KKR’s Henry McVey Says Leading Family Offices Plan to Allocate More to Alternatives in 2024

February 13 2024 - 7:00AM

Business Wire

New Asset Allocation Report Based on

Proprietary Survey Highlights the Growth Ambitions of Family

Offices

KKR, a leading global investment firm, today released “Loud and

Clear,” a new Insights piece by Henry McVey, CIO of KKR’s Balance

Sheet and Head of Global Macro and Asset Allocation (GMAA).

Based on a proprietary survey of more than 75 Chief Investment

Officers (CIOs) who oversee over three billion dollars in assets,

on average, the report examines how family office CIOs are

leveraging their longer-term focus and owner/operator mentality to

create a sustainable competitive advantage.

“We hear the message ‘Loud and Clear’ that this segment of the

market is changing – and for the better,” said McVey. “These

investors are diversifying across asset classes, and as they

mature, they are getting better at harnessing the value of the

illiquidity premium to compound capital. They are also using better

hedging techniques and increasing both their desire and ability to

lean into dislocations, strengths that we believe will position

them to be at the winner’s table at the end of this cycle.”

In the report, McVey notes several key parallels between the

asset allocation objectives of KKR’s Balance Sheet and those of the

surveyed CIOs. These include a focus on compounding capital in a

tax efficient manner to build wealth and investing behind key

themes such as supply chain disruption, industrial automation,

artificial intelligence and the ‘security of everything.’ Other key

takeaways from the survey included:

- Family offices are allocating more to Alternatives, with 52

percent of assets allocated to Alternatives on average, up 200

basis points since 2020.

- Within Alternatives, there is meaningful diversification

including a significant jump in allocations to Real Assets.

- Cash positions are still high at nine percent, which further

confirms our thesis that many investors are under-risked for

today’s markets.

- Family offices are planning to allocate more to Private Credit,

Infrastructure and Private Equity at the expense of Public Equities

and Cash.

- We continue to see notable bifurcation in the asset allocation

approaches between family offices set up within the last five years

and those that had already scaled before COVID, with more seasoned

family offices typically holding less cash and allocating more to

Private Equity.

- There are pronounced regional differences in asset allocation.

U.S. family offices allocated less to traditional Private Equity

compared to counterparts in Latin America, Asia and Europe, while

Asia-based family offices had relatively heavy allocations to Real

Estate.

- CIOs are going against the grain to find value-based private

market opportunities, especially in the Oil & Gas and

Industrial sectors.

- Geopolitics is eclipsing inflation as the main concern for

CIOs, with more than 40% of respondents identifying geopolitics as

the single most important risk today.

- There is growing concern that more resources are required to

support both the growth in assets under management and the increase

in diversification across asset classes.

Links to access this report in full as well as an archive of

Henry McVey's previous publications follow:

- To read the latest Insights, click here.

- To access the 2020 Family Capital survey, click here.

- For an archive of previous publications please visit

www.KKRInsights.com.

About Henry McVey

Henry H. McVey joined KKR in 2011 and is Head of the Global

Macro, Balance Sheet and Risk team. Mr. McVey also serves as Chief

Investment Officer for the Firm’s Balance Sheet, oversees Firmwide

Market Risk at KKR, and co-heads KKR’s Strategic Partnership

Initiative. As part of these roles, he sits on the Firm’s Global

Operating Committee and the Risk & Operations Committee. Prior

to joining KKR, Mr. McVey was a Managing Director, Lead Portfolio

Manager and Head of Global Macro and Asset Allocation at Morgan

Stanley Investment Management (MSIM). Learn more about Mr. McVey

here.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

The views expressed in the report and summarized herein are the

personal views of Henry McVey of KKR and do not necessarily reflect

the views of KKR or the strategies and products that KKR offers or

invests. Nothing contained herein constitutes investment, legal,

tax or other advice nor is it to be relied on in making an

investment or other decision. This release is prepared solely for

information purposes and should not be viewed as a current or past

recommendation or a solicitation of an offer to buy or sell any

securities or to adopt any investment strategy. This release

contains projections or other forward-looking statements, which are

based on beliefs, assumptions and expectations that may change as a

result of many possible events or factors. If a change occurs,

actual results may vary materially from those expressed in the

forward-looking statements. All forward-looking statements speak

only as of the date such statements are made, and neither KKR nor

Mr. McVey assumes any duty to update such statements except as

required by law.

KKR’s Balance Sheet refers to that portion of KKR’s corporate

balance sheet that is primarily used to support KKR’s asset

management business, including the general partners of KKR’s

investment funds and other controlling interests.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213746598/en/

Media: Julia Kosygina 212-750-8300 media@kkr.com

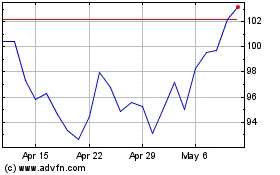

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

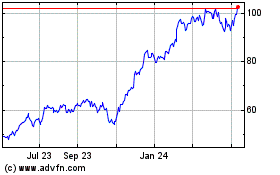

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024