0001300514false00013005142025-01-082025-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) January 8, 2025

| | | | | | | | |

| LAS VEGAS SANDS CORP. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| (State or other jurisdiction of incorporation) |

| 001-32373 | 27-0099920 |

| (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| 5420 S. Durango Dr. | |

| Las Vegas, | Nevada | 89113 |

| (Address of principal executive offices) | (Zip Code) |

(702) 923-9000

(Registrant's Telephone Number, Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: | |

| | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

| Common Stock ($0.001 par value) | | LVS | | New York Stock Exchange | |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | | | | | | | |

| Emerging growth company | ☐ | | | | |

| | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| ITEM 1.01. | Entry into a Material Definitive Agreement. |

As previously disclosed, on April 3, 2019, Marina Bay Sands Pte. Ltd. (“MBS”), an indirect wholly owned subsidiary of Las Vegas Sands Corp. (the “Company”), and the Singapore Tourism Board (the “STB”) entered into a Development Agreement (the “Development Agreement”), pursuant to which MBS will construct a development, which includes a comprehensive range of integrated amenities for tourism, recreation, entertainment and lifestyle uses (the “MBS Expansion Project”). In connection with entering into the Development Agreement, MBS made an upfront premium payment of $963 million to lease the parcels of land underlying the MBS Expansion Project site through August 21, 2066.

Since entering into the Development Agreement, MBS has further progressed the development plans for the MBS Expansion Project and has made certain changes thereto, which require an allocation of gross floor area across the MBS Expansion Project by the STB (the “Allocation”) and the purchase of 2,000 square meters of approved gaming area and 10,000 square meters of ancillary area in support of the gaming area from the STB (the “Additional Gaming Area Purchase”) to make the planned changes. In connection with the foregoing, on January 8, 2025, MBS entered into a second supplemental agreement to the Development Agreement with the Singapore government (the “Second Supplemental Agreement”) whereby MBS committed to assume liability for the cost of the land premium associated with the Additional Gaming Area Purchase as well as other adjustments to the land premiums resulting from the consequential changes to the allocations of gross floor area for the MBS Expansion Project since the first payment made in 2019. These allocations prescribe and limit the use of the gross floor area for hotel, gaming, retail, food and beverage, meetings, incentives, conventions and exhibitions (“MICE”) and arena at the MBS Expansion Project site. The Second Supplemental Agreement also formalizes the dates by which MBS has agreed with the Singapore government to commence and complete construction of the MBS Expansion Project, being July 8, 2025 and July 8, 2029, respectively. These dates were previously agreed by way of the letter agreement, dated April 1, 2024 between the STB and MBS as disclosed in the Company’s Current Report on Form 8‑K filed on April 5, 2024. The additional upfront payment amount under the Second Supplemental Agreement is currently anticipated to be approximately $1 billion.

The foregoing summary of the Second Supplemental Agreement is not complete and is qualified in its entirety by reference to the full and complete text of the Second Supplemental Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about beliefs and expectations and statements relating to the anticipated payment amount involving MBS and the Singapore government in connection with the Allocation and the Additional Gaming Area Purchase. In addition, in certain portions included in this Current Report on Form 8-K, the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “positions,” “remains,” “seeks,” “will” and similar expressions, as they relate to the Company, MBS, or management, are intended to identify forward-looking statements. Although we believe these forward-looking statements are reasonable, we cannot assure you any forward-looking statements will prove to be correct. These statements represent our expectations, beliefs, intentions or strategies concerning future events that, by their nature, involve a number of risks, uncertainties or other factors beyond our control, which may cause our actual results, performance, achievements or other expectations to be materially different from any future results, performance, achievements or other expectations expressed or implied by these forward-looking statements. These factors include, but are not limited to, the risks associated with: our gaming license in Singapore and concession in Macao and amendments to Macao's gaming laws; general economic conditions; disruptions or reductions in travel and our operations due to natural or man-made disasters, pandemics, epidemics or outbreaks of infectious or contagious diseases; our ability to invest in future growth opportunities, or attempt to expand our business in new markets and new ventures, execute our capital expenditure programs at our existing properties and produce future returns; government regulation; the extent to which the laws and regulations of mainland China become applicable to our operations in Macao and Hong Kong; the possibility that economic, political and legal developments in Macao adversely affect our Macao operations, or that there is a change in the manner in which regulatory oversight is conducted in Macao; our subsidiaries’ ability to make distribution payments to us; substantial leverage and debt service; fluctuations in currency exchange rates and interest rates; our ability to collect gaming receivables; win rates for our gaming operations; risk of fraud and cheating; competition; tax law changes; political instability, civil unrest, terrorist acts or war; legalization of gaming; insurance; the collectability of our outstanding loan receivable; limitations on the transfers of cash to and from our subsidiaries; limitations of the pataca exchange markets; restrictions on the export of the renminbi; and other risks and uncertainties detailed in Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q filed by the Company with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date such statements are made. The Company assumes no obligation to update any forward-looking statements and information.

| | | | | |

| ITEM 9.01. | Financial Statements and Exhibits. |

| | | | | |

| (d) | Exhibits |

| 10.1* | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

| |

| |

| |

| |

_____________________

*Certain schedules to this exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: January 10, 2025

| | | | | | | | | | | |

| | | LAS VEGAS SANDS CORP. |

| | By: | /S/ D. ZACHARY HUDSON |

| | | Name: D. Zachary Hudson

Title: Executive Vice President, Global General Counsel and Secretary |

| | | |

Exhibit 10.1

Execution Version

Dated 8 January 2025

SINGAPORE TOURISM BOARD

and

MARINA BAY SANDS PTE. LTD.

SECOND SUPPLEMENTAL AGREEMENT

(to the Development Agreement dated 3 April 2019

as amended, varied and supplemented by

the Supplemental Agreement dated 22 March 2023 and the Letter Agreements dated 29 March 2022 and 1 April 2024)

Allen & Gledhill LLP

One Marina Boulevard #28-00 Singapore 018989

Tel: +65 6890 7188 | Fax +65 6327 3800

allenandgledhill.com

TABLE OF CONTENTS

| | | | | | | | |

| 1. | Interpretation | 2 |

| | |

| 2. | SA2(DA2) Operative Date | 3 |

| | |

| 3. | Amendments to the Principal Agreement | 3 |

| | |

| 4. | Security Deposit | 4 |

| | |

| 5. | External Auditors | 6 |

| | |

| 6. | Development Investment | 6 |

| | |

| 7. | Permitted Use | 7 |

| | |

| 8. | Construction | 9 |

| | |

| 9. | Connection(s) (Including Associated Circulation Spaces) in Parcels AR1, AR2 and AR3 | 10 |

| | |

| 9A. | Option to Purchase Additional Gaming Area | 11 |

| | |

| 9B. | Assumption of Liability under the Land Betterment Charge Act 2021 | 11 |

| | |

| 10. | New Casino Areas | 12 |

| | |

| 11. | Determination of Lease | 15 |

| | |

| 12. | Costs Expenses and Stamp Fees | 16 |

| | |

| 13. | Notices | 16 |

| | |

| 14. | Contracts (Rights of Third Parties) Act 2001 | 17 |

| | |

| 15. | Counterparts | 17 |

| | |

| 16. | Governing Law and Jurisdiction | 18 |

| | |

| Appendix 1 Form of Lease (Annexure “C” to the Principal Agreement) | 19 |

| | |

| Appendix 2 Accepted Proposal (Annexure “D” to the Principal Agreement) | 20 |

| | |

| | |

This Second Supplemental Agreement is made on 8 January 2025 between:

(1)SINGAPORE TOURISM BOARD, a body corporate established under the Singapore Tourism Board Act 1963 and having its principal office at No. 1 Orchard Spring Lane, Tourism Court, Singapore 247729 (the “Lessor”); and

(2)MARINA BAY SANDS PTE. LTD., a company incorporated in the Republic of Singapore and having its registered office at 10 Collyer Quay, #10-01, Ocean Financial Centre, Singapore 049315 (the “Lessee”).

Whereas:

1.By a Development Agreement dated 3 April 2019 made between the Lessor and the Lessee (the “Development Agreement”), the Lessor has agreed to grant, and the Lessee has agreed to take, a lease of the Land for a term commencing from the Effective Date and ending on 21 August 2066, upon the terms and conditions contained in the Development Agreement and the Lease. Pursuant to a letter dated 8 April 2019 from Drew & Napier LLC (as counsel to the Lessee) to and accepted by the Lessor, the Parties agreed and confirmed that the Effective Date is 8 April 2019.

2.The Development Agreement requires the Lessee to: (i) Commence Construction within three (3) years from the Effective Date i.e. by 8 April 2022 (the “Construction Commencement Date”), and (ii) Complete the IR2 and Complete construction of one hundred percent (100%) of the Proposed GFA within eight (8) years from the Effective Date (the “Construction Completion Date”) i.e. by 8 April 2027.

3.Pursuant to the letter dated 29 March 2022 issued by the Lessee to the Lessor and counter-signed by the Lessor on 30 March 2022, the Lessor agreed to the Lessee’s request to defer the Construction Commencement Date to 8 April 2023 (i.e. four (4) years from the Effective Date).

4.By a Supplemental Agreement dated 22 March 2023 made between the Lessor and the Lessee (the “First Supplemental Agreement”), the Lessor and the Lessee agreed to, inter alia, (i) a further extension of the Construction Commencement Date to 8 April 2024 (i.e. five (5) years from the Effective Date), and (ii) an extension of the Construction Completion Date to 8 April 2028 (i.e. nine (9) years from the Effective Date). The other amendments, variations and supplements to the Development Agreement and the Lease are more particularly provided in the First Supplemental Agreement.

5.Pursuant to the letter dated 1 April 2024 issued by the Lessee to the Lessor and counter-signed by the Lessor on 3 April 2024, the Lessor agreed to the Lessee’s request to (i) further extend the Construction Commencement Date by fifteen (15) months i.e. from 8 April 2024 to 8 July 2025, and (ii) further extend the Construction Completion Date by fifteen (15) months i.e. from 8 April 2028 to 8 July 2029. The Development Agreement as amended, varied and supplemented by the First Supplemental Agreement and the extension letters referred to in recital (3) and this recital (5) shall hereinafter be referred to as the “Principal Agreement”.

6.The Lessee is desirous of exercising the Option to purchase the Additional Gaming Area in full, and additional amounts of Ancillary Area, on a single occasion such Option to be exercised upon payment of the Relevant Payment Amount, and has requested for certain changes to the permitted use of the Land, and the Lessor and the Lessee are desirous of entering into this Second Supplemental Agreement for purposes of, inter alia:

(i)providing for changes to the permitted use of the Land (including such changes to the Gaming Area and the Ancillary Area upon the Lessee’s exercise of the Option to purchase the Additional Gaming Area and additional amounts of Ancillary Area); and

(ii)making certain other amendments and variations to, and supplementing, the Principal Agreement and the Lease, as more particularly provided in this Second Supplemental Agreement.

It is agreed as follows:

1.Interpretation

1.1Definitions: In this Second Supplemental Agreement, unless there is something in the subject or context inconsistent therewith:

“Failure Notification” has the meaning ascribed to it in Clause 13.2.4.

“Parties” means the Lessor and the Lessee, and “Party” means either of them.

“Principal Agreement” has the meaning ascribed to it in recital (5).

“SA2(DA2) Operative Date” has the meaning ascribed to it in Clause 2.1.

1.2Defined Terms: All terms and references used in the Principal Agreement and which are defined or construed in the Principal Agreement but are not defined or construed in this Second Supplemental Agreement shall have the same meaning and construction in this Second Supplemental Agreement.

1.3References: In this Second Supplemental Agreement, including the recitals, unless the context otherwise requires:

1.3.1a reference to a recital, Clause or Appendix is to a recital, Clause or Appendix of or to this Second Supplemental Agreement; and

1.3.2any reference to any agreement or document is to that agreement or document (and where applicable, any of its provisions) as amended, novated, supplemented or replaced from time to time.

1.4Headings: In this Second Supplemental Agreement, headings are for convenience of reference only and do not affect interpretation and where an expression is defined in this Second Supplemental Agreement or the Principal Agreement, another part of speech or grammatical form of that expression has a corresponding meaning.

1.5Appendices: The Appendices attached to this Second Supplemental Agreement shall be taken, read and construed as parts of the Principal Agreement.

2.SA2(DA2) Operative Date

2.1Applicable Date: The Parties hereby agree that the amendments, variations and supplements to the Principal Agreement as more particularly provided in this Second Supplemental Agreement shall take effect on the date of this Second Supplemental Agreement (the “SA2(DA2) Operative Date”), unless otherwise stated.

2.2Construction of Principal Agreement and Second Supplemental Agreement: The Principal Agreement and this Second Supplemental Agreement shall be read and construed as one document and this Second Supplemental Agreement shall be considered to be part of the Principal Agreement and, without prejudice to the generality of the foregoing, where the context so allows:

2.2.1references in the Principal Agreement to “this Agreement”, howsoever expressed, shall be read and construed as references to the Principal Agreement as amended, varied and/or supplemented by this Second Supplemental Agreement; and

2.2.2references in the Lease to the “Development Agreement”, howsoever expressed, shall be read and construed as references to the Principal Agreement as amended, varied and/or supplemented by this Second Supplemental Agreement.

2.3Terms of Principal Agreement: Subject to the amendments, variations and supplements to the Principal Agreement as provided in this Second Supplemental Agreement, all of the terms and conditions of the Principal Agreement are hereby confirmed and shall remain in full force and effect.

3.Amendments to the Principal Agreement

3.1The Parties hereby agree to the following taking effect from (and including) the SA2(DA2) Operative Date:

3.1.1the insertion of the following new definition in clause 1.1 of the Principal Agreement:

3.1.2““Baseline Date” means 3 April 2019, which is the date of the Development Agreement for the Land that was executed between the Lessor and the Lessee;”;

3.1.2the insertion of the following new definition in clause 1.1 of the Principal Agreement:

3.1.3““IR1 Reinstatement Gaming GFA” has the meaning ascribed to it in Clause 16.4.3;”;

3.1.3the insertion of the following new definition in clause 1.1 of the Principal Agreement:

““IR2 Podium Gaming Area” means the Gaming Area for use at the podium (with configuration and other details as may be approved by the Competent Authorities) resulting from exercise of the Option for the Additional Gaming Area;”;

3.1.4the deletion of the definition “IR2 Gaming Area” in clause 1.1 of the Principal Agreement in its entirety and substituting it with the following definition:

““IR2 Tower Gaming Area” has the meaning ascribed to it in Clause 16.4.1(ii)(a);”;

3.1.5the deletion of the definition “Regulator” in clause 1.1 of the Principal Agreement in its entirety and substituting it with the following definition:

““Regulator” means the Gambling Regulatory Authority of Singapore;”;

3.1.6 the insertion of the following new definition in clause 1.1 of the Principal Agreement:

““Relevant Payment Amount” means the Land Betterment Charge payable pursuant to the liability order to be issued by the Competent Authority based on the uses and intensity as proposed by the Lessee, and which takes into account the changes to the GFA constituents since the Baseline Date, and determined based on the planning approval of the Competent Authority granted pursuant to the Lessee’s planning application submitted on 7 October 2024, including any amendments and/or re-submissions related thereto as approved by the Competent Authority;”;

3.1.7the insertion of the following new definition in clause 1.1 of the Principal Agreement:

““SA2(DA2) Operative Date” means the date of the Second Supplemental Agreement;”;

3.1.8the insertion of the following new definition in clause 1.1 of the Principal Agreement:

““Second Supplemental Agreement” means the second supplemental agreement made between the Lessor and the Lessee, which is supplemental to this Agreement as amended, varied and supplemented by the supplemental agreement dated 22 March 2023 and the letter agreements dated 29 March 2022 and 1 April 2024;”;

3.1.9Annexure “C” referred to in the Principal Agreement shall mean and refer to the Annexure “C” attached to this Second Supplemental Agreement as Appendix 1 (Form of Lease); and

3.1.10Annexure “D” referred to in the Principal Agreement shall mean and refer to the Annexure “D” attached to this Second Supplemental Agreement as Appendix 2 (Accepted Proposal).

4.Security Deposit

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clauses 5.2 and 5.4 of the Principal Agreement shall be deleted in their entirety and substituted with the following new clauses 5.2 and 5.4:

“5.2 If the Security Deposit is provided by way of the Banker’s Guarantee, then the Banker’s Guarantee (or such consecutive renewals and/or replacements thereof) shall be valid for an aggregate period of either:

(i)at least ten (10) years and nine (9) months after the Effective Date (the “Banker’s Guarantee Period”); or

(ii)up to at least six (6) months from such earlier date (“Earlier Date”) as proposed in writing by the Lessee and accepted in writing by the Lessor for Completion.

For purposes of this Clause 5.2(ii), in the event that the Lessee shall be unable to Complete the IR2 by such Earlier Date, then the Lessee shall at least six (6) months before the expiry of the Earlier Date, apply to the Lessor in writing for an extension of time for Completion. Immediately upon the Lessor’s acceptance of the Lessee’s request for the extension of time, the Lessee shall renew the Banker’s Guarantee for such extended period and a further period of six (6) months. If the Lessee shall fail to renew the Banker’s Guarantee on the expiry of the Earlier Date, then the Lessor shall be entitled to demand the payment of the Security Deposit secured by the Banker’s Guarantee and hold such monies until the Completion of the IR2.

The Lessee shall be entitled to provide a Banker’s Guarantee that is valid for a period less than the Banker’s Guarantee Period provided that no less than six (6) months prior to the expiry of such Banker’s Guarantee, the Lessee shall provide a further or further Banker’s Guarantee(s) for the remainder of the Banker’s Guarantee Period. All expenses incurred by the Lessee in obtaining, maintaining and extending the Banker’s Guarantee shall be borne by the Lessee.”

“5.4 If the Lessee shall fail to:

(i)make all the payments and deliver all the items required to be paid and delivered under Clause 4.2 on or before twelve (12) noon on 10 April 2019; or

(ii)Commence Construction within six (6) years and three (3) months from the Effective Date; or

(iii)pay or incur one hundred per cent (100%) of the Development Investment within ten (10) years and three (3) months from the Effective Date; or

(iv)Complete construction of one hundred per cent (100%) of the Proposed GFA within ten (10) years and three (3) months from the Effective Date,

or such extended period as may be reasonably allowed in writing by the Lessor, the Lessor shall thereupon be entitled to forfeit the Security Deposit, if paid in cash or to demand the payment of the Security Deposit secured by the Banker’s Guarantee and thereafter the Lessor shall be free of any obligation to return the same. The exercise by the Lessor of its rights under this Clause 5.4 shall be the sole remedy available to the Lessor for failure by

the Lessee to Commence Construction within six (6) years and three (3) months from the Effective Date, pay or incur one hundred per cent (100%) of the Development Investment within ten (10) years and three (3) months from the Effective Date, or Complete construction of one hundred per cent (100%) of the Proposed GFA within ten (10) years and three (3) months from the Effective Date, but shall be without prejudice to the rights and remedies conferred upon the Lessor by any provision of this Agreement arising from any breach by the Lessee of its obligations under any other provision of this Agreement (including under Clauses 12.1, 12.2 and 27). In the event the Lessor forfeits the whole or any part of the Security Deposit pursuant to this provision, there shall be no obligation on the Lessee to furnish a further amount by way of security deposit to top up the amount so forfeited.”

5.External Auditors

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clause 6.1 of the Principal Agreement shall be deleted in its entirety and substituted with the following new clause 6.1:

“6.1 The Lessor shall, at the cost of the Lessee, appoint the External Auditors to undertake: (i) the auditing and certification of the Completion of the Proposed GFA; and (ii) the auditing and certification of the expenditure by the Lessee towards the Development Investment, such auditing to be conducted upon Completion of the Proposed GFA or ten (10) years and three (3) months from the Effective Date, whichever is earlier.”

6.Development Investment

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clauses 7.1 and 7.2 of the Principal Agreement shall be deleted in their entirety and substituted with the following new clauses 7.1 and 7.2:

“7.1 Subject to Clause 10.1, the Development Investment shall be of a total sum of not less than Singapore Dollars Three billion and sixty-two million (S$3,062,000,000.00), which amount shall be expended towards the Completion of the IR2, in respect of, inter alia, the following:

(i)the areas and facilities dedicated to MICE, a total sum of not less than Singapore Dollars Two hundred and twenty million (S$220,000,000.00);

(ii)the area dedicated to the rooftop attraction, a total sum of not less than Singapore Dollars One hundred and ninety-six million (S$196,000,000.00); and

(iii)the area dedicated to the arena (such arena as referred to in the Accepted Proposal and sub-paragraph (iii) of the definition of Key Attractions), a total sum of not less than Singapore Dollars Eight hundred and eighty million (S$880,000,000.00).

PROVIDED ALWAYS that any reduction of any of the amounts as set out in this Clause 7.1 shall, save as specifically set out below, require the prior written approval of the Lessor and

shall be as a result of amendment, modification or variation to the Accepted Proposal as approved in writing by the Lessor:

(a)If such reduction is not more than 10%, the Lessee shall reinvest the reduction in the IR1 Key Attractions and/or the Key Attractions, subject only to the approval of the Lessor as to the selection of such IR1 Key Attractions and/or the Key Attractions and the timing of the reinvestment (such approval not to be unreasonably withheld, delayed or conditioned), and the reduction shall in any event be paid or incurred within eleven (11) years and three (3) months from the Effective Date. The parties also agree to negotiate in good faith a reasonable reduction in the value of the Banker’s Guarantee to be held for the period of the reinvestment.

(a)If such reduction is more than 10%, and without prejudice to the rights and remedies conferred upon the Lessor by any provision of this Agreement arising from any breach by the Lessee of its obligations under any other provision of this Agreement (including under Clauses 5.4, 12.1, 12.2 and 27), the Lessee may discuss with the Lessor to consider what step or action the Lessee may take, including any reinvestment of such reduction in IR1 Key Attractions and/or the Key Attractions, and the timing for such reinvestment.

7.2 The Lessee shall pay or incur one hundred per cent (100%) of the Development Investment within ten (10) years and three (3) months from the Effective Date, or such other time as may be allowed by the Lessor pursuant to Provisos 7.1(a) and 7.1(b).”

7.Permitted Use

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clause 11.1 of the Principal Agreement shall be deleted in its entirety and substituted with the following new clause 11.1:

“11.1 The Lessee shall not use the Land for any purpose except for the development of the IR2 in accordance with the Accepted Proposal subject to payment of the Relevant Payment Amount and further subject to and in compliance with, in all material respects, the following:

(i)the Permissible GFA;

(ii)in respect of the Land:

(a)a GFA not exceeding 120,000 square metres for purely hotel use comprising not more than 1,164 rooms;

(b)

(A)subject to sub-clause (II) of the proviso to this Clause 11.1(ii)(b), an area not exceeding 1,000 square metres for the Lessee’s development and use as the IR2 Tower Gaming Area;

(B)subject to sub-clause (II) of the proviso to this Clause 11.1(ii)(b), upon exercise by the Lessee in full of the Option for the Additional Gaming Area by way of payment of the Relevant Payment Amount, an area not exceeding 2,300 square metres for use as the IR2 Podium Gaming Area;

(C) subject to sub-clause (III) of the proviso to this Clause 11.1(ii)(b), upon exercise by the Lessee in full of the Option for the Additional Gaming Area by way of payment of the Relevant Payment Amount, an area not exceeding 6,000 square metres for the Ancillary Area for IR2, to support the IR2 Tower Gaming Area (“IR2 Tower Ancillary Area”); and

(D) subject to sub-clause (III) of the proviso to this Clause 11.1(ii)(b), upon exercise by the Lessee in full of the Option for the Additional Gaming Area by way of payment of the Relevant Payment Amount, an area not exceeding 5,000 square metres for use as the Ancillary Area for IR2, to support the IR2 Podium Gaming Area (“IR2 Podium Ancillary Area”),

Provided that:

(I)nothing in this Clause 11.1(ii)(b) shall prejudice or derogate from the provisions of Clauses 16.2.4, 16.4 and 16A of this Agreement;

(II)nothing in Clauses 11.1(ii)(b)(A) and/or (B) shall be construed to permit the area for the IR2 Tower Gaming Area and the IR2 Podium Gaming Area to exceed 3,000 square metres in aggregate at any time; and

(III)nothing in Clauses 11.1(ii)(b)(C) and/or (D) shall be construed to permit the area for the IR2 Tower Ancillary Area and the IR2 Podium Ancillary Area to exceed 10,000 square metres in aggregate at any time;

(c)a GFA not exceeding 12,000 square metres for retail, and food and beverage use. The Parties further agree that GFA for any food and beverage use and which forms part of the Ancillary Area for IR2 will not be taken into account in the computation of the GFA under this Clause 11.1(ii)(c);

(d)a GFA of at least 21,700 square metres for MICE use, which includes GFA for support and circulation for MICE;

(e)a GFA of at least 53,000 square metres for entertainment (arena (performing venue)) use; and

(f)a GFA not exceeding 25,500 square metres for support and circulation (other than for use as support and circulation for MICE and the Ancillary Area for IR2),

Provided that nothing herein shall be construed to permit the aggregate GFA for the Land to exceed the Permissible GFA;

(iii)use of Parcel 3 Demised Land for the purposes of underground pedestrian links and other uses as approved by the Lessor and the Competent Authorities, use of Parcel 2 Demised Land and Parcel 6 Demised Land solely for the purposes of underground pedestrian links, and use of Parcel 4 Demised Land and Parcel 5 Demised Land solely for the purposes of elevated pedestrian links;

(iv)the Planning Parameters;

(v)the Planning Permission;

(vi)all the terms and conditions of this Agreement and the Lease; and

(vii)any Law imposed on the Lessor or the Lessee in respect of the Land and/or the regulation of the activities in the IR2.”

8.Construction

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clauses 12.2 and 12.7 of the Principal Agreement shall be deleted in their entirety and substituted with the following new clauses 12.2 and 12.7:

“12.2 Without prejudice to or derogation from Clause 5.4, if the Lessee does not Complete the IR2 with one hundred per cent (100%) of the Proposed GFA being built, and procure the issue of TOP by the Competent Authority for the whole of the IR2, in each case within ten (10) years and three (3) months from the Effective Date or such extended period as may be reasonably allowed in writing by the Lessor and in accordance with Clause 12.1, the Lessor shall thereupon be entitled (but not be obliged) to:

(i)set a new date for the Lessee to Complete the IR2 with one hundred per cent (100%) of the Proposed GFA being built and for the Lessee to procure the issue of TOP by the Competent Authority for the whole of the IR2 (the “Extended Completion Date”), in each case in accordance with Clause 12.1 (and provided that such date shall be reasonable having regard to the then-prevailing circumstances); and

(ii)if, and only if, the Lessor sets the Extended Completion Date, deem the Lessee’s failure to Complete the IR2 with one hundred per cent (100%) of the Proposed GFA being built and procure the issue of TOP by the Competent Authority for the whole of the IR2 by the Extended Completion Date as an Event of Default.”

“12.7 The Lessor hereby agrees that:

(i)the Lessee’s failure to Commence Construction within six (6) years and three (3) months from the Effective Date, pay or incur one hundred per cent (100%) of the Development Investment within ten (10) years and three (3) months from the Effective Date, or Complete construction of one hundred per cent (100%) of the Proposed GFA within ten (10) years and three (3) months from the Effective Date shall not be an Event of Default under Clause 27.1 but save as specifically provided in this Clause 12.7(i), nothing herein shall prejudice:

(a)the exercise by the Lessor of its rights under Clause 5.4; and

(b)the rights and remedies conferred upon the Lessor by any provision of this Agreement arising from any breach by the Lessee of its obligations under the provisions of this Agreement (including under Clauses 12.1, 12.2 and 27); and

(ii)the Lessee shall not be deemed to have failed to Complete one hundred per cent (100%) of the Proposed GFA or to have failed to Complete the IR2 by virtue only of:

(a)a tenant having vacated any premises located in that part of the IR2 comprising the retail areas;

(b)a tenant not having completed its fitting out; or

(c)the Lessee not having obtained a tenant for any premises located in that part of the IR2 comprising the retail areas,

provided that the TOP has been obtained for premises located in that part of the IR2 comprising the retail areas within ten (10) years and three (3) months from the Effective Date; and

(iii)the Lessee is not obliged to open all parts of the IR2 on the same day. The Lessee may open such parts of the IR2 as and when they are ready for opening. Nothing herein shall relieve the Lessee from its obligations under Clause 12.1 and/or Clause 12.2.”

9.Connection(s) (Including Associated Circulation Spaces) in Parcels AR1, AR2 and AR3

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clause 13C.1 of the Principal Agreement shall be deleted in its entirety and substituted with the following new clause 13C.1:

“13C.1 The Lessee shall at its own cost and expense as provided in Clause 13 construct and complete on and within Parcels AR1, AR2 and AR3 the connection(s) (including the associated circulation spaces) to the Land in accordance with the Planning Parameters

within ten (10) years and three (3) months from the Effective Date or such extended period as may be reasonably allowed in writing by the Lessor. Upon completion of the connection(s) (including the associated circulation spaces) to the Land, the Lessee shall at its own cost and expense, operate, maintain and keep in good repair and condition the connection(s) (including the associated circulation spaces).”

9A. Option to Purchase Additional Gaming Area

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, a new clause 16A shall be inserted in the Principal Agreement:

“16A. Maximum Gaming Area under Legislation

16A.1 The Lessee acknowledges and confirms that as at the SA2(DA2) Operative Date:

16A.1.1 an area of 16,000 square metres (inclusive of an area of 1,000 square metres permitted for the purposes of developing, fitting out and operating as part of the Additional Gaming Area) is permitted under the Legislation with effect from 7 April 2020 for the purposes of developing, fitting out and operating as Gaming Area; and

16A.1.2 the utilisation of the area of 1,000 square metres (referred to in Clause 16A.1.1 of this Agreement) is subject to the exercise by the Lessee of the Option to purchase such part of the Additional Gaming Area by way of payment of the Relevant Payment Amount.

16A.2 The provisions of this Clause 16A shall be in addition to and shall not affect the other provisions of this Agreement, in particular (but without affecting the generality of the foregoing) the provisions of Clause 16.2.4 of this Agreement.”

9B. Assumption of Liability under the Land Betterment Charge Act 2021

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, a new clause 16B shall be inserted in the Principal Agreement:

“16B. Assumption of Liability under the Land Betterment Charge Act 2021

16B.1 In respect of any liability order issued by the Competent Authority pursuant to the Land Betterment Charge Act 2021 pertaining to any chargeable consent given in relation to the development of the IR2, in the event such chargeable consent is addressed to the Lessor:

16B.1.1 the Lessee shall assume liability under such liability order (including (but not limited to) the giving of an assumption of liability notice under Section 16 of the Land Betterment Charge Act 2021 to the Competent Authority, that the person assumes liability to pay the Land Betterment Charge in place of the person to whom the liability notice is issued). The assumption of liability notice shall be in such form and given within such time frame as the Competent Authority may stipulate; and

16B.1.2 if the Lessee requires more time for payment of the Land Betterment Charge, it may seek the Competent Authority’s agreement for extension of time and the Lessor shall use reasonable efforts to support and facilitate the Lessee’s request.”

10.New Casino Areas

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clauses 16.4.1 to 16.4.4 of the Principal Agreement shall be deleted in their entirety and substituted with the following new clauses 16.4.1 to 16.4.4, and clause 16.4.5 shall be deleted in its entirety:

“16.4.1 The Lessor hereby consents to and grants its approval for:

(i)the change of use of the area comprising the whole of the fifty-third (53rd) and fifty-fourth (54th) floors within MBS Hotel Tower 2 and/or such other area(s) as may be agreed between the Lessor and the Lessee within the existing MBS hotel in IR1 to be developed and used as part of the Casino with a Gaming Area not exceeding 500 square metres (“IR1 Tower Casino Area”); and

(ii)in respect of IR2:

(a)subject to sub-clause (II) of the proviso to this Clause 16.4.1(ii), the use of an area not exceeding 1,000 square metres as Gaming Area at such location within the hotel as may be agreed between the Lessor and the Lessee in writing to be developed as part of IR2 (“IR2 Tower Gaming Area”);

(b)subject to sub-clause (II) of the proviso to this Clause 16.4.1(ii), upon exercise by the Lessee in full of the Option for the Additional Gaming Area by way of payment of the Relevant Payment Amount, the use of an area not exceeding 2,300 square metres as the IR2 Podium Gaming Area;

(c)subject to sub-clause (III) of the proviso to this Clause 16.4.1(ii), upon exercise by the Lessee in full of the Option for the Additional Gaming Area by way of payment of the Relevant Payment Amount, the use of an area not exceeding 6,000 square metres as the Ancillary Area for IR2, to support the IR2 Tower Gaming Area; and

(d)subject to sub-clause (III) of the proviso to this Clause 16.4.1(ii), upon exercise by the Lessee in full of the Option for the Additional Gaming Area by way of payment of the Relevant Payment Amount, the use of such area not exceeding 5,000 square metres as the Ancillary Area for IR2, to support the IR2 Podium Gaming Area.

Provided that:

(I)nothing in this Clause 16.4.1(ii) shall prejudice or derogate from the provisions of Clauses 16.2.4 and 16A, and the other provisions of Clause 16.4, of this Agreement;

(II)nothing in Clauses 16.4.1(ii)(a) and/or (b) shall be construed to permit the area for the IR2 Tower Gaming Area and the IR2 Podium Gaming Area to exceed 3,000 square metres in aggregate at any time; and

(III)nothing in Clauses 16.4.1(ii)(c) and/or (d) shall be construed to permit the area for the IR2 Tower Ancillary Area and the IR2 Podium Ancillary Area to exceed 10,000 square metres in aggregate at any time.

The IR1 Tower Casino Area, the IR2 Tower Gaming Area and the IR2 Podium Gaming Area shall be collectively known as the “New Casino Areas”.

16.4.2 The provisions of this Clause 16 shall be in addition to and shall not affect the other provisions of this Agreement and nothing in Clause 16.4.1 shall be interpreted as restricting or limiting the ability of the Lessor or any other Competent Authority from imposing terms or conditions as may be imposed in accordance with the Law for the development or use of the IR1 Tower Casino Area, the IR2 Tower Gaming Area, the IR2 Podium Gaming Area and/or the Ancillary Area for IR2, or any part thereof, or operation of the New Casino Areas as part of the Gaming Area allocated or to be allocated to the Lessee under the Legislation. Such terms and conditions shall include, but not be limited to, the following:

(i)the Lessee shall ensure that the regulatory requirements imposed by the Regulator and/or other Competent Authority shall be complied with at all times;

(ii)the Lessee shall ensure that the Maximum Gaming Area shall not be exceeded at any time;

(iii)notwithstanding that no Land Betterment Charge is levied in respect of the IR2 Tower Gaming Area where the conditions set out after sub-clause (iv) of this Clause 16.4.2 are fulfilled, any Land Betterment Charge arising from or in respect of the siting of the Ancillary Area in IR2 pertaining thereto and in accordance with this Agreement shall be borne by the Lessee (which the Lessor acknowledges will be satisfied through the payment of the Relevant Payment Amount); and

(iv)the Lessee shall submit the appropriate documents and applications relating to (inter alia) changes to the boundaries of the Casino Premises, surveillance systems and entry levy system, for the Regulator’s assessment.

The Lessee shall not be required to bear any Land Betterment Charge in respect of such part of the Casino within the IR2 Tower Gaming Area, if:

(a) the aggregate area permitted for use as Gaming Area within the Casino Premises does not exceed the Maximum Gaming Area; and

(b) the IR2 Tower Gaming Area does not exceed 1,000 square metres,

Provided that nothing herein shall be construed to permit the area for the IR2 Tower Gaming Area and the IR2 Podium Gaming Area to exceed 3,000 square metres in aggregate at any time.

16.4.3 Notwithstanding the provisions of Clauses 16.4.1 and 16.4.2, in the event:

(i)the Lease Term is terminated pursuant to Clause 27 of this Agreement; or

(ii)the Lessee assigns, demises, sells, transfers or otherwise disposes of, parts with or deals with in any other way:

(a)all of the Lessee’s estate interest and rights in this Agreement and the Land, or any part thereof; or

(b)all of the Lessee’s estate interest and rights in the IR1 Leases, the Original Demised Land and the Additional Demised Land, or any part thereof,

in addition to and without affecting the Lessor’s rights under Clause 22.2 (including (but not limited to) the Lessor’s rights to impose terms and conditions to be determined by the Lessor),

the Lessor may impose a condition that:

(1)the provisions of Clauses 16.4.1(i) and 16.4.1(ii)(a) shall cease to apply, in whole or in part;

(2)the provisions of Clauses 16.4.2 shall cease to apply to the whole or such affected part (as the case may be); and

(3)upon cessation of the application of Clause 16.4.1(ii)(a), (I) the GFA of the Gaming Area in IR1 shall be reinstated correspondingly to the extent that any such area or part thereof had previously, with the approval of the Lessor and the relevant Competent Authorities, been reduced as a result of it being used as the IR2 Tower Gaming Area and/or as part of the IR2 Podium Gaming Area (such reduced GFA, the “IR1 Reinstatement Gaming GFA”), and (II) where any part of the IR1 Reinstatement Gaming GFA was used as part of the IR2 Podium Gaming Area, the GFA of the IR2 Podium Gaming Area shall be reduced to the same extent that such IR1 Reinstatement Gaming GFA had formed part of the IR2 Podium Gaming Area.

16.4.4 Notwithstanding anything to the contrary provided in Clause 16.4.3(ii), Clause 16.4.3(ii) shall not apply to:

(i)an assignment, demise, sale, transfer or other disposal of, parting with or dealing with in any other way, (a) all of the Lessee’s estate interest and rights in this Agreement and the Land, collectively and concurrently with (b) all of the Lessee’s estate interest and rights in the IR1 Leases, the Original Demised Land and the Additional Demised Land; or

(ii)an assignment, demise, sale, transfer or other disposal of, parting with or dealing with in any other way the Lessee’s estate interest and rights in parts of the Land or IR2 that are not the IR2 Tower Gaming Area and/or the IR2 Podium Gaming Area (e.g. the arena referred to in the Accepted Proposal and sub-paragraph (iii) of the definition of Key Attractions) subject to such dealing being carried out in accordance with Clauses 14 and 22 with the prior written approval of the Lessor and where applicable, the approvals of the Competent Authorities.”

11.Determination of Lease

The Parties hereby agree that, with effect from (and including) the SA2(DA2) Operative Date, clause 27.5 of the Principal Agreement shall be deleted in its entirety and substituted with the following new clause 27.5:

“27.5 Neither party shall be liable for any loss or damage suffered or incurred by the other party (including liability to have the Security Deposit forfeited pursuant to Clause 5.4) arising from the first party’s delay in performing or failure to perform its obligations hereunder to the extent that such delay or failure results from any event of Force Majeure and for so long as such Force Majeure event continues to prevent the first party from performing and discharging such obligations, provided that:

(i)the same arises without the fault or negligence of the affected party;

(ii)the affected party notifies the other party within two (2) Business Days of becoming aware of such event of Force Majeure and the manner and extent to which its obligations are likely to be prevented or delayed; and

(iii)in the event that any event of Force Majeure results in any delay or failure by the Lessee to Commence Construction within six (6) years and three (3) months from the Effective Date, pay or incur one hundred per cent (100%) of the Development Investment within ten (10) years and three (3) months from the Effective Date, or Complete one hundred per cent (100%) of the Proposed GFA within ten (10) years and three (3) months from the Effective Date, the Lessee shall renew the Banker’s Guarantee for such extended period as shall be necessary to ensure that the Banker’s Guarantee shall be valid for a period of not less than ten (10) years and nine (9) months from the Effective Date plus the period of delay caused by the event of Force Majeure. If the Lessee shall fail to renew the Banker’s Guarantee in accordance with this Clause 27.5(iii) by the date falling ten (10) years and nine (9) months from the Effective Date, then the Lessor shall, notwithstanding any other provision in this Agreement, be entitled to demand the payment of the Security Deposit secured by the Banker’s Guarantee and hold such monies as security for

the due performance and observance by the Lessee of the terms and conditions of this Agreement SAVE THAT the Lessee shall not be required to renew the Banker’s Guarantee for so long as the Banker’s Guarantee shall remain valid for a period of not less than six months after the date falling ten (10) years and three (3) months from the Effective Date plus the period of delay caused by the event of Force Majeure.

Each party shall use its reasonable endeavours to minimise the duration and effects of any event of Force Majeure on the affected party.”

12.Costs Expenses and Stamp Fees

12.1The Lessee shall forthwith pay on demand all legal and other professional and technical fees and expenses on a full indemnity basis incurred by the Lessor in connection with the preparation, finalisation and completion of this Second Supplemental Agreement and in respect of all matters incidental thereto or arising therefrom or in connection therewith.

12.2The Lessee shall pay all Stamp Duty payable in respect of this Second Supplemental Agreement.

13.Notices

13.1All notices or other communication of any nature whatsoever under this Second Supplemental Agreement shall be made by email, facsimile, letter or otherwise in writing and shall be sent to a Party at the email address, facsimile number or the address of that Party set out below (or at such other email address, number or address as may be notified in writing by that Party to the other Party from time to time):

The Lessor

SINGAPORE TOURISM BOARD

1 Orchard Spring Lane

Singapore 247729

Attention: Ranita Sundramoorthy

Executive Director, Infrastructure Planning & Management Division

Fax: +65 6732 2108

Email Address: ranita_sundramoorthy@stb.gov.sg

The Lessee

MARINA BAY SANDS PTE. LTD.

10 Collyer Quay, #10-01

Ocean Financial Centre

Singapore 049315

Attention: The General Counsel

Marina Bay Sands Pte. Ltd.

Fax: +65 6688 1204

Email Address: faris.alsagoff@marinabaysands.com

With copy to:

LAS VEGAS SANDS CORP.

5420 S. Durango Dr.,

Las Vegas,

NV 89113

United States of America

Attention: Global General Counsel

Fax: (1) 702 414 5330

Email Address: zac.hudson@sands.com

13.2Any notice or communication shall be deemed to be received:

13.2.1if sent by prepaid post, on the date of actual receipt;

13.2.2if delivered by hand, on the date of delivery;

13.2.3if sent by facsimile and a correct and complete transmission report for that transmission is obtained by the sender, upon transmission if transmission takes place on a Business Day before 4:00pm in the place to which the communication is transmitted and in any other case on the Business Day next following the day of transmission; and

13.2.4if delivered by email, at the time of transmission in legible form, provided that no notification was received by the sender that the email was undeliverable (a “Failure Notification”) and if a Failure Notification was received, the sender shall re-send a copy of the notice or communication by email and shall also send a copy of the notice or communication by another method of service set out in Clause 13.1, in which case it shall be deemed to have been received in accordance with this Clause 13.2 as it applies to that other method of service.

14.Contracts (Rights of Third Parties) Act 2001

The terms and provisions of this Second Supplemental Agreement are intended for the benefit of the Lessor (including the Government and the Competent Authorities), the Lessee and their respective successors or permitted assigns, and it is not the intention of the Parties to confer third party beneficiary rights upon any other person. Subject to the foregoing and save for the Government and the Competent Authorities, a person who is not a party to this Second Supplemental Agreement shall have no right under the Contracts (Rights of Third Parties) Act 2001 to enforce any of its terms.

15.Counterparts

This Second Supplemental Agreement may be signed in any number of counterparts, all of which taken together shall constitute one and the same instrument. Each Party may enter into this Second Supplemental Agreement by signing any such counterpart and each counterpart shall be valid and effectual as if executed as an original.

16.Governing Law and Jurisdiction

This Second Supplemental Agreement is governed by, and is to be construed in accordance with, the laws of Singapore. Save as expressly provided otherwise, the Parties agree to submit to the exclusive jurisdiction of the courts of Singapore.

[Remainder of page intentionally left blank.]

Appendix 1

Form of Lease

(Annexure “C” to the Principal Agreement)

Appendix 2

Accepted Proposal

(Annexure “D” to the Principal Agreement)

IN WITNESS WHEREOF the parties hereto have hereunto set their hands the day and year first abovewritten.

| | | | | | | | | | | |

| The Lessor | | | |

| | | |

SIGNED by MELISSA OW | ) | | |

| for and on behalf of | ) | | |

| SINGAPORE TOURISM BOARD | ) | | |

| in the presence of: | ) | /s/ Melissa Ow | |

| | | |

| | | |

| | | |

| | | |

| /s/ Ong Huey Hong | | | |

| Witness’ signature | | | |

| Name: Ong Huey Hong | | | |

| Designation: Assistant Chief Executive (Industry Dev. Grp) | |

Signature Page to the Second Supplemental Agreement

| | | | | | | | | | | |

| The Lessee | | | |

| | | |

SIGNED by FARIS ALSAGOFF | ) | | |

| for and on behalf of | ) | | |

MARINA BAY SANDS PTE. LTD. | ) | | |

| in the presence of: | ) | /s/ Faris Alsagoff | |

| | | |

| | | |

| | | |

| | | |

/s/ Penny Lo Wai Pek | | | |

| Witness’ signature | | | |

Name: Penny Lo Wai Pek | | | |

Designation: Deputy General Counsel | |

Signature Page to the Second Supplemental Agreement

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

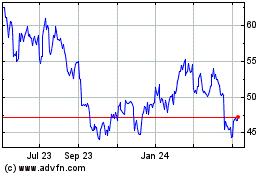

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Dec 2024 to Jan 2025

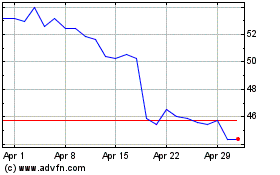

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Jan 2024 to Jan 2025