MISTRAS Group Announces Amendment to Existing Credit Agreement

May 19 2021 - 4:01PM

MISTRAS Group, Inc. (NYSE: MG) – a leading, "one source"

multinational provider of integrated technology-enabled asset

protection solutions – announced an amendment to its existing

credit agreement.

The updated terms of the agreement consist of $253.1 million of

aggregate credit facilities, including a funded $88.1 million loan

and a $165.0 million revolving facility, of which $125.1 million

was outstanding at March 31, 2021. The maturity of the credit

agreement remains at December 2023.

The new credit terms result in an immediate reduction in the

effective interest rate via removal of a 1.00% LIBOR floor, which

effectively lowers the all-in cost of borrowing by 90 basis points.

This reduction represents an annual interest expense savings of

approximately $1.9 million. The amendment modestly contracts the

unused revolving credit by $10.0 million at closing with an

additional $15.0 million reduction later in 2021. The amendment

also adds a modest step up in required term loan amortization,

increasing the required payment to $3.75 million quarterly for the

remainder of 2021, and $5.0 million quarterly for 2022 and 2023.

This amendment also provides the Company with leverage flexibility

by increasing the maximum allowable total funded debt up to 4.0X

adjusted EBITDA for the Q2 2021 through Q1 2022 measurement

periods, with a step down to 3.5X for the Q2 2022 measurement

period and all periods thereafter. This compares to the prior

allowable funded debt of up to 3.75X for the Q2 2021 measurement,

and 3.5X for Q3 2021 and all periods thereafter, per the previous

amendment. The Company also retained its $100 million uncommitted

accordion.

”We have an extremely supportive bank group, and appreciate

their willingness to partner with us in creating shareholder

value,” said Ed Prajzner, MISTRAS Group Chief Financial Officer

(CFO). “This amendment to our existing credit agreement yielded us

a lower cost of borrowing, with ample liquidity to fund our growth.

Although this amendment gives us additional leverage flexibility,

we anticipate further deleveraging as our capital allocation

strategy remains to apply all residual free cash flow to debt

service. The additional amortization requirement, which doubles the

previous required amortization over the next two years, was in line

with our existing debt repayment plans. More immediately, once we

are below 3.75X later in 2021, our cost of borrowing will drop by

an additional 165 basis points prospectively.”

“This finance restructuring represents an important milestone

towards the continued investment in our data initiatives and other

organic growth drivers to help propel a more digital and

diversified future,” said Dennis Bertolotti, MISTRAS Group

President and Chief Executive Officer (CEO). “Through this

refinancing, we’re restoring the flexibility to accelerate

investments in our customers and employees.”

MISTRAS continues to invest in data solutions, including its

mobile field inspection and execution platform, MISTRAS Digital®,

along with a forthcoming insights-driven asset protection software

ecosystem. With the burgeoning success of these initiatives – with

MISTRAS Digital® already being implemented at facilities owned by a

multitude of major energy companies – this amendment enables the

Company to utilize its resources in support of their continued

advancement.

About MISTRAS Group, Inc. - One Source for Asset

Protection Solutions®

MISTRAS Group, Inc. (NYSE: MG) is a leading "one source"

multinational provider of integrated technology-enabled asset

protection solutions, helping to maximize the safety and

operational uptime for civilization’s most critical industrial and

civil assets.

Backed by an innovative, data-driven asset protection portfolio,

proprietary technologies, and decades-long legacy of industry

leadership, MISTRAS leads clients in the oil and gas, aerospace and

defense, renewable and nonrenewable power, civil infrastructure,

and manufacturing industries towards achieving and maintaining

operational excellence. By supporting these organizations that help

fuel our vehicles and power our society; inspecting components that

are trusted for commercial, defense, and space craft; and building

real-time monitoring equipment to enable safe travel across

bridges, MISTRAS helps the world at large.

MISTRAS enhances value for its clients by integrating asset

protection throughout supply chains and centralizing integrity data

through a suite of Industrial IoT-connected digital software and

monitoring solutions. The company’s core capabilities also include

non-destructive testing field and in-line inspections enhanced by

advanced robotics, laboratory quality control and assurance

testing, sensing technologies and NDT equipment, asset and

mechanical integrity engineering services, and light mechanical

maintenance and access services.

For more information about how MISTRAS helps protect

civilization’s critical infrastructure, visit

https://www.mistrasgroup.com/.

MEDIA CONTACT:Nestor S. MakarigakisGroup

Vice-President of Marketing and Communications+1 (609) 716-4000

| marcom@mistrasgroup.com

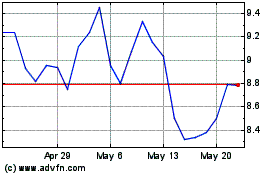

Mistras (NYSE:MG)

Historical Stock Chart

From Oct 2024 to Nov 2024

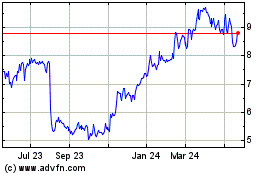

Mistras (NYSE:MG)

Historical Stock Chart

From Nov 2023 to Nov 2024