Ladder Capital Corp (NYSE: LADR) (“we,” “our,” “Ladder,” or the

“Company”) today announced operating results for the quarter ended

June 30, 2024. GAAP income before taxes for the three months ended

June 30, 2024 was $31.0 million, and diluted earnings per share

(“EPS”) was $0.26. Distributable earnings was $40.4 million, or

$0.31 of distributable EPS.

“We are pleased with Ladder’s second quarter results, as we

generated strong returns with low leverage and a large cash

position. We were also pleased with the execution of our seventh

unsecured corporate bond issuance and the resulting positive

actions received from all three rating agencies, moving Ladder one

step closer to an investment grade credit rating. With our balance

sheet further strengthened, we are well-positioned to capitalize on

investment opportunities as they arise.” said Brian Harris,

Ladder’s Chief Executive Officer.

Supplemental

The Company issued a supplemental presentation detailing its

second quarter 2024 operating results, which can be viewed at

http://ir.laddercapital.com.

Conference Call and

Webcast

We will host a conference call on Thursday, July 25, 2024 at

10:00 a.m. Eastern Time to discuss second quarter 2024 results. The

conference call can be accessed by dialing (877) 407-4018 domestic

or (201) 689-8471 international. Individuals who dial in will be

asked to identify themselves and their affiliations. For those

unable to participate, an audio replay will be available until

midnight on Thursday, August 8, 2024. To access the replay, please

call (844) 512-2921 domestic or (412) 317-6671 international,

access code 13747656. The conference call will also be webcast

though a link on Ladder Capital Corp’s Investor Relations website

at ir.laddercapital.com/event. A web-based archive of the

conference call will also be available at the above website.

About Ladder

Ladder Capital Corp is an internally-managed commercial real

estate investment trust with $5.0 billion of assets as of June 30,

2024. Our investment objective is to preserve and protect

shareholder capital while producing attractive risk-adjusted

returns. As one of the nation’s leading commercial real estate

capital providers, we specialize in underwriting commercial real

estate and offering flexible capital solutions within a

sophisticated platform.

Ladder originates and invests in a diverse portfolio of

commercial real estate and real estate-related assets, focusing on

senior secured assets. Our investment activities include: (i) our

primary business of originating senior first mortgage fixed and

floating rate loans collateralized by commercial real estate with

flexible loan structures; (ii) owning and operating commercial real

estate, including net leased commercial properties; and (iii)

investing in investment grade securities secured by first mortgage

loans on commercial real estate.

Founded in 2008, Ladder is run by a highly experienced

management team with extensive expertise in all aspects of the

commercial real estate industry, including origination, credit,

underwriting, structuring, capital markets and asset management.

Members of Ladder’s management and board of directors are highly

aligned with the Company’s investors, owning over 11% of the

Company’s equity. Ladder is headquartered in New York City with

regional offices in Miami, Florida and Los Angeles, California.

Forward-Looking

Statements

Certain statements in this release may constitute

“forward-looking” statements. These statements are based on

management’s current opinions, expectations, beliefs, plans,

objectives, assumptions or projections regarding future events or

future results. These forward-looking statements are only

predictions, not historical fact, and involve certain risks and

uncertainties, as well as assumptions. Actual results, levels of

activity, performance, achievements and events could differ

materially from those stated, anticipated or implied by such

forward-looking statements. While Ladder believes that its

assumptions are reasonable, it is very difficult to predict the

impact of known factors, and, of course, it is impossible to

anticipate all factors that could affect actual results on the

Company's business. There are a number of risks and uncertainties

that could cause actual results to differ materially from

forward-looking statements made herein including, most prominently,

the risks discussed under the heading “Risk Factors” in each of the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, as well as its consolidated financial statements, related

notes, and other financial information appearing therein, and its

other filings with the U.S. Securities and Exchange Commission.

Such forward-looking statements are made only as of the date of

this release. Ladder expressly disclaims any obligation or

undertaking to release any updates or revisions to any

forward-looking statements contained herein to reflect any change

in its expectations with regard thereto or changes in events,

conditions, or circumstances on which any such statement is

based.

Ladder Capital Corp

Consolidated Balance Sheets (Dollars in

Thousands)

June 30,

December 31,

2024(1)

2023(1)

(Unaudited)

Assets

Cash and cash equivalents

$

1,195,559

$

1,015,678

Restricted cash

11,921

15,450

Mortgage loan receivables held for

investment, net, at amortized cost:

Mortgage loans receivable

2,539,323

3,155,089

Allowance for credit losses

(54,107

)

(43,165

)

Mortgage loan receivables held for

sale

26,414

26,868

Securities

481,109

485,533

Real estate and related lease intangibles,

net

707,083

726,442

Real estate held for sale

11,455

—

Investments in and advances to

unconsolidated ventures

20,005

6,877

Derivative instruments

757

1,454

Accrued interest receivable

20,946

24,233

Other assets

87,722

98,218

Total assets

$

5,048,187

$

5,512,677

Liabilities and Equity

Liabilities

Debt obligations, net

$

3,378,099

$

3,783,946

Dividends payable

31,206

32,294

Accrued expenses

48,652

65,144

Other liabilities

61,735

99,095

Total liabilities

3,519,692

3,980,479

Commitments and contingencies

—

—

Equity

Class A common stock, par value $0.001 per

share, 600,000,000 shares authorized; 129,883,019 and 128,027,478

shares issued and 127,866,107 and 126,911,689 shares outstanding as

of June 30, 2024 and December 31, 2023, respectively.

128

127

Additional paid-in capital

1,770,275

1,756,750

Treasury stock, 2,016,912 and 1,115,789

shares, at cost

(21,852

)

(12,001

)

Retained earnings (dividends in excess of

earnings)

(207,728

)

(197,875

)

Accumulated other comprehensive income

(loss)

(10,752

)

(13,853

)

Total shareholders’ equity

1,530,071

1,533,148

Noncontrolling interests in consolidated

ventures

(1,576

)

(950

)

Total equity

1,528,495

1,532,198

Total liabilities and equity

$

5,048,187

$

5,512,677

_________________________ (1) Includes amounts relating to

consolidated variable interest entities.

Ladder Capital Corp

Consolidated Statements of Income (Dollars in Thousands,

Except Per Share and Dividend Data) (Unaudited)

Three Months Ended

June 30,

March 31,

2024

2024

Net interest income

Interest income

$

88,516

$

95,912

Interest expense

54,199

58,771

Net interest income (expense)

34,317

37,141

Provision for (release of) loan loss

reserves, net

5,055

5,768

Net interest income (expense) after

provision for (release of) loan loss reserves

29,262

31,373

Other income (loss)

Real estate operating income

26,133

23,887

Net result from mortgage loan receivables

held for sale

(541

)

87

Gain (loss) on real estate, net

12,543

—

Fee and other income

3,638

3,700

Net result from derivative

transactions

617

4,019

Earnings (loss) from investment in

unconsolidated ventures

18

(15

)

Gain on extinguishment of debt

—

177

Total other income (loss)

42,408

31,855

Costs and expenses

Compensation and employee benefits

13,721

20,789

Operating expenses

5,178

4,643

Real estate operating expenses

11,034

9,146

Investment related expenses

2,288

1,993

Depreciation and amortization

8,413

8,302

Total costs and expenses

40,634

44,873

Income (loss) before taxes

31,036

18,355

Income tax expense (benefit)

(1,089

)

1,925

Net income (loss)

32,125

16,430

Net (income) loss attributable to

noncontrolling interests in consolidated ventures

224

179

Net income (loss) attributable to Class

A common shareholders

$

32,349

$

16,609

Earnings per share:

Basic

$

0.26

$

0.13

Diluted

$

0.26

$

0.13

Weighted average shares

outstanding:

Basic

125,730,765

125,315,765

Diluted

125,839,500

125,520,373

Dividends per share of Class A common

stock

$

0.23

$

0.23

Non-GAAP Financial

Measures

During the first quarter of 2024, the Company refined its

definition of distributable earnings and its descriptions of the

adjustments to GAAP income. The refined definition and descriptions

do not change how distributable earnings or adjustments to GAAP

income are calculated for prior, current or future periods. The

Company utilizes distributable earnings, distributable EPS, and

after-tax distributable return on average equity (“ROAE”), non-GAAP

financial measures, as supplemental measures of our operating

performance. We believe distributable earnings, distributable EPS

and after-tax distributable ROAE assist investors in comparing our

operating performance and our ability to pay dividends across

reporting periods on a more relevant and consistent basis by

excluding from GAAP measures certain non-cash expenses and

unrealized results as well as eliminating timing differences

related to conduit securitization gains and changes in the values

of assets and derivatives. In addition, we use distributable

earnings, distributable EPS and after-tax distributable ROAE: (i)

to evaluate our earnings from operations because management

believes that they may be useful performance measures; and (ii)

because our board of directors considers distributable earnings in

determining the amount of quarterly dividends. Distributable EPS is

defined as after-tax distributable earnings divided by the weighted

average diluted shares outstanding during the period.

We define distributable earnings as income before taxes adjusted

for: (i) net (income) loss attributable to noncontrolling interests

in consolidated ventures; (ii) our share of real estate

depreciation, amortization and gain adjustments and (earnings) loss

from investments in unconsolidated ventures in excess of

distributions received; (iii) the impact of derivative gains and

losses related to hedging fair value variability of fixed rate

assets caused by interest rate fluctuations and overall portfolio

market risk as of the end of the specified accounting period; (iv)

economic gains or losses on loan sales, certain of which may not be

recognized under GAAP accounting in consolidation for which risk

has substantially transferred during the period, as well as the

exclusion of the related GAAP economics in subsequent periods; (v)

unrealized gains or losses related to our investments in securities

recorded at fair value in current period earnings; (vi) unrealized

and realized provision for loan losses and real estate impairment;

(vii) non-cash stock-based compensation; and (viii) certain

non-recurring transactional items.

We exclude the effects of our share of real estate depreciation

and amortization. Given GAAP gains and losses on sales of real

estate include the effects of previously-recognized real estate

depreciation and amortization, our adjustment eliminates the

portion of the GAAP gain or loss that is derived from depreciation

and amortization.

Our derivative instruments do not qualify for hedge accounting

under GAAP and, therefore, any net payments under, or fluctuations

in the fair value of derivatives are recognized currently in our

income statement. The Company utilizes derivative instruments to

hedge exposure to interest rate risk associated with fixed rate

mortgage loans, fixed rate securities, and/or overall portfolio

market risks. Distributable earnings excludes the GAAP results from

derivative activity until the associated mortgage loan or security

for which the derivative position is hedging is sold or paid off,

or the hedge position for overall portfolio market risk is closed,

at which point any gain or loss is recognized in distributable

earnings in that period. For derivative activity associated with

securities or mortgage loans held for investment, any hedging gain

or loss is amortized over the expected life of the underlying asset

for distributable earnings. We believe that adjusting for these

specifically identified gains and losses associated with hedging

positions adjusts for timing differences between when we recognize

the gains or losses associated with our assets and the gains and

losses associated with derivatives used to hedge such assets.

We originate conduit loans, which are first mortgage loans on

stabilized, income producing commercial real estate properties that

we intend to sell into third-party CMBS securitizations. Mortgage

loans receivable held for sale are recorded at the lower of cost or

market under GAAP. For purposes of distributable earnings, we

exclude the impact of unrealized lower of cost or market

adjustments on conduit loans held for sale and include the realized

gains or losses in distributable earnings in the period when the

loan is sold. Our conduit business includes mortgage loans made to

third parties and may also include mortgage loans secured by real

estate owned in our real estate segment. Such mortgage loans

receivable secured by real estate owned in our real estate segment

are eliminated in consolidation within our GAAP financial

statements until the loans are sold in a third-party

securitization. Upon the sale of a loan to a third-party

securitization trust (for cash), the related mortgage note payable

is recognized on our GAAP financial statements. For purposes of

distributable earnings, we include adjustments for economic gains

and losses related to the sale of these inter-segment loans for

which risk has substantially transferred during the period and

exclude the resultant GAAP recognition of amortization of any

related premium/discount on such mortgage loans payable recognized

in interest expense during the subsequent periods. This adjustment

is reflected in distributable earnings when there is a true risk

transfer on the mortgage loan sale and settlement. Conversely, if

the economic risk was not substantially transferred, no adjustments

to net income would be made relating to those transactions for

distributable earnings purposes. Management believes recognizing

these amounts for distributable earnings purposes in the period of

transfer of economic risk is a useful supplemental measure of our

performance.

We invest in certain securities that are recorded at fair value

with changes in fair value recorded in current period earnings. For

purposes of distributable earnings, we exclude the impact of

unrealized gains and losses associated with these securities and

include realized gains or losses in connection with any disposition

of securities. Distributable earnings includes declines in fair

value deemed to be an impairment for GAAP purposes if the decline

is determined to be non-recoverable and the loss to be nearly

certain to be eventually realized. In those cases, an impairment is

included in distributable earnings for the period in which such

determination was made.

We include adjustments for unrealized and realized provision for

loan losses and real estate impairment. For purposes of

distributable earnings, management recognizes loan and real estate

losses as being realized generally in the period in which the asset

is sold or the Company determines a decline in value to be

non-recoverable and the loss to be nearly certain.

Set forth below is an unaudited reconciliation of income (loss)

before taxes to distributable earnings, and an unaudited

computation of distributable EPS (in thousands, except per share

data):

Three Months Ended

June 30,

March 31,

2024

2024

Income (loss) before taxes

$

31,036

$

18,355

Net (income) loss attributable to

noncontrolling interests in consolidated ventures

224

179

Our share of real estate depreciation,

amortization and gain adjustments (1)

(1,398

)

7,668

Adjustments for derivative results and

loan sale activity (2)

2,345

8

Unrealized (gain) loss on fair value

securities

19

7

Adjustment for impairment (3)

5,055

5,768

Non-cash stock-based compensation

3,117

10,298

Distributable earnings

40,398

42,283

Estimated corporate tax (expense) benefit

(4)

(1,307

)

(1,162

)

After-tax distributable earnings

$

39,091

$

41,121

Weighted average diluted shares

outstanding

125,840

125,520

Distributable EPS

$

0.31

$

0.33

_________________

(1)

The following is a reconciliation of GAAP depreciation and

amortization to our share of real estate depreciation, amortization

and gain adjustments and (earnings) loss from investment in

unconsolidated ventures in excess of distributions received ($ in

thousands):

Three Months Ended

June 30,

March 31,

2024

2024

Total GAAP depreciation and

amortization

$

8,413

$

8,302

Depreciation and amortization related to

non-rental property fixed assets

(109

)

(110

)

Non-controlling interests in consolidated

ventures’ share of depreciation and amortization

(108

)

(107

)

Our share of operating lease income from

above/below market lease intangible amortization

(430

)

(432

)

Our share of real estate depreciation and

amortization

7,766

7,653

Accumulated depreciation and amortization

on real estate sold (a)

(9,146

)

—

Adjustment for (earnings) loss from

investments in unconsolidated ventures in excess of distributions

received

(18

)

15

Our share of real estate depreciation,

amortization and gain adjustments

$

(1,398

)

$

7,668

(a)

GAAP gains/losses on sales of real estate

include the effects of previously-recognized real estate

depreciation and amortization. For purposes of distributable

earnings, our share of real estate depreciation and amortization is

eliminated and, accordingly, the resultant gains/losses also must

be adjusted. The following is a reconciliation of the related

consolidated GAAP amounts to the amounts reflected in distributable

earnings ($ in thousands):

Three Months Ended

June 30,

March 31,

2024

2024

GAAP realized gain/loss on sale of real

estate, net

$

12,543

$

—

Adjusted gain/loss on sale of real estate

for purposes of distributable earnings

(3,397

)

—

Accumulated depreciation and

amortization on real estate sold

$

9,146

$

—

(2)

The following is a reconciliation of GAAP

net results from derivative transactions to our adjustments for

derivative results and loan sale activity within distributable

earnings ($ in thousands):

Three Months Ended

June 30,

March 31,

2024

2024

GAAP net results from derivative

transactions

$

(617

)

$

(4,019

)

Realized results of loan sales, net (a)

(b)

1,558

1,496

Unrealized lower of cost or market

adjustments related to loans held for sale

541

(87

)

Amortization of premium on mortgage loan

financing included in interest expense (b)

(190

)

(151

)

Recognized derivative results

1,053

2,769

Adjustments for derivative results and

loan sale activity

$

2,345

$

8

__________________ (a)

Includes realized gains from sales of

conduit mortgage loans collateralized by net lease properties in

our real estate segment of $1.8 million and $0.9 million and net

hedge related gain (loss) on such mortgage loan sales of $(0.2)

million and $0.6 million, for the three months ended June 30, 2024

and March 31, 2024, respectively.

(b)

Prior to the first quarter of 2024, the

Company presented these adjustments within “Adjustment for economic

gain on loan sales not recognized under GAAP for which risk has

been substantially transferred, net of reversal/amortization.”

(3)

The adjustment reflects the portion of the

loan loss provision that management determined to be recoverable.

Additional provisions and releases of those provisions are excluded

from distributable earnings as a result.

(4)

Estimated corporate tax benefit (expense)

is based on an effective tax rate applied to distributable earnings

generated by the activity within our taxable REIT subsidiaries.

After-tax distributable ROAE is presented on an annualized basis

and is defined as after-tax distributable earnings divided by the

average total shareholders’ equity during the period. Set forth

below is an unaudited computation of after-tax distributable ROAE

($ in thousands):

Three Months Ended

June 30,

March 31,

2024

2024

After-tax distributable earnings

$

39,091

$

41,121

Average shareholders’ equity

1,527,643

1,529,181

After-tax distributable ROAE

10.2

%

10.8

%

Non-GAAP Measures -

Limitations

Our non-GAAP financial measures have limitations as analytical

tools. Some of these limitations are:

- distributable earnings, distributable EPS and after-tax

distributable ROAE do not reflect the impact of certain cash

charges resulting from matters we consider not to be indicative of

our ongoing operations and are not necessarily indicative of cash

necessary to fund cash needs;

- distributable EPS and after-tax distributable ROAE are based on

a non-GAAP estimate of our effective tax rate, including the impact

of Unincorporated Business Tax and the impact of our election to be

taxed as a REIT effective January 1, 2015. Our actual tax rate may

differ materially from this estimate; and

- other companies in our industry may calculate non-GAAP

financial measures differently than we do, limiting their

usefulness as comparative measures.

Because of these limitations, our non-GAAP financial measures

should not be considered in isolation or as a substitute for net

income (loss) attributable to shareholders, earnings per share or

book value per share, or any other performance measures calculated

in accordance with GAAP. Our non-GAAP financial measures should not

be considered an alternative to cash flows from operations as a

measure of our liquidity.

In addition, distributable earnings should not be considered to

be the equivalent to REIT taxable income calculated to determine

the minimum amount of dividends the Company is required to

distribute to shareholders to maintain REIT status. In order for

the Company to maintain its qualification as a REIT under the

Internal Revenue Code, we must annually distribute at least 90% of

our REIT taxable income. The Company has declared, and intends to

continue declaring, regular quarterly distributions to its

shareholders in an amount approximating the REIT’s net taxable

income.

In the future, we may incur gains and losses that are the same

as or similar to some of the adjustments in this presentation. Our

presentation of non-GAAP financial measures should not be construed

as an inference that our future results will be unaffected by

unusual or non-recurring items.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725826410/en/

Investor Contact Ladder

Capital Corp Investor Relations (917) 369-3207

investor.relations@laddercapital.com

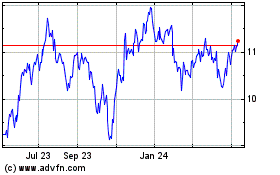

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Nov 2024 to Dec 2024

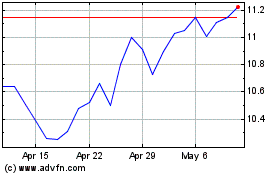

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Dec 2023 to Dec 2024