Current Report Filing (8-k)

September 08 2020 - 5:10PM

Edgar (US Regulatory)

0001587523FALSE00015875232020-05-012020-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 4, 2020

Knowles Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-36102

|

90-1002689

|

|

|

|

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1511 Maplewood Drive, Itasca, IL

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (630) 250-5100

N/A

(Former Name or Former Address, if Changed since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

|

KN

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

|

|

|

|

|

|

|

|

Item 1.01. Entry into a Material Definitive Agreement.

|

|

|

|

|

On September 4, 2020, Knowles Corporation (the “Company”) entered into a new Credit Agreement (the “New Credit Agreement”) among the Company and one or more of its subsidiaries designated from time to time by the Company (together with the Company, the “Borrowers”), JPMorgan Chase Bank, N.A. (“JPMorgan”), as administrative agent (the “Administrative Agent”), and a syndicate of other financial institutions (the “Lenders”) named in the New Credit Agreement. The New Credit Agreement provides for a senior secured revolving credit facility (the “New Credit Facility”) with borrowings in an aggregate principal amount at any time outstanding not to exceed US$400,000,000.

|

|

Borrowings under the New Credit Facility are to be used for working capital and other general corporate purposes of the Borrowers, including, without limitation, refinancing of indebtedness under the Company’s Credit Agreement dated as of October 11, 2017 (the “Prior Credit Agreement”).

|

|

All obligations of the Borrowers (and each subsequently organized or acquired subsidiary that becomes a borrower under the New Credit Facility) will be guaranteed by the Company and the Borrowers and will be secured by a perfected pledge of all the capital stock or other equity interests (including equity interests in subsidiaries) held by the Company and the subsidiary guarantors, which pledge, in the case of equity interests in any foreign subsidiary of the Company, will be limited to 65% of the voting equity interests and all the non-voting equity interests (if any) of such foreign subsidiary.

|

|

Up to US$100,000,000 of the New Credit Facility will be available in Euro, Pounds Sterling and other currencies requested by the Company and agreed to by each Lender and up to US$50,000,000 of the New Credit Facility will be made available in the form of letters of credit denominated in currencies approved by the Administrative Agent and the issuing banks as requested by the Company. Undrawn amounts under the New Credit Facility accrue a commitment fee at a per annum rate of 0.225% to 0.375%, based on a leverage ratio grid.

|

|

JPMorgan will make available under the New Credit Facility a swingline facility under which the Borrowers may request and JPMorgan, at its discretion, may make short-term borrowings in US dollars in an aggregate amount outstanding at any time not to exceed US$20,000,000.

|

|

|

At any time during the term of the New Credit Facility, the Company will be permitted to increase the commitments under the New Credit Facility or to establish one or more incremental term loan facilities under the New Credit Facility in an aggregate principal amount not to exceed US$200,000,000 for all such incremental facilities.

|

|

|

Commitments under the New Credit Facility will terminate, and loans outstanding thereunder will mature, on January 2, 2024; provided, that if all the Company’s 3.25% Convertible Senior Notes due November 1, 2021 (the “Existing Senior Notes”) shall not have been repaid, refinanced and/or converted to common stock of the Company by August 2, 2021 (the “Springing Maturity Test Date”), then the commitments under the New Credit Facility will terminate, and the loans outstanding thereunder will mature, on such earlier date unless, from and after the Springing Maturity Test Date and for so long as the Existing Senior Notes have not been repaid, refinanced and/or converted to common stock of the Company, the Company does not permit liquidity for any period of three consecutive business days to be less than US$150,000,000.

|

|

|

The interest rates under the New Credit Facility will be, at the Borrowers’ option (1) LIBOR (or, in the case of borrowings under the New Credit Facility denominated in Euro, EURIBOR) plus the rates per annum determined from time to time based on the total leverage ratio of the Company as of the end of and for the most recent period of four fiscal quarters for which financial statements have been delivered (the “Applicable Margin”); or (2) in the case of borrowings denominated in US Dollars, alternate base rate (“ABR”) (as defined in the New Credit Agreement) plus the Applicable Margin; provided, however, that any swingline borrowings shall bear interest at the rate applicable to ABR borrowings or, prior to the purchase of participations in such borrowings by the Lenders, at such other rate as shall be agreed between the Company and JPMorgan as the swingline lender.

|

|

|

|

|

|

|

|

|

|

The New Credit Agreement includes requirements, to be tested quarterly, that the Company maintains (i) a minimum ratio of Consolidated EBITDA to consolidated interest expense of 3.25 to 1.0 (the “Interest Coverage Ratio”), (ii) a maximum ratio of consolidated total indebtedness to Consolidated EBITDA of 3.75 to 1.0 (the “Total Leverage Ratio”), and (iii) a maximum ratio of senior secured indebtedness to Consolidated EBITDA of 3.25 to 1.0 (the “Senior Secured Leverage Ratio”); provided, that following the completion of a material acquisition financed in whole or in part with indebtedness of the Company of US$80,000,000 or more that on a pro forma basis would result in an increase in the Company’s Total Leverage Ratio and/or Senior Secured Leverage Ratio, as applicable, the Company may elect, by written notice delivered to the Administrative Agent within 30 days following such completion, to increase the applicable ratio(s) by 0.25 for the fiscal quarter during which such acquisition has been completed and for each of the following four consecutive fiscal quarters; provided, further, that a period of at least two consecutive fiscal quarters must elapse during which the Company is required to maintain a Total Leverage Ratio of not greater than 3.75 to 1.0 and/or Senior Secured Leverage Ratio of not greater than 3.25 to 1.00, as applicable, before an additional increase in the applicable ratio may occur. For these ratios, Consolidated EBITDA and consolidated interest expense are calculated using the most recent four consecutive fiscal quarters in a manner defined in the New Credit Agreement. In addition, the New Credit Agreement contains customary affirmative and negative covenants for financings of its type (subject to customary exceptions).

|

|

|

The New Credit Agreement provides that the occurrence of any of the following events (subject to applicable cure periods and exceptions, if any) will constitute an event of default: payment default, breach of representation or warranty, covenant breach, payment default in other indebtedness in excess of a certain monetary threshold, cross default to other indebtedness in excess of a certain monetary threshold, involuntary termination of a hedging agreement due to default, certain bankruptcy events, certain ERISA events, final judgment or settlement in excess of a certain monetary threshold, any security or guarantee documents cease to be in effect and a change of control of the Company. Upon the occurrence and during the continuation of an event of default, the Administrative Agent may exercise remedies on behalf of the lenders, including accelerating the repayment of outstanding loans under the New Credit Agreement.

|

|

|

The Company and its affiliates may from time to time engage certain of the lenders under the New Credit Agreement to provide other banking, investment banking and financial services.

|

|

|

The foregoing description of the New Credit Agreement is qualified in its entirety by reference to the complete terms and conditions of such document. A copy of the New Credit Agreement is filed herewith as Exhibit 10.1 and is hereby incorporated by reference.

|

|

|

|

|

|

Item 1.02. Termination of a Material Definitive Agreement.

|

|

|

|

|

|

In connection with entering into the New Credit Agreement, on September 4, 2020, the Company terminated the Prior Credit Agreement. As of September 4, 2020, the Prior Credit Agreement consisted of a US$400,000,000 senior secured revolving credit facility (of which US$100,000,000 principal amount was outstanding). A portion of the proceeds from borrowings under the New Credit Agreement was used to repay in full all amounts outstanding under the Prior Credit Agreement on the date of its termination. The Company and its affiliates may from time to time engage certain of the lenders under the Prior Credit Agreement to provide other banking, investment banking and financial services.

|

|

|

|

|

|

Item 2.03. Creation of Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

|

|

|

|

|

The discussion in Item 1.01 of this Form 8-K regarding the New Credit Facility is hereby incorporated by reference.

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

(d) Exhibits.

|

|

|

|

|

|

|

|

The following exhibits are furnished as part of this report:

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

KNOWLES CORPORATION

|

|

|

|

|

|

|

Date: September 8, 2020

|

By: /s/ Robert J. Perna

|

|

|

|

Robert J. Perna

|

|

|

|

Senior Vice President, General Counsel & Secretary

|

|

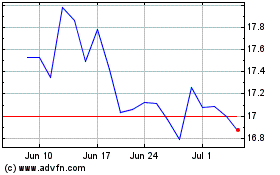

Knowles (NYSE:KN)

Historical Stock Chart

From Sep 2024 to Oct 2024

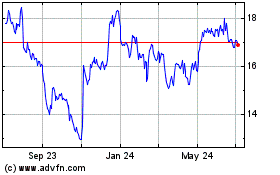

Knowles (NYSE:KN)

Historical Stock Chart

From Oct 2023 to Oct 2024