McEwen Mining: Q4 Preview

December 12 2023 - 6:51PM

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to report consolidated production in the October-November

period has increased to 29,600 gold equivalent ounces

(“GEOs”)(1), a significant improvement over the first nine months

of the year. In November, Gold Bar production increased to 7,800

gold ounces. As a result of the strong performance at Gold Bar,

partially offset by slightly lower production at Fox and San José,

our forecast for the full year 2023 is now estimated at 154,200

GEOs (see Table 1).

“Gold Bar has picked up the pace in the

fourth quarter due to higher ore crushing rates combined with an

expansion of the heap leach pad, which resulted in a large gold

inventory on the heap leach pad starting to produce in October.

Monthly production is projected to remain strong in December and

into Q1 2024. The additional production from Gold Bar, combined

with the announced flow-through equity financing for Fox

exploration and development, puts us in a good financial position

to enter 2024. Our focus is on driving continued operational

improvements and growth projects across the organization,”

commented Rob McEwen, Chairman and Chief Owner.

Table 1: Consolidated Production

Summary

|

|

October2023 |

November2023 |

YTD 2023 (11 months) |

Full Year 2023 Forecast(3) |

2023Guidance |

|

Consolidated Production |

|

|

|

|

| Gold (oz) |

10,900 |

14,300 |

112,000 |

128,100 |

123,000-139,000 |

| Silver (oz) |

192,900 |

205,400 |

1,930,000 |

2,183,000 |

2.3M-2.6M |

|

GEOs(1) |

13,100 |

16,800 |

135,300 |

154,200 |

150,000-170,000 |

|

Gold Bar Mine, Nevada |

|

|

|

|

|

GEOs |

3,600 |

7,800 |

35,300 |

41,800 |

42,000-48,000 |

|

Fox Complex, Canada |

|

|

|

|

|

GEOs |

3,600 |

2,800 |

40,600 |

45,100 |

42,000-48,000 |

|

San José Mine, Argentina (49%)(2) |

|

|

|

|

| Gold Production |

3,700 |

3,700 |

35,300 |

39,200 |

39,000-43,000 |

| Silver Production |

192,900 |

205,400 |

1,930,000 |

2,183,000 |

2.3M-2.6M |

|

GEOs |

5,900 |

6,200 |

58,600 |

65,300 |

66,000-74,000 |

|

Notes: |

|

(1) |

|

'Gold Equivalent Ounces' are calculated based on a gold-to-silver

price ratio of 82:1 for Q1 2023, 82:1 for Q2, 2023, 81:1 for Q3

2023, 86:1 for October 2023 and 85:1 for November 2023. 2023

production guidance is calculated based on an 85:1 gold-to-silver

price ratio. |

| (2) |

|

The San José Mine is 49% owned by McEwen Mining Inc. and 51% owned

and operated by Hochschild Mining plc. Production is shown on a 49%

basis. |

| (3) |

|

El Gallo Mine (on care and

maintenance) is expected to recover 2,000 gold oz in 2023 from

plant and pond cleanout. |

| |

|

|

McEwen Copper

Eighteen drill rigs are currently on site at Los

Azules and over 18,000 meters of drilling have already been

completed, representing more than one-third of the planned meters

for this season’s campaign.

Recently, key management and directors from

McEwen Mining and McEwen Copper visited the project to review the

progress made towards delivery of the feasibility study for the

future Los Azules Mine (see Inset Photo). Michael Meding, Vice

President and General Manager of McEwen Copper, commented:

“We are very pleased with the progress at Los Azules since

2021, when McEwen Copper was created to drive forward the

development of one of the world’s largest undeveloped copper

projects. Our vision is to develop Los Azules as a model for the

future of mining.”

Technical

InformationThe technical content of this news release

related to financial results, mining and development projects has

been reviewed and approved by William (Bill) Shaver, P.Eng., COO of

McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and

the Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

Reliability of

Information Regarding San JoséMinera Santa Cruz S.A., the

owner of the San José Mine, is responsible for and has supplied the

Company with all reported results from the San José Mine. McEwen

Mining’s joint venture partner, a subsidiary of Hochschild Mining

plc, and its affiliates other than MSC do not accept responsibility

for the use of project data or the adequacy or accuracy of this

release.

CAUTION

CONCERNING FORWARD-LOOKING STATEMENTSThis news release

contains certain forward-looking statements and information,

including "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements and information expressed, as at the

date of this news release, McEwen Mining Inc.'s (the "Company")

estimates, forecasts, projections, expectations or beliefs as to

future events and results. Forward-looking statements and

information are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management, are

inherently subject to significant business, economic and

competitive uncertainties, risks and contingencies, and there can

be no assurance that such statements and information will prove to

be accurate. Therefore, actual results and future events could

differ materially from those anticipated in such statements and

information. Risks and uncertainties that could cause results or

future events to differ materially from current expectations

expressed or implied by the forward-looking statements and

information include, but are not limited to, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have

not reviewed and do not accept responsibility for the adequacy or

accuracy of the contents of this news release, which has been

prepared by management of McEwen Mining Inc.

ABOUT MCEWEN

MINING

McEwen Mining is a

gold and silver producer with operations in Nevada, Canada, Mexico

and Argentina. In addition, it owns approximately 47.7% of McEwen

Copper which owns the large, advanced stage Los Azules copper

project in Argentina. The Company’s goal is to improve the

productivity and life of its assets with the objective of

increasing its share price and providing a yield. Its Chairman and

Chief Owner has personally provided the company with $220 million

and takes an annual salary of $1.

| WEB

SITEwww.mcewenmining.com CONTACT

INFORMATION150 King Street West Suite 2800, PO Box

24 Toronto, ON, Canada M5H 1J9 Relationship with

Investors: (866)-441-0690 Toll

free (647)-258-0395 Mihaela

Iancu ext. 320 info@mcewenmining.com |

SOCIAL

MEDIA |

|

| |

McEwen Mining |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewenmininglinkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmininginstagram.com/mcewenmining |

| |

| |

McEwen Copper |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/

mcewencopperlinkedin.com/company/mcewencoppertwitter.com/mcewencopperinstagram.com/mcewencopper |

| |

| |

Rob

McEwen |

|

Facebook:LinkedIn:Twitter: |

facebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24twitter.com/robmcewenmux |

A photo accompanying this announcement is available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/474ae1b0-d182-4aa0-a406-55abbe84663f

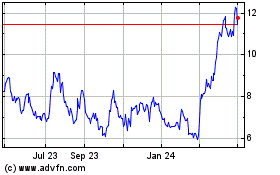

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Oct 2024 to Nov 2024

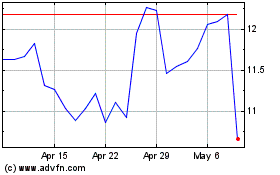

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2023 to Nov 2024