Mr.

Eugene W. Landy

December

1, 2020

|

|

|

Priority

|

|

e.

|

A description of any material disputes, oral or written, with franchisors, managers, vendors, joint venture partners or similar entities.

|

1

|

|

f.

|

Descriptions of material liens, charges, security interests, pledges, covenants, agreements, restrictions and encumbrances.

|

1

|

|

g.

|

All material reports to, and filings and agreements with, any governmental agency or self-regulatory agency.

|

1

|

|

IX. INSURANCE

|

|

a.

|

With respect to the Company, a schedule of current insurance arrangements summarizing all policies, including, but not limited to:

|

1

|

|

|

(i) Title insurance

|

|

|

|

(ii) Property insurance

|

|

|

|

(iii) Corporate liability insurance

|

|

|

|

(iv) Directors and officers liability insurance

|

|

|

|

(v) Stop-loss, catastrophic and similar insurance

|

|

|

|

(vi) Terrorism insurance

|

|

|

|

(vii) Other forms of insurance

|

|

|

b.

|

With respect to the Company, claims history received from insurer or third party administrator, including an indication of the status of such claims and any disputes.

|

3

|

|

X. REPORTS AND STUDIES

|

|

a.

|

Financial, operating and business plans for the next three years, including projected income statements, cash flows, and balance sheets, with assumptions.

|

1

|

|

b.

|

Management presentations and reports, including presentations and reports discussing business outlook and prospects and property operating/strategic plans.

|

1

|

|

c.

|

All market research and industry studies conducted, including any internal or outside consultant studies.

|

1

|

|

XI. MATERIAL TRANSACTIONS (ACQUISITIONS / DIVESTITURES, JVs, ETC.)

|

|

a.

|

Documentation relating to material acquisitions, divestitures, mergers, consolidations or similar transactions involving the Company, including pending or contemplated transactions.

|

1

|

|

b.

|

Any correspondence relating to any post-closing disputes, indemnification claims or purchase price adjustments involving the Company.

|

1

|

|

c.

|

Schedule setting forth the timing, nature and amount of any deferred consideration or earn-outs (whether or not contingent) involving the Company.

|

1

|

|

d.

|

List and provide copies of all partnership or joint venture agreements

involving the Company. Please include in such list a description of the ownership, voting rights, other contractual arrangements and the involvement

or interest of the Company, and any shareholder, member, partner, trustee, manager, general partner or officer thereof.

|

1

|

Mr.

Eugene W. Landy

December

1, 2020

|

|

|

Priority

|

|

e.

|

Any non-competition or similar agreements involving the Company, including any agreements, contracts or commitments restricting the Company from engaging in any line of business.

|

1

|

|

XII.

OTHER MATERIAL CONTRACTS AND REQUIRED CONSENTS

|

|

a.

|

Schedule of all notifications required to be given to, or consents required from, any third party (including any governmental agency or instrumentality) required for the Transaction.

|

1

|

|

XIII. TAX

MATTERS

|

|

a.

|

Please confirm that (x) there have been no mergers or consolidations involving the Company (or any of its subsidiaries) and C corporations and (y) the Company has not succeeded to any C corporation earnings and profits in connection with any non-taxable merger or similar transaction involving any other entity other than a C corporation. If any such mergers or consolidations have taken place, please provide information regarding (a) the date of such transaction(s), (b) the amount of C corporation earnings and profits and how such amount was determined, and (c) the mechanisms by which such C corporation earnings and profits were timely purged from the Company.

|

1

|

|

b.

|

To the extent that the Company directly or indirectly holds any asset the disposition of which would be subject to (or to rules similar to) section 1374 of the Code (or otherwise result in any “built-in gains” Tax under section 337(d) of the Code and the applicable Treasury Regulations thereunder), please provide detailed information regarding such asset including:

|

1

|

|

|

(i) the date such asset was acquired;

|

|

|

|

(ii) the manner in which such asset was acquired;

|

|

|

|

(iii) the built-in gain on each such asset as of the date of its acquisition by the Company, including the adjusted tax basis and fair market value of the asset on the relevant acquisition date; and

|

|

|

|

(iv) information regarding whether any such built-in gains tax has been recognized to date.

|

|

|

c.

|

Please describe any stock or other equity investments held or acquired by the Company, other than the stock of publicly offered REITs, QRSs or TRSs.

|

1

|

|

d.

|

Please provide the Company’s tax compliance schedules showing:

|

2

|

|

|

(i) compliance with the asset tests for each quarter of the Company’s 2012-2019 taxable years;

|

|

|

|

(ii) compliance with the gross income tests for the Company’s 2012-2019 taxable years; and

|

|

Mr.

Eugene W. Landy

December

1, 2020

|

|

|

Priority

|

|

|

(iii) compliance

with the distribution tests for the Company’s 2012-2019 taxable years.

|

|

|

e.

|

Please provide copies of the federal and state income tax returns for each of the Company and any of its subsidiaries filing tax returns for their 2012-2019 taxable years.

|

2

|

|

f.

|

To the extent not already provided, please provide copies of any tax elections made by the Company or any of its subsidiaries since inception, including, without limitation, TRS elections and Section 754 elections.

|

2

|

|

g.

|

Please provide current tax basis balance sheets showing the Company’s assets and liabilities (whether owned directly or through lower-tier entities).

|

2

|

|

h.

|

Please provide materials showing the Company’s compliance with the 5/50 test for the 2012-2019 taxable years.

|

2

|

|

i.

|

Please provide copies of any analyses, memoranda (including, without limitation, FIN 48 memos, tax memos provided to auditors or tax memos or analysis from outside tax advisors), opinions (including accompanying officer’s certificates) or correspondence (including substantive emails) regarding any tax issue of the Company or any of its subsidiaries, including, but not limited to, the Company’s qualification as a REIT.

|

2

|

|

j.

|

If the Company has completed property services questionnaires, please provide copies of all questionnaires completed since October 1, 2012. In the absence of such questionnaires, please provide a narrative description of any services provided.

|

2

|

|

k.

|

Please confirm that the Company sent shareholder demand letters for each of its 2012-2019 taxable years and provide copies of any responses received.

|

2

|

|

l.

|

Please describe any instances in which the Company has relied upon “REIT savings” clauses to cure any REIT qualification violations.

|

2

|

|

m.

|

Please provide copies of any private letter ruling requests or presubmission memoranda submitted to the IRS and any private letter rulings received from the IRS by the Company or any of its subsidiaries. Please also provide copies of any requests for closing agreements submitted to the IRS and any closing agreements entered into with the IRS.

|

2

|

|

n.

|

Please provide descriptions of any tax shelters or aggressive tax planning techniques entered into or utilized by the Company or any of its subsidiaries, along with any filings with the IRS (or any state taxing authority) with respect to any “reportable transaction” (or state equivalent).

|

2

|

|

o.

|

Please either confirm that there is no pending audit of the Company or any of its subsidiaries, or describe any such audit. Also confirm that none of the Company or any of its subsidiaries has waived or extended the statute of limitations with respect to any open tax year.

|

2

|

|

p.

|

Please describe any loan held by the Company or any of its non-TRS

subsidiaries (including the acquisition of an interest in a loan), where the Company or the non-TRS subsidiary, as applicable, is

the lender, that has not been fully secured by real property during the term of the loan

or any equity securities (other than equity securities of a TRS, QRS, or any entity taxed as a partnership for federal income tax purposes)

acquired by the Company or any of its non-TRS subsidiaries.

|

3

|

Mr.

Eugene W. Landy

December

1, 2020

|

|

|

Priority

|

|

q.

|

Please list any related party tenants of the Company and the amount of rent received from, or anticipated to be received from, such tenants in 2012- 2019 and 2020, as applicable.

|

3

|

|

r.

|

Please describe any situations in which the Company derives income from independent contractors that perform services at the related property, including, but not limited to, rental income from any such independent contractors.

|

3

|

|

s.

|

Please provide a schedule listing any properties of the Company or any of its subsidiaries with respect to which the fair market value of the personal property exceeds 15% of the aggregate fair market value of the real and personal property.

|

3

|

|

t.

|

Please provide a list of any sales of properties via taxable transactions by the Company since October 1, 2012. For each such property sold, please list the dates on which it was acquired and sold, the amount of tax gain or loss on the disposition, the reason(s) for the disposition, and confirm that the aggregate expenditures made during the two years preceding the sale and includable in the property’s basis did not exceed 30% of the net sales price of the property. Please also provide any opinions (or other memoranda or analyses) addressing why such dispositions do not constitute prohibited transactions.

|

3

|

|

u.

|

Please describe any hedging transactions entered into by the Company or any of its non-TRS subsidiaries. To the extent the applicable company has treated those transactions as qualifying liability hedges under section 856(c)(5)(G) of the Code, please provide copies of the documentation showing that those transactions were clearly and timely identified as hedging transactions in accordance with section 1221(a)(7) of the Code and Treasury Regulations section 1.1221-2.

|

3

|

Mr.

Eugene W. Landy

December

1, 2020

Appendix

III

PRIVATE

& CONFIDENTIAL

Monmouth

Real Estate Investment Corporation

101

Crawfords Corner Road

Suite

1405

Holmdel,

New Jersey 07733

Attention:

Eugene W. Landy, Chairman of the Board and Executive Director

Re:

Exclusivity Agreement

Dear

Mr. Landy:

This

letter agreement (this “Agreement”) sets forth our understanding with respect to certain matters relating to

our negotiations regarding a potential transaction (a “Potential Transaction”) between Monmouth Real Estate

Investment Corporation, a Maryland corporation (the “Company”), and Blackwells Capital LLC (“Blackwells”).

The Company and Blackwells are referred to individually herein as a “Party,” and collectively herein as the

“Parties.”

In

order to induce Blackwells to devote additional time and resources in consideration of a Potential Transaction and in consideration therefor,

from the date of this Agreement until the earlier of (i) the execution of a definitive agreement involving a Potential Transaction by

the Parties and (ii) and 11:59 p.m. Eastern Time on February 5th 2021 (the “Exclusivity Period”), the Company

agrees that it shall negotiate exclusively with Blackwells with respect to a Potential Transaction, and the Company shall not, and it

shall cause its Representatives (as defined below) not to, directly or indirectly (i) initiate, solicit, encourage or assist any inquiries

or the making of any proposal or offer concerning an Alternative Transaction (as defined below), including by way of furnishing or otherwise

making available any non-public information or data concerning the Company or any assets owned (in whole or in part) by the Company or

by providing or permitting access to any of the properties of the Company; (ii) engage in, continue or otherwise participate in any discussions,

communications or negotiations with any person concerning an Alternative Transaction or that could reasonably be expected to lead to

an Alternative Transaction; (iii) enter into any agreement or agreement in principle (in each case, whether written or oral) with any

person concerning an Alternative Transaction or that could reasonably be expected to lead to an Alternative Transaction; (iv) grant any

waiver, amendment or release under any standstill or confidentiality agreement concerning an Alternative Transaction or that could reasonably

be expected to lead to an Alternative Transaction; or (v) otherwise facilitate any effort or attempt by any person to make a proposal

or offer concerning an Alternative Transaction or that could reasonably be expected to lead to an Alternative Transaction.

Mr.

Eugene W. Landy

December

1, 2020

As

used in this Agreement, the term (i) “Representatives” means, with respect to a Party, such Party’s stockholders,

affiliates, directors, officers, employees, agents, investment bankers, attorneys, accountants, consultants, advisors and other representatives,

and (ii) “Alternative Transaction”

means, other than any transaction solely with Blackwells, any transaction, or any solicitation, inquiry, offer or proposal concerning

a transaction, to, directly or indirectly (a) purchase or otherwise acquire 5% or more of the outstanding shares of any class of equity

securities or debt securities of the Company or its subsidiaries or any interests therein, (b) effect any merger, share exchange, tender

offer, business combination, consolidation, joint venture, restructuring, reorganization, recapitalization, spin-off, split-off or other

alternative transaction involving any capital stock, businesses or assets of the Company, or (c) transfer, sell or lease 5% or more of

the assets and properties of the Company or interests therein. The Company shall be responsible for any breach of the terms of this Agreement

by any of its Representatives.

Upon

the execution of this Agreement, the Company shall, and shall cause its Representatives to, immediately cease any discussions, communications

or negotiations with, or any solicitation, encouragement or assistance of, any person and terminate access to any virtual or electronic

data room provided to any person, in each case that may be ongoing with respect to an Alternative Transaction or that could reasonably

be expected to lead to an Alternative Transaction. In the event that the Company receives an unsolicited inquiry, offer or proposal with

respect to an Alternative Transaction during the Exclusivity Period, or obtains information that such an inquiry, offer or proposal is

likely to be made, the Company will provide Blackwells with immediate notice thereof, which notice shall include the terms of, and the

identity of the person or persons making, such inquiry, offer or proposal.

The

Parties acknowledge that the execution and delivery of this Agreement does not create any legally binding obligations between the Parties

relating to the Potential Transaction except those specifically set forth herein. Each Party acknowledges and agrees that this Agreement

expresses the Parties’ interests in continuing discussions regarding the Potential Transaction and is not intended to, and does

not, create any legally binding obligation on either Party to consummate the Potential Transaction. Such an obligation will arise only

upon the execution and delivery of final definitive agreements relating to the Potential Transaction.

The

existence of this Agreement, the terms hereof and any communications regarding it constitute confidential information to be treated by

the Parties in accordance with the terms of the Confidentiality Agreement, dated as of [ ],

2020 by and between the Parties.

The

Parties acknowledge that a breach of this Agreement would cause irreparable harm for which monetary damages would be an inadequate remedy.

Accordingly, each Party agrees that the other Party shall be entitled to seek equitable relief in the event of any breach or threatened

breach of this Agreement, including injunctive relief against any breach hereof and specific performance of any provision hereof, in

addition to any other remedy to which such other Party may be entitled. The Parties further agree that no Party shall be required to

obtain, furnish or post any bond or similar instrument in connection with or as a condition to obtaining any remedy referred to in this

paragraph, and each Party waives any objection to the imposition of such relief or any right it may have to require the obtaining, furnishing

or posting of any such bond or similar instrument.

Mr.

Eugene W. Landy

December

1, 2020

This

Agreement shall be governed by and construed in accordance with the internal laws of the State of Maryland without giving effect to

any choice or conflict of law provision or rule (whether of the State of Maryland or any other jurisdiction) that would cause

the application of laws of any jurisdiction other than those of the State of Maryland. With respect to any action or proceeding

between the parties arising out of or relating to this Agreement, each party: (a) irrevocably and unconditionally consents and

submits to the exclusive jurisdiction and venue of the Circuit Court of Baltimore City of the State of Maryland or, to the extent

such court does not have subject matter jurisdiction, the United States District Court for the State of Maryland, (b) agrees that

all claims in respect of such action or proceeding shall be heard and determined exclusively in accordance with the preceding clause

(a), (c) waives any objection to laying venue in any such action or proceeding in such courts, and (d) waives any objection that

such courts are an inconvenient forum or do not have jurisdiction over any party. Each party irrevocably waives any and all rights

to trial by jury in any action or proceeding between the parties arising out of or relating to this Agreement.

In

the event that any of the provisions of this Agreement shall be held by a court or other tribunal of competent jurisdiction to be invalid

or unenforceable, the remaining portions hereof shall remain in full force and effect and such provision shall be enforced to the maximum

extent possible so as to effect the intent of the Parties, and shall in no way be affected, impaired, or invalidated.

Please

confirm your agreement with the foregoing by signing and returning one copy of this Agreement to the undersigned, whereupon this Agreement

shall become a binding agreement between the Company and Blackwells.

|

|

Very truly yours,

|

|

|

|

|

|

Blackwells Capital LLC

|

|

|

|

|

|

|

By:

|

|

|

|

Name:

|

Jason Aintabi

|

|

|

Title:

|

Chief Investment Officer

|

|

ACCEPTED AND AGREED:

|

|

|

|

|

|

Monmouth Real Estate Investment

|

|

|

Corporation

|

|

|

|

|

|

|

By:

|

|

|

|

Name:

|

Eugene W. Landy

|

|

|

Title:

|

Chairman of the Board and Executive

|

|

|

|

Director

|

|

Monmouth

Real Estate Investment Corporation

BELL WORKS

101 CRAWFORDS CORNER ROAD

SUITE 1405

HOLMDEL, NEW JERSEY 07733

A Public REIT Since 1968

|

INTERNET:

|

|

(732) 577-9996

|

|

EMAIL:

|

|

www.mreic.reit

|

|

FAX: (732) 577-9981

|

|

mreic@mreic.com

|

December 10, 2020

VIA E-MAIL AND OVERNIGHT DELIVERY

Blackwells Capital

800 Third Avenue, 39th Floor

New York, NY 10022

Attn: Jason Aintabi

Dear Mr. Aintabi:

I

received your letter dated December 1, 2020, provided a copy of it to the Board of Directors of Monmouth Real Estate Investment

Corporation and the Board has considered your offer contained in the letter. Thank you for your interest in Monmouth, and we are glad

to hear that one of our shareholders shares our confidence in Monmouth’s long-term business plans. After discussion of your offer and

other matters relevant to the Board’s determination, the Board of Directors has determined that pursuing a sale of the Company at this

time would not be in the best interest of the Company.

|

|

Very truly yours,

|

|

|

|

|

|

/s/ Eugene W. Landy

|

|

|

Eugene W. Landy

|

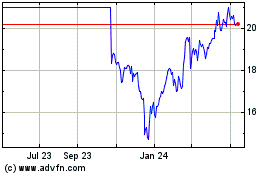

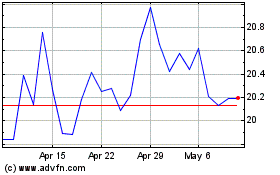

Blackwells Offers to Acquire Monmouth Real Estate

Investment Corporation

Makes All-Cash Offer to Acquire Company for

$18.00 per Share

Offer Represents 21.6% Premium to Unaffected

Share Price as of December 1, 2020,

and 24.8% Premium Over 6-Month VWAP

Calls on Board to Form Independent Special Committee

to Evaluate Offer

NEW YORK, Dec. 21, 2020 (GLOBE NEWSWIRE) —

Blackwells Capital LLC (together with its affiliates “Blackwells”), an alternative investment management firm that is one

of the largest owners of Monmouth Real Estate Investment Corporation (NYSE: MNR) (“Monmouth” or the “Company”),

announced today that on December 18, 2020, it submitted an offer letter to the Company’s Board of Directors (the “Board”)

outlining an all-cash offer to acquire Monmouth for $18.00 per share.

Blackwells’ offer represents a 21.6% premium to the unaffected

share price as of December 1, 2020 (at which time Blackwells privately submitted its first all-cash offer to the Chairman of the Board,

Eugene Landy), and exceeds the unaffected three-month and six-month VWAPs by 23.8% and 24.8%, respectively. The all-cash transaction is

valued at approximately $3.8 billion, including the assumption of debt.

Jason Aintabi, Chief Investment Officer of Blackwells, said,

“As a public company, Monmouth has significantly underperformed comparable industrial REITs over the last five years, further exacerbated

by the stock’s lack of liquidity. Blackwells’ cash offer provides shareholders immediate liquidity at a 17% premium above

consensus net asset value – though the stock has long traded at a discount to it. Our offer also represents a premium to unaffected

price well above the average premium for completed REIT deals over the last five years.”

Added Aintabi, “After we privately made our first offer

on December 1, I had a constructive dialog with the Company’s CEO Michael Landy, who expressed enthusiasm and a desire to engage.

Soon thereafter, we received a puzzling follow-up letter from Michael’s father, Chairman Eugene Landy, indicating that on second

thought Monmouth would not engage with us, because exploring our offer would ‘not be in the best interests of the company.’

For myriad and tangible reasons, Monmouth in its current state, does not belong in the public markets. Pursuing our offer is the best

way to maximize value for all Monmouth shareholders.”

Blackwells believes that a Special Committee of the Board,

excluding Landy family members, Landy family affiliates, and those directors affiliated with UMH Properties, Inc., should be formed to

objectively review the new Blackwells offer.

Blackwells is now making its offer public, to ensure all Monmouth

shareholders have equal access to this information, in light of unusual trading volumes and share price dynamics since the submission

of our first offer privately to the Company.

The full text of the offer letter follows:

December 18, 2020

Mr. Eugene W. Landy

Chairman of the Board and Executive Director

Monmouth Real Estate Investment Corp.

401 Crawfords Corner

Suite 1405

Holmdel, NJ 07733

RE: Proposal for Acquisition of Monmouth

Dear Mr. Landy:

It is my pleasure on behalf of Blackwells Capital LLC (“Blackwells”

or “we”) to submit this preliminary proposal for the negotiated acquisition of Monmouth Real Estate Investment Corporation

(the “Company” or “you”) by Blackwells (the “Transaction”). Blackwells has made a substantial investment

in the common stock of the Company and is one of the Company’s largest shareholders.

Blackwells proposes to acquire 100% of the outstanding equity interests

in the Company for $18.00 per share of common stock, par value $0.01 per share, in cash, subject to the terms set forth below (the “Proposal”).

The Transaction will provide your stockholders with a substantial premium to recent trading prices of the stock and an attractive value

for their shares. Our Proposal provides stockholders with compelling value, low execution risk and a quick timeline to closing.

Blackwells is a leading global alternative asset manager, founded

in 2016 by Jason Aintabi, its Chief Investment Officer. Blackwells has an extensive background in real estate, with existing public and

private investments in similar assets to the Company. Throughout their careers, Blackwells’ principals have invested globally on

behalf of leading public and private equity firms and have held operating roles and served on the boards of media, energy, technology,

insurance and real estate enterprises.

Blackwells looks forward to working collaboratively with the

Company’s Board of Directors to finalize our Proposal. Having analyzed publicly available information about the Company comprehensively,

we believe you have an attractive portfolio of high-quality properties, demonstrated portfolio and NOI growth, and conservative expense

management. We have a tremendous amount of respect for the Company’s history, and the amount of diligent effort and foresight the

Landy family has employed in achieving the Company’s success to date.

Proposal

Value: Blackwells proposes an all-cash acquisition

of 100% of the outstanding shares of the Company for $18.00 per share of common stock, par value $0.01 per share, reflecting a 21.6% premium

to the unaffected market price of $14.80 prior to our offer and premiums to the then 52-week high ($15.53) and 52-week low ($8.42) of

15.9% and 113.8%, respectively. Notably, the proposed price exceeds the unaffected 1-month, 3-month, and 6-month VWAPs by 19.3%, 23.8%,

and 24.8%, respectively1.

Financing: We would expect to finance the Transaction

with a combination of debt and equity. Blackwells’ internal resources, as well as certain limited partner commitments, conditioned

on completion of satisfactory diligence investigations, will fund the equity portion of the Transaction. We have engaged [REDACTED] to

arrange the debt financing of the Proposal; its highly confident letter is attached as Appendix I to this letter.

Below please find our expected sources and uses to finance the Transaction:

|

($ in millions)

|

|

Sources & Uses2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Uses of Funds

|

|

|

|

$

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of Equity

|

|

|

|

|

[REDACTED]

|

|

|

|

[REDACTED]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committed Acquisitions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refinanced Debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refinanced Preferred

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Defeasance Costs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Financing Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management Change of Control

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advisory Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

$

|

3,780

|

|

|

|

100.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sources of Funds

|

|

|

|

$

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sponsor Equity

|

|

|

|

|

[REDACTED]

|

|

|

|

[REDACTED]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash from Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

$

|

3,780

|

|

|

|

100.0%

|

|

Due Diligence: The Proposal is subject to our

completion of standard confirmatory diligence. Given our industry experience and the substantial preparatory work we have done, we can

proceed expeditiously with the requisite due diligence and simultaneously negotiate a definitive agreement. Our work would include customary

property-level diligence, financial diligence, and confirmatory legal, accounting and tax reviews. We have engaged [REDACTED] as our legal

advisor in connection with the Proposal and are prepared to enter into a confidentiality agreement with you to facilitate these reviews.

Given our and our advisors’ experience with transactions of this type, we expect to be able to complete the required due diligence

and enter into definitive documentation within 45 days. A preliminary copy of our due diligence request list is attached as Appendix II

to this letter. We are eager to commence work, and our team is available immediately.

Closing Conditions: The consummation of the

Transaction will be subject to limited customary closing conditions for a public company transaction of this nature.

Exclusivity: We propose to enter into exclusive

bilateral negotiations with you and work expeditiously to sign and announce the Transaction. We would expect the Transaction to provide

for a customary “Go-Shop” period. A copy of our proposed exclusivity agreement is attached as Appendix III to this letter.

Reviews and Approvals: This letter has been reviewed

and approved by our investment committee.

Management and Founders: We are impressed with

the management team and prior to executing a definitive agreement, we would expect customary access to management to discuss their continuing

roles. We are also happy, at the appropriate time, to discuss the Landy family’s goals and desires for future involvement with the

Company, including continuing participation in the equity ownership of the Company.

This letter does not constitute a binding obligation or commitment

of either party or its affiliates to proceed with any transaction. No such obligations will be imposed on either party or its affiliates

unless and until a mutually acceptable definitive agreement is formally entered into by both parties.

We look forward to working collaboratively with the Board and its

advisors to advance our Proposal. Please contact me at your earliest convenience to discuss next steps.

Sincerely,

Appendix I

[FINANCIAL INSTITUTION ADDRESS]

12/01/2020

Blackwells Asset Management LLC

800 Third Avenue, 39th Floor

NY, NY 10022

Attention:

Mr. Jason Aintabi

Chief Investment Officer

Re: Acquisition Financing – Highly Confident Letter Ladies and

Gentlemen:

You have informed [REDACTED] (“[REDACTED]”) that

you are presently considering a transaction pursuant to which you and/or one or more of your affiliates (collectively, the “Sponsor”)

would (i) acquire (the “Acquisition”), through a newly-formed corporation (“Newco”) wholly-owned by the Sponsor

and other equity investors reasonably acceptable to [REDACTED] (collectively with the Sponsor, the “Equity Investors”), all

or substantially all of the outstanding equity interests of, or all or substantially all of the business (including, without limitation,

all assets, licenses and related operations) of, a company identified to us and code- named “[REDACTED]” (together with its

subsidiaries, the “Acquired Business”) and (ii) refinance substantially all of the existing indebtedness of the Acquired

Business and pay any and all accrued and unpaid interest and call premiums thereon (the “Refinancing”). We understand that

the Acquired Business shall be acquired free of indebtedness and preferred stock, with such exceptions (if any) for any existing indebtedness

as may be agreed to by [REDACTED].

[REDACTED] further understands that the sources of funds needed

to effect the Acquisition and the Refinancing, to pay all fees and expenses incurred in connection with the Transaction (as defined below)

and to provide for the working capital needs and general corporate purposes of Newco and its subsidiaries after giving effect to the Transaction

shall be provided through:

(i) a

cash common equity financing to be provided by the Equity Investors in an aggregate amount of not less than approximately 25% of the pro

forma total consolidated capitalization of Newco and its subsidiaries after giving effect to the Transaction (the “Equity Financing”);

and

(ii)

third-party debt financing consisting of mortgage secured notes (the “Senior Mortgage Debt”) to be issued by Newco

(either pursuant to a bridge financing or by private placement; all or a portion of the Senior Mortgage Debt may be in the form of an

CMBS execution, and may include a mezzanine debt portion secured by equity pledges) in an aggregate principal amount of $2,640 million

(the “Senior Acquisition Financing”)

The Acquisition, the Refinancing, the Equity Financing and

the Senior Acquisition Financing collectively are herein called the “Transaction”.

[REDACTED] is pleased to inform you that, based on our preliminary

review of certain financial information and projections provided by you to us, our understanding of the Transaction as described above

and current market conditions and subject to the satisfaction of all conditions outlined below, we are highly confident in our ability

to arrange and/or place the Senior Acquisition Financing (directly and/or through one or more of our affiliates) to finance, in part,

the Transaction.

You understand and agree that our confidence in our ability

to arrange and/or place the Senior Acquisition Financing is subject to, among other things, (i) there not having occurred any material

adverse change in the condition (financial or otherwise), results of operations, business, assets, property, liabilities or prospects

of the Acquired Business since the date of the most recent audited financial statements available on the date hereof for the Acquired

Business, (ii) the terms and structure of the Senior Acquisition Financing and the Equity Financing being acceptable to [REDACTED], (iii)

the negotiation, execution and delivery of documentation for each component of the Transaction and related transactions in form and substance

satisfactory to [REDACTED], (iv) [REDACTED]’s and its representatives’ completion of and satisfaction with the results of

their business and legal due diligence with respect to the Acquired Business and the Transaction, including, but not limited to, proposed

business plans and projections and financial, accounting, environmental, tax, litigation, labor and pension matters, (v) the availability

of audited and unaudited historical financial statements of the Acquired Business and pro forma financial statements of Newco and its

subsidiaries after giving effect to the Transaction, in each case reasonably acceptable to [REDACTED] and in form and presentation as

required by the Securities Act of 1933, as amended, and the rules and regulations thereunder applicable to registration statements filed

thereunder, (vi) there not having been any disruption or material adverse change in the syndication market for credit facilities or the

financial or capital markets in general, in the judgment of [REDACTED], (vii) [REDACTED] having been engaged to and having a reasonable

time to arrange and market the Senior Acquisition Financing based on [REDACTED]’s experience in comparable transactions, (viii)

satisfaction of all other conditions [REDACTED] would require to be fulfilled with respect to the Senior Acquisition Financing, and (ix)

there is sufficient real estate collateral value that is free and clear of existing encumbrances and / or liens that would prevent the

perfection of a mortgage security interest by the Senior Acquisition Financing.

You understand and agree that (i) we assume no responsibility

for independently verifying any information provided to us in connection with our evaluation of the Transaction and that we have relied

upon such information being complete and accurate in all material respects, (ii) this letter does not constitute a commitment on the part

of, or engagement of, [REDACTED] or any of its affiliates to provide, arrange, place, underwrite and/or participate in any or all of the

Senior Acquisition Financing or any other financing, on the terms described herein or otherwise, and that neither [REDACTED] nor any of

its affiliates are under any obligation, as a result of this letter or otherwise, to provide or offer to provide any such commitment or

engagement and (iii) [REDACTED] cannot make any commitments on behalf of any of its affiliates. Any commitment or engagement by [REDACTED]

or any of its affiliates, if forthcoming, in respect of the Senior Acquisition Financing or any other financing would be evidenced by

a separate written agreement executed by [REDACTED] (or a designated affiliate thereof) and would be subject to, among other things, (x)

[REDACTED]’s and its representatives’ completion of and satisfaction with the results of their business and legal due diligence

as outlined above, (y) [REDACTED]’s receipt of all credit, business selection, conflicts and other internal approvals of [REDACTED]

and its relevant affiliates and our verification of all assumptions we have made and (z) the satisfaction of all conditions we would require

to be fulfilled with respect thereto.

None of [REDACTED], any of its affiliates or any of their

respective directors, officers, employees, representatives and agents shall be responsible or liable to you or any other person or entity

for any damages or amounts of any kind or character which may be alleged as a result of this letter or the proposed Transaction, or any

other transactions contemplated hereby. This letter is not intended to confer any benefits upon, or create any rights in favor of, any

person or entity and may not be relied upon by any person or entity.

You acknowledge that (i) [REDACTED] may share with any of its

affiliates, and such affiliates may share with [REDACTED], any information (including as relating to creditworthiness) related to the

Transaction, the Sponsor, Newco or the Acquired Business (and each of their respective subsidiaries and affiliates), or any of the matters

contemplated hereby and (ii) [REDACTED] and its affiliates may be providing debt financing, equity capital or other services (including

financial advisory services) to other companies in respect of which you or the Acquired Business may have conflicting interests regarding

the transactions described herein and otherwise. [REDACTED] agrees to treat, and cause any such affiliate to treat, all non-public information

provided to it by you and the Acquired Business as confidential information in accordance with customary banking industry practices.

You agree that this letter is for your confidential use

only and that, unless [REDACTED] has otherwise consented in writing, neither its existence nor the terms hereof will be disclosed by

you to any person or entity other than (x) your officers, directors, employees, accountants, attorneys and other advisors and

(y) the Acquired Business and its officers, directors, shareholders, employees,

accountants, attorneys and other advisors, and then (in either case) only on a “need to know” basis in connection with

the transactions contemplated hereby and on a confidential basis. Notwithstanding the foregoing, (i) you may file a copy of this

letter in any public record in which it is required by law, in the opinion of your counsel, to be filed, and (ii) you may make such

other public disclosure of the terms and conditions hereof as, and to the extent, you are required by law, in the opinion of your

counsel, to make; provided that, in any such case, you shall provide written notification to [REDACTED] in advance of such

disclosure.

We look forward to working with you to complete the proposed Transaction

successfully.

Very truly yours,

[REDACTED]

About Blackwells Capital

Blackwells Capital was founded in 2016 by Jason Aintabi, its

Chief Investment Officer. Since that time, it has made investments in public securities, engaging with management and boards, both publicly

and privately, to help unlock value for stakeholders, including shareholders, employees and communities. Throughout their careers, Blackwells’

principals have invested globally on behalf of leading public and private equity firms and have held operating roles and served on the

boards of media, energy, technology, insurance and real estate enterprises. For more information, please visit www.blackwellscap.com

Contact:

Gagnier Communications

Dan Gagnier / Jeffrey Mathews

646-569-5897

Blackwells@gagnierfc.com

|

|

1

|

Market data as of 12/1/2020.

|

|

|

2

|

Balance sheet data as of 9/30/2020. Pro forma for issuance of

1.4 million units of Series C Preferred Stock.

|

BLACKWELLS CAPITAL LLC

800 Third Avenue, 39th

Floor

New York, NY 10022

December 23, 2020

BY OVERNIGHT DELIVERY AND ELECTRONIC MAIL

Monmouth Real Estate Investment Corporation

101 Crawfords Corner Road,

Suite 1405

Holmdel, NJ 07733

General Counsel and Corporate Secretary

|

|

Re:

|

Notice of Intention to Nominate Individuals for Election

as Directors and to Submit Business Proposals for Consideration at the 2021 Annual Meeting of Stockholders of Monmouth Real Estate Investment

Corporation

|

Dear Mr. Prashad:

This letter serves as notice

to Monmouth Real Estate Investment Corporation, a Maryland corporation (“Monmouth” or the “Company”), as to the

nomination by Blackwells Capital LLC, a Delaware limited liability company (“Blackwells” or the “Nominating Stockholder”),

of nominees for election to the Company’s Board of Directors (the “Board”) and the submission of business proposals

to be brought before the Company’s stockholders at the 2021 annual meeting of stockholders of the Company, or any other meeting

of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof (collectively, the “Annual

Meeting”). This letter and all Exhibits attached hereto, which are incorporated herein by reference, are collectively referred to

as the “Notice.”

As of the date of the Notice,

the Nominating Stockholder and its affiliates beneficially own in the aggregate 3,616,333 shares of the Company’s common stock,

par value $0.01 per share (the “Common Stock”), including 280,000 shares of Common Stock underlying call options exercisable

within sixty (60) days of the date hereof and 100,000 shares of Common Stock underlying put options exercisable within sixty (60) days

of the date hereof. As of the date of the Notice, the Nominating Stockholder is the direct owner of 175,100 shares of Common Stock, including

100 shares of which are held in record name by the Nominating Stockholder, 125,000 shares of Common Stock underlying call options exercisable

within sixty (60) days of the date hereof, and 25,000 shares of Common Stock underlying put options exercisable within sixty (60) days

of the date hereof. As of the date of the Notice, the Nominating Stockholder, together with Jason Aintabi and the Nominees (as defined

below) (collectively, the “Group”) beneficially own in the aggregate approximately 3,780,670 shares of Common Stock, including

280,000 shares of Common Stock underlying call options exercisable within sixty (60) days of the date hereof and 100,000 shares of Common

Stock underlying put options exercisable within sixty (60) days of the date hereof, representing approximately 3.9% of the outstanding

shares of Common Stock.

Through the Notice and consistent

with Company’s Bylaws, as amended and restated (the “Bylaws”), the Nominating Stockholder hereby submits, and notifies

you of its intent to submit six (6) business proposals for consideration by stockholders at the Annual Meeting (each a “Proposal”

and collectively, the “Proposals”).

Through the Notice and consistent

with the Bylaws, the Nominating Stockholder also hereby nominates, and notifies you of its intent to nominate at the Annual Meeting, each

of Craig M. Hatkoff, Jennifer M. Hill, Allison Nagelberg and Todd S. Schuster as a nominee to be elected as a Class III director to the

Board at the Annual Meeting (each, a “Nominee,” and collectively, the “Nominees”) to serve for three-year terms

or until his or her respective successor is duly elected and qualified. Catherine B. Elflein, Eugene W. Landy, Michael P. Landy and Samuel

A. Landy are Class III directors whose terms naturally expire at the Annual Meeting. Therefore, the Nominating Stockholder believes that

four (4) seats on the Board will need to be filled at the Annual Meeting. Depending on the size of the Board and the number of candidates

up for election at the Annual Meeting, the Nominating Stockholder reserves the right to either withdraw certain or all of its Nominees

or to nominate additional nominees for election to the Board at the Annual Meeting. Additional nominations made pursuant to the preceding

sentence are without prejudice to the position of the Nominating Stockholder that any attempt by the Company to increase the size of the

current Board without the input and approval of the Company’s stockholders prior to the Annual Meeting will constitute an unlawful

manipulation of the Company’s corporate machinery.

If the Notice shall be deemed

for any reason by a court of competent jurisdiction to be ineffective or deficient with respect to the nomination of any of the Nominees

or the submission of any of the Proposals by the Nominating Stockholder, or if any individual Nominee shall be unable to serve for any

reason, the Notice shall continue to be effective with respect to the remaining Nominee(s) and/or the Proposals and as to any replacement

nominee(s) selected by the Nominating Stockholder.

Below please find information

required by Article II, Sections 11 and 12 of the Bylaws. The inclusion or incorporation by reference of information in the Notice shall

not be deemed to constitute an admission that any such information is required by Article II, Sections 11 or 12 of the Bylaws. Information

included in any subsection below shall also be deemed to be information provided in response to items requested in any other subsection

of the Notice. With respect to any information required by the Bylaws, the Securities Exchange Act of 1934, as amended, and the rules

and regulations promulgated thereunder (collectively, the “Exchange Act”) or any other applicable statutory provision, with

respect to the Notice, the Nominating Stockholder, where there is an absence of responsive information in the Notice, the Exhibits and/or

the information incorporated by reference herein, the absence of responsive information indicates that there is no responsive information

to disclose pursuant to the Bylaws, applicable law or otherwise.

|

|

A.

|

As to each Nominee, all information relating to such person

that is required to be disclosed in connection with solicitations of proxies for election of directors pursuant to Regulation 14A of

the Exchange Act and the rules and regulations promulgated thereunder:

|

Craig M. Hatkoff,

age 66, currently serves as Executive Chairman of LEX Markets, a real estate and alternative asset fintech start-up, and has served

in this capacity since April 2019. From 1978 to 1990, Mr. Hatkoff worked at Chemical Bank where he started and served as Co-Head of

the Real Estate Investment Banking Unit and was a pioneer in the creation and development of the commercial mortgage-backed

securities market. Mr. Hatkoff has served as a Director of Colony Capital, Inc., a public real estate investment trust that focuses

on global digital infrastructure, since February 2019. Mr. Hatkoff has served as a Director of Subversive Capital Acquisition Corp.,

a Canadian SPAC listed on the Toronto-based NEO Exchange, since February 2019, and as a Director of SL Green Realty Corp., a public

real estate investment trust and the largest owner of commercial real estate in Manhattan, since 2010. He served as a Director of

Taubman Centers, Inc., a real estate investment trust engaged in the ownership, management and leasing of retail properties, from

May 2004 to January 2019, and was a Co-Founder and Director of Capital Trust, Inc., a real estate investment management company,

from 1997 to 2010. In 2001, he co-founded the Tribeca Film Festival along with Robert De Niro and Jane Rosenthal. Mr. Hatkoff also

serves on the boards of a number of non-profit organizations including the Tribeca Film Institute which he co-founded in 2001, the

Desmond Tutu Peace Foundation, Richard Leakey’s Wildlife Direct, the Child Mind Institute, The Rock and Roll Hall of Fame,

Sesame Workshop and the Borough of Manhattan Community College Foundation. Mr. Hatkoff served as an Adjunct Professor at Columbia

Business School from 1990 to 1994 where he created and taught the country’s first real estate capital markets program. He

began teaching as an Adjunct Professor at Columbia again in 2015, co-creating the Think Bigger platform for innovation, design and

creativity. He also served as a Trustee of the New York City School Construction Authority, from 2002 to 2004. Mr. Hatkoff received

a Bachelor of Arts from Colgate University in 1976 and a MBA from Columbia Business School in 1978. The Nominating Stockholder

believes Mr. Hatkoff’s innovation in the real estate and capital markets, knowledge of corporate governance and

compliance-related matters and his experience with the financial markets generally make him qualified to serve as a director of the

Company.

Jennifer M. Hill, age

55, currently serves as the Founder and CEO of Murphy Hill Consulting, a Connecticut-based consulting business providing consulting services

focused on the financial services, asset management, insurance and risk management industries, since October 2017. Ms. Hill served as

the Chief Financial Officer of Bank of America Merrill Lynch (NYSE: BAC) from 2011 to 2014. Prior to joining Bank of America, Ms. Hill

was Group Director of Strategy and Corporate Finance at Royal Bank of Scotland, from 2008 to 2011. From 2006 to 2008, Ms. Hill was the

Chief Financial Officer of Tisbury Capital Management and from 1996 to 2006, Ms. Hill served as a Managing Director of Goldman Sachs, & Co. Since January 2015, Ms. Hill has served as a member of the Board of Directors of Santander Asset Management, an international

asset manager, where she is the Chair of the Audit Committee and a member of the Risk Committee and the Remuneration Committee. Ms. Hill

also serves on the Boards of Directors of the Melqart Funds, which are London-based hedge funds focused on event-driven strategies; LaCrosse

Milling, a Wisconsin-based oat milling company; and Arkadia Asset Management, a Swiss-based hedge fund. Ms. Hill received a Bachelor of

Arts in Government and French from Hamilton College in 1987 and a MBA from Columbia University in 1994. The Nominating Stockholder believes

Ms. Hill’s extensive experience in the financial services industry and specific knowledge of auditing issues qualify her to serve

as a director of the Company.

Allison

Nagelberg, age 56, is retired and provides pro-bono consulting services to non-profit organizations since January 2020. From

2000 until her retirement in December 2019, Ms. Nagelberg served as the General Counsel of the Company (NYSE: MNR), a public REIT

investing in net-leased industrial properties. Ms. Nagelberg served as General Counsel of UMH Properties, Inc. (NYSE: UMH), a public

REIT and related company of the Company that owns and operates manufactured housing communities, from 2000 to 2013. Ms. Nagelberg

served as General Counsel of Monmouth Capital Corporation (NASDAQ: MONM) (“Monmouth Capital”), a public REIT investing

in net-leased industrial properties, from 2000 to 2007, at which time Monmouth Capital became a wholly owned subsidiary of the

Company. Ms. Nagelberg served as an associate at Weiss, Lennon & Sharfman, from 1991 to 1992 and worked at Carpenter, Bennett

& Morrissey (now McElroy, Deutsch, Mulvaney & Carpenter, LLP), from 1987 to 1991. Ms. Nagelberg has also served in senior

leadership roles in numerous non-profit, civic and advocacy organizations, including: the National Council and New Jersey Council of

American Israel Public Affairs Committee (AIPAC), since 2016; the Redevelopment Agency of East Brunswick, New Jersey, of which she

serves as Vice-Chair and Commissioner, since 2017; the Advisory Board of the Center for Real Estate at Rutgers Business School, from

2017 to 2019; the Central New Jersey Board of the Jewish National Fund (JNF), since 2017; the Board of Trustees of Congregation

B’nai Tikvah, from 2002 to 2019, where she served as Co-President from 2013 to 2017; the Board of Trustees at the National

Ramah Commission, from 2017 to 2019; the Steering and Strategic Planning Committees of Ramah Day Camp in Nyack, where she served as

Chair, since 2015; the Board of Trustees at Illini Hillel – Cohen Center for Jewish Life, from 2016 to 2019; the Advisory

Board of the Texas A&M Chabad, where she served as Chair, from 2015 to 2018; and the Board of Trustees of Special Strides, a

therapeutic riding organization, from 2013 to 2020. Ms. Nagelberg received a Bachelor of Arts from Tufts University, a JD from New

York University School of Law and a MBA from Rutgers University. The Nominating Stockholder believes that Ms. Nagelberg’s

significant experience with identifying and managing risks facing public companies and particular insight on the Company qualify her

to serve as a director of the Company.

Todd S. Schuster,

age 60, has been an investor for his own account since 2015. He most recently served as a Senior Partner for Ares Management (NYSE: ARES)

(“ARES”), a global alternative asset manager with over $140 billion of assets under management, from June 2013 to September

2015. While at ARES and during the same time period, he also served as Global Head of Real Estate Credit Investments and in that role

served as the Co-Chief Executive Officer, then sole Chief Executive Officer, of Ares Commercial Real Estate Corporation (NYSE: ACRE),

a publicly traded specialty finance company and real estate investment trust. During his tenure at ARES, Mr. Schuster served on ARES’

twelve-member Executive Committee and on the Investment Committee for all of ARES’ sponsored real estate debt and equity vehicles,

which invested in both the US and Europe/UK. Mr. Schuster previously founded, and served as the Chief Executive Officer, and as a member

of the Board of Directors, of CW Financial Services LLC, an investment and financial services firm, from 1992 to 2009. Since July 2020,

he has served as a member of the board of directors of TPG Real Estate Finance Trust, a publicly held commercial real estate finance company.

Mr. Schuster served on the Board of Directors of ACRE from April 2012 to September 2015, including as an independent director and member

of the audit committee until May 2013. He also serves on the Board of Councilors at the Davis School at the University of Southern California.

Mr. Schuster received a Bachelor of Arts from Tufts University in 1982. The Nominating Stockholder believes Mr. Schuster’s executive

management experience, prior board experience and extensive background in the real estate industry qualify him to serve as a director

of the Company.

As of the date of the Notice,

(i) neither Ms. Hill nor Mr. Hatkoff owns any shares of Common Stock, (ii) Ms. Nagelberg is the beneficial owner of 64,088.5767 shares

of Common Stock and (iii) Mr. Schuster is the beneficial owner of 100,248 shares of Common Stock. The acquisitions and dispositions of

the Company’s securities made within the past two (2) years by each of Ms. Nagelberg and Mr. Schuster are included in Exhibit

A hereto.

Each of the Nominees, the

Nominating Stockholder and Mr. Aintabi disclaims beneficial ownership of shares of Common Stock except to the extent of his, her or its

pecuniary interest therein.

Each of the Nominees is a citizen of the United States of America.

The age and principal business address of each Nominee is as set forth

below:

|

Name

|

|

Age

|

|

Principal Business Address

|

|

|

|

|

|

|

|

Craig M. Hatkoff

|

|

66

|

|

25 West 39th Street

|

|

|

|

|

|

New York, New York 10018

|

|

|

|

|

|

|

|

Jennifer M. Hill

|

|

55

|

|

741 Hollow Tree Ridge Road

|

|

|

|

|

|

Darien, Connecticut 06820

|

|

|

|

|

|

|

|

Allison Nagelberg

|

|

56

|

|

51 Patton Drive

|

|

|

|

|

|

East Brunswick, New Jersey 08816

|

|

|

|

|

|

|

|

Todd S. Schuster

|

|

60

|

|

c/o Blackwells Capital LLC

|

|

|

|

|

|

800 Third Avenue, 39th Floor New York, New York 10022

|

The Nominating Stockholder

believes that each of Messrs. Hatkoff and Schuster and Ms. Hill presently is, and if elected as a director of the Company, each of Messrs.

Hatkoff and Schuster and Ms. Hill would be, an “independent director” within the meaning of (i) applicable New York Stock

Exchange listing standards applicable to board composition, (ii) Section 301 of the Sarbanes-Oxley Act of 2002, and (iii) Item 407(a)

of Regulation S-K (“Regulation S-K”) of the rules and regulations of the Securities and Exchange Commission. In making this

determination, the Nominating Stockholder considered that none of Messrs. Hatkoff and Schuster and Ms. Hill is employed by the Company

or has any other material relationship with the Company. None of Messrs. Hatkoff and Schuster and Ms. Hill is a member of the Company’s

audit, compensation and nominating/corporate governance committee that is not independent under any such committee’s applicable

independence standards. Due to her previous employment with the Company, described elsewhere in the Notice, the Nominating Stockholder

believes that Ms. Nagelberg will not be considered an “independent director” of the Company, if elected as a director of the

Company, under the applicable standards until January 1, 2023.

Effective January 1, 2017,

Ms. Nagelberg entered into a three-year employment agreement with the Company, under which Ms. Nagelberg received an annual base salary

of $358,313 for calendar year 2017, with increases of 5% for each of calendar years 2018 and 2019, plus bonuses and customary fringe benefits.

In connection with her retirement, Ms. Nagelberg entered into a Letter Agreement with the Company, dated December 23, 2019, which effectively

terminated her employment agreement consistent with its terms. Under the Letter Agreement the Company paid Ms. Nagelberg $395,039.54 on

December 31, 2019 and will make payments at an annual rate of $395,039.54, payable bi-weekly through December 31, 2020 and paid a 2019

bonus of $30,000 on December 23, 2019.

Except as set forth in

the Notice (including the Exhibits hereto), (i) during the past ten (10) years, no Nominee has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors); (ii) no Nominee directly or indirectly beneficially owns any

securities of the Company; (iii) no Nominee owns any securities of the Company which are owned of record but not beneficially; (iv)

no Nominee has purchased or sold any securities of the Company during the past two (2) years; (v) no part of the purchase price or

market value of the securities of the Company owned by any Nominee is represented by funds borrowed or otherwise obtained for the

purpose of acquiring or holding such securities; (vi) no Nominee is, or within the past year was, a party to any contract,

arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint

ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or

profits, or the giving or withholding of proxies; (vii) no associate of any Nominee owns beneficially, directly or indirectly, any

securities of the Company; (viii) no Nominee owns beneficially, directly or indirectly, any securities of any parent or subsidiary

of the Company; (ix) no Nominee or any of his or her associates had any direct or indirect interest in any transaction, or series of

similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed

transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which

the amount involved exceeds $120,000; (x) no Nominee or any of his or her associates has any arrangement or understanding with any

person with respect to any future employment by the Company or its affiliates, nor with respect to any future transactions to which

the Company or any of its affiliates will or may be a party; (xi) no Nominee has a substantial interest, direct or indirect, by

securities holdings or otherwise, in any matter to be acted on at the Annual Meeting; (xii) no Nominee holds any positions or

offices with the Company; (xiii) no Nominee has a family relationship with any director, executive officer, or person nominated or

chosen by the Company to become a director or executive officer; and (xiv) no companies or organizations, with which any of the

Nominees has been employed in the past five (5) years, is a parent, subsidiary or other affiliate of the Company. Except as set

forth in the Notice (including the Exhibits hereto), (i) there are no material proceedings to which any Nominee or any of his or her

associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of

its subsidiaries and (ii) none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K occurred during the past ten (10)

years.

Each Nominee has consented

to being named as a Nominee in the Notice and to serve as a director of the Company, if so elected (each, a “Consent” and

collectively, the “Consents”). Such Consents are attached hereto as Exhibit B.

|

|

B.

|

As to the Nominating Stockholder:

|

|

|

(i)

|

The name and address of the Nominating Stockholder as they

appear on the Company’s books and of the beneficial owner, if any, on whose behalf the nomination is made:

|

|

Name

|

|

Business Address

|

|

|

|

|

|

Blackwells Capital LLC

|

|

800 Third Avenue, 39th Floor

|

|

|

|

New York, New York 10022

|

|

|

|

|

|

Jason Aintabi

|

|

c/o Blackwells Capital LLC

|

|

|

|

800 Third Avenue, 39th Floor

New York, New York 10022

|

BW Coinvest Management I LLC,

wholly owned and member managed by Blackwells Asset Management LLC, wholly owned by Mr. Aintabi and of which Mr. Aintabi serves as the

President & Secretary, is an “associate” (as defined by Rule 14a-1(a) of the Exchange Act) of Mr. Aintabi. The address

for this entity is 800 Third Avenue, 39th Floor, New York, New York 10022.

|

|

(ii)

|

The class or series and number of shares of capital stock

of the Company which are owned beneficially or of record by the Nominating Stockholder and the beneficial owner.

|

|

Name

|

|

Class

|

|

Series

|

|

Beneficial Ownership

|

|

Record Ownership

|

|

|

|

|

|

|

|

|

|

|

|

Blackwells Capital LLC

|

|

Common Stock, par value $0.01

|

|

--

|

|

175,100 (consisting of (i) 75,100 shares of Common Stock directly owned, (ii) 125,000 shares of Common Stock underlying currently exercisable call options and (iii) 25,000 shares of Common Stock underlying currently exercisable put options, as described further below)

|

|

100

|

|

Name

|

|

Class

|

|

Series

|

|

Beneficial Ownership

|

|

Record Ownership

|

|

|

|

|

|

|

|

|

|

|

|

Jason Aintabi

|

|

Common Stock, par value $0.01

|

|

--

|

|

3,616,333 (consisting of (i) 175,100 shares of Common Stock owned by Blackwells which Mr. Aintabi, as Managing Partner of Blackwells, may be deemed to beneficially own, (ii) 3,211,233 shares of Common Stock owned by BW Coinvest Management I LLC, which Mr. Aintabi as the owner and President & Secretary of Blackwells Asset Management LLC, the owner and sole member of BW Coinvest Management I LLC, may be deemed to beneficially own, (iii) 55,000 shares of Common Stock underlying currently exercisable call options, as described further below, and (iv) 25,000 shares of Common Stock underlying currently exercisable put options, as further described below.)

|

|

0

|

BW Coinvest Management I

LLC, wholly owned and member managed by Blackwells Asset Management LLC, wholly owned by Mr. Aintabi and of which Mr. Aintabi serves as

the President & Secretary, is an “associate” (as defined by Rule 14a-1(a) of the Exchange Act) of Mr. Aintabi. This entity

directly owns 3,211,233 shares of Common Stock, consisting of (i) 3,161,233 shares of Common Stock directly owned, (ii) 100,000 shares

of Common Stock underlying currently exercisable call options, as described further below, and (iii) 50,000 shares of Common Stock underlying

currently exercisable put options, as described further below.

Blackwells directly owns

American-style call options referencing (i) 25,000 shares of Common Stock, which have an exercise price of $12.50 per share and

expire on February 19, 2021, and (ii) 100,000 shares of Common Stock, which have an exercise price of $15.00 per share and expire on

February 19, 2021. Blackwells directly owns American-style put options referencing 25,000 shares of Common Stock, which have an

exercise price of $12.50 per share and expire on February 19, 2021. BW Coinvest Management I LLC directly owns American-style call

options referencing 100,000 shares of Common Stock, which have an exercise price of $17.50 per share and expire on February 19,

2021. BW Coinvest Management I LLC directly owns American-style put options referencing 50,000 shares of Common Stock, which have an

exercise price of $15.00 per share and expire on February 19, 2021. Mr. Aintabi, as Managing Partner of Blackwells, may be deemed to

beneficially own the American-style call and put options beneficially owned by Blackwells, and, as the owner and President &

Secretary of Blackwells Asset Management LLC, the owner and sole member of BW Coinvest Management I LLC, may be deemed to

beneficially own the American-style put options beneficially owned by BW Coinvest Management I LLC. Mr. Aintabi directly owns

American-style call options referencing 55,000 shares of Common Stock, which have an exercise price of $15.00 per share and expire

on February 19, 2021. Mr. Aintabi directly owns American-style put options referencing 25,000 shares of Common Stock, which have an

exercise price of $15.00 per share and expire on February 19, 2021.

Other than as set forth in

the Notice (including the Exhibits hereto), neither the Nominating Stockholder nor Mr. Aintabi owns any securities of the Company, whether

beneficially, directly or indirectly, nor do either of the Nominating Stockholder or Mr. Aintabi own any securities of the Company which

are owned of record but not beneficially.

|

|

(iii)

|

A description of all arrangements or understandings between

the Nominating Stockholder and each Nominee and any other person or persons (including their names) pursuant to which the nomination(s)

are to be made by the Nominating Stockholder.

|

On December 23, 2020, Blackwells

and the Nominees entered into a Joint Filing and Solicitation Agreement pursuant to which, among other things, each of the parties (i)

agreed to the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto, with respect to the securities

of the Company, (ii) agreed to solicit proxies for the Proposals and the election of the Nominees to the Board at the Annual Meeting (the

“Solicitation”), and (iii) Blackwells agreed to bear all expenses incurred in connection with the Solicitation.

The Nominating Stockholder

has signed letter agreements with each Nominee, pursuant to which it has agreed to indemnify each Nominee against certain claims arising

from the proposed nomination and the Solicitation and any related transactions. The Nominating Stockholder has also agreed to bear any

and all legal fees incurred by Ms. Nagelberg in connection with the Solicitation.

Other than as disclosed in

the Notice (including the Exhibits hereto), there are no arrangements or understandings between the Nominating Stockholder or its affiliates

and the Nominees or any other person or persons pursuant to which the nominations are to be made by the Nominating Stockholder.

|

|

(iv)

|

A representation that the Nominating Stockholder intends

to appear in person at the Annual Meeting to nominate the persons named in the Notice.

|

The Nominating Stockholder

hereby represents that it intends to appear in person at the Annual Meeting to nominate the persons named in the Notice.

|

|

(v)

|

Any other information relating to the Nominating Stockholder

that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of

proxies for election of directors pursuant to Regulation 14A of the Exchange Act and the rules and regulations promulgated thereunder.

|

The solicitation is

being made by the Nominating Stockholder. The Nominating Stockholder intends to solicit proxies in support of the Nominees’

election and the Proposals in accordance with applicable law and intends to comply with applicable requirements of the Exchange Act.

Proxies may be solicited by mail, facsimile, telephone, electronic mail, internet, in person or by advertisements. Solicitations

with respect to the election of the Nominees and the Proposals may also be made by certain employees of, and entities controlled by,

the Nominating Stockholder, none of whom will, except as described elsewhere in the Notice, receive additional compensation for such

engagement. The Nominees may make solicitations of proxies but will not receive compensation for such solicitation or for acting as