KKR Closes $4.6 Billion Ascendant Fund

September 23 2024 - 7:00AM

Business Wire

The Fund is the first of its kind at KKR,

targeting the large and fragmented North American middle market

KKR to support implementation of broad-based

employee ownership and engagement programs in all control

investments in the Fund

KKR, a leading global investment firm, today announced the final

closing of KKR Ascendant Fund SCSP (“Ascendant” or the “Fund”), a

$4.6 billion fund dedicated to investing in middle market

businesses in North America. Launched in 2022 as part of KKR’s

Americas Private Equity platform, Ascendant is the first KKR

vehicle solely focused on opportunities in the middle market. The

Fund will target established companies with strong growth potential

across seven industry verticals: Consumer, Financial Services,

Health Care, Industrials, Media, Software and Tech-Enabled

Services. Ascendant is also the first middle-market private equity

fund committed to supporting the implementation of employee

ownership programs at every majority-owned company in which it

invests.

The Fund brings to bear KKR’s extensive and integrated Private

Equity platform, breadth of resources, and depth of industry

coverage on an attractive segment of the North American middle

market. Building upon KKR’s 48-year history of investing in and

evaluating companies of all sizes in North America, the Fund

marries KKR’s well-honed private equity investment process,

value-creation capabilities and deep industry expertise with an

experienced investment team to pursue a differentiated offering in

the U.S. middle market.

“We are very proud of the strong response we have received from

our fundraising efforts and believe that Ascendant is

well-positioned to address the robust and attractive opportunities

in the North American middle market,” said Pete Stavros and Nate

Taylor, Co-Heads of KKR Global Private Equity. “We have long

invested in this space in our Americas Private Equity funds and

have found that we can harness KKR’s unique resources and expertise

in value creation to deliver highly differentiated business

outcomes. We wanted to launch a fund dedicated to this segment so

that our investors could directly participate in the compelling

outcomes we believe we can continue to deliver in the middle

market.”

“Broad-based employee ownership and engagement programs are a

key part of how KKR creates and maintains value across our

portfolio companies. Having seen the great success of these

programs in other areas of KKR’s portfolio, we are thrilled that

Ascendant will build on that strong foundation,” said Nancy Ford

and Brandon Brahm, Co-Heads of KKR’s Ascendant strategy. “These

programs, which provide both equity ownership to employees and a

strategy to enhance employee engagement, are implemented with the

goal of creating aligned interests and enabling all employees to

participate in the investment outcomes their work creates.”

To date, Ascendant has invested in six leading North American

companies including Alchemer, 123Dentist, Industrial Physics,

Potter Global Technologies, mdf commerce and Marmic Fire &

Safety.

The Fund, which was oversubscribed and closed at its hard cap,

received strong backing from a diverse group of new and existing

global investors, including public pensions, family offices,

insurance companies and other institutional investors.

Since 2011, KKR has supported companies in implementing

broad-based employee ownership programs throughout our portfolio,

first in our US Industrials private equity investments and now more

broadly across sectors and regions. This strategy is based on the

belief that employee engagement is a key driver in building

stronger companies. To date, more than 50 KKR portfolio companies

have awarded billions of dollars in equity to over 110,000

non-senior management employees.

Debevoise & Plimpton LLP represented KKR as primary fund

counsel for this fundraise.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240923737460/en/

Media Liidia Liuksila or Emily Cummings (212) 750-8300

media@kkr.com

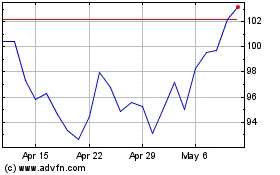

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

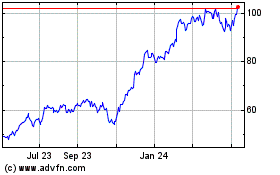

KKR (NYSE:KKR)

Historical Stock Chart

From Dec 2023 to Dec 2024