Current Report Filing (8-k)

February 22 2022 - 5:26PM

Edgar (US Regulatory)

0001679273

false

0001679273

2022-02-18

2022-02-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 18, 2022

Lamb Weston Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

1-37830 |

61-1797411 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| 599 S. Rivershore Lane |

|

|

| Eagle, Idaho |

|

83616 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

(208) 938-1047 |

|

| |

(Registrant’s telephone number, including area code) |

|

| |

|

|

| |

N/A |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $1.00 par value |

|

LW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item

1.01 | Entry into a Material Definitive Agreement. |

On

February 18, 2022, Ulanqab Lamb Weston Food Co., Ltd. (“LW Ulanqab”), a limited liability company incorporated

under the laws of the People’s Republic of China (the “PRC”) and a wholly-owned subsidiary of Lamb Weston

Holdings, Inc. (the “Company”), entered into a Facility Agreement (the “Facility Agreement”) with the

financial institutions party thereto and HSBC Bank (China) Company Limited, Shanghai Branch, as the facility agent (the

“Facility Agent”), providing for an RMB 1,079,000,000 (approximately USD 170,579,110 equivalent as of February 18,

2022 based on prevailing exchange rates on that date) term loan facility (the “Term Loan Facility”). The Term Loan

Facility will be used for fixed asset investments in the PRC and matures on February 18, 2027.

Borrowings

under the Term Loan Facility may be made through and including February 18, 2024 (the “Initial Availability Period”);

provided, that, if LW Ulanqab has borrowed a principal amount equal to at least 50% of the commitments available under the Term Loan Facility

by the Initial Availability Period, additional borrowings may be made through and including February 18, 2025. Borrowings under the

Facility Agreement bear interest at the prime rate for five-year loans published by the PRC National Interbank Funding Center plus 0.30%.

The Term Loan Facility requires amortization repayments, commencing on the earlier of (x) the date that is 36 months after the initial

borrowing or (y) the date that is 6 months after the completed Project (as defined in the Facility Agreement) begins to generate cash

flow, and in quarterly installments thereafter beginning on the date that is 39 months after the initial borrowing, with the remaining

principal balance payable on the maturity date (in each case, subject to adjustment for prepayments). LW Ulanqab’s payment obligations

under the Term Loan Facility are unconditionally guaranteed by the Company.

The Term Loan Facility contains

covenants that are standard for credit facilities originated in the PRC, including, among others, covenants with regards to mergers and

consolidations and asset sales, and is subject to acceleration upon various events of default, including, among others, the failure to

observe certain stated covenants under the Term Loan Facility, the acceleration of the Company’s obligations under its senior secured

credit facility with Bank of America, N.A. and certain bankruptcy related events.

General

The Facility Agreement is prepared in Chinese and English, with the

Chinese version of the agreement prevailing in the event of any conflicts between the translations. A copy of the English version of the

Facility Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The

description above is a summary of the Facility Agreement, does not purport to be complete, and is qualified in its entirety by the complete

text of the Facility Agreement.

Certain of the agents and lenders and their affiliates perform various

financial advisory, investment banking and commercial banking services from time to time for the Company and its affiliates for which

they have received customary fees and compensation for these transactions and may in the future receive customary fees and compensation.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth above in Item 1.01 is hereby incorporated

by reference into this Item 2.03.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LAMB WESTON HOLDINGS, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Eryk J. Spytek |

| |

|

Name: Eryk J. Spytek |

| |

|

Title: Senior Vice President, General Counsel and Chief Compliance Officer |

Date: February 22, 2022

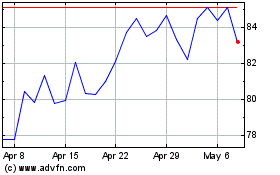

Lamb Weston (NYSE:LW)

Historical Stock Chart

From Jun 2024 to Jul 2024

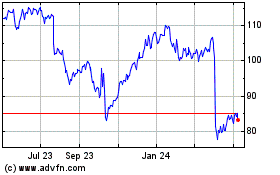

Lamb Weston (NYSE:LW)

Historical Stock Chart

From Jul 2023 to Jul 2024