Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 13 2023 - 10:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2023

Commission File Number: 000-53445

KB Financial Group Inc.

(Translation of registrant’s name into English)

26, Gukjegeumyung-ro 8-gil, Yeongdeungpo-gu, Seoul 07331, Korea

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or

legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Update on Kookmin Bank’s Decision on Capital Injection in PT Bank KB Bukopin Tbk.

On June 13, 2023, KB Financial Group Inc. (“KB Financial Group”) updated its previous disclosures made on April 7,

2023, February 17, 2023, October 11, 2022 and October 4, 2022 regarding the decision by Kookmin Bank, one of KB Financial Group’s wholly-owned subsidiaries, to inject capital into PT Bank KB Bukopin Tbk. (“Bank KB

Bukopin”), as follows:

On June 13, 2023, KB Financial Group disclosed that Bank KB Bukopin completed its increase of capital through

the issuance of new shares (the “Rights Offerings”) on May 31, 2023, and that Kookmin Bank completed its participation in the Rights Offerings (the “Capital Injection”) on May 31, 2023.

The key details of the Capital Injection are as follows:

| 1. |

Information on Bank KB Bukopin, as of May 31, 2023 |

| |

A. |

Total number of shares issued: 187,887,539,870 shares |

| |

B. |

Share Capital: KRW 1,651,099,997,323 (converted from IDR to KRW at the exchange rate of IDR 1.00 = KRW 0.0869

as announced on June 13, 2023) |

| 2. |

Details of the Capital Injection |

| |

A. |

Number of shares acquired: 80,170,875,138 shares |

| |

B. |

Purchase price (the actual amount paid on the date of the acquisition): KRW 709,047,133,548 (IDR

8,017,087,513,800) |

| |

C. |

Ratio of purchase price to Kookmin Bank shareholders’ equity: 2.10% |

| |

D. |

Total number of Bank KB Bukopin’s shares owned by Kookmin Bank following the Capital Injection:

125,655,736,951 shares, representing 66.88% of Bank KB Bukopin’s total number of shares issued |

| 3. |

Method of the Capital Injection: Cash payment for the acquisition of new shares |

| 4. |

Purpose of the Capital Injection: Participate in the rights offerings by Bank KB Bukopin in pursuit of its

business normalization and procurement of future growth drivers |

| 5. |

For information regarding Kookmin Bank’s put option agreement with STIC Eugene Star Holdings Inc., please

refer to KB Financial Group’s Form 6-K furnished to the Securities and Exchange Commission on April 7, 2023. |

| 6. |

Key Financial Information of Bank KB Bukopin |

(Unit: millions of KRW)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Period |

|

Total Assets |

|

|

Total

Liabilities |

|

|

Total

Equity |

|

|

Share

Capital |

|

|

Operating

Revenue |

|

|

Net Loss |

|

| FY2022 |

|

|

7,820,596 |

|

|

|

6,845,873 |

|

|

|

974,723 |

|

|

|

608,300 |

|

|

|

358,781 |

|

|

|

-437,325 |

|

| FY2021 |

|

|

7,752,842 |

|

|

|

6,605,249 |

|

|

|

1,147,593 |

|

|

|

608,300 |

|

|

|

366,511 |

|

|

|

-200,068 |

|

| FY2020 |

|

|

6,946,662 |

|

|

|

6,210,929 |

|

|

|

735,734 |

|

|

|

302,288 |

|

|

|

461,297 |

|

|

|

-283,130 |

|

| * |

Note: The figures above have been converted from IDR to KRW at the exchange rate of IDR 1.00 = KRW 0.0869, as

announced on June 13, 2023. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KB Financial Group Inc. |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

|

|

|

| Date: June 13, 2023 |

|

|

|

By: |

|

/s/ Scott Y. H. Seo |

|

|

|

|

|

|

(Signature) |

|

|

|

|

|

|

|

|

|

|

Name: Scott Y. H. Seo |

|

|

|

|

|

|

Title: Senior Executive Vice President and Chief Finance Officer |

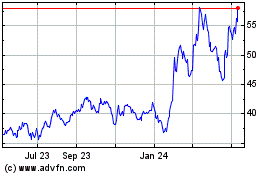

KB Financial (NYSE:KB)

Historical Stock Chart

From Jan 2025 to Feb 2025

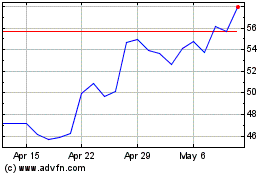

KB Financial (NYSE:KB)

Historical Stock Chart

From Feb 2024 to Feb 2025