Kayne Anderson Energy Infrastructure Fund Provides Unaudited Balance Sheet Information and Announces its Net Asset Value and Asset Coverage Ratios at November 30, 2023

December 04 2023 - 7:35PM

Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company”)

(NYSE: KYN) today provided a summary unaudited statement of assets

and liabilities and announced its net asset value and asset

coverage ratios under the Investment Company Act of 1940 (the “1940

Act”) as of November 30, 2023.

As of November 30, 2023, the Company’s net assets

were $1.8 billion, and its net asset value per share was $10.51. As

of November 30, 2023, the Company’s asset coverage ratio under the

1940 Act with respect to senior securities representing

indebtedness was 659% and the Company’s asset coverage ratio under

the 1940 Act with respect to total leverage (debt and preferred

stock) was 456%.

|

Kayne Anderson Energy Infrastructure Fund,

Inc. |

|

|

Statement of Assets and Liabilities |

|

|

November 30, 2023 |

|

|

(Unaudited) |

|

| |

|

(in millions) |

|

|

Investments |

|

$ |

2,414.2 |

|

|

|

Cash and cash equivalents |

|

|

0.6 |

|

|

|

Accrued income |

|

|

3.2 |

|

|

|

Current tax asset, net |

|

|

5.2 |

|

|

|

Other assets |

|

|

0.9 |

|

|

|

Total assets |

|

|

2,424.1 |

|

|

| |

|

|

|

|

Credit facility |

|

|

9.0 |

|

|

|

Term loan |

|

|

50.0 |

|

|

|

Notes |

|

|

286.7 |

|

|

|

Unamortized notes issuance costs |

|

|

(1.5 |

) |

|

|

Preferred stock |

|

|

153.1 |

|

|

|

Unamortized preferred stock issuance costs |

|

|

(1.5 |

) |

|

|

Total leverage |

|

|

495.8 |

|

|

| |

|

|

|

|

Payable for securities purchased |

|

|

5.0 |

|

|

|

Other liabilities |

|

|

14.4 |

|

|

|

Deferred tax liability, net |

|

|

131.3 |

|

|

|

Total liabilities |

|

|

150.7 |

|

|

| |

|

|

|

|

Net assets |

|

$ |

1,777.6 |

|

|

|

|

|

|

|

|

|

|

|

|

The Company had 169,126,038 common shares

outstanding as of November 30, 2023.

Long-term investments were comprised of Midstream

Energy Company (89%), Utility Company (4%), Renewable

Infrastructure Company (4%) and Other Energy (3%).

The Company’s ten largest holdings by issuer at

November 30, 2023 were:

| |

|

|

Amount(in millions)* |

|

Percent ofLong-TermInvestments |

|

1. |

Enterprise Products Partners L.P. (Midstream Energy Company) |

|

$ |

263.2 |

|

10.9 |

% |

| 2. |

Energy Transfer LP (Midstream

Energy Company) |

|

|

240.7 |

|

10.0 |

% |

| 3. |

MPLX LP (Midstream Energy

Company) |

|

|

224.6 |

|

9.3 |

% |

| 4. |

The Williams Companies, Inc.

(Midstream Energy Company) |

|

|

189.9 |

|

7.9 |

% |

| 5. |

Targa Resources Corp.

(Midstream Energy Company) |

|

|

176.9 |

|

7.3 |

% |

| 6. |

Cheniere Energy, Inc.

(Midstream Energy Company) |

|

|

171.5 |

|

7.1 |

% |

| 7. |

ONEOK, Inc. (Midstream Energy

Company) |

|

|

162.1 |

|

6.7 |

% |

| 8. |

Plains All American Pipeline,

L.P.** (Midstream Energy Company) |

|

|

159.9 |

|

6.6 |

% |

| 9. |

Western Midstream Partners, LP

(Midstream Energy Company) |

|

|

97.5 |

|

4.0 |

% |

| 10. |

Kinder Morgan, Inc. (Midstream

Energy Company) |

|

|

87.5 |

|

3.6 |

% |

| |

|

|

|

|

|

_________________

|

* |

Includes ownership of common and

preferred units. |

| ** |

Includes ownership of Plains All

American Pipeline, L.P. (“PAA”), Plains GP Holdings, L.P. (“PAGP”)

and Plains AAP, L.P. (“PAGP-AAP”). |

###

Portfolio holdings are subject to change without

notice. The mention of specific securities is not a recommendation

or solicitation for any person to buy, sell or hold any particular

security. You can obtain a complete listing of holdings by viewing

the Company’s most recent quarterly or annual report.

Kayne Anderson Energy Infrastructure Fund, Inc.

(NYSE: KYN) is a non-diversified, closed-end management investment

company registered under the Investment Company Act of 1940, as

amended, whose common stock is traded on the NYSE. The company's

investment objective is to provide a high after-tax total return

with an emphasis on making cash distributions to stockholders. KYN

intends to achieve this objective by investing at least 80% of its

total assets in securities of Energy Infrastructure Companies. See

Glossary of Key Terms in the Company’s most recent quarterly report

for a description of these investment categories and the meaning of

capitalized terms.

This press release shall not constitute an offer to

sell or a solicitation to buy, nor shall there be any sale of any

securities in any jurisdiction in which such offer or sale is not

permitted. Nothing contained in this press release is intended to

recommend any investment policy or investment strategy or take into

account the specific objectives or circumstances of any investor.

Please consult with your investment, tax, or legal adviser

regarding your individual circumstances prior to investing.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS: This communication contains statements reflecting

assumptions, expectations, projections, intentions, or beliefs

about future events. These and other statements not relating

strictly to historical or current facts constitute forward-looking

statements as defined under the U.S. federal securities laws.

Forward-looking statements involve a variety of risks and

uncertainties. These risks include, but are not limited to, changes

in economic and political conditions; regulatory and legal changes;

energy industry risk; leverage risk; valuation risk; interest rate

risk; tax risk; and other risks discussed in detail in the

Company’s filings with the SEC, available at www.kaynefunds.com or

www.sec.gov. Actual events could differ materially from these

statements or from our present expectations or projections. You

should not place undue reliance on these forward-looking

statements, which speak only as of the date they are made. Kayne

Anderson undertakes no obligation to publicly update or revise any

forward-looking statements made herein. There is no assurance that

the Company’s investment objectives will be attained.

Contact: Investor Relations at (877) 657-3863 or

cef@kaynecapital.com

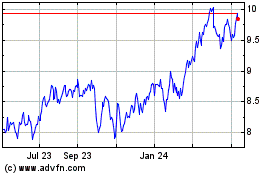

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Nov 2023 to Nov 2024