Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

March 11 2024 - 3:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or

15d-16

under the Securities Exchange Act of 1934

For the Month of March 2024

Commission File Number 001-13372

KOREA ELECTRIC POWER CORPORATION

(Translation of registrant’s name into English)

55 Jeollyeok-ro, Naju-si, Jeollanam-do, 58322, Korea

(Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Korea Electric Power Corporation (“KEPCO”) hereby calls the annual ordinary general meeting of

shareholders (“AGM”) and seeks the attendance of its shareholders.

The following is an English translation of the notice given to the

shareholders in connection with the AGM:

To: Shareholders

From: Kim, Dong-Cheol, President & CEO of KEPCO

We

hereby call the fiscal year 2023 AGM pursuant to Article 18 of the Articles of Incorporation of KEPCO as follows and seek your attendance. Pursuant to Article 542-4 of the Commercial Act, this notice shall be

in lieu of notices to be given to the shareholders.

| |

1. |

Date / Time: March 26, 2024 / 11:00 a.m. (Seoul Time) |

| |

2. |

Location: 55 Jeollyeok-ro,

Naju-si, Jeollanam-do, 58322, Korea |

KEPCO Headquarters

| |

2) |

Management report on KEPCO’s operation |

| |

3) |

Operation report on internal accounting control system |

| |

4. |

Agendas for Shareholder Approval: |

| |

1) |

Approval of financial statements for the fiscal year 2023 |

| |

2) |

Approval of the ceiling amount of remuneration for directors in 2024 |

| |

ø |

Details on the proposed agenda for the AGM are attached. |

| * |

KEPCO will disclose its audit report on March 11, 2024 on the SEC and its webpage

(https://www.kepco.co.kr). Business report in Korean will be disclosed on March 18, 2024, through Data Analysis, Retrieval and Transfer System (“DART”) of the Financial Supervisory Service. Business report in Korean shall be changed after

the AGM or revised to correct any miswriting. KEPCO will disclose the revised report on DART if there is any amendment. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| By: |

|

/s/ Park, WooGun |

| Name: |

|

Park, WooGun |

| Title: |

|

Vice President |

Date: March 11, 2024

Attachment

Agenda 1. Approval of Financial Statements for the Fiscal Year 2023

KEPCO seeks to obtain approval for its consolidated financial statements, separate financial statements and accompanying documents for the fiscal year 2023,

pursuant to Article 449 of the Commercial Act, Article 43 of the Act on the Management of Public Institutions and Article 50 of the Articles of Incorporation of KEPCO.

Disclaimer: The financial statements for the fiscal year 2023 as presented below is in accordance with the International Financial Reporting Standard adopted

in Korea (K-IFRS), and are subject to shareholders’ approval.

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Financial Position

As of

December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| In millions of won |

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

W |

|

|

|

|

3,234,780 |

|

| Current financial assets, net |

|

|

3,107,397 |

|

|

|

4,286,975 |

|

| Trade and other receivables, net |

|

|

11,985,735 |

|

|

|

10,461,822 |

|

| Inventories, net |

|

|

8,875,615 |

|

|

|

9,930,732 |

|

| Income tax receivables |

|

|

69,612 |

|

|

|

46,619 |

|

| Current non-financial assets |

|

|

1,109,321 |

|

|

|

1,744,869 |

|

| Assets

held-for-sale |

|

|

45,648 |

|

|

|

44,748 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

29,536,215 |

|

|

|

29,750,545 |

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

| Non-current financial assets, net |

|

|

3,546,214 |

|

|

|

3,336,835 |

|

| Non-current trade and other receivables, net |

|

|

2,193,587 |

|

|

|

2,153,080 |

|

| Property, plant and equipment, net |

|

|

179,875,535 |

|

|

|

177,865,308 |

|

| Investment properties, net |

|

|

185,527 |

|

|

|

208,286 |

|

| Goodwill |

|

|

99,156 |

|

|

|

100,093 |

|

| Intangible assets other than goodwill, net |

|

|

1,033,984 |

|

|

|

956,664 |

|

| Investments in associates |

|

|

6,176,889 |

|

|

|

5,844,464 |

|

| Investments in joint ventures |

|

|

3,485,699 |

|

|

|

3,147,584 |

|

| Defined benefit assets, net |

|

|

70,187 |

|

|

|

198,626 |

|

| Deferred tax assets |

|

|

13,161,802 |

|

|

|

10,934,375 |

|

| Non-current

non-financial assets |

|

|

350,170 |

|

|

|

309,134 |

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

210,178,750 |

|

|

|

205,054,449 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

W |

|

|

|

|

234,804,994 |

|

|

|

|

|

|

|

|

|

|

(Continued)

1

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Financial Position, Continued

As

of December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| In millions of won |

|

2023 |

|

|

2022 |

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Trade and other payables, net |

|

W |

|

|

|

|

11,983,549 |

|

| Current financial liabilities, net |

|

|

41,139,726 |

|

|

|

22,703,996 |

|

| Income tax payables |

|

|

482,934 |

|

|

|

429,604 |

|

| Current non-financial liabilities |

|

|

7,881,663 |

|

|

|

6,974,377 |

|

| Current provisions |

|

|

2,654,125 |

|

|

|

2,427,051 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

61,248,421 |

|

|

|

44,518,577 |

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

| Non-current trade and other payables, net |

|

|

4,981,957 |

|

|

|

5,638,914 |

|

| Non-current financial liabilities, net |

|

|

92,944,338 |

|

|

|

98,334,120 |

|

| Non-current

non-financial liabilities |

|

|

11,196,000 |

|

|

|

10,662,661 |

|

| Employee benefits liabilities, net |

|

|

1,035,320 |

|

|

|

828,721 |

|

| Deferred tax liabilities |

|

|

5,163,135 |

|

|

|

6,457,103 |

|

| Non-current provisions |

|

|

25,881,044 |

|

|

|

26,364,642 |

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

141,201,794 |

|

|

|

148,286,161 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

W |

|

|

|

|

192,804,738 |

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Contributed capital |

|

|

|

|

| Share capital |

|

W |

|

|

|

|

3,209,820 |

|

| Share premium |

|

|

843,758 |

|

|

|

843,758 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4,053,578 |

|

|

|

4,053,578 |

|

|

|

|

|

|

|

|

|

|

| Retained earnings |

|

|

|

|

|

|

|

|

| Legal reserves |

|

|

1,604,910 |

|

|

|

1,604,910 |

|

| Voluntary reserves |

|

|

2,812,313 |

|

|

|

27,782,969 |

|

| Unappropriated retained earnings (Undisposed accumulated deficits) |

|

|

11,921,039 |

|

|

|

(7,956,579 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

16,338,262 |

|

|

|

21,431,300 |

|

|

|

|

|

|

|

|

|

|

| Other components of equity |

|

|

|

|

|

|

|

|

| Other capital surplus |

|

|

1,600,801 |

|

|

|

1,268,569 |

|

| Accumulated other comprehensive income |

|

|

557,430 |

|

|

|

496,976 |

|

| Other equity |

|

|

13,294,972 |

|

|

|

13,294,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

15,453,203 |

|

|

|

15,060,518 |

|

|

|

|

|

|

|

|

|

|

| Equity attributable to owners of the controlling company |

|

|

35,845,043 |

|

|

|

40,545,396 |

|

| Non-controlling interests |

|

|

1,419,707 |

|

|

|

1,454,860 |

|

|

|

|

|

|

|

|

|

|

| Total Equity |

|

W |

|

|

|

|

42,000,256 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

|

W |

|

|

|

|

234,804,994 |

|

|

|

|

|

|

|

|

|

|

2

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss)

For

each of the two years in the period ended December 31, 2023

|

|

|

|

|

|

|

|

|

| In millions of won, except per share information |

|

2023 |

|

|

2022 |

|

| Sales |

|

|

|

|

|

|

|

|

| Sales of goods |

|

W |

|

|

|

|

69,184,469 |

|

| Sales of services |

|

|

750,878 |

|

|

|

714,602 |

|

| Sales of construction services |

|

|

785,395 |

|

|

|

646,953 |

|

| Revenue related to transfer of assets from customers |

|

|

743,051 |

|

|

|

711,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

88,219,461 |

|

|

|

71,257,863 |

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

|

|

|

|

|

|

| Cost of sales of goods |

|

|

(88,066,120 |

) |

|

|

(99,441,768 |

) |

| Cost of sales of services |

|

|

(629,806 |

) |

|

|

(520,572 |

) |

| Cost of sales of construction services |

|

|

(1,003,601 |

) |

|

|

(941,254 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

(89,699,527 |

) |

|

|

(100,903,594 |

) |

|

|

|

|

|

|

|

|

|

| Gross loss |

|

|

(1,480,066 |

) |

|

|

(29,645,731 |

) |

| Selling and administrative expenses |

|

|

(3,061,582 |

) |

|

|

(3,009,422 |

) |

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(4,541,648 |

) |

|

|

(32,655,153 |

) |

| Other income |

|

|

532,851 |

|

|

|

383,650 |

|

| Other expenses |

|

|

(258,905 |

) |

|

|

(212,150 |

) |

| Other gains, net |

|

|

22,686 |

|

|

|

243,122 |

|

| Finance income |

|

|

1,425,031 |

|

|

|

1,833,312 |

|

| Finance expenses |

|

|

(5,347,018 |

) |

|

|

(4,746,791 |

) |

| Profit (loss) related to associates, joint ventures and subsidiaries |

|

|

|

|

|

|

|

|

| Gain on valuation of investments in associates and joint ventures |

|

|

804,141 |

|

|

|

1,393,486 |

|

| Gain on disposal of investments in associates and joint ventures |

|

|

18,204 |

|

|

|

11,091 |

|

| Reversal of impairment loss on investments in associates and joint ventures |

|

|

347 |

|

|

|

— |

|

| Gain on disposal of investments in subsidiaries |

|

|

2 |

|

|

|

— |

|

| Loss on valuation of investments in associates and joint ventures |

|

|

(209,085 |

) |

|

|

(55,193 |

) |

| Loss on disposal of investments in associates and joint ventures |

|

|

— |

|

|

|

(1,675 |

) |

| Loss on impairment of investments in associates and joint ventures |

|

|

(19 |

) |

|

|

(5,174 |

) |

| Loss on disposal of investments in subsidiaries |

|

|

(564 |

) |

|

|

(32,144 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

613,026 |

|

|

|

1,310,391 |

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

(7,553,977 |

) |

|

|

(33,843,619 |

) |

| Income tax benefit |

|

|

2,837,833 |

|

|

|

9,414,511 |

|

|

|

|

|

|

|

|

|

|

| Loss for the year |

|

W |

|

|

|

|

(24,429,108 |

) |

(Continued)

3

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss), Continued

For each of the two years in the period ended December 31, 2023

|

|

|

|

|

|

|

|

|

| In millions of won, except per share information |

|

2023 |

|

|

2022 |

|

| Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|

|

| Items that will not be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

| Remeasurement of defined benefit liability |

|

W |

|

|

|

|

663,095 |

|

| Share in other comprehensive income of associates and joint ventures (loss) |

|

|

(27,349 |

) |

|

|

12,305 |

|

| Net change in fair value of equity investments at fair value through other comprehensive income

(loss) |

|

|

(31,665 |

) |

|

|

58,010 |

|

| Items that are or may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

| Net change in the unrealized fair value of derivatives using cash flow hedge accounting |

|

|

(3,654 |

) |

|

|

(24,415 |

) |

| Foreign currency translation of foreign operations |

|

|

(17,274 |

) |

|

|

28,387 |

|

| Share in other comprehensive income of associates and joint ventures |

|

|

122,994 |

|

|

|

509,487 |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) for the year |

|

|

(228,672 |

) |

|

|

1,246,869 |

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the year |

|

W |

|

|

|

|

(23,182,239 |

) |

|

|

|

|

|

|

|

|

|

| Profit (loss) attributable to: |

|

|

|

|

|

|

|

|

| Owners of the controlling company |

|

W |

|

|

|

|

(24,466,853 |

) |

| Non-controlling interests |

|

|

106,405 |

|

|

|

37,745 |

|

|

|

|

|

|

|

|

|

|

|

|

W |

|

|

|

|

(24,429,108 |

) |

|

|

|

|

|

|

|

|

|

| Total comprehensive income (loss) attributable to: |

|

|

|

|

|

|

|

|

| Owners of the controlling company |

|

W |

|

|

|

|

(23,273,171 |

) |

| Non-controlling interests |

|

|

87,768 |

|

|

|

90,932 |

|

|

|

|

|

|

|

|

|

|

|

|

W |

|

|

|

|

(23,182,239 |

) |

|

|

|

|

|

|

|

|

|

| Loss per share (in won) |

|

|

|

|

|

|

|

|

| Basic and diluted loss per share |

|

W |

|

|

|

|

(38,112 |

) |

4

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Changes in Equity

For each of the

two years in the period ended December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions of won |

|

Equity attributable to owners of the controlling company |

|

|

Non-

controlling

interests |

|

|

|

|

| |

|

Contributed

capital |

|

|

Retained

earnings |

|

|

Other

components

of equity |

|

|

Subtotal |

|

|

Total

equity |

|

| Balance as of January 1, 2022 |

|

W |

|

|

|

|

45,258,244 |

|

|

|

14,468,450 |

|

|

|

63,780,272 |

|

|

|

1,546,434 |

|

|

|

65,326,706 |

|

| Total comprehensive income (loss) for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (Loss) for the period |

|

|

— |

|

|

|

(24,466,853 |

) |

|

|

— |

|

|

|

(24,466,853 |

) |

|

|

37,745 |

|

|

|

(24,429,108 |

) |

| Items that will not be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Remeasurement of defined benefit liability, net of tax |

|

|

— |

|

|

|

626,769 |

|

|

|

— |

|

|

|

626,769 |

|

|

|

36,326 |

|

|

|

663,095 |

|

| Share of other comprehensive income of associates and joint ventures, net of tax |

|

|

— |

|

|

|

12,305 |

|

|

|

— |

|

|

|

12,305 |

|

|

|

— |

|

|

|

12,305 |

|

| Net change in fair value of financial assets at fair value through other comprehensive income, net

of tax |

|

|

— |

|

|

|

— |

|

|

|

58,008 |

|

|

|

58,008 |

|

|

|

2 |

|

|

|

58,010 |

|

| Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in the unrealized fair value of derivatives using cash flow hedge accounting, net of

tax |

|

|

— |

|

|

|

— |

|

|

|

(32,437 |

) |

|

|

(32,437 |

) |

|

|

8,022 |

|

|

|

(24,415 |

) |

| Foreign currency translation of foreign operations, net of tax |

|

|

— |

|

|

|

— |

|

|

|

19,550 |

|

|

|

19,550 |

|

|

|

8,837 |

|

|

|

28,387 |

|

| Share of other comprehensive income of associates and joint ventures, net of tax |

|

|

— |

|

|

|

— |

|

|

|

509,487 |

|

|

|

509,487 |

|

|

|

— |

|

|

|

509,487 |

|

| Transactions with owners of the Group, recognized directly in equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(42,344 |

) |

|

|

(42,344 |

) |

| Issuance of shares of capital by subsidiaries and others |

|

|

— |

|

|

|

835 |

|

|

|

39,641 |

|

|

|

40,476 |

|

|

|

86,316 |

|

|

|

126,792 |

|

| Transactions between consolidated entities |

|

|

— |

|

|

|

— |

|

|

|

(1,584 |

) |

|

|

(1,584 |

) |

|

|

(75,791 |

) |

|

|

(77,375 |

) |

| Changes in consolidation scope |

|

|

— |

|

|

|

— |

|

|

|

(597 |

) |

|

|

(597 |

) |

|

|

32,311 |

|

|

|

31,714 |

|

| Dividends paid for hybrid bonds |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13,461 |

) |

|

|

(13,461 |

) |

| Repayment of hybrid bond |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(169,537 |

) |

|

|

(169,537 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of December 31, 2022 |

|

W |

|

|

|

|

21,431,300 |

|

|

|

15,060,518 |

|

|

|

40,545,396 |

|

|

|

1,454,860 |

|

|

|

42,000,256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Continued)

5

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Changes in Equity, Continued

For

each of the two years in the period ended December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions of won |

|

Equity attributable to owners of the controlling company |

|

|

Non-

controlling

interests |

|

|

|

|

| |

|

Contributed

capital |

|

|

Retained

earnings |

|

|

Other

components

of equity |

|

|

Subtotal |

|

|

Total

equity |

|

| Balance as of January 1, 2023 |

|

W |

|

|

|

|

21,431,300 |

|

|

|

15,060,518 |

|

|

|

40,545,396 |

|

|

|

1,454,860 |

|

|

|

42,000,256 |

|

| Total comprehensive income (loss) for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (Loss) for the period |

|

|

— |

|

|

|

(4,822,549 |

) |

|

|

— |

|

|

|

(4,822,549 |

) |

|

|

106,405 |

|

|

|

(4,716,144 |

) |

| Items that will not be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Remeasurement of defined benefit liability, net of tax |

|

|

— |

|

|

|

(242,987 |

) |

|

|

— |

|

|

|

(242,987 |

) |

|

|

(28,737 |

) |

|

|

(271,724 |

) |

| Share of other comprehensive (loss) of associates and joint ventures, net of tax |

|

|

— |

|

|

|

(27,349 |

) |

|

|

— |

|

|

|

(27,349 |

) |

|

|

— |

|

|

|

(27,349 |

) |

| Net change in fair value of financial assets at fair value through other comprehensive (loss), net

of tax |

|

|

— |

|

|

|

— |

|

|

|

(31,665 |

) |

|

|

(31,665 |

) |

|

|

— |

|

|

|

(31,665 |

) |

| Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in the unrealized fair value of derivatives using cash flow hedge accounting, net of

tax |

|

|

— |

|

|

|

— |

|

|

|

(5,078 |

) |

|

|

(5,078 |

) |

|

|

1,424 |

|

|

|

(3,654 |

) |

| Foreign currency translation of foreign operations, net of tax |

|

|

— |

|

|

|

— |

|

|

|

(25,950 |

) |

|

|

(25,950 |

) |

|

|

8,676 |

|

|

|

(17,274 |

) |

| Share of other comprehensive income of associates and joint ventures, net of tax |

|

|

— |

|

|

|

— |

|

|

|

122,994 |

|

|

|

122,994 |

|

|

|

— |

|

|

|

122,994 |

|

| Transactions with owners of the Group, recognized directly in equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(45,322 |

) |

|

|

(45,322 |

) |

| Issuance of shares of capital by subsidiaries and others |

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

6,024 |

|

|

|

6,023 |

|

| Transactions between consolidated entities |

|

|

— |

|

|

|

— |

|

|

|

332,280 |

|

|

|

332,280 |

|

|

|

(73,795 |

) |

|

|

258,485 |

|

| Changes in consolidation scope |

|

|

— |

|

|

|

— |

|

|

|

(48 |

) |

|

|

(48 |

) |

|

|

384 |

|

|

|

336 |

|

| Dividends paid for hybrid bonds |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,212 |

) |

|

|

(10,212 |

) |

| Others |

|

|

— |

|

|

|

(153 |

) |

|

|

153 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of December 31, 2023 |

|

W |

|

|

|

|

16,338,262 |

|

|

|

15,453,203 |

|

|

|

35,845,043 |

|

|

|

1,419,707 |

|

|

|

37,264,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Cash Flows

For each of the two

years in the period ended December 31, 2023

|

|

|

|

|

|

|

|

|

| In millions of won |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Loss for the year |

|

W |

|

|

|

|

(24,429,108 |

) |

|

|

|

|

|

|

|

|

|

| Adjustments to reconcile profit (loss) for the period to net cash

provided by operating activities: |

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

(2,837,833 |

) |

|

|

(9,414,511 |

) |

| Depreciation |

|

|

12,869,089 |

|

|

|

12,305,252 |

|

| Amortization |

|

|

163,174 |

|

|

|

156,160 |

|

| Retirement benefit expenses |

|

|

358,730 |

|

|

|

485,700 |

|

| Bad debt expense |

|

|

101,550 |

|

|

|

29,997 |

|

| Interest expense |

|

|

4,451,659 |

|

|

|

2,818,546 |

|

| Loss on disposal of financial assets |

|

|

1 |

|

|

|

1,841 |

|

| Loss on disposal of property, plant and equipment |

|

|

98,120 |

|

|

|

100,066 |

|

| Loss on abandonment of property, plant and equipment |

|

|

196,697 |

|

|

|

160,909 |

|

| (Reversal of) Loss on impairment of property, plant and equipment |

|

|

17,031 |

|

|

|

(97,425 |

) |

| Loss on impairment of intangible assets |

|

|

2,865 |

|

|

|

164 |

|

| Loss on disposal of intangible assets |

|

|

71 |

|

|

|

116 |

|

| Increase in provisions |

|

|

1,611,082 |

|

|

|

2,146,979 |

|

| Loss on foreign currency translation, net |

|

|

363,659 |

|

|

|

523,285 |

|

| Gain on valuation of financial assets at fair value through profit or loss |

|

|

(152,322 |

) |

|

|

(7,099 |

) |

| Loss on valuation of financial assets at fair value through profit or loss |

|

|

24,015 |

|

|

|

44,329 |

|

| Gain on valuation and transaction of derivative instruments, net |

|

|

(323,858 |

) |

|

|

(448,903 |

) |

| Gain on valuation of investments in associates and joint ventures, net |

|

|

(595,056 |

) |

|

|

(1,338,293 |

) |

| Gain on disposal of financial assets |

|

|

(13,162 |

) |

|

|

(11,199 |

) |

| Gain on disposal of property, plant and equipment |

|

|

(32,196 |

) |

|

|

(148,667 |

) |

| Gain on disposal of intangible assets |

|

|

(136 |

) |

|

|

(41 |

) |

| Gain on disposal of associates and joint ventures |

|

|

(18,204 |

) |

|

|

(11,091 |

) |

| Loss on disposal of associates and joint ventures |

|

|

— |

|

|

|

1,675 |

|

| Loss on impairment investments in associates and joint ventures |

|

|

19 |

|

|

|

5,174 |

|

| Reversal of impairment loss on investments in associates and joint ventures |

|

|

(347 |

) |

|

|

— |

|

| Gain on disposal of subsidiaries |

|

|

(2 |

) |

|

|

— |

|

| Loss on disposal of subsidiaries |

|

|

564 |

|

|

|

32,144 |

|

| Interest income |

|

|

(429,620 |

) |

|

|

(340,753 |

) |

| Dividends income |

|

|

(25,941 |

) |

|

|

(28,875 |

) |

| Others, net |

|

|

6,910 |

|

|

|

215,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

15,836,559 |

|

|

|

7,181,423 |

|

|

|

|

|

|

|

|

|

|

| Changes in working capital: |

|

|

|

|

|

|

|

|

| Trade receivables |

|

|

(1,484,134 |

) |

|

|

(1,909,649 |

) |

| Non-trade receivables |

|

|

625,993 |

|

|

|

80,444 |

|

| Accrued income |

|

|

(258,993 |

) |

|

|

(34,706 |

) |

| Other receivables |

|

|

56,460 |

|

|

|

80,236 |

|

| Other current assets |

|

|

251,842 |

|

|

|

(651,926 |

) |

| Inventories |

|

|

147,798 |

|

|

|

(3,000,669 |

) |

| Other non-current assets |

|

|

(101,576 |

) |

|

|

58,790 |

|

| Trade payables |

|

|

(3,154,822 |

) |

|

|

2,782,474 |

|

| Non-trade payables |

|

|

(960,450 |

) |

|

|

61,737 |

|

| Accrued expenses |

|

|

(228,464 |

) |

|

|

(191,681 |

) |

| Other current liabilities |

|

|

901,692 |

|

|

|

446,064 |

|

| Other non-current liabilities |

|

|

437,809 |

|

|

|

422,916 |

|

| Investments in associates and joint ventures (dividends received) |

|

|

592,812 |

|

|

|

473,700 |

|

| Provisions |

|

|

(1,497,699 |

) |

|

|

(1,564,243 |

) |

| Payments of employee benefit obligations |

|

|

(281,383 |

) |

|

|

(218,319 |

) |

| Plan assets |

|

|

(188,566 |

) |

|

|

(347,778 |

) |

|

|

|

|

|

|

|

|

|

|

|

W |

|

|

|

|

(3,512,610 |

) |

|

|

|

|

|

|

|

|

|

(Continued)

7

KOREA ELECTRIC POWER CORPORATION AND ITS SUBSIDIARIES

Consolidated Statements of Cash Flows, Continued

For each of

the two years in the period ended December 31, 2023

|

|

|

|

|

|

|

|

|

| In millions of won |

|

2023 |

|

|

2022 |

|

| Cash generated from operating activities |

|

W |

|

|

|

|

(20,760,295 |

) |

| Dividends received |

|

|

25,941 |

|

|

|

28,875 |

|

| Interest paid |

|

|

(4,245,838 |

) |

|

|

(2,517,694 |

) |

| Interest received |

|

|

329,740 |

|

|

|

220,471 |

|

| Income taxes paid |

|

|

(566,415 |

) |

|

|

(448,857 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

|

|

1,522,162 |

|

|

|

(23,477,500 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Proceeds from disposals of investments in associates and joint ventures |

|

|

5,806 |

|

|

|

56,171 |

|

| Acquisition of investments in associates and joint ventures |

|

|

(497,634 |

) |

|

|

(360,962 |

) |

| Proceeds from disposals of property, plant and equipment |

|

|

309,627 |

|

|

|

629,924 |

|

| Acquisition of property, plant and equipment |

|

|

(13,908,373 |

) |

|

|

(12,346,878 |

) |

| Proceeds from disposals of intangible assets |

|

|

153 |

|

|

|

279 |

|

| Acquisition of intangible assets |

|

|

(74,832 |

) |

|

|

(80,508 |

) |

| Disposal of investment properties |

|

|

— |

|

|

|

515 |

|

| Proceeds from disposals of financial assets |

|

|

4,389,228 |

|

|

|

14,182,348 |

|

| Acquisition of financial assets |

|

|

(3,141,906 |

) |

|

|

(16,496,258 |

) |

| Increase in loans |

|

|

(212,994 |

) |

|

|

(401,377 |

) |

| Collection of loans |

|

|

124,386 |

|

|

|

102,061 |

|

| Increase in deposits |

|

|

(138,205 |

) |

|

|

(237,266 |

) |

| Decrease in deposits |

|

|

130,221 |

|

|

|

141,000 |

|

| Proceeds from disposals of assets

held-for-sale |

|

|

28,727 |

|

|

|

24,205 |

|

| Receipt of government grants |

|

|

57,207 |

|

|

|

50,755 |

|

| Net cash outflow from changes in consolidation scope |

|

|

(25,849 |

) |

|

|

(31,350 |

) |

| Other cash outflow from investing activities, net |

|

|

(119,319 |

) |

|

|

(186,412 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(13,073,757 |

) |

|

|

(14,953,753 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Proceeds from short-term borrowings, net |

|

|

1,946,992 |

|

|

|

5,852,426 |

|

| Proceeds from long-term borrowings and debt securities |

|

|

21,714,092 |

|

|

|

43,594,078 |

|

| Repayment of long-term borrowings and debt securities |

|

|

(10,968,160 |

) |

|

|

(10,252,688 |

) |

| Payment of lease liabilities |

|

|

(574,239 |

) |

|

|

(562,646 |

) |

| Settlement of derivative instruments, net |

|

|

332,263 |

|

|

|

407,627 |

|

| Change in non-controlling interests |

|

|

218,766 |

|

|

|

175,645 |

|

| Repayment of hybrid bond |

|

|

— |

|

|

|

(169,537 |

) |

| Dividends paid (for hybrid bond) |

|

|

(10,212 |

) |

|

|

(13,461 |

) |

| Dividends paid |

|

|

(45,323 |

) |

|

|

(42,348 |

) |

| Other cash outflow from financing activities, net |

|

|

47,703 |

|

|

|

8,803 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

12,661,882 |

|

|

|

38,997,899 |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents before effect of exchange rate

fluctuations |

|

|

1,110,287 |

|

|

|

566,646 |

|

| Effect of exchange rate fluctuations on cash held |

|

|

(2,180 |

) |

|

|

32,896 |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

1,108,107 |

|

|

|

599,542 |

|

| Cash and cash equivalents as of January 1, 2023 and 2022 |

|

|

3,234,780 |

|

|

|

2,635,238 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents as of December 31, 2023 and 2022 |

|

W |

|

|

|

|

3,234,780 |

|

|

|

|

|

|

|

|

|

|

8

Agenda 2. Approval of the ceiling amount of remuneration for directors in 2024

KEPCO seeks to obtain approval regarding the ceiling amount of remuneration for directors for the fiscal year 2024, pursuant to Article 388 of the Commercial

Act and Article 35 of the Articles of Incorporation of KEPCO.

| |

• |

|

Proposed aggregate ceiling on remuneration for directors: |

| |

• |

|

2,011,083 thousand won in fiscal year 2024 (total number of directors: 15; number of non-standing directors: 8) |

| |

• |

|

2,019,724 thousand won in fiscal year 2023 (total number of directors: 15; number of non-standing directors: 8) |

| |

• |

|

The actual remuneration for directors in the fiscal year 2023 was 1,225,751 thousand won (60.7% of the

ceiling). |

| |

• |

|

We proposed to decrease the maximum aggregate ceiling on remuneration for directors in 2024 by

8,641 thousand won compared to 2023 as a result of (i) the notification by the Government to increase the remuneration for directors of government controlled entities by 2.3% (21,980 thousand won), (ii) the adjusted payment ceiling

for performance-based compensation (52,228 thousand won) and (iii) the decreased severance payments by 82,849 thousand won due to the decrease in the average incumbency of our directors (from 30 to 16 months). |

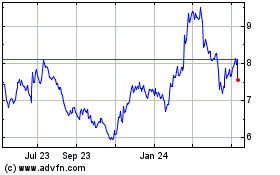

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Oct 2024 to Nov 2024

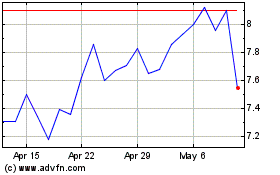

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Nov 2023 to Nov 2024