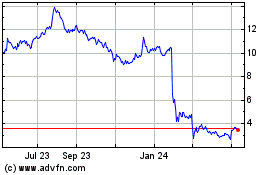

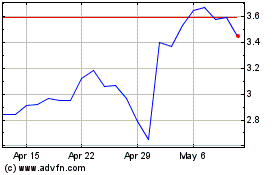

New York Community Bancorp (NYSE:NYCB)

Historical Stock Chart

From May 2024 to Jun 2024

New York Community Bancorp (NYSE:NYCB)

Historical Stock Chart

From Jun 2023 to Jun 2024