KKR Acquires Three Self-Storage Facilities in Austin and Nashville

July 26 2021 - 4:30PM

Business Wire

Purchases mark KKR real estate’s first

investments in the self-storage sector

KKR, a leading global investment firm, today announced the

acquisition of three self-storage properties located in Austin,

Texas and Nashville, Tennessee. The properties include

approximately 1,800 storage units and were built between 2019 and

2020. They were acquired through separate transactions with two

different sellers for an aggregate purchase price of approximately

$36 million.

The purchases represent KKR real estate’s first investment in

the self-storage sector. KKR is making the investment through its

Americas opportunistic equity real estate strategy.

“We are excited to anchor our self-storage portfolio with these

high quality assets in Austin and Nashville,” said Roger Morales,

KKR Partner and Head of Commercial Real Estate Acquisitions in the

Americas. “We believe that the self-storage sector exhibits strong

supply-demand fundamentals and has appealing long-term dynamics,

including resiliency through economic cycles. We expect to continue

to grow our self-storage footprint through 2021 and into 2022.”

Since launching a dedicated real estate platform in 2011, KKR

has grown its real estate assets under management to approximately

$28 billion across the U.S., Europe and Asia Pacific as of March

31, 2021. KKR’s global real estate team consists of over 110

dedicated investment professionals, spanning both the equity and

credit business, across 11 offices and eight countries.

About KKR

KKR is a leading global investment firm that offers alternative

asset management and capital markets and insurance solutions. KKR

aims to generate attractive investment returns by following a

patient and disciplined investment approach, employing world-class

people, and supporting growth in its portfolio companies and

communities. KKR sponsors investment funds that invest in private

equity, credit and real assets and has strategic partners that

manage hedge funds. KKR’s insurance subsidiaries offer retirement,

life and reinsurance products under the management of The Global

Atlantic Financial Group. References to KKR’s investments may

include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210726005773/en/

Media: Cara Major or Miles Radcliffe-Trenner 212-750-8300

media@kkr.com

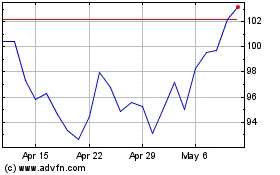

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

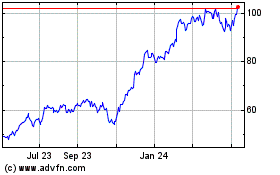

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024