Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 12 2024 - 6:00AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

August 12, 2024

Commission File Number 001-36761

1 Temasek Avenue #37-02B

Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-201716) OF KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH

REGISTRATION STATEMENT.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

KENON HOLDINGS LTD.

|

|

|

|

|

|

|

|

Date: August 12, 2024

|

By:

|

/s/ Robert L. Rosen

|

|

|

|

|

Name: Robert L. Rosen

|

|

|

|

|

Title: Chief Executive Officer

|

|

Exhibit 99.1

Kenon’s Subsidiary OPC Energy Ltd. Announces New Financing Arrangements to Refinance

Project Financing of the Tzomet and Gat Power Plants

Singapore, August 12, 2024.

Kenon Holdings Ltd.’s (NYSE: KEN, TASE: KEN) (“Kenon”) subsidiary OPC Energy Ltd. (“OPC”) has announced that OPC’s 80%-owned subsidiary OPC Holdings Israel Ltd (“OPC Israel”)

has entered into two financing agreements with Bank Hapoalim and Bank Leumi for loans in aggregate amount of approximately NIS 1.65 billion (approximately $443 million) (the “Financing Agreements”). OPC announced that the loans will be used primarily for early repayment of the existing project financing of the Tzomet and Gat power plants in the amounts of approximately NIS 1.14

billion (approximately $307 million) in respect of Tzomet, and approximately NIS 443 million (approximately $119 million) in respect of Gat (in each case including estimated accrued interest and early repayment fees).

OPC announced that the loans under the Financing Agreements will bear interest at a rate based on Prime interest plus a spread ranging from 0.3% to 0.4%. The loan principal is repayable in

quarterly installments from March 25, 2025 through December 25, 2033 as follows: 0.5% per quarter in 2025; 0.75% per quarter in 2026; 1% per quarter in 2027-2029; 5% per quarter in 2030-2032; and 5.75% per quarter in 2033. The Financing Agreements

include covenants and events of default provisions including the following financial covenants: OPC Israel’s net debt to EBITDA ratio not exceeding 8 and equity to asset ratio not falling below 20%; OPC’s equity not falling below NIS 1.1 billion;

and distributions (including repayment of OPC Israel and its subsidiaries’ subordinated shareholder loans) by OPC Israel are subject to net debt to adjusted EBITDA not exceeding 7.

OPC also announced that as a result of the early repayment of the project financing arrangements, OPC expects to recognize one-off finance expenses of approximately NIS 52 million (approximately

$14 million) in the third quarter of 2024.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify these forward-looking

statements by words or phrases such as “may,” “will,” “expect,” “estimate,” “intend,” “plan,” “believe,” “likely to” “should,” or other similar expressions. These statements include statements about the Financing Agreements, including the terms and

conditions thereof, the use of proceeds, the expected impact on OPC’s financials, and other non-historical statements. These forward-looking statements are based on current expectations or beliefs, and are subject to uncertainty and changes in

circumstances. These forward-looking statements are subject to a number of risks and uncertainties which could cause the actual results to differ materially from those indicated in Kenon’s forward-looking statements. Such risks include risks relating

to the Financing Arrangements, including compliance with the terms of and covenants in the Financing Agreements, the ultimate impact on OPC’s financial statements of the early repayment of the project financing and other risks, including those set

forth under the heading “Risk Factors” in Kenon’s most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Except as required by law, Kenon undertakes no obligation to update these forward-looking statements,

whether as a result of new information, future events, or otherwise.

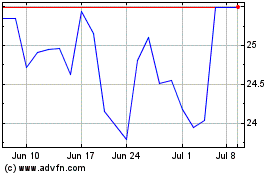

Kenon (NYSE:KEN)

Historical Stock Chart

From Dec 2024 to Dec 2024

Kenon (NYSE:KEN)

Historical Stock Chart

From Dec 2023 to Dec 2024