KKR to Sell Industrial Real Estate Portfolio to Oxford Properties for $2.2 Billion

August 17 2021 - 8:00AM

Business Wire

KKR, a leading global investment firm, today announced that KKR

has agreed to sell a 14.5 million square foot infill and light

industrial portfolio to Oxford Properties (‘Oxford’), a leading

global real estate investor, asset manager and business builder,

for approximately $2.2 billion. The portfolio consists of 149

high-quality distribution buildings strategically located across 12

major industrial U.S. markets, including the Inland Empire, Dallas,

Atlanta, Phoenix, Chicago, Houston, Tampa, Orlando, San Diego and

the Baltimore Washington corridor. The transaction is anticipated

to close in the coming months.

Since 2018, KKR strategically aggregated and scaled this

portfolio of well located, high barrier to entry infill warehouses

with a focus on high-growth markets with diverse multi-faceted

demand drivers, near major supply chain hubs and transportation

corridors. Roger Morales, Partner and Head of Real Estate

Acquisitions, and Ben Brudney, Director on KKR’s real estate team

leading its logistics efforts, architected the strategy and

assembled the portfolio though more than 50 individual property

transactions together with KKR’s industrial operating platform,

Alpha Industrial Properties.

“Four years ago, we set out to create a large stabilized

portfolio that would benefit from secular changes in the logistics

sector largely driven by e-commerce and consumer preference

changes. Given the highly fragmented asset class, the strategy

included the creation of a best-in-class operating platform and a

targeted investment effort focused on growing cities and key

distribution nodes in the U.S.,” said Mr. Morales. “Today’s

transaction not only demonstrates how this strategy is performing

for our investors, but also reflects the tremendous market

opportunity we continue to see in industrial real estate.”

Following the completion of the sale of the portfolio, KKR will

continue to own over 20 million square feet of industrial property

across major metropolitan areas in the U.S. Since launching a

dedicated real estate platform in 2011, KKR has grown real estate

assets under management to approximately $32 billion across the

U.S., Europe and Asia as of June 30, 2021. KKR’s global real estate

team consists of over 110 dedicated investment professionals,

spanning both the equity and credit business, across 11 offices and

eight countries.

”High quality, infill, consumption-driven industrial portfolios

of scale trade infrequently, so this transaction is an important

next step for Oxford to build a large scale industrial business in

the U.S.,” commented Ankit Bhatt, VP of Investments at Oxford

Properties who leads the firm’s U.S. industrial investment

strategy. “Growing our U.S. industrial business is one of Oxford’s

highest conviction global investment strategies as we continue to

build, buy and invest in the physical infrastructure that serves

the digital economy. The acquisition serves as a launchpad for

Oxford’s light industrial business which perfectly complements our

big box development platform, IDI Logistics. We believe scale will

become an important differentiator for industrial real estate

operators, and we continue to pursue opportunities in the U.S.

light industrial sector.”

Oxford has substantially grown its global industrial business in

recent years. In January 2019, it acquired IDI Logistics alongside

Ivanhoe Cambridge for US$3.5 billion. In 2020, it became a

significant investor in the U.S.-based Lineage Logistics, the

world’s leading cold storage logistics provider. Oxford was a

cornerstone investor in the IPO of ESR Cayman, the leading

logistics real estate platform in Asia, and follow-on investments

have made it one of the largest institutional investors in the

company. In January this year, it announced it had agreed to

acquire M7 Real Estate (‘M7’), a market-leading pan European

logistics investment and asset manager. The acquisition of M7

accelerates Oxford’s ability and ambition to deploy more than US$4

billion into European industrial real estate by 2025.

“Across the globe, we are building, buying and growing world

class industrial business in service of our global capital

allocation priorities,” commented Chad Remis, EVP of North America

at Oxford Properties. “As a result of this transaction, and recent

activity in the sector, we are rapidly closing in our stated goal

to have one-third of our global equity deployed into the industrial

asset class. Having previously been a mezzanine lender on the

portfolio acquired from KKR, we have a high degree of conviction on

the growth potential of these assets. It also demonstrates the

power of Oxford’s fully integrated Credit business to help drive

future investment synergies while generating attractive

returns.”

CBRE National Partners acted as real estate advisor for KKR. JLL

Industrial Capital Markets acted as advisor for Oxford.

About KKR

KKR is a leading global investment firm that offers alternative

asset management and capital markets and insurance solutions. KKR

aims to generate attractive investment returns by following a

patient and disciplined investment approach, employing world-class

people, and supporting growth in its portfolio companies and

communities. KKR sponsors investment funds that invest in private

equity, credit and real assets and has strategic partners that

manage hedge funds. KKR’s insurance subsidiaries offer retirement,

life and reinsurance products under the management of The Global

Atlantic Financial Group. References to KKR’s investments may

include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

About Oxford Properties

Oxford Properties Group (“Oxford”) is a leading global real

estate investor, asset manager and business builder. It builds,

buys and grows defined real estate operating business with

world-class management teams. Established in 1960, Oxford and its

portfolio companies manage approximately C$70 billion of assets

across four continents on behalf of their investment partners.

Oxford’s owned portfolio encompasses office, logistics, retail,

multifamily residential, life sciences and hotels; it spans more

than 150 million square feet in global gateway cities and

high-growth hubs. A thematic investor with a committed source of

capital, Oxford invests in properties, portfolios, development

sites, debt, securities and real estate businesses across the

risk-reward spectrum. Together with its portfolio companies, Oxford

is one of the world’s most active developers with over 100 projects

currently underway globally across all major asset classes. Oxford

is owned by OMERS, the Canadian defined benefit pension plan for

Ontario's municipal employees.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210817005347/en/

For KKR Cara Major and Miles Radcliffe-Trenner +1 212 750 8300

media@kkr.com For Oxford Properties Daniel O’Donnell and Chris

Sarpong +1 416 865 8300 media@oxfordproperties.com

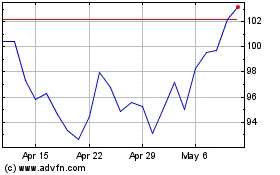

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

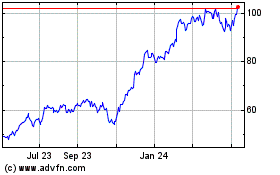

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024