false

0001509991

0001509991

2024-09-10

2024-09-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 10, 2024

KOSMOS ENERGY LTD.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-35167 |

|

98-0686001 |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

|

|

|

8176 Park Lane

Dallas, Texas |

|

|

|

75231 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including

area code: +1 214 445 9600

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 Par Value |

|

KOS |

|

New York Stock Exchange

London Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

On September 10, 2024, the Company announced that it has priced an

offering of $500,000,000 aggregate principal amount of its 8.750% senior notes due 2031 (the “New Notes”). The offering is

expected to close on September 24, 2024, subject to customary closing conditions.

The Company intends to use the net proceeds from

the offering of the New Notes, together with cash on hand, to fund the tender offers for a portion of its 7.125% Senior Notes due 2026,

7.750% Senior Notes due 2027 and 7.500% Senior Notes due 2028 and to pay any related premiums, fees and expenses.

The New Notes have not been and will not be registered

under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and may not be offered

or sold in the United States absent registration or an applicable exemption from registration under the Securities Act or any applicable

state securities or blue sky laws. The New Notes will be offered only to persons reasonably believed to be qualified institutional buyers

under Rule 144A under the Securities Act and outside the United States, to non-U.S. persons in compliance with Regulation S under the

Securities Act.

A copy of the press releases announcing the pricing

of the New Notes is attached hereto as Exhibits 99.1 and is incorporated herein by reference.

This report is neither an offer to sell nor a

solicitation of an offer to buy the New Notes or any other securities, and it does not constitute an offer to purchase or a solicitation

to sell any notes subject to the tender offers or any other securities or a conditional notice of partial redemption with respect to any

securities. This report shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, the New Notes or any

other securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

| |

Item 9.01 |

Financial Statements and Other Exhibits |

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 10, 2024

| |

KOSMOS ENERGY LTD. |

| |

|

|

| |

|

|

| |

By: |

/s/ Neal D. Shah |

| |

|

Neal D. Shah |

| |

|

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

KOSMOS ENERGY ANNOUNCES PRICING OF $500 MILLION

OF SENIOR NOTES DUE 2031

DALLAS--September 10, 2024 –

Kosmos Energy Ltd. (“Kosmos”) (NYSE/LSE: KOS) announced today the pricing of $500 million aggregate principal amount of its

8.750% senior notes due 2031. The offering is expected to close on September 24, 2024, subject to customary closing conditions. Kosmos

intends to use the net proceeds from the offering, together with cash on hand, to fund the tender offers for a portion of its 7.125%

Senior Notes due 2026, 7.750% Senior Notes due 2027 and 7.500% Senior Notes due 2028 and to pay any related premiums, fees and expenses.

The senior notes offered have not been

and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws,

and the securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state securities or blue sky laws. The senior notes were offered only to persons reasonably

believed to be qualified institutional buyers in reliance on the exemption from registration set forth in Rule 144A under the Securities

Act, and outside the United States, to non-U.S. persons in reliance on the exemption from registration set forth in Regulation S under

the Securities Act.

This press release is being issued pursuant

to, and in accordance with, Rule 135c under the Securities Act, and is neither an offer to sell nor a solicitation of an offer to buy

the senior notes or any other securities, and it does not constitute an offer to purchase or a solicitation to sell any notes subject

to the tender offers or any other securities or a conditional notice of partial redemption with respect to any securities. This press

release shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, the senior notes or any other securities

in any jurisdiction in which such offer, solicitation or sale is unlawful.

About Kosmos

Energy

Kosmos is a full-cycle,

deepwater, independent oil and gas exploration and production company focused along the offshore Atlantic Margins. Our key assets include

production offshore Ghana, Equatorial Guinea and the U.S. Gulf of Mexico, as well as world-class gas projects offshore Mauritania and

Senegal. We also pursue a proven basin exploration program in Equatorial Guinea and the U.S. Gulf of Mexico. Kosmos is listed on the

NYSE and LSE and is traded under the ticker symbol KOS. Kosmos is engaged in a single line of business, which is the exploration, development,

and production of oil and natural gas. Substantially all of our long-lived assets and all of our product sales are related to operations

in four geographic areas: Ghana, Equatorial Guinea, Mauritania/Senegal and the U.S. Gulf of Mexico.

Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements, other than statements of historical facts, included in this press release that address activities, events or developments

that Kosmos expects, believes or anticipates will or may occur in the future are forward-looking statements. Kosmos’ estimates

and forward-looking statements are mainly based on its current expectations and estimates of future events and trends, which affect or

may affect its businesses and operations. Although Kosmos believes that these estimates and forward-looking statements are based upon

reasonable assumptions, they are subject to several risks and uncertainties and are made in light of information currently available

to Kosmos. When used in this press release, the words “anticipate,” “believe,” “intend,” “expect,”

“plan,” “will,” “may,” “potential” or other similar words are intended to identify forward-looking

statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of

Kosmos, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Further

information on such assumptions, risks and uncertainties is available in Kosmos’ Securities and Exchange Commission filings. Kosmos

undertakes no obligation and does not intend to update or correct these forward-looking statements to reflect events or circumstances

occurring after the date of this press release, except as required by applicable law. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified

in their entirety by this cautionary statement.

European Economic Area and United

Kingdom Notices

Financial Conduct Authority (FCA)

stabilization rules apply.

MiFIR professionals / ECPs only /

No PRIIPs / UK PRIIPs KID - Manufacturer target market (MiFID II product governance) is eligible counterparties and professional clients

only (all distribution channels). No PRIIPs regulation key information document (KID) has been prepared as the notes are not available

to retail investors in the EEA or the United Kingdom.

Source: Kosmos Energy Ltd.

Investor Relations

Jamie Buckland

+44 (0) 203 954 2831

jbuckland@kosmosenergy.com

or

Media Relations

Thomas Golembeski

+1-214-445-9674

tgolembeski@kosmosenergy.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

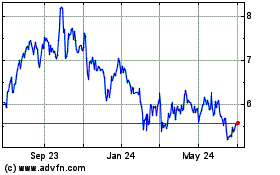

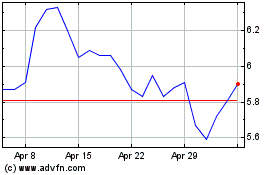

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Dec 2023 to Dec 2024