KKR to Acquire Teaching Strategies

July 21 2021 - 4:15PM

Business Wire

KKR Backs Pioneering Developer of Early

Childhood Curriculum, Assessment and Engagement tools for Educators

and Families

KKR, a leading global investment firm, announced today that KKR

has agreed to acquire Teaching Strategies (the “Company”), the

leading provider of curriculum, assessment and family engagement

tools to the early childhood education (“ECE”) market, from global

growth investor Summit Partners. Financial details of the

transaction were not disclosed.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210721005908/en/

Teaching Strategies aims to empower and inspire early childhood

educators as they support the development of our youngest learners

during the critical, formative years from birth through third

grade. Founded in 1988, the Company is the largest provider of

comprehensive ECE solutions for holistic child development,

offering the leading digital early learning platform, integrating

curriculum, assessment and engagement tools for educators and

families. Teaching Strategies employs a whole-child teaching

philosophy designed to support and nurture all areas of children’s

development and learning from social-emotional and cognitive skills

to literacy, math and science.

“Since our founding, Teaching Strategies has been steadfast in

our mission of supporting educators and the children and families

they serve through innovative resources and technologies,” said

John Olsen, CEO of Teaching Strategies. “We are thrilled to have

KKR join us on this mission and look forward to leveraging their

global expertise to build on that commitment to children, educators

and families. We are also incredibly thankful for our partnership

with Summit Partners, which has been instrumental in getting us to

this point and positioning us for continued success.”

Webster Chua, Partner at KKR, said, “The foundation of a strong

early childhood education is of critical importance when it comes

to helping our children succeed in school and in life. We are

excited to be supporting the Teaching Strategies team as they

continue to advance the field of early childhood education through

research-based, technology-enabled resources that allow educators

to be significantly more effective with far more students in

delivering a better education.”

Len Ferrington, Managing Director at Summit Partners, said, “We

are proud to have supported Teaching Strategies’ transformative

growth over the past few years and look forward to seeing the

Company continue to thrive with the support of KKR.”

KKR will be acquiring Teaching Strategies through its Core

Investments strategy, which represents capital with a longer-term

investment horizon. Teaching Strategies is KKR’s latest investment

in the education technology sector and follows investments in Weld

North, Education Perfect, OverDrive, Burning Glass and MasterD,

among others.

Macquarie Capital (USA) Inc. is acting as financial advisor and

Simpson Thacher & Bartlett LLP is acting as legal advisor to

KKR. Deutsche Bank Securities Inc. is acting as lead financial

advisor to Summit and the Company with R.W. Baird & Co. acting

as an additional financial advisor and Kirkland & Ellis LLP

acting as legal advisor.

About Teaching Strategies

With a strong belief that a child’s first eight years form a

critical foundation for success in school and in life, Teaching

Strategies has been an advocate for the early education community

for over 40 years. Today, Teaching Strategies connects teachers,

children and families to inspired teaching and learning

experiences, informative data, stronger family partnerships, and

professional learning through the leading early learning platform.

Its products, including the most widely-used curriculum and

assessment solutions The Creative Curriculum® and GOLD®, are found

in over 270,000 classrooms and have served more than 15 million

children across the globe. To learn why thousands of early

childhood programs and many states choose to partner with Teaching

Strategies to help ensure children's success in school and in life,

visit teachingstrategies.com and follow us on Twitter

@TeachStrategies.

About KKR

KKR is a leading global investment firm that offers alternative

asset management and capital markets and insurance solutions. KKR

aims to generate attractive investment returns by following a

patient and disciplined investment approach, employing world-class

people, and supporting growth in its portfolio companies and

communities. KKR sponsors investment funds that invest in private

equity, credit and real assets and has strategic partners that

manage hedge funds. KKR’s insurance subsidiaries offer retirement,

life and reinsurance products under the management of The Global

Atlantic Financial Group. References to KKR’s investments may

include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

About Summit Partners

Founded in 1984, Summit Partners is a global alternative

investment firm that is currently managing more than $28 billion in

capital dedicated to growth equity, fixed income and public equity

opportunities. Summit invests across growth sectors of the economy

and has invested in more than 500 companies in technology,

healthcare and other growth industries. Notable e-learning and

EdTech companies backed by Summit Partners include A Cloud Guru,

Allego, Immersive Labs, Jamf, LearnUpon, Lingoda and Ruffalo Noel

Levitz. Summit maintains offices in North America and Europe and

invests in companies around the world. For more information, please

see www.summitpartners.com or follow on LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210721005908/en/

For Teaching Strategies: Sydni Dunn (337) 309-6046

sydni.dunn@whiteboardadvisors.com For KKR: Cara Major or Miles

Radcliffe-Trenner (212) 750-8300 media@kkr.com For Summit Partners:

Meg Devine +1-617-824-1047 mdevine@summitpartners.com

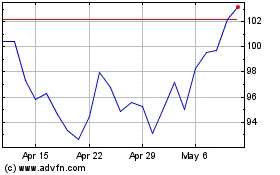

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

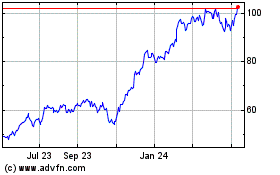

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024