Additional Proxy Soliciting Materials (definitive) (defa14a)

March 16 2022 - 5:00PM

Edgar (US Regulatory)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the

Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Lennar Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

SUPPLEMENT TO PROXY STATEMENT DATED MARCH 16, 2022

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 12, 2022

This Supplement to Proxy Statement (this “Supplement”), dated March 16, 2022, is furnished to the stockholders of Lennar

Corporation (the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders to be held on April 12, 2022, or at any adjournments or postponements thereof (the “Annual Meeting”).

This Supplement supplements the definitive Proxy Statement dated March 1, 2022 (the “2022 Proxy Statement”).

This

Supplement is being furnished in order to add background information regarding Proposal 4, Approval of Lennar Corporation 2016 Equity Incentive Plan, as Amended and Restated (the “Amended Equity Plan”). Capitalized terms used in this

Supplement and not otherwise defined herein have the meanings given to them in the 2022 Proxy Statement. This Supplement does not provide all of the information that is important to your decisions in voting at the Annual Meeting. This Supplement

should be read in conjunction with the 2022 Proxy Statement.

Supplemental Disclosure Concerning Proposal 4

As set forth in the 2022 Proxy Statement, Proposal 4 seeks stockholder approval of the Amended Equity Plan primarily to (i) increase the

number of shares of our Common Stock authorized for issuance under the 2016 Equity Plan by an additional 10,000,000 shares (subject to adjustment for stock splits, stock dividends and similar events), (ii) extend the term of the 2016 Equity Plan to

January 12, 2032 (the 10-year anniversary of the approval of the Amended Equity Plan by the Board) and (iii) remove provisions of the 2016 Equity Plan included to comply with the exception for

“performance-based compensation” under Section 162(m) of the Internal Revenue Code, or the Code, which was repealed in December 2017 (“Section 162(m) Changes”).

Included in the Section 162(m) Changes were the removal of annual limits on awards that an individual participant could receive. Under

these limits, the maximum number of shares that may underlie awards (other than (i) stock options and (ii) phantom shares paid in cash that are not intended to qualify as “performance-based compensation” under Section 162(m)

of the Code) granted in any one calendar year to any individual could not exceed 500,000, and no individual could receive stock options (or stock appreciation rights) for more than 1,000,000 shares during any calendar year.

Section 162(m) of the Code limits the annual deduction available for compensation paid to a covered employee to $1,000,000. Previously

there was an exception to this annual deduction limit for “qualified performance-based compensation,” but the Tax Cuts and Jobs Act eliminated this exception commencing with the Company’s fiscal year beginning December 1, 2018.

As a result, the Amended Equity Plan removes provisions previously included to allow awards to meet this “qualified performance-based compensation” exception, including the performance vesting criteria, the individual award limits and the

related provisions requiring approval of such awards and the certification of the attainment of the relevant performance goals by a committee of “outside directors”, as there is no longer any potential tax benefit for a plan to retain

these provisions. The appropriate sizing of awards under the Amended Equity Plan will continue to be subject to the discretion of our Compensation Committee, which is composed solely of independent directors and is expected to oversee a compensation

program with a significant emphasis on performance-based awards.

The removal of annual individual award limits explained above also

applies to awards to our non-employee directors, who are eligible to receive awards under the Amended Equity Plan.

If stockholders would like to review all the changes made in the Amended Equity Plan, they should refer to the full text of the Amended Equity

Plan attached as Exhibit A to the 2022 Proxy Statement.

Except as specifically supplemented by the information contained in this

Supplement, all information set forth in the 2022 Proxy Statement remains unchanged and should be considered in voting your shares.

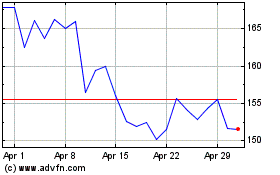

Lennar (NYSE:LEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Jul 2023 to Jul 2024