Filed pursuant to Rule 424(b)(3)

Registration No. 333‑261027

Prospectus Supplement No. 4

(To Prospectus dated March 17, 2023)

MediaAlpha, Inc.

Class A Common Stock

This Prospectus Supplement No. 4 (the “Prospectus Supplement”) updates, supplements and amends the Prospectus dated March 17, 2023 (the “Prospectus”), which forms part of our registration statement on Form S-1 (No. 333-261027) (the “Registration Statement”) relating to the offer and sale from time to time of up to 34,351,485 shares of our Class A common stock by the selling stockholders identified in the Prospectus (the “Selling Stockholders”). The Selling Stockholders may sell these shares through public or private transactions at market prices prevailing at the time of sale or at negotiated prices. The timing and amount of any sale are within the sole discretion of the Selling Stockholders. We will not receive any of the proceeds from the sale of shares of our Class A common stock by the Selling Stockholders.

This Prospectus Supplement is being filed to incorporate into our Registration Statement the information contained in our Quarterly Report on Form 10-Q for the period ended September 30, 2023, filed with the Securities and Exchange Commission on November 2, 2023. Accordingly, we have attached Part I and Part II of our Quarterly Report on Form 10-Q for the period ended September 30, 2023 to this Prospectus Supplement.

You should read this Prospectus Supplement in conjunction with the Prospectus, and this Prospectus Supplement is qualified by reference to the Prospectus, except to the extent that the information contained in this Prospectus Supplement supersedes the information contained in the Prospectus. This Prospectus Supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any and all additional amendments or supplements thereto.

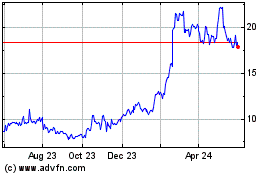

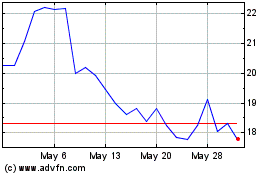

Our Class A common stock is traded on the New York Stock Exchange under the symbol “MAX.”

Investing in our Class A common stock involves risks. See “Risk Factors” on page 44 of this Prospectus Supplement and page 8 of the Prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is November 2, 2023.

MediaAlpha, Inc. and Subsidiaries

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| Item 1 | | |

| | |

| | |

| | |

| | |

| | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| | |

| Item 1 | | |

| Item 1A | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| Item 5 | | |

Certain Definitions

As used in this Quarterly Report on Form 10-Q:

•“Class A-1 units” refers to the Class A-1 units of QL Holdings LLC (“QLH”).

•“Class B-1 units” refers to the Class B-1 units of QLH.

•“Company,” “we,” or “us” refers to MediaAlpha, Inc. and its consolidated subsidiaries, unless the context requires otherwise.

•“Consumer Referral” means any consumer click, call or lead purchased by a buyer on our platform.

•“Consumers” and “customers” refer interchangeably to end consumers. Examples include individuals shopping for insurance policies.

•“Digital consumer traffic” refers to visitors to the mobile, tablet, desktop and other digital platforms of our supply partners, as well as to our proprietary websites.

•“Direct-to-consumer” or “DTC” means the sale of insurance products or services directly to end consumers, without the use of retailers, brokers, agents or other intermediaries.

•“Distributor” means any company or individual that is involved in the distribution of insurance, such as an insurance agent or broker.

•“Exchange agreement” means the exchange agreement, dated as of October 27, 2020 by and among MediaAlpha, Inc., QLH, Intermediate Holdco, Inc. and certain Class B-1 unitholders party thereto.

•“Founders” means, collectively, Steven Yi, Eugene Nonko, and Ambrose Wang.

•“High-intent” consumer or customer means an in-market consumer that is actively browsing, researching or comparing the types of products or services that our partners sell.

•“Insignia” means Insignia Capital Group, L.P. and its affiliates.

•“Intermediate Holdco” means Guilford Holdings, Inc., our wholly owned subsidiary and the owner of all Class A-1 units.

•“Inventory,” when referring to our supply partners, means the volume of Consumer Referral opportunities.

•“IPO” means our initial public offering of our Class A common stock, which closed on October 30, 2020.

•“Legacy Profits Interest Holders” means certain current or former employees of QLH or its subsidiaries (other than the Senior Executives), who indirectly held Class B units in QLH prior to our IPO and includes any estate planning vehicles or other holding companies through which such persons hold their units in QLH (which holding companies may or may not include QL Management Holdings LLC).

•“Lifetime value” or “LTV” is a type of metric that many of our business partners use to measure the estimated total worth to a business of a customer over the expected period of their relationship.

•“Open Marketplace” refers to one of our two business models. In Open Marketplace transactions, we have separate agreements with demand partners and suppliers. We earn fees from our demand partners and separately pay a revenue share to suppliers and a fee to Internet search companies to drive consumers to our proprietary websites.

•“Partner” refers to a buyer or seller on our platform, also referred to as “demand partners” and “supply partners,” respectively.

◦“Demand partner” refers to a buyer on our platform. As discussed under Part I, Item 2. Management’s Discussion & Analysis – Management Overview, our demand partners are generally insurance carriers and distributors looking to target high-intent consumers deep in their purchase journey.

◦“Supply partner” or “supplier” refers to a seller to our platform. As discussed under Part I, Item 2. Management’s Discussion & Analysis – Management Overview, our supply partners are primarily insurance carriers looking to maximize the value of non-converting or low LTV consumers, and insurance-focused research destinations or other financial websites looking to monetize high-intent consumers.

•“Private Marketplace” refers to one of our two business models. In Private Marketplace transactions, demand partners and suppliers contract with one another directly and leverage our platform to facilitate transparent, real-time transactions utilizing the reporting and analytical tools available to them from use of our platform. We charge a fee based on the Transaction Value of the Consumer Referrals sold through Private Marketplace transactions.

•“Proprietary” means, when used in reference to our properties, the websites and other digital properties that we own and operate. Our proprietary properties are a source of Consumer Referrals on our platform.

•“Reorganization Transactions” means the series of reorganization transactions completed on October 27, 2020 in connection with our IPO.

•“Senior Executives” means the Founders and the other current and former officers of the Company listed in Exhibit A to the Exchange Agreement. This term also includes any estate planning vehicles or other holding companies through which such persons hold their units in QLH.

•“Transaction Value” means the total gross dollars transacted by our partners on our platform.

•“Vertical” means a market dedicated to a specific set of products or services sold to end consumers. Examples include property & casualty insurance, life insurance, health insurance, and travel.

•“White Mountains” means White Mountains Insurance Group, Ltd. and its affiliates.

•“Yield” means the return to our sellers on their inventory of Consumer Referrals sold on our platform.

Cautionary Statement Regarding Forward-Looking Statements and Risk Factor Summary

We are including this Cautionary Statement to caution investors and qualify for the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the “Act”) for forward-looking statements. This Quarterly Report on Form 10-Q contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following:

•Our ability to attract and retain supply partners and demand partners to our platform and to make available quality Consumer Referrals at attractive volumes and prices to drive transactions on our platform;

•Our reliance on a limited number of supply partners and demand partners, many of which have no long-term contractual commitments with us, and any potential termination of those relationships;

•Fluctuations in customer acquisition spending by property and casualty insurance carriers due to unexpected changes in underwriting profitability as the carriers go through cycles in their business;

•Existing and future laws and regulations affecting the property & casualty insurance, health insurance and life insurance verticals;

•Changes and developments in the regulation of the underlying industries in which our partners operate;

•Competition with other technology companies engaged in digital customer acquisition, as well as buyers that attract consumers through their own customer acquisition strategies, third-party online platforms or other traditional methods of distribution;

•Our ability to attract, integrate and retain qualified employees;

•Reductions in DTC digital spend by our buyers;

•Mergers and acquisitions could result in additional dilution and otherwise disrupt our operations and harm our operating results and financial condition;

•Our dependence on internet search companies to direct a significant portion of visitors to our suppliers’ websites and our proprietary websites;

•The impact of broad-based pandemics or public health crises, such as COVID-19;

•The terms and restrictions of our existing and future indebtedness;

•Disruption to operations as a result of future acquisitions;

•Our failure to obtain, maintain, protect and enforce our intellectual property rights, proprietary systems, technology and brand;

•Our ability to develop new offerings and penetrate new vertical markets;

•Our ability to manage future growth effectively;

•Our reliance on data provided to us by our demand and supply partners and consumers;

•Natural disasters, public health crises, political crises, economic downturns, or other unexpected events;

•Significant estimates and assumptions in the preparation of our consolidated financial statements;

•Potential litigation and claims, including claims by regulatory agencies and intellectual property disputes;

•Our ability to collect our receivables from our partners;

•Fluctuations in our financial results caused by seasonality;

•The development of the DTC insurance distribution sector and evolving nature of our relatively new business model;

•Disruptions to or failures of our technological infrastructure and platform;

•Failure to manage and maintain relationships with third-party service providers;

•Cybersecurity breaches or other attacks involving our systems or those of our partners or third-party service providers;

•Our ability to protect consumer information and other data and risks of reputational harm due to an actual or perceived failure by us to protect such information and other data;

•Risks related to laws and regulation subject to us both in the U.S. and internationally, many of which are evolving;

•Risks related to changes in tax laws or exposure to additional income or other tax liabilities could affect our future profitability;

•Risks related to being a public company;

•Risks related to internal control on financial reporting;

•Risks related to shares of our Class A common stock;

•Risks related to our intention to take advantage of certain exemptions as a “controlled company” under the rules of the NYSE, and the fact that the interests of our controlling stockholders (White Mountains, Insignia, and the Founders) may conflict with those of other investors;

•Risks related to our corporate structure; and

•The other risk factors described under Part I, Item 1A "Risk Factors" in the 2022 Annual Report on Form 10-K.

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this Quarterly Report on Form 10-Q. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Part I. Financial Information

Item 1. Financial Statements.

MediaAlpha, Inc. and subsidiaries

Consolidated Balance Sheets

(Unaudited; in thousands, except share data and per share amounts)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 15,196 | | | $ | 14,542 | |

Accounts receivable, net of allowance for credit losses of $314 and $575, respectively | 33,051 | | | 59,998 | |

| Prepaid expenses and other current assets | 2,773 | | | 5,880 | |

| Total current assets | 51,020 | | | 80,420 | |

| Intangible assets, net | 27,744 | | | 32,932 | |

| Goodwill | 47,739 | | | 47,739 | |

| | | |

| Other assets | 6,529 | | | 8,990 | |

| Total assets | $ | 133,032 | | | $ | 170,081 | |

| Liabilities and stockholders' deficit | | | |

| Current liabilities | | | |

| Accounts payable | $ | 38,749 | | | $ | 53,992 | |

| Accrued expenses | 12,708 | | | 14,130 | |

| Current portion of long-term debt | 8,797 | | | 8,770 | |

| Total current liabilities | 60,254 | | | 76,892 | |

| Long-term debt, net of current portion | 167,697 | | | 174,300 | |

| | | |

| Other long-term liabilities | 4,760 | | | 4,973 | |

| Total liabilities | $ | 232,711 | | | $ | 256,165 | |

Commitments and contingencies (Note 7) | | | |

| Stockholders' (deficit): | | | |

Class A common stock, $0.01 par value - 1.0 billion shares authorized; 46.6 million and 43.7 million shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 466 | | | 437 | |

Class B common stock, $0.01 par value - 100 million shares authorized; 18.1 million and 18.9 million shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 181 | | | 189 | |

Preferred stock, $0.01 par value - 50 million shares authorized; 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | — | | | — | |

| Additional paid-in capital | 503,303 | | | 465,523 | |

| Accumulated deficit | (520,196) | | | (482,142) | |

| Total stockholders' (deficit) attributable to MediaAlpha, Inc. | $ | (16,246) | | | $ | (15,993) | |

| Non-controlling interests | (83,433) | | | (70,091) | |

| Total stockholders' (deficit) | $ | (99,679) | | | $ | (86,084) | |

| Total liabilities and stockholders' deficit | $ | 133,032 | | | $ | 170,081 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Operations

(Unaudited; in thousands, except share data and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 74,573 | | | $ | 89,017 | | | $ | 270,975 | | | $ | 335,065 | |

| Costs and operating expenses | | | | | | | |

| Cost of revenue | 62,277 | | | 76,343 | | | 226,545 | | | 285,149 | |

| Sales and marketing | 6,101 | | | 6,853 | | | 19,802 | | | 22,034 | |

| Product development | 4,296 | | | 5,291 | | | 14,525 | | | 16,168 | |

| General and administrative | 16,648 | | | 11,105 | | | 50,473 | | | 40,569 | |

| Total costs and operating expenses | 89,322 | | | 99,592 | | | 311,345 | | | 363,920 | |

| (Loss) from operations | (14,749) | | | (10,575) | | | (40,370) | | | (28,855) | |

| Other (income) expense, net | (100) | | | 8,602 | | | 1,165 | | | 8,123 | |

| Interest expense | 3,947 | | | 2,593 | | | 11,397 | | | 5,908 | |

| Total other expense, net | 3,847 | | | 11,195 | | | 12,562 | | | 14,031 | |

| (Loss) before income taxes | (18,596) | | | (21,770) | | | (52,932) | | | (42,886) | |

| Income tax expense (benefit) | 102 | | | (544) | | | 330 | | | 1,210 | |

| Net (loss) | $ | (18,698) | | | $ | (21,226) | | | $ | (53,262) | | | $ | (44,096) | |

| Net (loss) attributable to non-controlling interest | (5,196) | | | (6,740) | | | (15,208) | | | (13,395) | |

| Net (loss) attributable to MediaAlpha, Inc. | $ | (13,502) | | | $ | (14,486) | | | $ | (38,054) | | | $ | (30,701) | |

| Net (loss) per share of Class A common stock | | | | | | | |

| -Basic and diluted | $ | (0.29) | | | $ | (0.34) | | | $ | (0.84) | | | $ | (0.74) | |

| | | | | | | |

| Weighted average shares of Class A common stock outstanding | | | | | | | |

| -Basic and diluted | 46,229,672 | | | 42,210,186 | | | 45,095,417 | | | 41,592,783 | |

| | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Stockholders’ Equity (Deficit)

(Unaudited; in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

common stock | | Class B

common stock | | Additional

Paid-In-

Capital | | Accumulated

deficit | | Non-

Controlling

Interest | | Total

Stockholders’

(Deficit) |

| Units | | Amount | | Units | | Amount | | Amount | | Amount | | Amount | | Amount |

| Balance at December 31, 2022 | 43,650,634 | | | $ | 437 | | | 18,895,493 | | | $ | 189 | | | $ | 465,523 | | | $ | (482,142) | | | $ | (70,091) | | | $ | (86,084) | |

| | | | | | | | | | | | | | | |

| Exchange of non-controlling interest for Class A common stock | 10,000 | | | — | | | (10,000) | | | — | | | (39) | | | — | | | 39 | | | — | |

| Vesting of restricted stock units | 608,022 | | | 6 | | | — | | | — | | | (6) | | | — | | | — | | | — | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 14,259 | | | — | | | 45 | | | 14,304 | |

| | | | | | | | | | | | | | | |

| Shares withheld on tax withholding on vesting of restricted stock units | — | | | — | | | — | | | — | | | (1,238) | | | — | | | — | | | (1,238) | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | (1,104) | | | (1,104) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net (loss) | — | | | — | | | — | | | — | | | — | | | (10,266) | | | (4,318) | | | (14,584) | |

| Balance at March 31, 2023 | 44,268,656 | | | $ | 443 | | | 18,885,493 | | | $ | 189 | | | $ | 478,499 | | | $ | (492,408) | | | $ | (75,429) | | | $ | (88,706) | |

| | | | | | | | | | | | | | | |

| Exchange of non-controlling interest for Class A common stock | 766,000 | | | 8 | | | (766,000) | | | (8) | | | (3,130) | | | — | | | 3,130 | | | — | |

| Vesting of restricted stock units | 822,147 | | | 8 | | | — | | | — | | | (8) | | | — | | | — | | | — | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 15,171 | | | — | | | 14 | | | 15,185 | |

| | | | | | | | | | | | | | | |

| Shares withheld on tax withholding on vesting of restricted stock units | — | | | — | | | — | | | — | | | (701) | | | — | | | — | | | (701) | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | (192) | | | (192) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net (loss) | — | | | — | | | — | | | — | | | — | | | (14,286) | | | (5,694) | | | (19,980) | |

| Balance at June 30, 2023 | 45,856,803 | | | $ | 459 | | | 18,119,493 | | | $ | 181 | | | $ | 489,831 | | | $ | (506,694) | | | $ | (78,171) | | | $ | (94,394) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Vesting of restricted stock units | 741,283 | | | 7 | | | — | | | — | | | (7) | | | — | | | — | | | — | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 14,440 | | | — | | | 14 | | | 14,454 | |

| | | | | | | | | | | | | | | |

| Shares withheld on tax withholding on vesting of restricted stock units | — | | | — | | | — | | | — | | | (961) | | | — | | | — | | | (961) | |

| Contributions from QLH’s members | — | | | — | | | — | | | — | | | — | | | — | | | 196 | | | 196 | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | (276) | | | (276) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net (loss) | — | | | — | | | — | | | — | | | — | | | (13,502) | | | (5,196) | | | (18,698) | |

| Balance at September 30, 2023 | 46,598,086 | | | $ | 466 | | | 18,119,493 | | | $ | 181 | | | $ | 503,303 | | | $ | (520,196) | | | $ | (83,433) | | | $ | (99,679) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

common stock | | Class B

common stock | | Additional

Paid-In-

Capital | | Accumulated deficit | | Non- Controlling Interest | | Total Stockholders’ (Deficit) |

| Units | | Amount | | Units | | Amount | | Amount | | Amount | | Amount | | Amount |

| Balance at December 31, 2021 | 40,969,952 | | | $ | 410 | | | 19,621,915 | | | $ | 196 | | | $ | 419,533 | | | $ | (424,476) | | | $ | (57,229) | | | $ | (61,566) | |

| Establishment of liabilities under tax receivables agreement and related changes to deferred tax assets associated with increases in tax basis | — | | | — | | | — | | | — | | | 19 | | | — | | | — | | | 19 | |

| Exchange of non-controlling interest for Class A common stock | 60,197 | | | — | | | (60,197) | | | — | | | (180) | | | — | | | 180 | | | — | |

| Vesting of restricted stock units | 593,810 | | | 6 | | | — | | | — | | | (6) | | | — | | | — | | | — | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 13,688 | | | — | | | 85 | | | 13,773 | |

| Forfeiture of equity awards | (23,294) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares withheld on tax withholding on vesting of restricted stock units | — | | | — | | | — | | | — | | | (820) | | | — | | | — | | | (820) | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | (130) | | | (130) | |

| Settlement of 2021 annual bonus as restricted stock units | — | | | — | | | — | | | — | | | 880 | | | — | | | — | | | 880 | |

| Tax impact of changes in investment in partnership | — | | | — | | | — | | | — | | | 43 | | | — | | | — | | | 43 | |

| Net (loss) | — | | | — | | | — | | | — | | | — | | | (7,076) | | | (2,772) | | | (9,848) | |

| Balance at March 31, 2022 | 41,600,665 | | | $ | 416 | | | 19,561,718 | | | $ | 196 | | | $ | 433,157 | | | $ | (431,552) | | | $ | (59,866) | | | $ | (57,649) | |

| Establishment of liabilities under tax receivables agreement and related changes to deferred tax assets associated with increases in tax basis | — | | | — | | | — | | | — | | | 4 | | | — | | | — | | | 4 | |

| Exchange of non-controlling interest for Class A common stock | 297,747 | | | 3 | | | (297,747) | | | (3) | | | (946) | | | — | | | 946 | | | — | |

| Vesting of restricted stock units | 674,674 | | | 6 | | | — | | | — | | | (6) | | | — | | | — | | | — | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 15,733 | | | — | | | 47 | | | 15,780 | |

| Forfeiture of equity awards | (14,160) | | | — | | | (93,478) | | | (1) | | | (305) | | | — | | | 306 | | | — | |

| Shares withheld on tax withholding on vesting of restricted stock units | — | | | — | | | — | | | — | | | (966) | | | — | | | — | | | (966) | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | (460) | | | (460) | |

| Repurchases of Class A common stock | (321,150) | | | (3) | | | — | | | — | | | (3,454) | | | — | | | — | | | (3,457) | |

| Tax impact of changes in investment in partnership | — | | | — | | | — | | | — | | | 297 | | | — | | | — | | | 297 | |

| Net (loss) | — | | | — | | | — | | | — | | | — | | | (9,139) | | | (3,883) | | | (13,022) | |

| Balance at June 30, 2022 | 42,237,776 | | | $ | 422 | | | 19,170,493 | | | $ | 192 | | | $ | 443,514 | | | $ | (440,691) | | | $ | (62,910) | | | $ | (59,473) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Vesting of restricted stock units | 634,809 | | | 6 | | | — | | | — | | | (6) | | | — | | | — | | | — | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 14,610 | | | — | | | 53 | | | 14,663 | |

| | | | | | | | | | | | | | | |

| Shares withheld on tax withholding on vesting of restricted stock units | — | | | — | | | — | | | — | | | (815) | | | — | | | — | | | (815) | |

| | | | | | | | | | | | | | | |

| Repurchases of Class A common stock | (134,147) | | | (1) | | | — | | | — | | | (1,550) | | | — | | | — | | | (1,551) | |

| Net (loss) | — | | | — | | | — | | | — | | | — | | | (14,486) | | | (6,740) | | | (21,226) | |

| Balance at September 30, 2022 | 42,738,438 | | | $ | 427 | | | 19,170,493 | | | $ | 192 | | | $ | 455,753 | | | $ | (455,177) | | | $ | (69,597) | | | $ | (68,402) | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Cash Flows

(Unaudited; in thousands)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net (loss) | $ | (53,262) | | | $ | (44,096) | |

| Adjustments to reconcile net (loss) to net cash provided by operating activities: | | | |

| Non-cash equity-based compensation expense | 43,943 | | | 44,216 | |

| Non-cash lease expense | 508 | | | 539 | |

| Depreciation expense on property and equipment | 275 | | | 295 | |

| Amortization of intangible assets | 5,188 | | | 4,064 | |

| Amortization of deferred debt issuance costs | 597 | | | 626 | |

| Change in fair value of contingent consideration | — | | | (6,591) | |

| Impairment of cost method investment | 1,406 | | | 8,594 | |

| Credit losses | (220) | | | (109) | |

| Deferred taxes | — | | | 1,054 | |

| Tax receivable agreement liability adjustments | 6 | | | (576) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 27,167 | | | 42,840 | |

| Prepaid expenses and other current assets | 3,059 | | | 5,451 | |

| Other assets | 375 | | | 322 | |

| Accounts payable | (15,243) | | | (19,452) | |

| Accrued expenses | 1,138 | | | (2,223) | |

| Net cash provided by operating activities | $ | 14,937 | | | $ | 34,954 | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (60) | | | (93) | |

| Cash consideration paid in connection with CHT acquisition | — | | | (49,677) | |

| Net cash (used in) investing activities | $ | (60) | | | $ | (49,770) | |

| Cash flows from financing activities | | | |

| Proceeds received from: | | | |

| Revolving credit facility | — | | | 25,000 | |

| Payments made for: | | | |

| Repayments on revolving line of credit | — | | | (15,000) | |

| | | |

| Repayments on long-term debt | (7,125) | | | (7,125) | |

| | | |

| Repurchases of Class A common stock | — | | | (5,008) | |

| Contributions from QLH’s members | 196 | | | — | |

| Distributions | (1,572) | | | (590) | |

| Payments pursuant to tax receivable agreement | (2,822) | | | (216) | |

| Shares withheld for taxes on vesting of restricted stock units | (2,900) | | | (2,601) | |

| Net cash (used in) financing activities | $ | (14,223) | | | $ | (5,540) | |

| Net increase (decrease) in cash and cash equivalents | 654 | | | (20,356) | |

| Cash and cash equivalents, beginning of period | 14,542 | | | 50,564 | |

| Cash and cash equivalents, end of period | $ | 15,196 | | | $ | 30,208 | |

| Supplemental disclosures of cash flow information | | | |

| Cash paid during the period for: | | | |

| Interest | $ | 10,081 | | | $ | 4,628 | |

| | | |

| Income taxes paid, net of refunds | $ | (233) | | | $ | (2,144) | |

| Non-cash Investing and Financing Activities: | | | |

| Adjustments to liabilities under the tax receivable agreement | $ | — | | | $ | (1,619) | |

| Establishment of deferred tax assets in connection with the Reorganization Transactions | $ | — | | | $ | (1,642) | |

| | | |

| Fair value of contingent consideration in connection with CHT acquisition | $ | — | | | $ | 7,007 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

MediaAlpha, Inc. and subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. Summary of significant accounting policies

The Company's significant accounting policies are included in the 2022 Annual Report on Form 10-K and did not materially change during the nine months ended September 30, 2023.

Basis of presentation

The accompanying unaudited consolidated financial statements and related disclosures have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") applicable to interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. In the opinion of management, all adjustments, consisting of only those of a normal recurring nature, considered necessary for a fair statement of the financial position and interim results of the Company as of and for the periods presented have been included.

The December 31, 2022 balance sheet data was derived from audited consolidated financial statements; however, the accompanying interim notes to the consolidated financial statements do not include all of the annual disclosures required by GAAP. Results for interim periods are not necessarily indicative of those that may be expected for a full year. The financial information included herein should be read in conjunction with the Company's consolidated financial statements and related notes in its 2022 Annual Report on Form 10-K.

Accounts receivable

Accounts receivable are net of allowances for credit losses of $0.3 million and $0.6 million as of September 30, 2023 and December 31, 2022, respectively.

Concentrations of credit risk and of significant customers and suppliers

Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash and cash equivalents and accounts receivable. The Company maintains cash balances that can, at times, exceed amounts insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in these accounts and believes it is not exposed to unusual risk beyond the normal credit risk in this area based on the financial strength of the institutions with which the Company maintains its deposits.

The Company's accounts receivable, which are unsecured, may expose it to credit risk based on their collectability. The Company controls credit risk by investigating the creditworthiness of all customers prior to establishing relationships with them, performing periodic reviews of the credit activities of those customers during the course of the business relationship, regularly analyzing the collectability of accounts receivable, and recording allowances for credit losses. The Company's supplier concentration can also expose it to business risks.

Customer and supplier concentrations consisted of the below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, 2023 | | Three Months Ended

September 30, 2022 |

| Number of customers or suppliers exceeding 10% | Aggregate Value

(in millions) | % of Total | | Number of customers or suppliers exceeding 10% | Aggregate Value

(in millions) | % of Total |

| Revenue | — | | $ | — | | — | % | | 1 | $ | 10 | | 11 | % |

| Purchases | 1 | | $ | 9 | | 14 | % | | 1 | $ | 9 | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended

September 30, 2023 | | Nine Months Ended

September 30, 2022 |

| Number of customers or suppliers exceeding 10% | Aggregate Value

(in millions) | % of Total | | Number of customers or suppliers exceeding 10% | Aggregate Value

(in millions) | % of Total |

| Revenue | — | | $ | — | | — | % | | 1 | $ | 42 | | 13 | % |

| Purchases | 1 | | $ | 26 | | 12 | % | | 1 | $ | 33 | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 | | As of December 31, 2022 |

| Number of customers or suppliers exceeding 10% | Aggregate Value

(in millions) | % of Total | | Number of customers or suppliers exceeding 10% | Aggregate Value

(in millions) | % of Total |

| Accounts receivable | 1 | | $ | 5 | | 15 | % | | — | $ | — | | — | % |

| Accounts payable | 1 | | $ | 6 | | 16 | % | | 2 | $ | 22 | | 40 | % |

Related Party Transactions

The Company is party to the tax receivables agreement ("TRA") under which it is contractually committed to pay certain holders of Class B-1 units 85% of the amount of any tax benefits that the Company actually realizes, or in some cases are deemed to realize, as a result of certain transactions. During the three and nine months ended September 30, 2023, payments of $0 and $2.8 million, respectively and $0 and $0.2 million during the three and nine months ended September 30, 2022, respectively, were made pursuant to the TRA.

Liquidity

As of September 30, 2023, the aggregate principal amount outstanding under the 2021 Credit Facilities was $178.4 million, with $45.0 million remaining available for borrowing under the 2021 Revolving Credit Facility. As of September 30, 2023, the Company was in compliance with all of its financial covenants under such credit facilities. The Company’s ability to continue to comply with its covenants will depend on, among other things, financial, business, market, competitive and other conditions, many of which are beyond the Company’s control.

The Company’s results are subject to fluctuations as a result of business cycles experienced by companies in the insurance industry. The Company believes that the property & casualty (P&C) insurance industry is currently in a cyclical downturn due to higher-than-expected carrier underwriting losses, which has led these carriers to reduce their customer acquisition spending in the Company’s Marketplaces. During the year, one of the Company's major insurance carrier partners significantly reduced its customer acquisition spend with the Company due to experiencing higher than expected loss ratios as a result of several factors, including ongoing loss cost inflation and unfavorable prior year reserve developments, reducing the Company's expected near-term revenue and Adjusted EBITDA and its forecasted cushion with respect to compliance with the financial covenants under the 2021 Credit Facilities. In spite of these reductions in carrier spending, the Company’s Adjusted EBITDA has increased year over year, due primarily to the Company’s continuing cost reduction efforts, including implementing workforce reductions during the second quarter of 2023. The Company believes it has sufficient cash on hand and availability to access additional cash under its 2021 Revolving Credit Facility to meet its business operating requirements, its capital expenditures and to continue to comply with its debt covenants for at least the next twelve months as of the filing date of this Quarterly Report on Form 10-Q.

The extent to which these market conditions impact the Company’s business, results of operations, cash flows and financial condition will depend on future developments impacting its carrier partners, including inflation rates, the extent of any major catastrophic losses, and the timing of regulatory approval of premium rate increases, which remain highly uncertain and cannot be predicted with accuracy. The Company considered the impact of this uncertainty on the assumptions and estimates used when preparing these quarterly financial statements. These assumptions and estimates may continue to change as new events occur, and such changes could have an adverse impact on the Company's results of operations, financial position and liquidity.

The Company expects customer acquisition spend by P&C carriers to remain depressed during the fourth quarter of 2023 and while the Company expects this spending to increase beginning in the first quarter of 2024, it is possible that such increase may be delayed or not occur. In the event that the Company’s financial results are below its expectations due to cyclical conditions in its primary vertical markets or other factors, the Company may not be able to remain in compliance with its financial covenants under the 2021 Credit Facilities, in which event the Company may need to take additional actions to reduce operating costs, which may include adjusting discretionary employee bonuses and other discretionary spending, negotiate amendments to or obtain waivers of such financial covenants, refinance the 2021 Credit Facilities, or raise additional capital. There can be no assurance that the Company would be able to raise additional capital or obtain any such amendments, refinancing or waivers on terms acceptable to the Company or at all. The consolidated financial statements do not include any adjustments that may result from the outcome of these uncertainties.

New Accounting Pronouncements

Recently adopted accounting pronouncements

In October 2021, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from contracts with customers. The ASU requires contract assets and contract liabilities acquired in a business combination to be recognized and measured by the acquirer on the acquisition date in accordance with Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers, as if it had originated the contracts. Under the current business combinations guidance, such assets and liabilities were recognized by the acquirer at fair value on the acquisition date. The guidance in ASU is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022, with early adoption permitted and will be applied prospectively to business combinations occurring on or after the effective date of the amendment. The Company adopted the ASU on January 1, 2023 and the adoption did not have any impact on the Company's consolidated financial statements.

In March 2020 and January 2021, the FASB issued ASU No. 2020-4, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting and ASU 2021-1, Reference Rate Reform (Topic 848): Scope, respectively. ASU 2020-4 and ASU 2021-1 provide optional expedients and exceptions for applying U.S. GAAP, to contracts, and other transactions that reference the London Interbank Offered Rate ("LIBOR") or another reference rate expected to be discontinued because of reference rate reform, if certain criteria are met. The guidance in ASU 2020-4 and ASU 2021-1 was effective upon issuance and, once adopted, may be applied prospectively to contract modifications and hedging relationships through December 31, 2022. In December 2022, the FASB issued ASU No. 2022-6, Deferral of the Sunset Date of Topic 848, which deferred the sunset date of Topic 848 from December 31, 2022 to December 31, 2024 to align with the amended cessation date of LIBOR, which had been delayed to June 30, 2023. On June 8, 2023, the Company amended its existing credit agreement to change the interest rate benchmark under the 2021 Credit Facilities from LIBOR to the Secured Overnight Financing Rate ("SOFR"), as further discussed in Note 6 - Long term debt. Effective June 8, 2023, the Company adopted ASC Topic 848 and qualified for the available optional expedients, which allows the Company to account for the contract modifications as continuations of the existing contract without further reassessment or remeasurement that would otherwise be required under the applicable U.S. GAAP. On October 1, 2023, the Company also amended its TRA to, among other things, change the interest rate benchmark from LIBOR to SOFR. The adoption did not have a material impact on the Company's consolidated financial statements.

Recently issued not yet adopted accounting pronouncements

There have been no other accounting pronouncements issued but not yet adopted by the Company which are expected to have a material impact on the Consolidated Financial Statements.

2. Disaggregation of revenue

The following table shows the Company’s revenue disaggregated by transaction model:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | | |

| Open marketplace transactions | | $ | 73,053 | | | $ | 86,279 | | | $ | 263,568 | | | $ | 324,008 | |

| Private marketplace transactions | | 1,520 | | | 2,738 | | | 7,407 | | | 11,057 | |

| Total | | $ | 74,573 | | | $ | 89,017 | | | $ | 270,975 | | | $ | 335,065 | |

The following table shows the Company’s revenue disaggregated by product vertical:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | | |

| Property & casualty insurance | | $ | 31,933 | | | $ | 43,844 | | | $ | 126,532 | | | $ | 188,869 | |

| Health insurance | | 33,961 | | | 33,393 | | | 115,192 | | | 108,665 | |

| Life insurance | | 5,341 | | | 6,977 | | | 18,321 | | | 21,049 | |

| Other | | 3,338 | | | 4,803 | | | 10,930 | | | 16,482 | |

| Total | | $ | 74,573 | | | $ | 89,017 | | | $ | 270,975 | | | $ | 335,065 | |

3. Business Combinations

On February 24, 2022, QuoteLab, LLC (“QL”), a wholly owned subsidiary of QLH, and CHT Buyer, LLC, a wholly owned subsidiary of QL ("Buyer"), entered into an Asset Purchase Agreement (as amended, the “Agreement”) to acquire substantially all of the assets of Customer Helper Team, LLC ("Seller" or "CHT"). CHT is a provider of customer generation and acquisition services, primarily for Medicare insurance, automobile insurance, health insurance and life insurance companies. The Company acquired CHT to increase its customer generation capabilities on various social media and short form video platforms. The transaction was closed on April 1, 2022.

The Company accounted for the transaction as a business combination using the acquisition method of accounting as CHT contained inputs and processes that were capable of being operated as a business. The acquisition date fair value of the purchase consideration for the acquisition was $56.7 million, and consisted of the following (in thousands):

| | | | | |

| Fair Value |

| Cash consideration (net of working capital adjustments) | $ | 49,677 | |

| Contingent consideration | 7,007 | |

| Total purchase consideration | $ | 56,684 | |

The Agreement also provides for the Company to pay contingent consideration, which could range from zero to $20.0 million, based upon CHT's achievement of certain revenue and gross margin targets for the two successive twelve-month periods following the closing, as set forth in the Agreement. The contingent consideration has been classified as a liability and the estimated fair value was determined using a Monte Carlo model based on the revenue and gross margin projected to be generated by CHT during the applicable periods. CHT was unable to meet its target for the first twelve-month period, and so the Company did not pay any consideration related to that period. In addition, based on further decline in CHT's projected revenue and gross margin, the Company does not expect CHT to meet the target for the second twelve-month period. The contingent consideration is subject to remeasurement at each reporting date until paid, with any adjustment resulting from the remeasurement reported within general & administrative expenses in the consolidated statements of operations. The fair value measurements of the contingent consideration are based primarily on significant unobservable inputs and thus represent a Level 3 measurement in the valuation hierarchy as defined in ASC 820.

Transaction-related costs incurred by the Company were $0.1 million and $0.6 million for the three and nine months ended September 30, 2022, respectively, and were expensed as incurred and included in general and administrative expenses in the consolidated statement of operations.

In accordance with the acquisition method of accounting, the purchase consideration was allocated to the assets acquired and liabilities assumed based on their fair values on the date of the acquisition as follows (in thousands):

| | | | | |

| Accounts receivable | $ | 1,275 | |

| Prepaid expenses and other current assets | 17 | |

| Intangible assets | 26,120 | |

| Goodwill | 29,337 | |

| Accounts payable | (18) | |

| Accrued expenses | (47) | |

| Net assets acquired | $ | 56,684 | |

The Company considers the measurement period for such purchase price allocation to be one year from the date of acquisition. The fair value of working capital related items, including accounts receivable, prepaid expenses and other current assets, accounts payable, and accrued expenses, approximated their book values as of the closing date of the acquisition.

The excess of the purchase consideration over the fair value of the net assets acquired was recorded as goodwill. The resulting goodwill is attributable primarily to CHT's assembled workforce and the expanded market opportunities provided by the CHT business by increasing the Company’s ability to generate Consumer Referrals on various social media and short form video platforms. The goodwill resulting from the acquisition is tax deductible. For tax purposes, contingent consideration does not become part of tax goodwill until paid. As such, the amount of goodwill deductible for tax purposes as of the closing date of the acquisition was $22.7 million. The Company's estimate of the amount of tax deductible goodwill may change as the amounts of the payments of contingent consideration, if any, are finalized.

The following pro forma financial information summarizes the combined results of operations for the Company and CHT, as though the companies were combined as of the beginning of the Company’s fiscal 2021. The unaudited pro forma financial information was as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2022 | | | | 2022 | | |

| Total revenues | | $ | 89,017 | | | | | $ | 341,335 | | | |

| Pretax (loss) | | $ | (21,664) | | | | | $ | (41,270) | | | |

The pro forma financial information presented above has been calculated after adjusting the results of CHT to reflect certain business combination and one-time accounting effects such as fair value adjustment of amortization expense from acquired intangible assets, interest expense on the amounts drawn under the 2021 Revolving Credit facility, and acquisition costs as though the acquisition occurred as of the beginning of the Company’s fiscal 2021. The historical consolidated financial information has been adjusted in the pro forma combined financial results to give effect to pro forma events that are directly attributable to the business combination, reasonably estimable and factually supportable. The pro forma financial information does not include the impact of remeasurement adjustments to the contingent considerations and restricted stock units granted to employees of CHT on the date of acquisition for post combination services, which are included within the periods they were incurred. The pro forma financial information is for informational purposes only and is not indicative of the results of operations that would have been achieved if the acquisition had taken place at the beginning of the Company’s fiscal 2021.

4. Goodwill and intangible assets

Goodwill and intangible assets consisted of:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | | | September 30, 2023 | | December 31, 2022 |

| (in thousands) | | Useful

life

(months) | | Gross carrying amount | | Accumulated amortization | | Net carrying amount | | Gross carrying amount | | Accumulated amortization | | Net carrying amount |

| Customer relationships | | 84 - 120 | | $ | 43,500 | | | $ | (22,415) | | | $ | 21,085 | | | $ | 43,500 | | | $ | (17,820) | | | $ | 25,680 | |

| Non-compete agreements | | 60 | | 303 | | | (303) | | | — | | | 303 | | | (303) | | | — | |

| Trademarks, trade names, and domain names | | 60 - 120 | | 8,884 | | | (2,225) | | | 6,659 | | | 8,884 | | | (1,632) | | | 7,252 | |

| Intangible assets | | | | $ | 52,687 | | | $ | (24,943) | | | $ | 27,744 | | | $ | 52,687 | | | $ | (19,755) | | | $ | 32,932 | |

| Goodwill | | Indefinite | | $ | 47,739 | | | $ | — | | | $ | 47,739 | | | $ | 47,739 | | | $ | — | | | $ | 47,739 | |

Amortization expense related to intangible assets amounted to $1.7 million for the three months ended September 30, 2023 and 2022, respectively, and $5.2 million and $4.1 million for the nine months ended September 30, 2023 and 2022, respectively. The Company has no accumulated impairment of goodwill.

The following table presents the changes in goodwill and intangible assets:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | September 30, 2023 | | December 31, 2022 |

| (in thousands) | | Goodwill | | Intangible

assets | | Goodwill | | Intangible

assets |

| Beginning balance at January 1, | | $ | 47,739 | | | $ | 32,932 | | | $ | 18,402 | | | $ | 12,567 | |

| Additions to goodwill and intangible assets | | — | | | — | | | 29,337 | | | 26,120 | |

| Amortization | | — | | | (5,188) | | | — | | (5,755) | |

| Ending balance | | $ | 47,739 | | | $ | 27,744 | | | $ | 47,739 | | | $ | 32,932 | |

As of September 30, 2023, future amortization expense relating to identifiable intangible assets with estimable useful lives over the next five years was as follows:

| | | | | | | | |

| (in thousands) | | Amortization expense |

| 2023–Remaining Period | | $ | 1,729 | |

| 2024 | | 6,428 | |

| 2025 | | 5,759 | |

| 2026 | | 5,143 | |

| 2027 | | 4,106 | |

| Thereafter | | 4,579 | |

| | $ | 27,744 | |

5. Accrued expenses

Accrued expenses include the following:

| | | | | | | | | | | | | | |

| | As of |

| (in thousands) | | September 30,

2023 | | December 31,

2022 |

| Accrued payroll and related expenses | | $ | 3,116 | | | $ | 3,621 | |

| Accrued operating expenses | | 3,418 | | | 2,036 | |

6. Long-term debt

On July 29, 2021, the Company entered into an amendment (the "First Amendment") to the 2020 Credit Agreement dated as of September 23, 2020, with the lenders that are party thereto and JPMorgan Chase Bank, N.A., as administrative agent (as amended by the First Amendment, the “Existing Credit Agreement”). The Existing Credit Agreement provides for a new senior secured term loan facility in an aggregate principal amount of $190.0 million (the "2021 Term Loan Facility"), the proceeds of which were used to refinance all $186.4 million of the existing term loans outstanding and the unpaid interest thereof as of the date of the First Amendment, to pay fees related to these transactions, and to provide cash for general corporate purposes, and a new senior secured revolving credit facility with commitments in an aggregate amount of $50.0 million (the "2021 Revolving Credit Facility" and, together with the 2021 Term Loan Facility, the "2021 Credit Facilities"), which replaced the existing revolving credit facility under the 2020 Credit Agreement.

On June 8, 2023, the Company entered into a Second Amendment (the “Second Amendment”) to the Existing Credit Agreement, (as amended by the Second Amendment, the “Amended Credit Agreement”). The Second Amendment amends the Existing Credit Agreement to replace the existing LIBOR based rate applicable to the 2021 Credit Facilities with a Term SOFR or Daily Simple SOFR with a credit spread adjustment of 0.10% per annum and a floor of 0.00%, effective on the amendment date. Borrowings under the Amended Credit Agreement will continue to bear interest at a rate equal to, at the option of the Borrower, the Term SOFR or Daily Simple SOFR plus an applicable margin, with a floor of 0.00%, or the base rate plus an applicable margin. The applicable margins are based on the Company’s consolidated total net leverage ratio as calculated under the terms of the Amended Credit Agreement for the prior fiscal quarter and range from 2.00% to 2.75% with respect to the Term SOFR or Daily Simple SOFR and from 1.00% to 1.75% with respect to the base rate.

The Second Amendment did not impact the Company's outstanding debt or related debt covenants. The Second Amendment did not result in any additional cash proceeds or changes in commitment amounts. The Second Amendment has been accounted for as a continuation of the existing agreement in accordance with ASC 848 — Reference Rate Reforms and any third-party costs were expensed as incurred and included in general and administrative expenses in the consolidated statement of operations.

Long-term debt consisted of the following:

| | | | | | | | | | | | | | |

| | As of |

| (in thousands) | | September 30,

2023 | | December 31,

2022 |

| 2021 Term Loan Facility | | $ | 173,375 | | | $ | 180,500 | |

| | | | |

| 2021 Revolving Credit Facility | | 5,000 | | | 5,000 | |

| Debt issuance costs | | (1,881) | | | (2,430) | |

| Total debt | | $ | 176,494 | | | $ | 183,070 | |

Less: current portion, net of debt issuance costs of $703 and $730, respectively | | (8,797) | | | (8,770) | |

| Total long-term debt | | $ | 167,697 | | | $ | 174,300 | |

Loans under the 2021 Credit Facilities will mature on July 29, 2026. Loans under the 2021 Term Loan Facility amortize quarterly, beginning on the first business day after December 31, 2021 and ending with June 30, 2026, by an amount equal to 1.25% of the aggregate outstanding principal amount of the term loans initially made. Accordingly, the amount of mandatory quarterly principal payable amount under the 2021 Term Loan within the next twelve months has been classified within the current portion of long-term debt and the remaining balance as long-term debt, net of current portion on the consolidated balance sheets. The Company incurred interest expense on the 2021 Term Loan Facility of $3.8 million and $2.4 million for the three months ended September 30, 2023 and 2022, respectively, and $10.9 million and $5.4 million for the nine months ended September 30, 2023 and 2022, respectively. Interest expense included amortization of debt issuance costs on the 2021 Credit Facility of $0.2 million for the three months ended September 30, 2023 and 2022, respectively, and $0.6 million for the nine months ended September 30, 2023 and 2022, respectively.

The 2021 Revolving Credit Facility does not amortize and will mature on July 29, 2026 and has been classified as non-current within long-term debt, net of current portion on the consolidated balance sheet. As of September 30, 2023, the Company’s borrowing capacity available under the 2021 Revolving Credit Facility was $45.0 million, which holds a commitment fee based on the Company’s consolidated total net leverage ratio and ranges from 0.25% to 0.50%. The Company incurred interest expense on the 2021 Revolving Credit Facility of $0.2 million for the three months ended September 30, 2023 and 2022, respectively, and $0.5 million for the nine months ended September 30, 2023 and 2022, respectively.

Accrued interest was $3.7 million as of September 30, 2023 and $3.0 million as of December 31, 2022, and is included within accrued expenses on the consolidated balance sheets.

The expected future principal payments for all borrowings as of September 30, 2023 were as follows:

| | | | | | | | |

| (in thousands) | | Contractual maturity |

| | |

| 2023–Remaining Period | | $ | 2,375 | |

| 2024 | | 9,500 | |

| 2025 | | 9,500 | |

| 2026 | | 157,000 | |

| | |

| Debt and issuance costs | | 178,375 | |

| Unamortized debt issuance costs | | (1,881) | |

| Total debt | | $ | 176,494 | |

7. Commitments and contingencies

Litigation and other matters

The Company is subject to certain legal proceedings and claims that arise in the normal course of business. In the opinion of management, the Company does not believe that the amount of liability, if any, as a result of these proceedings and claims will have a materially adverse effect on the Company’s consolidated financial position, results of operations, or cash flows. As of September 30, 2023 and December 31, 2022, the Company did not have any material contingency reserves established for any litigation liabilities.

On February 21, 2023, the Company received a civil investigative demand from the Federal Trade Commission (FTC) regarding compliance with the FTC Act and the Telemarketing Sales Rule, as they relate to the advertising, marketing, promotion, offering for sale, or sale of healthcare-related products, the collection, sale, transfer or provision to third parties of consumer data, telemarketing practices, and/or consumer privacy or data security. The Company is cooperating fully with the FTC. During the three and nine months ended September 30, 2023, the Company incurred legal fees of $1.6 million and $3.0 million, respectively, in connection with the demand, which are included within general and administrative expenses on the consolidated statement of operations. At this time, the Company is unable to predict the ultimate outcome of this matter or the significance, if any, to the Company’s business, results of operations or financial condition.

8. Equity-based compensation

Equity-based compensation cost recognized for equity-based awards outstanding during the three and nine months ended September 30, 2023 and 2022 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| QLH restricted Class B-1 units | | 14 | | | 53 | | | 73 | | | 185 | |

| Restricted Class A shares | | 130 | | | 213 | | | 464 | | | 774 | |

| Restricted stock units | | 14,310 | | | 14,397 | | | 43,406 | | | 43,257 | |

| Performance-based restricted stock units | | — | | | (63) | | | — | | | — | |

| Total equity-based compensation | | $ | 14,454 | | | $ | 14,600 | | | $ | 43,943 | | | $ | 44,216 | |

Equity-based compensation cost was included in the following expense categories in the consolidated statements of operations during the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | | $ | 1,012 | | | $ | 999 | | | $ | 2,959 | | | $ | 2,637 | |

| Sales and marketing | | 2,151 | | | 2,477 | | | 6,895 | | | 7,951 | |

| Product development | | 1,905 | | | 2,426 | | | 6,176 | | | 7,321 | |

| General and administrative | | 9,386 | | | 8,698 | | | 27,913 | | | 26,307 | |

| Total equity-based compensation | | $ | 14,454 | | | $ | 14,600 | | | $ | 43,943 | | | $ | 44,216 | |

As of September 30, 2023, total unrecognized compensation cost related to unvested QLH restricted Class B-1 units, restricted Class A shares, restricted stock units, and PRSUs was $30 thousand, $0.4 million, $59.2 million, and $0, respectively, which are expected to be recognized over weighted-average periods of 0.48 years, 0.72 years, 2.36 years, and 0.45 years, respectively.

9. Stockholders' Equity (Deficit)

Share Repurchase Program

On March 14, 2022, the Company’s Board of Directors approved a Share Repurchase Program (“Repurchase Program”) that authorized the Company to repurchase up to $5.0 million of the Company’s share of Class A common stock in open market transactions at prevailing market prices or by other means in accordance with federal securities laws. The

Company completed the Repurchase Program during the year ended December 31, 2022. The Repurchase Program did not obligate the Company to repurchase a fixed number of shares and any repurchases were accounted for as of the trade date with a corresponding liability. The excess between the repurchase price and the par value of the shares of Class A common stock repurchased was recorded as an adjustment to additional-paid-in capital. During the three and nine months ended September 30, 2022, 134,147 and 455,297 shares of Class A common stock were repurchased for an aggregate amount of $1.6 million and $5.0 million, respectively.

10. Fair Value Measurements

The following are the Company’s financial instruments measured at fair value on a recurring basis:

Contingent consideration

Contingent consideration is measured at fair value on a recurring basis using significant unobservable inputs and thus represent a Level 3 measurement in the valuation hierarchy. The following table summarizes the changes in the contingent consideration:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Beginning fair value | $ | — | | | $ | 4,162 | | | $ | — | | | $ | — | |

| Additions in the period | — | | | — | | | — | | | 7,007 | |

| Change in fair value | | | | | | | |

| (Gain) included in General and administrative expenses | — | | | (3,746) | | | — | | | (6,591) | |

| Ending fair value | $ | — | | | $ | 416 | | | $ | — | | | $ | 416 | |

| Change in unrealized (gain) related to instrument still held at end of period | $ | — | | | $ | (3,746) | | | $ | — | | | $ | (6,591) | |

Contingent consideration relates to the estimated amount of additional cash consideration to be paid in connection with the Company's acquisition of CHT. The fair value is dependent on the probability of achieving certain revenue and gross profit margin targets for the two successive twelve-month periods following the closing of the acquisition. The Company uses the Monte Carlo simulation approach to estimate the fair value of the revenue and gross margin targets. A change in any of these unobservable inputs can significantly change the fair value of the contingent consideration. CHT was unable to meet its target for the first twelve-month period, and so the Company did not pay any consideration related to that period. In addition, based on further decline in CHT's projected revenue and gross margin, the Company does not expect CHT to meet the target for the second twelve-month period. Accordingly, the Company has determined the fair value of the consideration as of September 30, 2023 to be zero. As of September 30, 2023, the range of the undiscounted amounts the Company could pay under the agreement could be from zero to $15.0 million.

The following are the Company’s financial instruments measured at fair value on a non-recurring basis:

Long-Term Debt

As of September 30, 2023, the carrying amount of the 2021 Term Loan Facility and the 2021 Revolving Credit Facility approximates their respective fair values. The Company used a discounted cash flow analysis to estimate the fair value of the long-term debt, using an adjusted discount rate of 7.20% and the estimated payments under the 2021 Term Loan Facility until maturity, including interest payable based on the Company's forecasted total net leverage ratio.

Cost method investment

The Company has elected the measurement alternative for its investment in equity securities without readily determinable fair values and reviews such investment on a quarterly basis to determine if it has been impaired. If the Company's assessment indicates that an impairment exists, the Company estimates the fair value of the equity investment and recognizes in its consolidated statement of operations an impairment loss that is equal to the difference between the fair value of the equity investment and its carrying amount. The Company determined that the fair value of the investment as of September 30, 2023 continued to be zero, and recognized an impairment loss of $0 and $1.4 million within other expenses (income), net in the consolidated statements of operations for the three and nine months ended September 30, 2023, respectively. The accumulated impairment of this cost method investment as of September 30, 2023 and December 31, 2022, was $10.0 million and $8.6 million, respectively. The carrying value of the Company’s cost method investment, which is included in other assets in the consolidated balance sheets, was zero and $1.4 million as of September 30, 2023 and December 31, 2022, respectively.

The Company used a market approach to estimate the fair value of equity and allocated the overall equity value to estimate the fair value of the common stock based on the liquidation preference and is classified within Level 3 of the fair value hierarchy. A change in any of the unobservable inputs can significantly change the fair value of the investment.

11. Income taxes

MediaAlpha, Inc. is taxed as a corporation and pays corporate federal, state and local taxes on income allocated to it from QLH based upon MediaAlpha, Inc.’s economic interest held in QLH. QLH is treated as a pass-through partnership for income tax reporting purposes and is not subject to federal income tax. Instead, QLH’s taxable income or loss is passed through to its members, including MediaAlpha, Inc. Accordingly, the Company is not liable for income taxes on the portion of QLH’s earnings not allocated to it. MediaAlpha, Inc. files and pays corporate income taxes for U.S. federal and state income tax purposes and its corporate subsidiary, Skytiger Studio, Ltd., is subject to taxation in Taiwan. The Company expects this structure to remain in existence for the foreseeable future.

The Company estimates the annual effective tax rate for the full year to be applied to actual year-to-date income (loss) and adds the tax effects of any discrete items in the reporting period in which they occur. The Company’s effective income tax rate was (0.5)% and (0.6)% for the three and nine months ended September 30, 2023, respectively. The Company’s effective income tax rate was 2.5% and (2.8)% for the three and nine months ended September 30, 2022, respectively.

The following table summarizes the Company's income tax expense:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands, except percentages) | | 2023 | | 2022 | | 2023 | | 2022 |

| (Loss) before income taxes | | $ | (18,596) | | | $ | (21,770) | | | $ | (52,932) | | | $ | (42,886) | |

| Income tax expense (benefit) | | $ | 102 | | | $ | (544) | | | $ | 330 | | | $ | 1,210 | |

| Effective Tax Rate | | (0.5) | % | | 2.5 | % | | (0.6) | % | | (2.8) | % |

The Company's effective tax rate of (0.5)% and (0.6)% for the three and nine months ended September 30, 2023 differed from the U.S. federal statutory rate of 21%, due primarily to the tax impacts of recording a valuation allowance against current year losses, nondeductible equity-based compensation, losses associated with non-controlling interests not taxable to the Company, state taxes, and other nondeductible permanent items.

There were no material changes to the Company’s unrecognized tax benefits during the three and nine months ended September 30, 2023. The Company is currently under examination by various tax authorities in the United States. These examinations are in preliminary stages and the Company does not expect to have any significant changes to unrecognized tax benefits through the end of the fiscal year.

During the three and nine months ended September 30, 2023, holders of Class B-1 units exchanged 0 and 776,000 Class B-1 units, respectively, together with an equal number of shares of Class B common stock, for shares of Class A common stock on a one-for-one basis (“Exchanges”). In connection with the Exchanges, the Company did not establish any additional liabilities related to the TRA, which are presented within additional-paid-in-capital in its consolidated statements of stockholders’ equity (deficit). In connection with the Exchanges and the changes to the carrying value of the non-controlling interest, the Company also recognizes deferred tax assets associated with the basis difference in its investment in QLH through additional-paid-in-capital, but during the three and nine months ended September 30, 2023, the Company did not recognize any additional deferred tax assets as the Company recognized a full valuation allowance on its deferred tax assets.

As of September 30, 2023 and December 31, 2022, the Company had a valuation allowance of $87.3 million and $91.8 million, respectively, against its deferred tax assets based on the recent history of pre-tax losses, which is considered a significant piece of objective negative evidence that is difficult to overcome and limits the ability to consider other subjective evidence, such as projections of future growth. It is possible in the foreseeable future that there may be sufficient positive evidence, and/or that the objective negative evidence in the form of history of pre-tax losses will no longer be present, in which event the Company could release a portion or all of the valuation allowance. Release of any amount of valuation allowance would result in a benefit to income tax expense for the period the release is recorded, which could have a material impact on net earnings.

Tax Receivables Agreement

In connection with the Reorganization Transactions and the IPO, the Company entered into the TRA with Insignia, Senior Executives, and White Mountains. The Company expects to obtain an increase in its share of the tax basis in the net assets of QLH as Class B-1 units, together with shares of Class B common stock, are exchanged for shares of Class A common stock (or, at the Company’s election, redeemed for cash of an equivalent value). The Company intends to treat any redemptions and exchanges of Class B-1 units as direct purchases for U.S. federal income tax purposes. These increases in tax basis may reduce the amounts that it would otherwise pay in the future to various tax authorities.

As of September 30, 2023 and December 31, 2022, the Company determined that making a payment under the TRA was not probable under ASC 450 — Contingencies since a valuation allowance has been recorded against the Company’s deferred tax assets and the Company does not believe it will generate sufficient future taxable income to utilize related tax benefits and result in a payment under the TRA. As a result, the Company remeasured the liabilities due under the TRA to zero in the consolidated balance sheets. If the Company had determined that making a payment under the TRA and generating sufficient future taxable income was probable, it would have also recorded a liability pursuant to the TRA of approximately $88 million in the consolidated balance sheet.

As of September 30, 2023 and December 31, 2022, the Company recorded zero and $2.8 million, respectively, as current portion of payments due under the TRA within accrued expenses in the consolidated balance sheets. Payments of $0 and $2.8 million were made pursuant to the TRA during the three and nine months ended September 30, 2023, respectively, and $0 and $0.2 million during the three and nine months ended September 30, 2022, respectively.

12. Earnings (Loss) Per Share

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands except share data and per share amount) | 2023 | | 2022 | | 2023 | | 2022 |

| Basic | | | | | | | |

| Net (loss) | $ | (18,698) | | | $ | (21,226) | | | $ | (53,262) | | | $ | (44,096) | |

| Less: net (loss) attributable to non-controlling interest | (5,196) | | | (6,740) | | | (15,208) | | | (13,395) | |

| Net (loss) available for basic common shares | $ | (13,502) | | | $ | (14,486) | | | $ | (38,054) | | | $ | (30,701) | |

| Weighted-average shares of Class A common stock outstanding - basic and diluted | 46,229,672 | | | 42,210,186 | | | 45,095,417 | | | 41,592,783 | |

| (Loss) per share of Class A common stock - basic and diluted | $ | (0.29) | | | $ | (0.34) | | | $ | (0.84) | | | $ | (0.74) | |

Potentially dilutive shares, which are based on the weighted-average shares of underlying unvested QLH restricted Class B-1 units, restricted Class A shares, restricted stock units, and PRSUs using the treasury stock method and the outstanding QLH restricted Class B-1 units using the if-converted method, are included when calculating diluted net loss per share attributable to MediaAlpha, Inc. when their effect is dilutive. The effects of the Company’s potentially dilutive securities were not included in the calculation of diluted loss per share as the effect would be anti-dilutive. The following table summarizes the shares and units with a potentially dilutive impact:

| | | | | | | | | | | |

| As of |

| September 30, 2023 | | September 30, 2022 |

| QLH Class B-1 Units | 18,155,446 | | | 19,206,446 | |

| Restricted Class A Shares | 52,573 | | | 261,558 | |

| Restricted stock units | 4,342,036 | | | 5,688,174 | |

| | | |

| Potential dilutive shares | 22,550,055 | | | 25,156,178 | |

The outstanding PRSUs were not included in the potentially dilutive securities as of September 30, 2023 as the performance conditions have not been met.

13. Non-Controlling Interest