UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

| M.D.C. HOLDINGS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

FROM THE DESK OF

David Mandarich |

To: All Employees

Dear Team,

Today marks the beginning of a new chapter for our company. Moments ago,

we announced that we have entered into a definitive agreement to be acquired by a wholly owned subsidiary of Sekisui House, Ltd., a global

homebuilding company. A copy of the press release is linked https://ir.richmondamerican.com/2024-01-18-Sekisui-House-and-M-D-C-Holdings-Announce-Combination-to-Create-a-Top-Five-Homebuilder-in-the-U-S.

Since our founding over 50 years ago, we have grown to become one of the

leading home builders in the United States and we have expanded our portfolio of companies to help homeowners across the entire value

chain. By joining Sekisui House, we will become part of a global organization, gaining access to even more resources to support our future

growth.

Sekisui House is Japan’s leading homebuilder and has delivered over

2.62 million homes worldwide since its founding. It is known for superior quality homes through its advanced technology and cutting-edge

building practices. Sekisui House has an established presence in the United States with a growing family of U.S. brands that includes

Woodside, Holt, Hubble and Chesmar.

As part of the Sekisui House portfolio, we will provide a complete suite

of services from insights, design, manufacturing, marketing, sales and after-sales services to support efficiency and enhance homebuyer

experiences. What is particularly unique about Sekisui House is its renowned zero-emission homebuilding processes, which is in increasingly

high demand. Importantly, over time, the transaction is expected to provide new opportunities for economic growth and job creation in

the U.S. I am excited we have found a partner in Sekisui House who shares our values of providing superior quality, comfort and security.

While this announcement is an important milestone, please keep in mind

that today is only the first step. We expect to complete the transaction in the first half of 2024, subject to receipt of required approvals

and satisfaction of other customary closing conditions. Until then, we will continue to operate as a separate, independent company.

Following closing, we will become a portfolio company of Sekisui House

and we expect that much will stay the same! Your senior leaders, Larry A. Mizel, Bob Martin, David Viger and myself, will stay at the

helm, eager to gain industry knowledge that will fuel our company’s growth long-term. As with any change like this, we understand

there will be questions, but we want to reassure you that no material layoffs are in the works, we plan to keep Denver as our corporate

headquarters, and all of our companies will maintain their respective brands. We truly hope you find this change to be as exciting as

we do.

We will keep you informed as we move forward. In the meantime, we understand

that you may have questions and I encourage you to review the attached FAQ document. We will be scheduling a town hall meeting in

your area soon to share more about what the next several weeks and months will look like, as well as answer any questions.

I would like to thank you all for your exceptional hard work and dedication.

This announcement is a testament to the value and reputation we have built together in our industry. I am proud of all that we have accomplished

together and believe Sekisui House will enable us to take our growth to the next level.

Sincerely,

David Mandarich

President and Chief Executive Officer

|

MDC • RAH • HMC • AHI • AHT

|

| 1. | Why is MDC entering into a transaction with Sekisui House? |

| · | This is an exciting and positive

development for MDC and for all our stakeholders. |

| · | Joining Sekisui House and its global

portfolio of brands will provide access to even more resources to support our future growth and continue serving homeowners across the

entire value chain. The transaction also provides compelling value for our shareholders. |

| · | Sekisui House is known for its

advanced technology and cutting-edge building practices, including its zero-emission homebuilding processes, which is in increasingly

high demand in the U.S. Through this transaction we will be able to leverage these unique practices in our homes and strengthen our relationships

with our partners. |

| · | We and Sekisui House share similar

values of providing superior quality, comfort and security, and look forward to unlocking opportunities ahead. |

| · | Sekisui

House was founded over 60 years ago and is Japan’s leading homebuilder, known for delivering superior quality homes through its

advanced technology and cutting-edge building practices. |

| · | Sekisui House has delivered over

2.62 million homes worldwide since its founding and has an established presence in the United States with a growing family of U.S. brands

that includes Woodside, Holt, Hubble and Chesmar. |

| 3. | What does this announcement mean for me and my day-to-day responsibilities? |

| · | We

expect the transaction to have little to no impact on everyone’s day-to-day responsibilities. |

| · | Today’s

announcement is just the beginning and until the transaction has closed, MDC and all of our companies remain independent. Regardless

of which MDC company you work for, your responsibilities are not expected to change during this interim period. |

| · | At closing, we will become a portfolio

company of Sekisui House and we expect to operate just as we do today but as a private company. |

| 4. | Will there be any changes to the MDC portfolio of companies following closing,

including potential layoffs? |

| · | We do not expect any changes to

MDC or any of our companies leading up to or following closing. |

| · | Following close, we expect all

MDC companies - Richmond American Homes, HomeAmerican Mortgage Corporation, American Home Insurance Agency and American Home Title and

Escrow Company – to continue operating under their respective brand name, with the same leadership teams and ongoing go-to-market

strategies. |

| · | MDC and Sekisui House’s U.S.

operations have limited overlap in our footprint and we believe that the scale this transaction establishes will create new opportunities

for growth. In the coming weeks, we will work closely with the Sekisui House team to determine how to best facilitate a smooth transition

at the time of closing. |

| 5. | Will there be any changes to the MDC leadership team or the leadership teams

of MDC’s companies? |

| · | We expect our existing corporate

and individual company leadership structure will remain in place following closing. |

| 6. | How will MDC and our portfolio of companies fit into the overall organization

of Sekisui House? |

| · | Upon closing, MDC and all of our

companies – Richmond American Homes, HomeAmerican Mortgage Corporation, American Home Insurance Agency and American Home Title and

Escrow Company – will become a portfolio company of Sekisui House. |

| · | We expect to operate just as we

do today with the same organizational structure and same brand names. |

| 7. | How does this announcement impact my base compensation, bonus, benefits,

or other terms of my employment with MDC and our portfolio companies? |

| · | Until the transaction closes, MDC

and all of our companies will continue to operate independently and there are no expected changes to compensation and benefits. |

| 8. | What are the expectations with regard to interactions between MDC and Sekisui

House employees between now and closing? |

| · | Prior to closing, you should not

engage with any Sekisui House employees, including employees at any of its brands, unless a member of the MDC leadership team asks you

to do so. |

| · | MDC and all of our companies will

continue to operate independently until the closing of the transaction. |

| · | In the coming weeks, we will work

closely with the Sekisui House team to determine how to best facilitate a smooth transition at the time of closing. |

| 9. | Will there be any changes to building sites, developments, facilities or

operating locations? |

| · | We do not expect any impact on

our building sites, planned developments, facilities or locations. |

| 10. | Does this change our relationship or contracts with customers, trade partners,

realtors or other business partners? |

| · | We expect this transaction to strengthen

all of our partnerships as we continue to build more homes, serve more homeowners and solidify our industry leadership position. |

| 11. | What happens to the MDC Holdings stock I own? |

| · | Upon closing of the transaction,

each share of MDC common stock that you own will be automatically converted into $63.00 in cash, without interest, subject to and in accordance

with the terms of the Merger Agreement (a copy of which will be filed with the SEC). |

| · | If you own MDC stock, there is

no action you need to take right now. We will hold a Special Meeting of MDC shareholders to approve the transaction in the coming weeks.

We will communicate with all MDC shareholders, including employee owners, with more information about the Special Meeting. |

| 12. | What are the next steps to close the transaction? |

| · | There are various required approvals

we need to obtain, including from MDC shareholders and select regulatory agencies, in addition to satisfaction of other customary closing

conditions. |

| · | We

expect to achieve these approvals and close the transaction in the first half of 2024. |

| 13. | Who can I contact if I have more questions? |

| · | If you have additional questions,

please don’t hesitate to reach out to your division, department or subsidiary leader. |

| · | As always, we will be transparent

and communicate important updates, as appropriate. |

Forward-Looking Statements

This communication includes certain disclosures which contain “forward-looking

statements” within the meaning of the federal securities laws, including but not limited to those statements related to the proposed

transaction, including financial estimates and statements as to the expected timing, completion and effects of the proposed transaction,

as well as the operations of our business following the completion of the proposed transaction. These forward-looking statements may be

identified by terminology such as “likely,” “predicts,” “continue,” “anticipates,” “believes,”

“confident,” “could,” “estimates,” “expects,” “intends,” “target,”

“potential,” “may,” “will,” “might,” “plans,” “path,” “should,”

“approximately,” “our planning assumptions,” “forecast,” “outlook” or the negative of

such terms and other comparable terminology. These forward-looking statements, including statements regarding the proposed transaction,

are based largely on information currently available to our management and our management's current expectations and assumptions, and

involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of M.D.C.

Holdings, Inc. (the “Company”) to be materially different from those expressed or implied by the forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements contained in this communication are reasonable,

we cannot guarantee future results. There is no assurance that our expectations will occur or that our estimates or assumptions will be

correct, and we caution investors and all others not to place undue reliance on such forward-looking statements.

Important factors, risks and uncertainties and other factors that may cause

actual results to differ materially from such plans, estimates or expectations include but are not limited to: (i) the completion of the

proposed transaction on the anticipated terms and timing, including obtaining required stockholder and regulatory approvals, and the satisfaction

of other conditions to the completion of the proposed transaction; (ii) potential litigation relating to the proposed transaction that

could be instituted against the Company or its directors, managers or officers, including the effects of any outcomes related thereto;

(iii) the risk that disruptions from the proposed transaction will harm the Company’s business, including current plans and operations,

including during the pendency of the proposed transaction; (iv) the ability of the Company to retain and hire key personnel; (v) the diversion

of management’s time and attention from ordinary course business operations to completion of the proposed transaction and integration

matters; (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed

transaction; (vii) legislative, regulatory and economic developments; (viii) potential business uncertainty, including changes to existing

business relationships, during the pendency of the proposed transaction that could affect the Company’s financial performance; (ix)

certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business

opportunities or strategic transactions; (x) unpredictability and severity of catastrophic events, including but not limited to acts of

terrorism, outbreaks of war or hostilities or the COVID-19 pandemic, as well as management’s response to any of the aforementioned

factors; (xi) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result

of unexpected factors or events; (xii) the occurrence of any event, change or other circumstance that could give rise to the termination

of the proposed transaction, including in circumstances requiring the Company to pay a termination fee; (xiii) those risks and uncertainties

set forth under the headings “Forward Looking Statements” and “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K, as such risk factors may be amended, supplemented or superseded from time to time by other reports filed by

the Company with the SEC from time to time, which are available via the SEC’s website at www.sec.gov; and (xiv) those risks that

will be described in the proxy statement that will be filed with the SEC and available from the sources indicated below.

These risks, as well as other risks associated with the proposed transaction,

will be more fully discussed in the proxy statement that will be filed with the SEC in connection with the proposed transaction. There

can be no assurance that the proposed transaction will be completed, or if it is completed, that it will close within the anticipated

time period. These factors should not be construed as exhaustive and should be read in conjunction with the other forward-looking statements.

The forward-looking statements relate only to events as of the date on which the statements are made. The Company undertakes no duty to

update publicly any forward-looking statements except as required by law, whether as a result of new information, future events or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual

results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should

not place undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this communication

that could cause actual results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for

us to predict those events or how they may affect the Company.

Important Information for Investors and Stockholders

This communication is being made in connection with the proposed transaction

involving the Company, Sekisui House and the other parties to the Merger Agreement. In connection with the proposed transaction, the

Company plans to file a proxy statement and certain other documents regarding the proposed transaction with the SEC. The definitive proxy

statement (if and when available) will be mailed to stockholders of the Company. This communication is not a substitute for the proxy

statement or any other document that the Company may file with the SEC or send to its stockholders in connection with the proposed transaction.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION, STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT THAT WILL BE FILED WITH THE SEC (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY

WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Stockholders will be able

to obtain, free of charge, copies of such documents filed by the Company when filed with the SEC in connection with the proposed transaction

at the SEC’s website (http://www.sec.gov). In addition, the Company’s stockholders

will be able to obtain, free of charge, copies of such documents filed by the Company at the Company’s website (https://ir.richmondamerican.com/sec-filings).

Alternatively, these documents, when available, can be obtained free of charge from the Company upon written request to the Company at

4350 South Monaco Street, Suite 500, Denver, CO 80237.

Participants in the Solicitation

The Company and its directors, executive officers and certain other employees

may be deemed to be participants in the solicitation of proxies from stockholders of the Company in connection with the proposed transaction.

Information about the Company’s directors and executive officers is set forth in the Company’s proxy statement for its 2023

Annual Meeting of Stockholders, which was filed with the SEC on March 1, 2023. These documents are available free of charge at the SEC’s

web site at www.sec.gov and from the Company’s website (https://ir.richmondamerican.com/sec-filings). Additional information regarding

the identity of the participants, and their respective direct and indirect interests in the proposed transaction, by security holdings

or otherwise, will be set forth in the proxy statement and other relevant materials to be filed with the SEC in connection with the proposed

transaction (if and when they become available). You may obtain free copies of these documents using the sources indicated above.

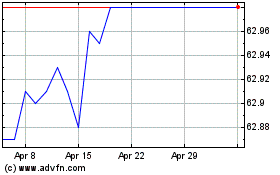

M D C (NYSE:MDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

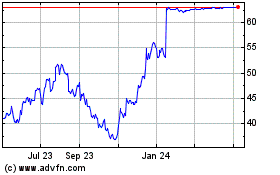

M D C (NYSE:MDC)

Historical Stock Chart

From Jul 2023 to Jul 2024