Strong growth for the Pierre & Vacances

- Center Parcs Group brands

- With an 11.8% increase in the tourism businesses in Q2

2023/2024, the Pierre & Vacances-Center Parcs Group stepped up

its growth, posting an almost 9% rise in first half

revenue1 relative to H1 2022/2023, across all brands.

- The Group expects full-year revenue growth in line with its

targets and is confident in a sharp increase in operating

profitability, driven especially by strict execution of the

Reinvention plan.

Regulatory News:

Pierre & Vacances-Center Parcs Group (Paris:VAC):

Franck Gervais, CEO of Pierre & Vacances - Center Parcs,

stated:

“In H1 2023/2024, the Pierre & Vacances - Center Parcs Group

continued to grow, posting an almost 9% increase in revenue from

the tourism businesses. This performance validates the quality of

the value proposition of each of our brands and the relevance of

their strategies. It also rewards the work of our teams, who are

committed on a daily basis to providing close support to our guests

and confirms our ability to accelerate growth in our operating

profitability over the year as a whole.”

1] Revenue

Under IFRS accounting, revenue for the first half of

2023/2024 totalled €778.6 million, compared with €741.8m in H1

2022/2023.

The Group comments on its revenue and the associated financial

indicators in compliance with its operational reporting, which is

more representative of its business, i.e. (i) with the presentation

of joint undertakings in proportional consolidation, and (ii)

excluding the impact of IFRS16 application. A reconciliation table

presenting revenue stemming from operational reporting and revenue

under IFRS accounting is presented at the end of the press

release.

Revenue is also presented according to the following operational

sectors defined in compliance with the IFRS 8 standard2, i.e.:

- Center Parcs covering both operation

of the domains marketed under the Center Parcs, Sunparks and

Villages Nature brands, and the building/renovation activities for

tourism assets and property marketing in the Netherlands, Germany

and Belgium;

- Pierre & Vacances covering the

tourism businesses operated in France and Spain under the Pierre

& Vacances brand, the property development business in Spain

and the Asset Management business line (responsible notably for

relations with individual and institutional lessors);

- maeva.com (included in the Pierre

& Vacances3 operating sector until 30 September 2023), a

distribution and services platform, operating the maeva.com,

Campings maeva, maeva Home and La France du Nord au Sud brands on

the French market and the Vacansoleil brand on European

markets.

- Adagio, covering operation of the

city residences leased by the Pierre & Vacances-Center Parcs

Group and entrusted to the Adagio SAS joint venture under

management mandates, as well as operation of the sites directly

leased by the joint venture;

- an operational sector covering the Major

Projects business line responsible for construction and

development of new assets on behalf of the Group in France, and

Senioriales, the subsidiary specialised in property

development and operation of non-medicalised residences for

independent elderly people;

- the Corporate operational segment

housing primarily the holding company activities.

Q2

H1

€m

23/24

22/23

Chg.

23/24

22/23

Chg.

Center Parcs

239.9

233.0

+3.0%

494.9

494.9

+0.0%

of which: Revenue from tourism

businesses

229.7

202.4

+13.5%

479.0

436.7

+9.7%

o/w accommodation revenue

175.9

155.5

+13.1%

372.2

340.5

+9.3%

P&V

108.7

99.0*

+9.8%

158.8

148.1*

+7.2%

of which: Revenue from tourism

businesses

108.7

99.0

+9.8%

158.8

148.1

+7.2%

o/w accommodation revenue

92.7

82.6

+12.2%

130.5

119.9

+8.8%

Adagio

46.8

43.9

+6.7%

105.8

99.2

+6.6%

of which: Revenue from tourism

businesses

46.8

43.9

+6.7%

105.8

99.2

+6.6%

o/w accommodation revenue

41.6

39.6

+5.0%

94.7

89.6

+5.7%

maeva.com:

18.5

15.8

+16.9%

23.9

20.7

+15.3%

of which: Revenue from tourism

businesses

18.5

15.8

+16.9%

23.9

20.7

+15.3%

Major Projects & Seniorales

13.8

25.8

-46.6%

38.2

44.9

-14.9%

Corporate

0.2

0.6

-61.6%

0.6

1.0

-38.8%

Total

428.0

418.1

+2.4%

822.2

808.8

+1.7%

Revenue from tourism businesses

403.8

361.1

+11.8%

767.5

704.7

+8.9%

Accommodation revenue

310.2

277.7

+11.7%

597.4

550.1

+8.6%

Supplementary income

93.6

83.4

+12.2%

170.2

154.7

+10.0%

Other revenue

24.2

57.0

-57.5%

54.7

104.1

-47.4%

*restated for the externalization of the maeva.com operating

segment

Revenue from the tourism

businesses

During Q2 2023/2024, the Group accelerated growth in its

business with a revenue increase of 11.8% (+5.9% in Q1), bringing

revenue from the tourism businesses to €767.5 million for the first

half as a whole (+8.9%).

Accommodation revenue

Accommodation revenue totalled €597.4 million during the

first half of 2023/2024, up 8.6% relative to the year-earlier

period.

Growth in revenue was driven by the rise in average letting

rates (+5.7%) and the number of nights sold (+2.7%).

The occupancy rate was up by 0.8 points to 70.1% over the period

(vs. 69.3% in H1 2022/2023). RevPar4 was up 7.2% compared with H1

2022/2023.

All brands contributed to the increase in revenue:

- Center Parcs: +9.3%

Growth was driven by the Domains in the BNG5 region and was

boosted by a rise in average letting rates (+7.5%) thanks to the

premiumisation strategy and park renovation works, and by a rise in

the number of nights sold (+1.6%).

Business at the French Domains was penalised by the partial

unavailability of cottages at Domaine des Hauts de Bruyères and

Domaine des Bois Francs, which were being renovated during the

first half.

The occupancy rate was down by 0.8 points to 71.2% over the

period.

RevPar was up 6.4%.

- Pierre & Vacances: +8.8%

Revenue at the brand was higher in both France and Spain.

- Revenue from the residences in

France increased by 5.7%, despite a reduction6 in the stock

operated by lease (-5.4% of nights offered relative to H1 of the

previous period). On a constant stock basis, revenue was up (RevPar

up 11.7%). Average letting rates were up 2.8% and the occupancy

rate up 5.1 points to 71.2%.

- Revenue from the residences in Spain

was up sharply (+41.4%), driven by both average letting rates

(+7.1%) and a higher occupancy rate (+10.8 points). RevPar was up

+33.0%.

All destinations combined, the P&V brand recorded

growth in the occupancy rate of 6.2 points to 67.4%.

Average letting rates were stable over H1 (-0.3%), due in

particular to a less favourable mix effect (high growth in revenue

from seaside destinations (+15.1%), with lower average prices than

mountain sites).

RevPar was up 11.4%.

- Adagio: +5.7%

Aparthotel revenue rose by 5.7% in the first half, driven by a

6.5% increase in average letting rates. The occupancy rate fell by

2.6 points to 70.8% (significant base effect with an occupancy rate

up 8 points in the first half of 2022/2023 following the rebound in

post-Covid activity).

RevPar was up +3.0%.

Supplementary income7:

H1 supplementary income totalled €170.2 million, up 10.0%

relative to H1 of the previous year, driven by higher onsite

sales (+13.0%) reflecting our strategy to enrich the offer as well

as growth in the maeva.com management and distribution business

(+15.3% over the half-year period).

Other revenue:

H1 2023/2024 revenue from other businesses totalled €54.7

million compared with €104.1 million in H1 2022/2023 (decline with

no significant impact on EBITDA), primarily made up of:

- Renovation operations at Center Parcs

domains on behalf of owner-lessors, for €15.9 million (compared

with €58.2 million in H1 2022/2023).

- Les Senioriales for €20.8 million (vs.

€33.3 million in H1 2022/2023);

- the Major Projects business line: €17.4

million (of which €15.7 million related to the extension of the

Villages Nature Paris domain (vs. €11.6 million in H1

2022/2023).

2] Change in operational KPIs

RevPar

Average letting rates

(by night, for accommodation)

Number of nights sold

Occupancy rate

€ (excl. tax)

Chg. % N-1

€ (excl. tax)

Chg. % N-1

Units

Chg. % N-1

Chg. Pts N-1

Chg. Pts N-1

Center Parcs

112.6

+10.7%

157.7

+9.2%

1,115 695

+3.6%

71.4%

+0.9 pt

Pierre & Vacances

101.5

+11.8%

159.5

-0.3%

581,247

+12.6%

72.1%

+6.8 pts

Adagio

64.4

+3.3%

96.4

+5.6%

431,103

-0.6%

67.3%

-1.7 pts

Total Q2 2023/2024 revenue

99.4

+10.0%

145.8

+6.4%

2,128 045

+5.0%

70.8%

+2.1 pts

Center Parcs

117.8

+6.4%

165.5

+7.5%

2,248 981

+1.6%

71.2%

-0.8 pt

Pierre & Vacances

80.1

+11.4%

134.9

-0.3%

966,911

+9.1%

67.4%

+6.2 pts

Adagio

72.6

+3.0%

103.3

+6.5%

917,263

-0.8%

70.8%

-2.6 pts

Total H1 2023/2024 revenue

98.0

+7.2%

144.5

+5.7%

4,133 155

+2.7%

70.1%

+0.8 pt

3] Main events during H1 2023/2024

On 28 December 2023, the Group completed the disposal of its

businesses operated by lease for 29 Senioriales residences to the

ACAPACE Group, shareholder of the brands Jardins d’Arcadie

(residences for the elderly) and Sandaya (open-air hotels).

ACAPACE's takeover of this perimeter is effective from January 1,

2024.

4] Outlook

The Group expects full-year revenue growth in line with its

targets and is confident in a sharp increase in operating

profitability, driven especially by strict execution of the

Reinvention plan.

5] Financial calendar

First half earnings for 2023/2024 will be published on 29 May

2024 after the market close. They will be discussed at a Capital

Markets Day on 30 May 2024. The Group will also announce its

updated financial targets at this event.

6] Reconciliation table between revenue

stemming from operational reporting and revenue under IFRS

accounting.

Under IFRS accounting, revenue for the first half of 2023/2024

totalled €778.6 million, compared with €741.8m in H1 2022/2023,

representing growth of 4.6% driven by the tourism businesses.

Growth in revenue was driven by both the rise in average letting

rates and the number of nights sold.

€ millions

2023/2024

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2023/2024

IFRS

Center Parcs

494.9

-

-5.6

489.3

Pierre & Vacances

158.8

-

-

158.8

Adagio

105.8

-25.5

-

80.3

maeva.com

23.9

-

-

23.9

Major Projects & Seniorales

38.2

-7.0

-5.5

25.6

Corporate

0.6

-

-

0.6

Total H1 2023/2024 revenue

822.2

-32.5

-11.2

778.6

€ millions

2022/2023

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2022/2023

IFRS

Center Parcs

494.9

-6.4

-25.2

463.3

Pierre & Vacances

148.1

148.1

Adagio

99.2

-23.5

75.8

maeva.com

20.7

20.7

Major Projects & Seniorales

44.9

-11.6

-0.4

32.9

Corporate

1.0

1.0

Total H1 2022/2023 revenue

808.8

-41.4

-25.6

741.8

IFRS11 adjustments: for its operating reporting, the

Group continues to integrate joint operations under the

proportional integration method, considering that this presentation

is a better reflection of its performance. In contrast, joint

ventures are consolidated under equity associates in the

consolidated IFRS accounts.

Impact of IFRS16: The application of IFRS16 as of 1

October 2019 leads to the cancellation, in the financial

statements, of a share of revenue and the capital gain for

disposals undertaken under the framework of property operations

with third-parties (given the Group’s leasing contracts). See below

for the impact on H1 revenue.

1according to operational reporting 2 See page 186 of the

Universal Registration Document, filed with the AMF on 22 December

2022 and available on the Group’s website: www.groupepvcp.com 3 The

Group has externalized the maeva.com operating segment in order to

improve the readability of the performance of this business line,

and has consequently restated the historical comparative

information presented in this press release. 4 RevPar

=accommodation revenue divided by the number of nights offered 5

Belgium, the Netherlands, Germany 6 Reduction in stocks related to

non renewal of leases 7 Revenue from onsite activities (catering,

animation, stores, services etc.), co-ownership and multi-owner

fees and management mandates, marketing margins and revenue

generated by the maeva.com business line.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423750679/en/

For further information: Investor Relations and

Strategic Operations Emeline Lauté : +33 (0) 1 58 21 54 76

info.fin@groupepvcp.com

Press Relations Valérie Lauthier : +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

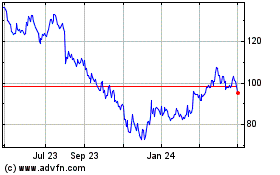

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

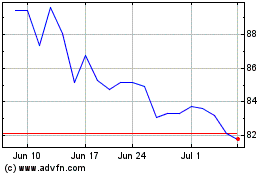

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Dec 2023 to Dec 2024