As filed with the Securities and Exchange Commission on May 17, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIBERTY ENERGY INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | |

| Delaware | | 81-4891595 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

950 17th Street, Suite 2400

Denver, Colorado 80202

(Address of principal executive offices, including zip code)

LIBERTY ENERGY INC. AMENDED AND RESTATED LONG TERM INCENTIVE PLAN

(Full title of the plan)

R. Sean Elliott

Chief Legal Officer and Corporate Secretary

950 17th Street, Suite 2400

Denver, Colorado 80202

Telephone: (303) 515-2800

(Name, address and telephone number of agent for service)

Copies to:

Jennifer Wisinski

Stephen W. Grant, Jr.

Haynes and Boone, LLP

2801 N. Harwood Street, Suite 2300

Dallas, Texas 75201

(214) 651-5000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

Emerging growth company ☐ (Do not check if a smaller reporting company)

| | | | | | | | | | | | | | |

| | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”). | | | ☐ | |

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration Statement”) filed by Liberty Energy Inc. (the “Registrant”) registers 8,747,035 additional shares of Class A common stock, par value $0.01 per share (“Class A common stock”), under the Liberty Oilfield Services Inc. Long Term Incentive Plan (the “Plan”), pursuant to the amendment and restatement of the Plan approved by the Registrant’s Board of Directors and stockholders (the “Amended and Restated Plan”). Such shares consist of (i) 8,330,510 shares of Class A common stock that became available for delivery under the Plan pursuant to the amendment and restatement of the Plan, and (ii) 416,525 shares of Class A common stock that may again become available for delivery with respect to awards under the Amended and Restated Plan pursuant to the share counting, share recycling and other terms and conditions of the Amended and Restated Plan. The Amended and Restated Plan, among other things, increased the number of shares of Class A common stock authorized for issuance under the Plan by 8,330,510 shares, for a total of 21,239,244 shares authorized for issuance under the Amended and Restated Plan. The additional shares are of the same class as other securities issuable pursuant to the Plan for which the Registrant’s Registration Statement on Form S-8 (Registration No. 333-222616), filed with the Securities and Exchange Commission (the “Commission”) on January 19, 2018 (the “Prior Registration Statement”) are effective. The information contained in the Prior Registration Statement is hereby incorporated by reference pursuant to General Instruction E of Form S-8, except to the extent supplemented, amended or superseded by the information set forth in this Registration Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

This Registration Statement incorporates herein by reference the following documents, which have been filed with the Commission by the Registrant:

a) Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Commission on February 9, 2024; b) the information responsive to Part III of Form 10-K for the year ended December 31, 2023 provided in the Registrant’s Proxy Statement on Schedule 14A filed with the Commission on March 7, 2024; c) Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 filed with the Commission on April 18, 2024; d) Current Report on Form 8-K filed with the Commission on April 19, 2024; and e) the description of capital stock contained in Exhibit 4.1 to the Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Commission on February 9, 2024, including any amendments or reports filed for the purpose of updating such description. All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

In no event, however, will any information that the Registrant discloses under Item 2.02 or Item 7.01 of any Current Report on Form 8-K that the Registrant may from time to time furnish to the Commission be incorporated by reference into, or otherwise become a part of, this Registration Statement. Any statement contained in a document that is deemed to be incorporated by reference or deemed to be part of this Registration Statement after the most recent effective date may modify or replace existing statements contained in this Registration Statement.

| | | | | | | | |

Exhibit

Number | | Description |

| 4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 5.1 | * | |

| 10.1 | | |

| 10.2 | * | |

| 10.3 | * | |

| 10.4 | * | |

| 23.1 | * | |

| 23.2 | * | |

| 24.1 | * | |

| 107 | * | |

| | |

| * Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused the Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Denver, Colorado on May 17, 2024.

| | | | | | | | |

| | |

| LIBERTY ENERGY INC. |

|

/s/ Christopher A. Wright |

| Name: | | Christopher A. Wright |

| Title: | | Chief Executive Officer |

POWER OF ATTORNEY

KNOWN ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below appoints Christopher A. Wright, Michael Stock and R. Sean Elliott, and each of them, any of whom may act without the joinder of the other, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to the Registration Statement and any Registration Statement (including any amendment thereto) for this offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act, and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or would do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them or their or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, the Registration Statement has been signed by the following persons in the capacities indicated on May 17, 2024.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

/s/ Christopher A. Wright | | Chairman of the Board and Chief Executive Officer | | May 17, 2024 |

| Christopher A. Wright | | (Principal Executive Officer) | | |

| | | | | |

/s/ Michael Stock | | Chief Financial Officer and Treasurer | | May 17, 2024 |

| Michael Stock | | (Principal Financial Officer) | | |

| | | | | |

/s/ Ryan T. Gosney | | Chief Accounting Officer | | May 17, 2024 |

| Ryan T. Gosney | | (Principal Accounting Officer) | | |

| | | | |

/s/ Simon Ayat | | Director | | May 17, 2024 |

| Simon Ayat | | | | |

| | | | | |

/s/ Ken Babcock | | Director | | May 17, 2024 |

| Ken Babcock | | | | |

| | | | | |

/s/ Peter A. Dea | | Director | | May 17, 2024 |

| Peter A. Dea | | | | |

| | | | | |

/s/ William F. Kimble | | Director | | May 17, 2024 |

| William F. Kimble | | | | |

| | | | | |

/s/ James R. McDonald | | Director | | May 17, 2024 |

| James R. McDonald | | | | |

| | | | | |

/s/ Gale A. Norton | | Director | | May 17, 2024 |

| Gale A. Norton | | | | |

| | | | | |

/s/ Audrey Robertson | | Director | | May 17, 2024 |

| Audrey Robertson | | | | |

| | | | |

/s/ Cary D. Steinbeck | | Director | | May 17, 2024 |

| Cary D. Steinbeck | | | | |

Exhibit 107

CALCULATION OF FILING FEE TABLE

FORM S-8

(Form Type)

Liberty Energy Inc.

(Exact Name as Specified in its Charter)

Table 1 - Newly Registered Shares

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Security Type | | Security Class Title | | Fee Calculation Rule | | Amount Registered (1) (2) | | Proposed Maximum Offering Price Per Unit (3) | | Maximum Aggregate Offering Price (3) | | Fee Rate | | Amount of

Registration

Fee |

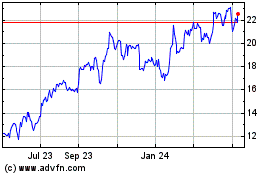

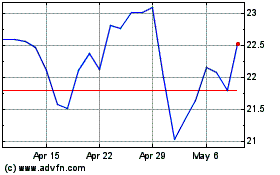

Equity | | Class A Common Stock, par value $0.01 per share | | 457(c) and 457(h) | | 8,747,035 | | $22.38 | | $195,758,643.30 | | 0.0001476 | | $28,893.98 |

Total Offering Amounts | | — | | $195,758,643.30 | | — | | $28,893.98 |

Total Fee Offsets | | — | | — | | — | | — |

Net Fee Due | | — | | — | | — | | $28,893.98 |

| | | | | |

(1) | This Registration Statement on Form S-8 (the “Registration Statement”) covers (i) shares of Class A common stock, $0.01 par value per share (“Common Stock”), of Liberty Energy Inc. (the “Registrant”) authorized for issuance under the Liberty Energy Inc. Amended and Restated Long Term Incentive Plan (the “Plan”) and (ii) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), any additional shares of Common Stock that may become issuable under the Plan by reason of any stock dividend, stock split or other similar transaction. |

(2) | Includes (i) 8,330,510 shares of the registrant’s Common Stock reserved and available for delivery with respect to awards under the Plan and (ii) 416,525 shares of Common Stock that may again become available for delivery with respect to awards under the Plan pursuant to the terms and conditions of the Plan. See Explanatory Note. |

(3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, based on the average of the high and low prices reported for a share of Common Stock on the New York Stock Exchange on May 10, 2024. |

Exhibit 5.1

May 17, 2024

Liberty Energy Inc.

950 17th Street, Suite 2400

Denver, Colorado 80202

Re: Liberty Energy Inc. Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to Liberty Energy Inc., a Delaware corporation (the “Company”), with respect to certain legal matters in connection with the preparation of the Company’s Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), filed with the Securities and Exchange Commission on the date hereof. The Registration Statement relates to the registration of 8,747,035 shares (the “Shares”) of the Company’s Class A common stock, $0.01 par value per share (the “Common Stock”), reserved for issuance pursuant to future awards under the Liberty Energy Inc. Amended and Restated Long Term Incentive Plan (the “Amended and Restated Plan”).

This opinion is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act.

The opinion expressed herein is limited exclusively to the General Corporation Law of the State of Delaware, as currently in effect, and we have not considered, and express no opinion on, any other laws.

In rendering the opinion set forth herein, we have examined originals or copies, certified or otherwise identified to our satisfaction, of (i) the Amended and Restated Certificate of Incorporation of the Company and the Second Amended and Restated Bylaws of the Company; (ii) certain resolutions of the board of directors and stockholders of the Company related to the approval of the Amended and Restated Plan; (iii) the Amended and Restated Plan; (iv) the Registration Statement and all exhibits thereto; (v) a certificate executed by an officer of the Company, dated as of the date hereof; and (vi) such other records, documents and instruments as we considered appropriate for purposes of the opinion stated herein.

In making the foregoing examinations, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents submitted to us as certified, conformed or photostatic copies thereof and the authenticity of the originals of such latter documents. As to all questions of fact material to the opinion stated herein, we have, without independent third-party verification of their accuracy, relied in part, to the extent we deemed reasonably necessary or appropriate, upon the representations and warranties of the Company contained in such documents, records, certificates, instruments or representations furnished or made available to us by the Company.

In rendering the opinion set forth below, we have assumed that, at the time of the issuance of the Shares, (i) the resolutions referred to above will not have been modified or rescinded; (ii) there will not have occurred any change in the law affecting the authorization, execution, delivery, validity or fully paid status of the Common Stock; and (iii) the Company will receive consideration for the issuance of the Shares that is at least equal to the par value of the Common Stock.

Haynes and Boone, LLP 2801 N. Harwood Street | Suite 2300 | Dallas, TX 75201

T: 214.651.5000 | haynesboone.com

HAYNES BOONE

Liberty Energy Inc.

May 17, 2024

Page 2

Based on the foregoing, and subject to the assumptions, qualifications, limitations, and exceptions set forth herein, we are of the opinion that upon the issuance of the Shares in accordance with the terms of the Amended and Restated Plan, the Shares will be validly issued, fully paid and non-assessable.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to all references to us in the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act and the rules and regulations thereunder. This opinion is given as of the date hereof and we assume no obligation to update or supplement such opinion after the date hereof to reflect any facts or circumstances that may thereafter come to our attention or any changes that may thereafter occur.

Very truly yours,

/s/ Haynes and Boone, LLP

HAYNES AND BOONE, LLP

Haynes and Boone, LLP 2801 N. Harwood Street | Suite 2300 | Dallas, TX 75201

T: 214.651.5000 | haynesboone.com

Exhibit 10.2

LIBERTY ENERGY INC.

AMENDED AND RESTATED LONG TERM INCENTIVE PLAN

FORM OF PERFORMANCE RESTRICTED STOCK UNIT GRANT NOTICE

[Date]

Pursuant to the terms and conditions of the Liberty Energy Inc. Amended and Restated Long Term Incentive Plan, as amended from time to time (the “Plan”), Liberty Energy Inc. (f/k/a Liberty Oilfield Services Inc.) (the “Company”) hereby grants to the individual listed below (“you” or the “Participant”) the number of Performance Restricted Stock Units (the “PSUs”) set forth below. This award of PSUs (this “Award”) is subject to the terms and conditions set forth herein and in the Performance Restricted Stock Unit Agreement attached hereto as Exhibit A (the “Agreement”) and the Plan, each of which is incorporated herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

Participant: _____________________

Date of Grant: _____________________

Award Type and

Description: Restricted Stock Units granted pursuant to Section 5(e) of the Plan that are designated as Performance Awards pursuant to Section 5(l) of the Plan. This Award represents the right to receive shares of Stock in an amount up to % of the Target PSUs (defined below), subject to the terms and conditions set forth herein and in the Agreement.

Your right to receive settlement of this Award in an amount ranging from % to % of the Target PSUs shall vest and become earned and nonforfeitable upon (i) your satisfaction of the continued employment or service requirements described below under “Service Requirement” and (ii) the Committee’s review and approval of the level of achievement of the Performance Goal (defined below). The portion of the Target PSUs actually earned upon satisfaction of the foregoing requirements is referred to herein as the “Earned PSUs.”

Target Number of PSUs: _____________________ (the “Target PSUs”).

Performance Period: ____________________ (the “Performance Period Commencement Date”) through ____________________ (the “Performance Period End Date”).

1st Annual Period: _____________________ through _____________________

2nd Annual Period: _____________________ through _____________________

3rd Annual Period: _____________________ through _____________________

Settlement Date: _____________________

Service Requirement: Except as expressly provided in Section 3 of the Agreement, you must remain continuously employed by, or continuously provide services to, the Company or an Affiliate, as applicable, from the Date of Grant through the Settlement Date to be eligible to receive payment of this Award, which is based on the level of achievement with respect to the Performance Goal (as defined below).

Performance Goal: Subject to the terms and conditions set forth in the Plan, the Agreement and herein, the number of Target PSUs, if any, that become Earned PSUs during the Performance Period will be determined as described on Exhibit B attached hereto.

Settlement: Settlement of the Earned PSUs shall be made solely in shares of Stock on the Settlement Date, which shall be delivered to you in accordance with Section 5 of the Agreement.

By your signature below, you agree to be bound by the terms and conditions of the Plan, the Agreement and this Performance Restricted Stock Unit Grant Notice (this “Grant Notice”). You acknowledge that you have reviewed this Grant Notice, the Agreement, and the Plan in their entirety and fully understand all provisions of this Grant Notice, the Agreement, and the Plan. You hereby agree to accept as binding, conclusive and final all decisions or interpretations of the Committee regarding any questions or determinations that arise under the Agreement, the Plan or this Grant Notice. This Grant Notice may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the Company has caused this Grant Notice to be executed by an officer thereunto duly authorized, and the Participant has executed this Grant Notice, effective for all purposes as provided above.

LIBERTY ENERGY INC.

By:

Name:

Title:

PARTICIPANT

Name:

EXHIBIT A

PERFORMANCE RESTRICTED STOCK UNIT AGREEMENT

This Performance Restricted Stock Unit Agreement (together with the Grant Notice to which this Agreement is attached, this “Agreement”) is made as of the Date of Grant set forth in the Grant Notice to which this Agreement is attached by and between Liberty Energy Inc. (f/k/a Liberty Oilfield Services Inc.), a Delaware corporation (the “Company”), and _________ (the “Participant”). Capitalized terms used but not specifically defined herein shall have the meanings specified in the Plan or the Grant Notice.

1. Award. In consideration of the Participant’s past and/or continued employment with, or service to, the Company or its Affiliates and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, effective as of the Date of Grant set forth in the Grant Notice (the “Date of Grant”), the Company hereby grants to the Participant the target number of PSUs set forth in the Grant Notice on the terms and conditions set forth in the Grant Notice, this Agreement and the Plan, which is incorporated herein by reference as a part of this Agreement. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan shall control. To the extent vested, each PSU represents the right to receive one share of Stock, subject to the terms and conditions set forth in the Grant Notice, this Agreement and the Plan; provided, however, that, depending on the level of performance determined to be attained with respect to the Performance Goal, the number of shares of Stock that may be earned hereunder in respect of this Award may range from 0% to 200% of the Target PSUs. Unless and until the PSUs have become vested in the manner set forth in the Grant Notice, the Participant will have no right to receive any Stock or other payments in respect of the PSUs. Prior to settlement of this Award, the PSUs and this Award represent an unsecured obligation of the Company, payable only from the general assets of the Company.

2. Vesting of PSUs. Except as otherwise set forth in Sections 3, the PSUs shall vest and become Earned PSUs in accordance with the Participant’s satisfaction of the vesting schedule set forth in the Grant Notice (the “Service Requirement”) based on the extent of satisfaction of the Performance Goal set forth in the Grant Notice, which shall be determined by the Committee in its sole discretion following the end of the Performance Period (and any PSUs that do not become Earned PSUs shall be automatically forfeited). Unless and until the PSUs have vested and become Earned PSUs as described in the preceding sentence, the Participant will have no right to receive any dividends or other distribution with respect to the PSUs.

3. Effect of Termination of Employment or Service.

(a) Termination of Employment or Service due to Disability or Death. Notwithstanding anything in the Grant Notice, this Agreement or the Plan to the contrary, subject to Section 11, upon the termination of the Participant’s employment or other service relationship with the Company or an Affiliate due to the Participant’s Disability or death that occurs prior to the Settlement Date, then the Participant shall be deemed to have satisfied the Service Requirement with respect to the PSUs, and the PSUs will remain outstanding and, subject to the satisfaction of the Performance Goal, will be eligible to become Earned PSUs and settled in accordance with Section 5; provided, however, that the settlement shall occur no later than March 15 of the calendar year following the calendar year in which the Performance Period End Date occurs.

(b) Other Termination of Employment or Service. Except as otherwise provided in Section 3(a), if the Participant has not satisfied the Service Requirement, then upon the termination of the

Participant’s employment or other service relationship with the Company or an Affiliate for any reason, any unearned PSUs (and all rights arising from such PSUs and from being a holder thereof) will terminate automatically without any further action by the Company and will be forfeited without further notice and at no cost to the Company.

4. Dividend Equivalents. In the event that the Company declares and pays a dividend in respect of its outstanding shares of Stock and, on the record date for such dividend, the Participant holds PSUs granted pursuant to this Agreement that have not been settled, the Company shall record the amount of such dividend in a bookkeeping account and pay to the Participant an amount in cash equal to the cash dividends the Participant would have received if the Participant was the holder of record, as of such record date, of a number of shares of Stock equal to the number of Target PSUs held by the Participant that have not been settled as of such record date, such payment to be made on the date on which any Earned PSUs are settled in accordance with Section 5. For purposes of clarity, if the PSUs (or any portion thereof) are forfeited by the Participant pursuant to the terms of this Agreement, then the Participant shall also forfeit the Dividend Equivalents, if any, accrued with respect to such forfeited PSUs. No interest will accrue on the Dividend Equivalents between the declaration and payment of the applicable dividends and the settlement of the Dividend Equivalents.

5. Settlement of PSUs. Within 30 days of the Settlement Date, the Company shall deliver to the Participant (or the Participant’s permitted transferee, if applicable), a number of shares of Stock equal to the number of Earned PSUs; provided, however, that any fractional PSU that becomes earned hereunder shall be rounded down at the time shares of Stock are issued in settlement of such PSU. No fractional shares of Stock, nor the cash value of any fractional shares of Stock, shall be issuable or payable to the Participant pursuant to this Agreement. All shares of Stock, if any, issued hereunder shall be delivered either by delivering one or more certificates for such shares to the Participant or by entering such shares in book-entry form, as determined by the Committee in its sole discretion. The value of shares of Stock shall not bear any interest owing to the passage of time. Neither this Section 5 nor any action taken pursuant to or in accordance with this Agreement shall be construed to create a trust or a funded or secured obligation of any kind.

6. Tax Withholding. To the extent that the receipt, vesting or settlement of this Award results in compensation income or wages to the Participant for federal, state, local and/or foreign tax purposes, the Participant shall make arrangements satisfactory to the Company for the satisfaction of obligations for the payment of withholding taxes and other tax obligations relating to this Award, which arrangements include the delivery of cash or cash equivalents, Stock (including previously owned Stock, net settlement, a broker-assisted sale, or other cashless withholding or reduction of the amount of shares otherwise issuable or delivered pursuant to this Award), other property, or any other legal consideration the Committee deems appropriate. If such tax obligations are satisfied through net settlement or the surrender of previously owned Stock, the maximum number of shares of Stock that may be so withheld (or surrendered) shall be the number of shares of Stock that have an aggregate Fair Market Value on the date of withholding or surrender equal to the aggregate amount of such tax liabilities determined based on the greatest withholding rates for federal, state, local and/or foreign tax purposes, including payroll taxes, that may be utilized without creating adverse accounting treatment for the Company with respect to this Award, as determined by the Committee. The Participant acknowledges that there may be adverse tax consequences upon the receipt, vesting or settlement of this Award or disposition of the underlying shares and that the Participant has been advised, and hereby is advised, to consult a tax advisor. The Participant represents that the Participant is in no manner relying on the Board, the Committee, the Company or an Affiliate or any of their respective managers, directors, officers, employees or authorized representatives

(including, without limitation, attorneys, accountants, consultants, bankers, lenders, prospective lenders and financial representatives) for tax advice or an assessment of such tax consequences.

7. Non-Transferability. During the lifetime of the Participant, the PSUs may not be sold, pledged, assigned or transferred in any manner other than by will or the laws of descent and distribution, unless and until the shares of Stock underlying the PSUs have been issued, and all restrictions applicable to such shares have lapsed. Neither the PSUs nor any interest or right therein shall be liable for the debts, contracts or engagements of the Participant or his or her successors in interest or shall be subject to disposition by transfer, alienation, anticipation, pledge, encumbrance, assignment or any other means, whether such disposition be voluntary or involuntary or by operation of law by judgment, levy, attachment, garnishment or any other legal or equitable proceedings (including bankruptcy), and any attempted disposition thereof shall be null and void and of no effect, except to the extent that such disposition is permitted by the preceding sentence.

8. Compliance with Applicable Law. Notwithstanding any provision of this Agreement to the contrary, the issuance of shares of Stock hereunder will be subject to compliance with all applicable requirements of Applicable Law with respect to such securities and with the requirements of any stock exchange or market system upon which the Stock may then be listed. No shares of Stock will be issued hereunder if such issuance would constitute a violation of any Applicable Law or regulation or the requirements of any stock exchange or market system upon which the Stock may then be listed. In addition, shares of Stock will not be issued hereunder unless (a) a registration statement under the Securities Act is in effect at the time of such issuance with respect to the shares to be issued or (b) in the opinion of legal counsel to the Company, the shares to be issued are permitted to be issued in accordance with the terms of an applicable exemption from the registration requirements of the Securities Act. The inability of the Company to obtain from any regulatory body having jurisdiction the authority, if any, deemed by the Company’s legal counsel to be necessary for the lawful issuance and sale of any shares of Stock hereunder will relieve the Company of any liability in respect of the failure to issue such shares as to which such requisite authority has not been obtained. As a condition to any issuance of Stock hereunder, the Company may require the Participant to satisfy any requirements that may be necessary or appropriate to evidence compliance with any Applicable Law or regulation and to make any representation or warranty with respect to such compliance as may be requested by the Company.

9. Legends. If a stock certificate is issued with respect to shares of Stock issued hereunder, such certificate shall bear such legend or legends as the Committee deems appropriate in order to reflect the restrictions set forth in this Agreement and to ensure compliance with the terms and provisions of this Agreement, the rules, regulations and other requirements of the SEC, any Applicable Laws or the requirements of any stock exchange on which the Stock is then listed. If the shares of Stock issued hereunder are held in book-entry form, then such entry will reflect that the shares are subject to the restrictions set forth in this Agreement.

10. Rights as a Stockholder. The Participant shall have no rights as a stockholder of the Company with respect to any shares of Stock that may become deliverable hereunder unless and until the Participant has become the holder of record of such shares of Stock, and no adjustments shall be made for dividends in cash or other property, distributions or other rights in respect of any such shares of Stock, except as otherwise specifically provided for in the Plan or this Agreement.

11. Execution of Receipts and Releases. Any issuance or transfer of shares of Stock or other property to the Participant or the Participant’s legal representative, heir, legatee or distributee, in accordance with this Agreement shall be in full satisfaction of all Claims of such person hereunder. As a

condition precedent to such payment or issuance, the Company may require the Participant or the Participant’s legal representative, heir, legatee or distributee to execute (and not revoke within any time provided to do so) a release and receipt therefor in such form as it shall determine appropriate; provided, however, that any review period under such release will not modify the date of settlement with respect to Earned PSUs.

12. No Right to Continued Employment, Service or Awards. Nothing in the adoption of the Plan, nor the award of the PSUs thereunder pursuant to the Grant Notice and this Agreement, shall confer upon the Participant the right to continued employment by, or a continued service relationship with, the Company or any Affiliate, or any other entity, or affect in any way the right of the Company or any such Affiliate, or any other entity to terminate such employment or other service relationship at any time. The grant of the PSUs is a one-time benefit and does not create any contractual or other right to receive a grant of Awards or benefits in lieu of Awards in the future. Any future Awards will be granted at the sole discretion of the Company.

13. Legal and Equitable Remedies. The Participant acknowledges that a violation or attempted breach of any of the Participant's covenants and agreements in this Agreement will cause such damage as will be irreparable, the exact amount of which would be difficult to ascertain and for which there will be no adequate remedy at law, and accordingly, the parties hereto agree that the Company and its Affiliates shall be entitled as a matter of right to an injunction issued by any court of competent jurisdiction, restraining the Participant or the affiliates, partners or agents of the Participant from such breach or attempted violation of such covenants and agreements, as well as to recover from the Participant any and all costs and expenses sustained or incurred by the Company or any Affiliate in obtaining such an injunction, including, without limitation, reasonable attorneys' fees. The parties to this Agreement agree that no bond or other security shall be required in connection with such injunction. Any exercise by either of the parties to this Agreement of its rights pursuant to this Section 13 shall be cumulative and in addition to any other remedies to which such party may be entitled. To the fullest extent permitted under Applicable Law the Participant (as consideration for receiving and accepting this Agreement) irrevocably waives and releases any right or opportunity the Participant might have to assert (or participate or cooperate in) any Claim or right of any nature against any Affiliate of the Company or any stockholder or existing or former director, officer or employee of the Company or any Affiliate of the Company arising out of the Plan or this Agreement.

14. Notices. All notices and other communications under this Agreement shall be in writing and shall be delivered to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

If to the Company, unless otherwise designated by the Company in a written notice to the Participant (or other holder):

Liberty Energy Inc.

Attn: Chief Legal Officer

950 17th Street, Suite 2400

Denver, Colorado 80202

If to the Participant, at the Participant’s last known address on file with the Company.

Any notice that is delivered personally or by overnight courier or telecopier in the manner provided herein shall be deemed to have been duly given to the Participant when it is mailed by the

Company or, if such notice is not mailed to the Participant, upon receipt by the Participant. Any notice that is addressed and mailed in the manner herein provided shall be conclusively presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, on the fourth day after the day it is so placed in the mail.

15. Consent to Electronic Delivery; Electronic Signature. In lieu of receiving documents in paper format, the Participant agrees, to the fullest extent permitted by law, to accept electronic delivery of any documents that the Company may be required to deliver (including, but not limited to, prospectuses, prospectus supplements, grant or award notifications and agreements, account statements, annual and quarterly reports and all other forms of communications) in connection with this and any other Award made or offered by the Company. Electronic delivery may be via a Company electronic mail system or by reference to a location on a Company intranet to which the Participant has access. The Participant hereby consents to any and all procedures the Company has established or may establish for an electronic signature system for delivery and acceptance of any such documents that the Company may be required to deliver, and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature.

16. Agreement to Furnish Information. The Participant agrees to furnish to the Company all information requested by the Company to enable it to comply with any reporting or other requirement imposed upon the Company by or under any applicable statute or regulation.

17. Entire Agreement; Amendment. This Agreement constitutes the entire agreement of the parties with regard to the subject matter hereof, and contains all the covenants, promises, representations, warranties and agreements between the parties with respect to the PSUs granted hereby; provided¸ however, that the terms of this Agreement shall not modify and shall be subject to the terms and conditions of any employment, consulting and/or severance agreement between the Company (or an Affiliate or other entity) and the Participant in effect as of the date a determination is to be made under this Agreement. Without limiting the scope of the preceding sentence, except as provided therein, all prior understandings and agreements, if any, among the parties hereto relating to the subject matter hereof are hereby null and void and of no further force and effect. The Committee may, in its sole discretion, amend this Agreement from time to time in any manner that is not inconsistent with the Plan; provided, however, that except as otherwise provided in the Plan or this Agreement, any such amendment that materially reduces the rights of the Participant shall be effective only if it is in writing and signed by both the Participant and an authorized officer of the Company.

18. Severability and Waiver. If a court of competent jurisdiction determines that any provision of this Agreement is invalid or unenforceable, then the invalidity or unenforceability of such provision shall not affect the validity or enforceability of any other provision of this Agreement, and all other provisions shall remain in full force and effect. Waiver by any party of any breach of this Agreement or failure to exercise any right hereunder shall not be deemed to be a waiver of any other breach or right. The failure of any party to take action by reason of such breach or to exercise any such right shall not deprive the party of the right to take action at any time while or after such breach or condition giving rise to such rights continues.

19. Clawback. The Awards granted hereunder are subject to any written clawback policies that the Company, with the approval of the Board or authorized committee thereof, may adopt either prior to or following the Date of Grant, including, without limitation, any policy adopted to conform to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and rules promulgated thereunder by the SEC and that the Company determines should apply to the Award. Any such policy shall subject

the Participant’s Awards and amounts paid or realized with respect to Awards to reduction, cancelation, forfeiture or recoupment to the extent required by Applicable Law and, even if not required by Applicable Law, if certain specified events or wrongful conduct to occur, including an accounting restatement due to the Company’s material noncompliance with financial reporting regulations or other events or wrongful conduct specified in any such clawback policy.

20. Governing Law. THIS AGREEMENT SHALL BE GOVERNED BY, CONSTRUED, AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE (EXCLUDING ANY CONFLICT OF LAWS, RULE OR PRINCIPLE OF DELAWARE LAW THAT MIGHT REFER THE GOVERNANCE, CONSTRUCTION, OR INTERPRETATION OF THIS AGREEMENT TO THE LAWS OF ANOTHER STATE). THE PARTICIPANT’S SOLE REMEDY FOR ANY CLAIM SHALL BE AGAINST THE COMPANY, AND NO PARTICIPANT SHALL HAVE ANY CLAIM OR RIGHT OF ANY NATURE AGAINST ANY AFFILIATE OF THE COMPANY OR ANY STOCKHOLDER OR EXISTING OR FORMER DIRECTOR, OFFICER OR EMPLOYEE OF THE COMPANY OR ANY AFFILIATE OF THE COMPANY.

21. Successors and Assigns. The Company may assign any of its rights under this Agreement without the Participant’s consent. This Agreement will be binding upon and inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein and in the Plan, this Agreement will be binding upon the Participant and the Participant's beneficiaries, executors, administrators and the person(s) to whom the PSUs may be transferred by will or the laws of descent or distribution.

22. Headings. Headings are for convenience only and are not deemed to be part of this Agreement.

23. Counterparts. The Grant Notice may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument. Delivery of an executed counterpart of the Grant Notice by facsimile or portable document format (.pdf) attachment to electronic mail shall be effective as delivery of a manually executed counterpart of the Grant Notice.

24. Section 409A. Notwithstanding anything herein or in the Plan to the contrary, the PSUs granted pursuant to this Agreement are intended to be exempt from the applicable requirements of the Nonqualified Deferred Compensation Rules and shall be construed and interpreted in accordance with such intent. Nevertheless, to the extent that the Committee determines that the PSUs may not be exempt from the Nonqualified Deferred Compensation Rules, then, if the Participant is deemed to be a “specified employee” within the meaning of the Nonqualified Deferred Compensation Rules, as determined by the Committee, at a time when the Participant becomes eligible for settlement of the PSUs upon his “separation from service” within the meaning of the Nonqualified Deferred Compensation Rules, then to the extent necessary to prevent any accelerated or additional tax under the Nonqualified Deferred Compensation Rules, such settlement will be delayed until the earlier of: (a) the date that is six months following the Participant’s separation from service and (b) the Participant’s death. Notwithstanding the foregoing, the Company and its Affiliates make no representations that the PSUs provided under this Agreement are exempt from or compliant with the Nonqualified Deferred Compensation Rules and in no event shall the Company or any Affiliate be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the Participant on account of non-compliance with the Nonqualified Deferred Compensation Rules.

EXHIBIT B

PERFORMANCE GOAL FOR PERFORMANCE RESTRICTED STOCK UNITS

[ ]

Exhibit 10.3

LIBERTY ENERGY INC.

AMENDED AND RESTATED LONG TERM INCENTIVE PLAN

FORM OF RESTRICTED STOCK UNIT GRANT NOTICE

[Date]

Pursuant to the terms and conditions of the Liberty Energy Inc. Amended and Restated Long Term Incentive Plan, as amended from time to time (the “Plan”), Liberty Energy Inc. (f/k/a Liberty Oilfield Services Inc.) (the “Company”) hereby grants to the individual listed below (“you” or the “Participant”) the number of Restricted Stock Units (the “RSUs”) set forth below. This award of RSUs (this “Award”) is subject to the terms and conditions set forth herein and in the Restricted Stock Unit Agreement attached hereto as Exhibit A (the “Agreement”) and the Plan, each of which is incorporated herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

Participant:

Date of Grant:

Total Number of Restricted

Stock Units:

Vesting Commencement Date:

Vesting Schedule: Subject to the Agreement, the Plan and the other terms and conditions set forth herein, the RSUs shall vest and become exercisable according to the following schedule:_______________________, so long as you remain continuously employed by, or you continuously provide services to, the Company or an Affiliate, as applicable, from the Date of Grant through each such vesting date. Notwithstanding anything in the preceding sentence to the contrary, the RSUs granted hereunder shall immediately become fully vested as set forth in Section 2(b) of the Agreement.

By your signature below, you agree to be bound by the terms and conditions of the Plan, the Agreement and this Restricted Stock Unit Grant Notice (this “Grant Notice”). You acknowledge that you have reviewed this Grant Notice, the Agreement, and the Plan in their entirety and fully understand all provisions of this Grant Notice, the Agreement, and the Plan. You hereby agree to accept as binding, conclusive and final all decisions or interpretations of the Committee regarding any questions or determinations that arise under the Agreement, the Plan or this Grant Notice. This Grant Notice may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the Company has caused this Grant Notice to be executed by an officer thereunto duly authorized, and the Participant has executed this Grant Notice, effective for all purposes as provided above.

LIBERTY ENERGY INC.

By:

Name:

Title:

PARTICIPANT

Name:

EXHIBIT A

RESTRICTED STOCK UNIT AGREEMENT

This Restricted Stock Unit Agreement (together with the Grant Notice to which this Agreement is attached, this “Agreement”) is made as of the Date of Grant set forth in the Grant Notice to which this Agreement is attached by and between Liberty Energy Inc. (f/k/a Liberty Oilfield Services Inc.), a Delaware corporation (the “Company”), and ___________________ (the “Participant”). Capitalized terms used but not specifically defined herein shall have the meanings specified in the Plan or the Grant Notice.

1. Award. In consideration of the Participant’s past and/or continued employment with, or service to, the Company or its Affiliates and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, effective as of the Date of Grant set forth in the Grant Notice (the “Date of Grant”), the Company hereby grants to the Participant the number of RSUs set forth in the Grant Notice on the terms and conditions set forth in the Grant Notice, this Agreement and the Plan, which is incorporated herein by reference as a part of this Agreement. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan shall control. To the extent vested, each RSU represents the right to receive one share of Stock, subject to the terms and conditions set forth in the Grant Notice, this Agreement and the Plan. Unless and until the RSUs have become vested in the manner set forth in the Grant Notice, the Participant will have no right to receive any Stock or other payments in respect of the RSUs. Prior to settlement of this Award, the RSUs and this Award represent an unsecured obligation of the Company, payable only from the general assets of the Company.

2. Vesting of RSUs.

(a) Except as otherwise set forth in Section 2(b), the RSUs shall vest in accordance with the vesting schedule set forth in the Grant Notice. Unless and until the RSUs have vested in accordance with such vesting schedule, the Participant will have no right to receive any dividends or other distribution with respect to the RSUs. In the event of the termination of the Participant’s employment or other service relationship prior to the vesting of all of the RSUs (but after giving effect to any accelerated vesting pursuant to this Section 2), any unvested RSUs (and all rights arising from such RSUs and from being a holder thereof) will terminate automatically without any further action by the Company and will be forfeited without further notice and at no cost to the Company.

(b) Notwithstanding anything in the Grant Notice, this Agreement or the Plan to the contrary, the RSUs shall immediately become fully vested upon the termination of the Participant’s employment or other service relationship with the Company or an Affiliate due to the Participant’s “Disability” or death.

3. Dividend Equivalents. In the event that the Company declares and pays a dividend in respect of its outstanding shares of Stock and, on the record date for such dividend, the Participant holds RSUs granted pursuant to this Agreement that have not been settled, the Company shall record the amount of such dividend in a bookkeeping account and pay to the Participant an amount in cash equal to the cash dividends the Participant would have received if the Participant was the holder of record, as of such record date, of a number of shares of Stock equal to the number of RSUs held by the Participant that have not been settled as of such record date, such payment to be made on or within 60 days following the date on which such RSUs vest in accordance with Section 2. For purposes of clarity, if the RSUs (or any portion thereof) are forfeited by the Participant pursuant to the terms of this Agreement, then the

Participant shall also forfeit the Dividend Equivalents, if any, accrued with respect to such forfeited RSUs. No interest will accrue on the Dividend Equivalents between the declaration and payment of the applicable dividends and the settlement of the Dividend Equivalents.

4. Settlement of RSUs. As soon as administratively practicable following the vesting of RSUs pursuant to Section 2, but in no event later than 30 days after such vesting date, the Company shall deliver to the Participant a number of shares of Stock equal to the number of RSUs subject to this Award. All shares of Stock issued hereunder shall be delivered either by delivering one or more certificates for such shares to the Participant or by entering such shares in book-entry form, as determined by the Committee in its sole discretion. The value of shares of Stock shall not bear any interest owing to the passage of time. Neither this Section 4 nor any action taken pursuant to or in accordance with this Agreement shall be construed to create a trust or a funded or secured obligation of any kind.

5. Tax Withholding. To the extent that the receipt, vesting or settlement of this Award results in compensation income or wages to the Participant for federal, state, local and/or foreign tax purposes, the Participant shall make arrangements satisfactory to the Company for the satisfaction of obligations for the payment of withholding taxes and other tax obligations relating to this Award, which arrangements include the delivery of cash or cash equivalents, Stock (including previously owned Stock, net settlement, a broker-assisted sale, or other cashless withholding or reduction of the amount of shares otherwise issuable or delivered pursuant to this Award), other property, or any other legal consideration the Committee deems appropriate. If such tax obligations are satisfied through net settlement or the surrender of previously owned Stock, the maximum number of shares of Stock that may be so withheld (or surrendered) shall be the number of shares of Stock that have an aggregate Fair Market Value on the date of withholding or surrender equal to the aggregate amount of such tax liabilities determined based on the greatest withholding rates for federal, state, local and/or foreign tax purposes, including payroll taxes, that may be utilized without creating adverse accounting treatment for the Company with respect to this Award, as determined by the Committee. The Participant acknowledges that there may be adverse tax consequences upon the receipt, vesting or settlement of this Award or disposition of the underlying shares and that the Participant has been advised, and hereby is advised, to consult a tax advisor. The Participant represents that the Participant is in no manner relying on the Board, the Committee, the Company or an Affiliate or any of their respective managers, directors, officers, employees or authorized representatives (including, without limitation, attorneys, accountants, consultants, bankers, lenders, prospective lenders and financial representatives) for tax advice or an assessment of such tax consequences.

6. Non-Transferability. During the lifetime of the Participant, the RSUs may not be sold, pledged, assigned or transferred in any manner other than by will or the laws of descent and distribution, unless and until the shares of Stock underlying the RSUs have been issued, and all restrictions applicable to such shares have lapsed. Neither the RSUs nor any interest or right therein shall be liable for the debts, contracts or engagements of the Participant or his or her successors in interest or shall be subject to disposition by transfer, alienation, anticipation, pledge, encumbrance, assignment or any other means, whether such disposition be voluntary or involuntary or by operation of law by judgment, levy, attachment, garnishment or any other legal or equitable proceedings (including bankruptcy), and any attempted disposition thereof shall be null and void and of no effect, except to the extent that such disposition is permitted by the preceding sentence.

7. Compliance with Applicable Law. Notwithstanding any provision of this Agreement to the contrary, the issuance of shares of Stock hereunder will be subject to compliance with all applicable requirements of Applicable Law with respect to such securities and with the requirements of any stock exchange or market system upon which the Stock may then be listed. No shares of Stock will be issued

hereunder if such issuance would constitute a violation of any Applicable Law or regulation or the requirements of any stock exchange or market system upon which the Stock may then be listed. In addition, shares of Stock will not be issued hereunder unless (a) a registration statement under the Securities Act is in effect at the time of such issuance with respect to the shares to be issued or (b) in the opinion of legal counsel to the Company, the shares to be issued are permitted to be issued in accordance with the terms of an applicable exemption from the registration requirements of the Securities Act. The inability of the Company to obtain from any regulatory body having jurisdiction the authority, if any, deemed by the Company’s legal counsel to be necessary for the lawful issuance and sale of any shares of Stock hereunder will relieve the Company of any liability in respect of the failure to issue such shares as to which such requisite authority has not been obtained. As a condition to any issuance of Stock hereunder, the Company may require the Participant to satisfy any requirements that may be necessary or appropriate to evidence compliance with any Applicable Law or regulation and to make any representation or warranty with respect to such compliance as may be requested by the Company.

8. Legends. If a stock certificate is issued with respect to shares of Stock issued hereunder, such certificate shall bear such legend or legends as the Committee deems appropriate in order to reflect the restrictions set forth in this Agreement and to ensure compliance with the terms and provisions of this Agreement, the rules, regulations and other requirements of the SEC, any Applicable Laws or the requirements of any stock exchange on which the Stock is then listed. If the shares of Stock issued hereunder are held in book-entry form, then such entry will reflect that the shares are subject to the restrictions set forth in this Agreement.

9. Rights as a Stockholder. The Participant shall have no rights as a stockholder of the Company with respect to any shares of Stock that may become deliverable hereunder unless and until the Participant has become the holder of record of such shares of Stock, and no adjustments shall be made for dividends in cash or other property, distributions or other rights in respect of any such shares of Stock, except as otherwise specifically provided for in the Plan or this Agreement.

10. Execution of Receipts and Releases. Any issuance or transfer of shares of Stock or other property to the Participant or the Participant’s legal representative, heir, legatee or distributee, in accordance with this Agreement shall be in full satisfaction of all Claims of such person hereunder. As a condition precedent to such payment or issuance, the Company may require the Participant or the Participant’s legal representative, heir, legatee or distributee to execute (and not revoke within any time provided to do so) a release and receipt therefor in such form as it shall determine appropriate; provided, however, that any review period under such release will not modify the date of settlement with respect to vested RSUs.

11. No Right to Continued Employment, Service or Awards. Nothing in the adoption of the Plan, nor the award of the RSUs thereunder pursuant to the Grant Notice and this Agreement, shall confer upon the Participant the right to continued employment by, or a continued service relationship with, the Company or any Affiliate, or any other entity, or affect in any way the right of the Company or any such Affiliate, or any other entity to terminate such employment or other service relationship at any time. The grant of the RSUs is a one-time benefit and does not create any contractual or other right to receive a grant of Awards or benefits in lieu of Awards in the future. Any future Awards will be granted at the sole discretion of the Company.

12. Legal and Equitable Remedies. The Participant acknowledges that a violation or attempted breach of any of the Participant's covenants and agreements in this Agreement will cause such damage as will be irreparable, the exact amount of which would be difficult to ascertain and for which

there will be no adequate remedy at law, and accordingly, the parties hereto agree that the Company and its Affiliates shall be entitled as a matter of right to an injunction issued by any court of competent jurisdiction, restraining the Participant or the affiliates, partners or agents of the Participant from such breach or attempted violation of such covenants and agreements, as well as to recover from the Participant any and all costs and expenses sustained or incurred by the Company or any Affiliate in obtaining such an injunction, including, without limitation, reasonable attorneys' fees. The parties to this Agreement agree that no bond or other security shall be required in connection with such injunction. Any exercise by either of the parties to this Agreement of its rights pursuant to this Section 12 shall be cumulative and in addition to any other remedies to which such party may be entitled. To the fullest extent permitted under Applicable Law the Participant (as consideration for receiving and accepting this Agreement) irrevocably waives and releases any right or opportunity the Participant might have to assert (or participate or cooperate in) any Claim or right of any nature against any Affiliate of the Company or any stockholder or existing or former director, officer or employee of the Company or any Affiliate of the Company arising out of the Plan or this Agreement.

13. Notices. All notices and other communications under this Agreement shall be in writing and shall be delivered to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

If to the Company, unless otherwise designated by the Company in a written notice to the Participant (or other holder):

Liberty Energy Inc.

Attn: Chief Legal Officer

950 17th Street, Suite 2400

Denver, Colorado 80202

If to the Participant, at the Participant’s last known address on file with the Company.

Any notice that is delivered personally or by overnight courier or telecopier in the manner provided herein shall be deemed to have been duly given to the Participant when it is mailed by the Company or, if such notice is not mailed to the Participant, upon receipt by the Participant. Any notice that is addressed and mailed in the manner herein provided shall be conclusively presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, on the fourth day after the day it is so placed in the mail.

14. Consent to Electronic Delivery; Electronic Signature. In lieu of receiving documents in paper format, the Participant agrees, to the fullest extent permitted by law, to accept electronic delivery of any documents that the Company may be required to deliver (including, but not limited to, prospectuses, prospectus supplements, grant or award notifications and agreements, account statements, annual and quarterly reports and all other forms of communications) in connection with this and any other Award made or offered by the Company. Electronic delivery may be via a Company electronic mail system or by reference to a location on a Company intranet to which the Participant has access. The Participant hereby consents to any and all procedures the Company has established or may establish for an electronic signature system for delivery and acceptance of any such documents that the Company may be required to deliver, and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature.

15. Agreement to Furnish Information. The Participant agrees to furnish to the Company all information requested by the Company to enable it to comply with any reporting or other requirement imposed upon the Company by or under any applicable statute or regulation.

16. Entire Agreement; Amendment. This Agreement constitutes the entire agreement of the parties with regard to the subject matter hereof, and contains all the covenants, promises, representations, warranties and agreements between the parties with respect to the RSUs granted hereby; provided, however, that the terms of this Agreement shall not modify and shall be subject to the terms and conditions of any employment, consulting and/or severance agreement between the Company (or an Affiliate or other entity) and the Participant in effect as of the date a determination is to be made under this Agreement. Without limiting the scope of the preceding sentence, except as provided therein, all prior understandings and agreements, if any, among the parties hereto relating to the subject matter hereof are hereby null and void and of no further force and effect. The Committee may, in its sole discretion, amend this Agreement from time to time in any manner that is not inconsistent with the Plan; provided, however, that except as otherwise provided in the Plan or this Agreement, any such amendment that materially reduces the rights of the Participant shall be effective only if it is in writing and signed by both the Participant and an authorized officer of the Company.

17. Severability and Waiver. If a court of competent jurisdiction determines that any provision of this Agreement is invalid or unenforceable, then the invalidity or unenforceability of such provision shall not affect the validity or enforceability of any other provision of this Agreement, and all other provisions shall remain in full force and effect. Waiver by any party of any breach of this Agreement or failure to exercise any right hereunder shall not be deemed to be a waiver of any other breach or right. The failure of any party to take action by reason of such breach or to exercise any such right shall not deprive the party of the right to take action at any time while or after such breach or condition giving rise to such rights continues.

18. Clawback. The Awards granted hereunder are subject to any written clawback policies that the Company, with the approval of the Board or authorized committee thereof, may adopt either prior to or following the Date of Grant, including, without limitation, any policy adopted to conform to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and rules promulgated thereunder by the SEC and that the Company determines should apply to the Award. Any such policy shall subject the Participant’s Awards and amounts paid or realized with respect to Awards to reduction, cancelation, forfeiture or recoupment to the extent required by Applicable Law and, even if not required by Applicable Law, if certain specified events or wrongful conduct to occur, including an accounting restatement due to the Company’s material noncompliance with financial reporting regulations or other events or wrongful conduct specified in any such clawback policy.

19. Governing Law. THIS AGREEMENT SHALL BE GOVERNED BY, CONSTRUED, AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE (EXCLUDING ANY CONFLICT OF LAWS, RULE OR PRINCIPLE OF DELAWARE LAW THAT MIGHT REFER THE GOVERNANCE, CONSTRUCTION, OR INTERPRETATION OF THIS AGREEMENT TO THE LAWS OF ANOTHER STATE). THE PARTICIPANT’S SOLE REMEDY FOR ANY CLAIM SHALL BE AGAINST THE COMPANY, AND NO PARTICIPANT SHALL HAVE ANY CLAIM OR RIGHT OF ANY NATURE AGAINST ANY AFFILIATE OF THE COMPANY OR ANY STOCKHOLDER OR EXISTING OR FORMER DIRECTOR, OFFICER OR EMPLOYEE OF THE COMPANY OR ANY AFFILIATE OF THE COMPANY.

20. Successors and Assigns. The Company may assign any of its rights under this Agreement without the Participant’s consent. This Agreement will be binding upon and inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein and in the Plan, this Agreement will be binding upon the Participant and the Participant's beneficiaries, executors, administrators and the person(s) to whom the RSUs may be transferred by will or the laws of descent or distribution.

21. Headings. Headings are for convenience only and are not deemed to be part of this Agreement.

22. Counterparts. The Grant Notice may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument. Delivery of an executed counterpart of the Grant Notice by facsimile or portable document format (.pdf) attachment to electronic mail shall be effective as delivery of a manually executed counterpart of the Grant Notice.

23. Section 409A. Notwithstanding anything herein or in the Plan to the contrary, the RSUs granted pursuant to this Agreement are intended to be exempt from the applicable requirements of the Nonqualified Deferred Compensation Rules and shall be limited, construed and interpreted in accordance with such intent. Nevertheless, to the extent that the Committee determines that the RSUs may not be exempt from the Nonqualified Deferred Compensation Rules, then, if the Participant is deemed to be a “specified employee” within the meaning of the Nonqualified Deferred Compensation Rules, as determined by the Committee, at a time when the Participant becomes eligible for settlement of the RSUs upon his “separation from service” within the meaning of the Nonqualified Deferred Compensation Rules, then to the extent necessary to prevent any accelerated or additional tax under the Nonqualified Deferred Compensation Rules, such settlement will be delayed until the earlier of: (a) the date that is six months following the Participant’s separation from service and (b) the Participant’s death. Notwithstanding the foregoing, the Company and its Affiliates make no representations that the RSUs provided under this Agreement are exempt from or compliant with the Nonqualified Deferred Compensation Rules and in no event shall the Company or any Affiliate be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the Participant on account of non-compliance with the Nonqualified Deferred Compensation Rules.

Exhibit 10.4

LIBERTY ENERGY INC.

AMENDED AND RESTATED LONG TERM INCENTIVE PLAN

FORM OF RESTRICTED STOCK UNIT GRANT NOTICE

[Date]

Pursuant to the terms and conditions of the Liberty Energy Inc. Amended and Restated Long Term Incentive Plan, as amended from time to time (the “Plan”), Liberty Energy Inc. (f/k/a Liberty Oilfield Services Inc.) (the “Company”) hereby grants to the individual listed below (“you” or the “Participant”) the number of Restricted Stock Units (the “RSUs”) set forth below. This award of RSUs (this “Award”) is subject to the terms and conditions set forth herein and in the Terms and Conditions of Restricted Stock Units attached hereto as Exhibit A (the “Terms and Conditions”) and the Plan, each of which is incorporated herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

Participant:

Date of Grant:

Total Number of Restricted

Stock Units:

Vesting Commencement Date:

Vesting Schedule: Subject to the Terms and Conditions, the Plan and the other terms and conditions set forth herein, the RSUs shall vest and become exercisable according to the following schedule:_______________________, so long as you remain continuously employed by, or you continuously provide services to, the Company or an Affiliate, as applicable, from the Date of Grant through each such vesting date. Notwithstanding anything in the preceding sentence to the contrary, the RSUs granted hereunder shall immediately become fully vested as set forth in Section 2(b) of the Terms and Conditions.

Unless you otherwise notify the Company within 10 business days of the date first set forth above that you do not accept this grant of RSUs, in exchange for such grant you agree to be bound by the terms and conditions of the Plan, the Terms and Conditions and this Restricted Stock Unit Grant Notice (this “Grant Notice”). Unless you otherwise timely notify the Company pursuant to the prior sentence, you hereby acknowledge that you have reviewed this Grant Notice, the Terms and Conditions, and the Plan in their entirety and fully understand all provisions of this Grant Notice, the Terms and Conditions, and the Plan. In exchange for this grant of RSUs, you agree to accept as binding, conclusive and final all decisions or interpretations of the Committee regarding any questions or determinations that arise under this Grant Notice, the Terms and Conditions, or the Plan.

LIBERTY ENERGY INC.

By:

Name:

Title:

EXHIBIT A

TERMS AND CONDITIONS OF RESTRICTED STOCK UNITS

These Terms and Conditions of Restricted Stock Units (together with the Grant Notice to which these Terms and Conditions are attached, collectively, the “Grant”) is made as of the Date of Grant set forth in the Grant Notice. Capitalized terms used but not specifically defined herein shall have the meanings specified in the Plan or the Grant Notice.

1. Award. In consideration of the Participant’s past and/or continued employment with, or service to, the Company or its Affiliates and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, effective as of the Date of Grant set forth in the Grant Notice (the “Date of Grant”), the Company hereby grants to the Participant the number of RSUs set forth in the Grant Notice on the terms and conditions set forth herein and those in the Grant Notice and the Plan, which is incorporated herein by reference as a part of this Grant. In the event of any inconsistency between the Plan and this Grant, the terms of the Plan shall control. To the extent vested, each RSU represents the right to receive one share of Stock, subject to the terms and conditions set forth herein and those in the Grant Notice and the Plan. Unless and until the RSUs have become vested in the manner set forth in the Grant Notice, the Participant will have no right to receive any Stock or other payments in respect of the RSUs. Prior to settlement of this Award, the RSUs and this Award represent an unsecured obligation of the Company, payable only from the general assets of the Company.

2. Vesting of RSUs.

(a) Except as otherwise set forth in Section 2(b), the RSUs shall vest in accordance with the vesting schedule set forth in the Grant Notice. Unless and until the RSUs have vested in accordance with such vesting schedule, the Participant will have no right to receive any dividends or other distribution with respect to the RSUs. In the event of the termination of the Participant’s employment or other service relationship prior to the vesting of all of the RSUs (but after giving effect to any accelerated vesting pursuant to this Section 2), any unvested RSUs (and all rights arising from such RSUs and from being a holder thereof) will terminate automatically without any further action by the Company and will be forfeited without further notice and at no cost to the Company.

(b) Notwithstanding anything set forth herein, in the Grant Notice or the Plan to the contrary, the RSUs shall immediately become fully vested upon the termination of the Participant’s employment or other service relationship with the Company or an Affiliate due to the Participant’s “Disability” or death.

3. Dividend Equivalents. In the event that the Company declares and pays a dividend in respect of its outstanding shares of Stock and, on the record date for such dividend, the Participant holds RSUs granted pursuant to this Grant that have not been settled, the Company shall record the amount of such dividend in a bookkeeping account and pay to the Participant an amount in cash equal to the cash dividends the Participant would have received if the Participant was the holder of record, as of such record date, of a number of shares of Stock equal to the number of RSUs held by the Participant that have not been settled as of such record date, such payment to be made on or within 60 days following the date on which such RSUs vest in accordance with Section 2. For purposes of clarity, if the RSUs (or any portion thereof) are forfeited by the Participant pursuant to the terms of this Grant, then the Participant shall also forfeit the Dividend Equivalents, if any, accrued with respect to such forfeited RSUs. No

interest will accrue on the Dividend Equivalents between the declaration and payment of the applicable dividends and the settlement of the Dividend Equivalents.

4. Settlement of RSUs. As soon as administratively practicable following the vesting of RSUs pursuant to Section 2, but in no event later than 30 days after such vesting date, the Company shall deliver to the Participant a number of shares of Stock equal to the number of RSUs subject to this Award. All shares of Stock issued hereunder shall be delivered either by delivering one or more certificates for such shares to the Participant or by entering such shares in book-entry form, as determined by the Committee in its sole discretion. The value of shares of Stock shall not bear any interest owing to the passage of time. Neither this Section 4 nor any action taken pursuant to or in accordance with this Grant shall be construed to create a trust or a funded or secured obligation of any kind.