REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

|

|

|

|

NATURAL RESOURCE PARTNERS L.P.

NRP FINANCE CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

Delaware

|

|

35-2164875

46-3569226

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

1201 Louisiana, 34th Floor

Houston, Texas 77002

(713) 751-7507

|

|

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

|

|

|

Kathryn S. Wilson

GP Natural Resource Partners LLC

1201 Louisiana Street, 34th Floor

Houston, Texas 77002

(713) 751-7507

|

|

|

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

|

|

|

Copy to:

|

|

|

|

E. Ramey Layne

Vinson & Elkins L.L.P.

1001 Fannin Street, Suite 2500

Houston, Texas 77002

(713) 758-2222

|

|

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box.

o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

o

Accelerated filer

ý

Non-accelerated filer

o

(Do not check if a smaller reporting company)

Smaller reporting company

o

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issue Tender Offer)

o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

o

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Natural Resource Partners L.P. and NRP Finance Corporation are filing this Amendment No. 1 to Registration Statement on Form S-4 to add NRP Finance Corporation as a co-registrant hereunder. NRP Finance Corporation was inadvertently omitted as a co-registrant in the original Registration Statement on Form S-4 filed on April 7, 2017.

PART II INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

|

|

Item 20.

|

Indemnification of Directors and Officers

|

Natural Resource Partners L.P.

Section 17-108 of the Delaware Revised Uniform Limited Partnership Act empowers a Delaware limited partnership to indemnify and hold harmless any partner or other persons from and against any and all claims and demands whatsoever. The partnership agreement of Natural Resource Partners L.P. provides that it will, to the fullest extent permitted by law, indemnify and advance expenses to the general partner, any Departing Partner (as defined therein), any person who is or was an affiliate of the general partner or any Departing Partner, any person who is or was a partner, officer, director, employee, member, agent or trustee of any Group Member (as defined therein), the general partner or any Departing Partner or any affiliate of any Group Member, the general partner or any Departing Partner, or any person who is or was serving at the request of the general partner or any affiliate of the general partner or any Departing Partner or any affiliate of any Departing Partner as a partner, officer, director, employee, member, fiduciary, agent or trustee of another person (“Indemnitees”) from and against any and all losses, claims, damages, liabilities (joint or several), expenses (including legal fees and expenses), judgments, fines, penalties, interest, settlements and other amounts arising from any and all claims, demands, actions, suits or proceedings, whether civil, criminal, administrative or investigative, in which any Indemnitee may be involved, or is threatened to be involved, as a party or otherwise, by reason of its status as an Indemnitee;

provided

,

that

in each case the Indemnitee acted in good faith and in a manner which such Indemnitee reasonably believed to be in, or (in the case of a person other than the general partner) not opposed to, the best interests of the partnership and, with respect to any criminal proceeding, had no reasonable cause to believe its conduct was unlawful. This indemnification would under certain circumstances include indemnification for liabilities under the Securities Act. In addition, each Indemnitee would automatically be entitled to the advancement of expenses in connection with the foregoing indemnification. Any indemnification under these provisions will be only out of the assets of the partnership.

Natural Resource Partners L.P. is authorized to purchase (or to reimburse the general partner for the costs of) insurance against liabilities asserted against and expenses incurred by the persons described in the paragraphs above in connection with their activities, whether or not they would have the power to indemnify such person against such liabilities under the provisions described in the paragraphs above. The general partner of Natural Resource Partners L.P. has purchased insurance, the cost of which is reimbursed by Natural Resource Partners L.P., covering its officers and directors against liabilities asserted and expenses incurred in connection with their activities as officers and directors of the general partner or any of its direct or indirect subsidiaries.

NRP Finance Corporation

Section 145 of the General Corporation Law of the State of Delaware, among other things, empowers a Delaware corporation to indemnify any person who was or is a party, or is threatened to be made a party. to any threatened, pending or completed action, suit or proceeding (other than an action by or in the right of the corporation) by reason of the fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. Similar indemnity is authorized for such persons against expenses (including attorneys’ fees) actually and reasonably incurred by such persons in connection with the defense or settlement of any such threatened, pending or completed action or suit, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation,

provided

that (unless a court of competent jurisdiction otherwise provides) such person shall not have been adjudged liable to the corporation. Any such indemnification may be made only as authorized in each specific case upon a determination by the stockholders or disinterested directors or by independent legal counsel in a written opinion that indemnification is proper because the indemnitee has met the applicable standard of conduct.

Section 145 further authorizes a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or enterprise, against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the corporation would otherwise have the power to indemnify him under Section 145. Also, the bylaws of NRP Finance Corporation provide for the indemnification of directors and officers of, and such directors and officers who serve at the request of, the company as directors, officers, employees or agents of any other enterprise against certain liabilities under certain circumstances.

|

|

|

|

Item 21.

|

Exhibits and Financial Statement Schedules

|

(a)

Exhibits

See Index to Exhibits on page II-6 for a list of exhibits filed as a part of this Registration Statement on Form S-4, which Index to Exhibits is incorporated herein by reference.

(a)

Each of the undersigned registrants hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser, if the registrants are subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness.

Provided

,

however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(5)

That, for the purpose of determining liability of the registrants under the Securities Act to any purchaser in the initial distribution of the securities:

Each of the undersigned registrants undertakes that in a primary offering of securities of the undersigned registrants pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrants will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrants relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrants or used or referred to by the undersigned registrants;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrants or their securities provided by or on behalf of the undersigned registrants; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrants to the purchaser.

(b) Each of the undersigned registrants hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of a registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrants pursuant to the provisions set forth in response to Item 15, or otherwise, the registrants have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrants of expenses incurred or paid by a director, officer or controlling person of the registrants in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrants will, unless in the opinion of their counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

(d) Each of the undersigned registrants hereby undertakes to respond to requests for information that is incorporated by reference into the prospectus pursuant to Items 4, 10(b), 11, or 13 of Form S-4, within one business day of receipt of such request, and to send the incorporated documents by first class mail or other equally prompt means. This includes information contained in documents filed subsequent to the effective date of the registration statement through the date of responding to the request.

(e) Each of the undersigned registrants hereby undertakes to supply by means of a post-effective amendment all information concerning a transaction, and the company being acquired involved therein, that was not the subject of and included in the registration statement when it became effective.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-4/A and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, in the State of Texas on April 17, 2017.

NATURAL RESOURCE PARTNERS L.P.

By: NRP (GP) LP,

its General Partner

By: GP NATURAL RESOURCE PARTNERS LLC,

its General Partner

By:

/s/ Corbin J. Robertson, Jr.

Name: Corbin J. Robertson, Jr.

Title: Chief Executive Officer

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on the dates indicated:

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Executive Officer and Chairman

|

|

April 17, 2017

|

|

Corbin J. Robertson, Jr.

|

|

of the Board of Directors of

|

|

|

|

|

|

GP Natural Resource Partners LLC

|

|

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Financial Officer and Treasurer

|

|

April 17, 2017

|

|

Craig W. Nunez

|

|

of GP Natural Resource Partners LLC

|

|

|

|

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Accounting Officer

|

|

April 17, 2017

|

|

Christopher J. Zolas

|

|

of GP Natural Resource Partners LLC

|

|

|

|

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Robert T. Blakely

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Russell D. Gordy

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

L.G. (Trey) Jackson

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Robert B. Karn III

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Jasvinder S. Khaira

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

S. Reed Morian

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Richard A. Navarre

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Corbin J. Robertson, III

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Stephen P. Smith

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director of GP Natural Resource Partners LLC

|

|

April 17, 2017

|

|

Leo A. Vecellio, Jr.

|

|

|

|

|

|

|

|

|

|

|

|

* By:

/s/ Kathryn S. Wilson

|

|

|

|

|

|

Kathryn S. Wilson

|

|

|

|

|

|

Attorney in fact

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-4/A and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, in the State of Texas on April 17, 2017.

NRP FINANCE CORPORATION

By:

/s/ Wyatt L. Hogan

Name: Wyatt L. Hogan

Title: President

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on the dates indicated:

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

|

|

Director and President

|

|

|

|

Wyatt L. Hogan

|

|

(Principal Executive Officer)

|

|

April 17, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Financial Officer, Treasurer and Director

|

|

|

|

Craig W. Nunez

|

|

(Principal Financial Officer)

|

|

April 17, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Accounting Officer

|

|

|

|

Christopher J. Zolas

|

|

(Principal Accounting Officer)

|

|

April 17, 2017

|

|

|

|

|

|

|

|

* By: /s/ Kathryn S. Wilson

|

|

|

|

|

|

Kathryn S. Wilson

|

|

|

|

|

|

Attorney in fact

|

|

|

|

|

INDEX TO EXHIBITS

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

3.1

|

—

|

Certificate of Limited Partnership of Natural Resource Partners L.P. (incorporated by reference to Exhibit 3.1 to the Registration Statement on Form S-1 (File No. 333-86582) filed April 19, 2002).

|

|

3.2

|

—

|

Fifth Amended and Restated Agreement of Limited Partnership of Natural Resource Partners L.P., dated as of March 2, 2017 (incorporated by reference to Exhibit 3.1 to Current Report on Form 8-K filed on March 6, 2017).

|

|

3.3

|

—

|

Certificate of Incorporation of NRP Finance Corporation (incorporated by reference to Exhibit 3.2 to Registration Statement on Form S-4 (File No. 333-195893) filed on May 12, 2014).

|

|

3.4

|

—

|

Bylaws of NRP Finance Corporation (incorporated by reference to Exhibit 3.3 to Registration Statement on Form S-4 (File No. 333-195893) filed on May 12, 2014).

|

|

4.1

|

—

|

Indenture, dated March 2, 2017, by and among Natural Resource Partners L.P. and NRP Finance Corporation, as issuers, and Wilmington Trust, National Association, as trustee (incorporated by reference to Exhibit 4.3 to Current Report on Form 8-K filed on March 6, 2017).

|

|

4.3

|

—

|

Form of 10.500% Senior Notes due 2022 (contained in Exhibit 1 to Exhibit 4.1 hereto).

|

|

4.4

|

—

|

Registration Rights Agreement, dated March 2, 2017, by and among Natural Resource Partners L.P., NRP Finance Corporation and the holders named therein (incorporated by reference to Exhibit 4.5 to Current Report on Form 8-K filed on March 6, 2017).

|

|

5.1**

|

—

|

Opinion of Vinson & Elkins L.L.P. as to the legality of the securities registered hereby.

|

|

12.1**

|

—

|

Computation of Ratios of Earnings to Fixed Charges.

|

|

21.1**

|

—

|

List of Subsidiaries of Natural Resource Partners L.P.

|

|

23.1*

|

—

|

Consent of Ernst & Young LLP.

|

|

23.2*

|

—

|

Consent of Deloitte & Touche LLP.

|

|

23.3**

|

—

|

Consent of Vinson & Elkins L.L.P. (contained in Exhibit 5.1 hereto).

|

|

24.1**

|

—

|

Powers of Attorney (included on the signature pages of this registration statement).

|

|

25.1**

|

—

|

Statement of Eligibility on Form T-1 of Wilmington Trust, National Association.

|

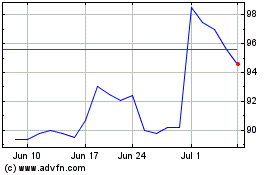

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Nov 2023 to Nov 2024