- Solid investment performance, with 75%, 71%, 67%, and 85% of

assets under management (“AUM”) outperforming relevant benchmarks

on a one-, three-, five-, and 10-year basis, respectively, as of

September 30, 2024

- Consecutive quarters of net inflows with third quarter 2024 net

inflows of US$0.4 billion

- Third quarter 2024 diluted EPS of US$0.17 includes a US$111.9

million non-cash, non-operating, accounting expense release.

Adjusted diluted EPS of US$0.91 is an increase of 42% year over

year

- AUM increased 6% quarter over quarter and 24% year over year to

US$382.3 billion as of September 30, 2024

- Returned US$102 million in capital to shareholders through

dividends and share buybacks in third quarter 2024

- Board of Directors ("Board") declared a quarterly dividend of

US$0.39 per share and approved a US$50 million increase to the

Company’s existing common stock repurchase authorization

Janus Henderson Group plc (NYSE: JHG; “JHG," "Janus Henderson,”

or the “Company”) published its third quarter 2024 results for the

period ended September 30, 2024. Third quarter 2024 operating

income was US$164.7 million compared to US$164.3 million in the

second quarter 2024 and US$121.7 million in the third quarter 2023.

Adjusted operating income, adjusted for one-time, acquisition and

transaction related costs, was US$170.5 million in the third

quarter 2024 compared to US$164.7 million in the second quarter

2024 and US$125.4 million in the third quarter 2023.

Third quarter 2024 diluted earnings per share of US$0.17, which

was impacted by a US$111.9 million non-cash, non-operating,

accounting expense release of accumulated foreign currency

translation adjustments related to JHG entities liquidated during

the quarter, compared to US$0.81 in the second quarter 2024 and

US$0.56 in the third quarter 2023. Adjusted diluted earnings per

share of US$0.91 in the third quarter 2024 compared to US$0.85 in

the second quarter 2024 and compared to US$0.64 in the third

quarter 2023.

Ali Dibadj, Chief Executive Officer, stated:

"Janus Henderson again delivered another solid set of quarterly

results, building upon tangible momentum in the business. The

results reflect market gains, solid investment performance produced

by our world-class investment professionals, a second consecutive

quarter of positive net flows delivered by our dedicated client

groups, and the efforts and productivity from all our operating and

support areas. Our teams have worked together to execute our

strategy to Protect & Grow, Amplify, and Diversify our

business, which is delivering growth across channels and regions.

Better net flows, a stable net management fee rate, and operating

leverage resulted in a 42% year-over-year increase in our adjusted

diluted EPS to US$0.91. Our healthy balance sheet and strong cash

flow generation provide us the flexibility to continue to invest in

the business—both organically and inorganically—as well as return

cash to shareholders. While we are pleased with the clear momentum,

we recognize there will always be work to be done, and we continue

to be focused on positioning Janus Henderson to deliver superior

outcomes for our clients, employees, shareholders, and other

stakeholders."

SUMMARY OF FINANCIAL RESULTS (unaudited) (in US$ millions,

except per share data or as

noted)

The Company presents its financial results in US$ and in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”). However, JHG management

evaluates the profitability of the Company and its ongoing

operations using additional non-GAAP financial measures. Management

uses these performance measures to evaluate the business, and

adjusted values are consistent with internal management reporting.

See “Reconciliation of non-GAAP financial information” below for

additional information.

Three months ended

30 Sep

30 Jun

30 Sep

2024

2024

2023

GAAP

basis:

Revenue

624.8

588.4

521.0

Operating expenses

460.1

424.1

399.3

Operating income

164.7

164.3

121.7

Operating margin

26.4

%

27.9

%

23.4

%

Net income attributable to JHG

27.3

129.7

93.5

Diluted earnings per share

0.17

0.81

0.56

Adjusted

basis:

Revenue

488.1

458.3

405.0

Operating expenses

317.6

293.6

279.6

Operating income

170.5

164.7

125.4

Operating margin

34.9

%

35.9

%

31.0

%

Net income attributable to JHG

144.7

135.2

106.7

Diluted earnings per share

0.91

0.85

0.64

SHARE REPURCHASE AND DIVIDEND

On October 30, 2024, the Board declared a dividend of US$0.39

per share for the quarter ended September 30, 2024. Shareholders on

the register on the record date of November 11, 2024, will be paid

the dividend on November 27, 2024.

As part of the US$150 million on-market share repurchase program

approved by the Board in May 2024, JHG purchased 1.1 million of its

common stock on the New York Stock Exchange (NYSE) in the third

quarter, for a total outlay of approximately US$40 million.

Additionally, on October 30, 2024, the Board approved a US$50

million increase to this existing on-market share repurchase

program, bringing the total repurchase authorization to up to

US$200 million of common stock.

AUM AND FLOWS (in US$ billions)

FX reflects movement in AUM resulting from changes in foreign

currency rates as non-US$ denominated AUM is translated into US$.

Redemptions include impact of client transfers.

Total comparative AUM and flows

Three months ended

30 Sep

30 Jun

30 Sep

2024

2024

2023

Opening AUM

361.4

352.6

322.1

Sales

16.1

18.1

11.8

Redemptions

(15.7

)

(16.4

)

(14.4

)

Net sales / (redemptions)

0.4

1.7

(2.6

)

Market / FX

19.4

7.1

(11.2

)

Acquisitions

1.1

—

—

Closing AUM

382.3

361.4

308.3

Quarterly AUM and flows by

capability

Fixed

Equities

Income

Multi-Asset

Alternatives

Total

AUM 30 Sep 2023

187.9

65.1

45.9

9.4

308.3

Sales

6.0

6.9

1.0

0.5

14.4

Redemptions

(9.2

)

(5.2

)

(2.4

)

(0.7

)

(17.5

)

Net sales / (redemptions)

(3.2

)

1.7

(1.4

)

(0.2

)

(3.1

)

Market / FX

20.4

4.7

4.4

0.2

29.7

AUM 31 Dec 2023

205.1

71.5

48.9

9.4

334.9

Sales

8.1

5.8

1.3

0.7

15.9

Redemptions

(9.2

)

(5.7

)

(2.1

)

(1.9

)

(18.9

)

Net sales / (redemptions)

(1.1

)

0.1

(0.8

)

(1.2

)

(3.0

)

Market / FX

18.3

(1.0

)

3.0

0.4

20.7

AUM 31 Mar 2024

222.3

70.6

51.1

8.6

352.6

Sales

7.0

8.3

1.6

1.2

18.1

Redemptions

(8.4

)

(5.0

)

(2.4

)

(0.6

)

(16.4

)

Net sales / (redemptions)

(1.4

)

3.3

(0.8

)

0.6

1.7

Market / FX

5.3

0.5

1.3

—

7.1

Reclassifications

—

0.1

(0.1

)

—

—

AUM 30 Jun 2024

226.2

74.5

51.5

9.2

361.4

Sales

7.9

6.1

1.4

0.7

16.1

Redemptions

(9.4

)

(3.9

)

(1.8

)

(0.6

)

(15.7

)

Net sales / (redemptions)

(1.5

)

2.2

(0.4

)

0.1

0.4

Market / FX

12.4

3.8

2.4

0.8

19.4

Acquisitions

—

0.8

—

0.3

1.1

AUM 30 Sep 2024

237.1

81.3

53.5

10.4

382.3

Average AUM by capability

Three months ended

30 Sep

30 Jun

30 Sep

2024

2024

2023

Equities

229.6

220.8

196.9

Fixed Income

78.5

71.7

66.1

Multi-Asset

52.1

50.7

47.7

Alternatives

9.7

8.9

9.4

Total

369.9

352.1

320.1

INVESTMENT PERFORMANCE

% of AUM outperforming benchmark (as of

September 30, 2024)

Capability

1-year

3-year

5-year

10-year

Equities

63

%

61

%

54

%

80

%

Fixed Income

98

%

81

%

89

%

93

%

Multi-Asset

97

%

96

%

97

%

97

%

Alternatives

84

%

94

%

100

%

100

%

Total

75

%

71

%

67

%

85

%

Outperformance is measured based on composite performance gross

of fees versus primary benchmark, except where a strategy has no

benchmark index or corresponding composite in which case the most

relevant metric is used: (1) composite gross of fees versus zero

for absolute return strategies, (2) fund net of fees versus primary

index, or (3) fund net of fees versus Morningstar peer group

average or median. Non-discretionary and separately managed account

assets are included with a corresponding composite where

applicable.

Cash management vehicles, ETF-enhanced beta strategies, legacy

Tabula passive ETFs, Fixed Income Buy & Maintain mandates,

legacy NBK Capital funds, Managed CDOs, Private Equity funds, and

custom non-discretionary accounts with no corresponding composite

are excluded from the analysis. Excluded assets represent 3% of

AUM. Capabilities defined by Janus Henderson.

% of mutual fund AUM in top 2

Morningstar quartiles (as of September 30, 2024)

Capability

1-year

3-year

5-year

10-year

Equities

77

%

73

%

80

%

87

%

Fixed Income

81

%

57

%

67

%

71

%

Multi-Asset

96

%

95

%

95

%

96

%

Alternatives

37

%

87

%

42

%

100

%

Total

80

%

74

%

81

%

87

%

Includes Janus Investment Fund, Janus Aspen Series, Janus

Henderson Detroit Street Trust (ETFs), and Clayton Street Trust

(U.S. Trusts), Janus Henderson Capital Funds (Dublin based), Dublin

and UK OEIC and Investment Trusts, Luxembourg SICAVs, Australian

Managed Investment Schemes, and legacy Tabula ICAVs (legacy Tabula

passive ETFs are excluded). The top two Morningstar quartiles

represent funds in the top half of their category based on total

return. For the 1-, 3-, 5-, and 10-year periods ending September

30, 2024, 62%, 57%, 60%, and 63% of the 187, 175, 160, and 144

total mutual funds, respectively, were in the top 2 Morningstar

quartiles.

Analysis based on "primary" share class (Class I Shares,

Institutional Shares, or share class with longest history for U.S.

Trusts; Class H Shares or share class with longest history for

Dublin based; primary share class as defined by Morningstar for

other funds). Performance may vary by share class. Rankings may be

based, in part, on the performance of a predecessor fund or share

class and are calculated by Morningstar using a methodology that

differs from that used by Janus Henderson. Methodology differences

may have a material effect on the return and therefore the ranking.

When an expense waiver is in effect, it may have a material effect

on the total return, and therefore the ranking for the period.

Funds not ranked by Morningstar are excluded from the analysis.

Capabilities defined by Janus Henderson. © 2024 Morningstar, Inc.

All Rights Reserved.

THIRD QUARTER 2024 RESULTS BRIEFING INFORMATION

Chief Executive Officer Ali Dibadj and Chief Financial Officer

Roger Thompson will present these results on October 31, 2024, on a

conference call and webcast to be held at 9:00 a.m. ET.

Those wishing to participate should call:

United States

833 470 1428

United Kingdom

0808 189 6484

All other countries

+1 929 526 1599

Conference ID

008089

Access to the webcast and accompanying slides will be available

via the investor relations section of Janus Henderson’s website

(ir.janushenderson.com).

About Janus Henderson

Janus Henderson Group is a leading global active asset manager

dedicated to helping clients define and achieve superior financial

outcomes through differentiated insights, disciplined investments,

and world-class service. As of September 30, 2024, Janus Henderson

had approximately US$382 billion in assets under management, more

than 2,000 employees, and offices in 24 cities worldwide. The firm

helps millions of people globally invest in a brighter future

together. Headquartered in London, Janus Henderson is listed on the

NYSE.

FINANCIAL DISCLOSURES

Condensed consolidated statements of

comprehensive income (unaudited)

Three months ended

30 Sep

30 Jun

30 Sep

(in US$ millions, except per share data

or as noted)

2024

2024

2023

Revenue:

Management fees

502.8

472.8

434.9

Performance fees

8.6

7.4

(15.8

)

Shareowner servicing fees

61.4

58.5

54.9

Other revenue

52.0

49.7

47.0

Total revenue

624.8

588.4

521.0

Operating expenses:

Employee compensation and benefits

177.0

166.3

149.2

Long-term incentive plans

40.5

36.4

32.6

Distribution expenses

133.7

126.6

116.0

Investment administration

17.7

12.8

12.4

Marketing

8.3

9.8

9.6

General, administrative and occupancy

77.4

66.9

73.7

Depreciation and amortization

5.5

5.3

5.8

Total operating expenses

460.1

424.1

399.3

Operating income

164.7

164.3

121.7

Interest expense

(4.5

)

(3.2

)

(3.2

)

Investment gains (losses), net

35.0

6.4

(5.9

)

Other non-operating income (expense),

net

(101.6

)

7.6

(13.4

)

Income before taxes

93.6

175.1

99.2

Income tax provision

(43.6

)

(41.6

)

(13.2

)

Net income

50.0

133.5

86.0

Net loss (income) attributable to

noncontrolling interests

(22.7

)

(3.8

)

7.5

Net income attributable to JHG

27.3

129.7

93.5

Less: allocation of earnings to

participating stock-based awards

(0.7

)

(3.2

)

(2.8

)

Net income attributable to JHG common

shareholders

26.6

126.5

90.7

Basic weighted-average shares outstanding

(in millions)

154.4

155.6

160.8

Diluted weighted-average shares

outstanding (in millions)

154.7

155.8

160.9

Diluted earnings per share (in

US$)

0.17

0.81

0.56

Reconciliation of non-GAAP financial information

In addition to financial results reported in accordance with

GAAP, we compute certain financial measures using non-GAAP

components, as defined by the SEC. These measures are not in

accordance with, or a substitute for, GAAP, and our financial

measures may be different from non-GAAP financial measures used by

other companies. We have provided a reconciliation of our non-GAAP

components to the most directly comparable GAAP components. The

following are reconciliations of GAAP revenue, operating expenses,

operating income, net income attributable to JHG, and diluted

earnings per share to adjusted revenue, adjusted operating

expenses, adjusted operating income, adjusted net income

attributable to JHG, and adjusted diluted earnings per share.

Three months ended

30 Sep

30 Jun

30 Sep

(in US$ millions, except per share data

or as noted)

2024

2024

2023

Reconciliation of revenue to adjusted

revenue

Revenue

624.8

588.4

521.0

Management fees1

(51.4

)

(48.2

)

(41.4

)

Shareowner servicing fees1

(49.9

)

(47.3

)

(43.9

)

Other revenue1

(35.4

)

(34.6

)

(30.7

)

Adjusted revenue

488.1

458.3

405.0

Reconciliation of operating expenses to

adjusted operating expenses

Operating expenses

460.1

424.1

399.3

Employee compensation and benefits2

(4.3

)

(4.7

)

(0.9

)

Long-term incentive plans2

(1.7

)

(1.7

)

2.4

Distribution expenses1

(133.7

)

(126.6

)

(116.0

)

General, administration and occupancy2

(2.7

)

2.6

(4.7

)

Depreciation and amortization3

(0.1

)

(0.1

)

(0.5

)

Adjusted operating expenses

317.6

293.6

279.6

Adjusted operating income

170.5

164.7

125.4

Operating margin

26.4

%

27.9

%

23.4

%

Adjusted operating margin

34.9

%

35.9

%

31.0

%

Reconciliation of net income

attributable to JHG to adjusted net income attributable to

JHG

Net income attributable to JHG

27.3

129.7

93.5

Employee compensation and benefits2

1.3

1.2

0.9

Long-term incentive plans2

1.7

1.7

(2.4

)

General, administration and occupancy2

2.7

(2.6

)

4.7

Depreciation and amortization3

0.1

0.1

0.5

Interest expense4

0.1

—

—

Investment gains (losses), net4

—

0.8

(0.2

)

Other non-operating income, net4

113.3

3.7

25.6

Income tax benefit (provision)5

(1.8

)

0.6

(15.9

)

Adjusted net income attributable to

JHG

144.7

135.2

106.7

Less: allocation of earnings to

participating stock-based awards

(3.6

)

(3.4

)

(3.2

)

Adjusted net income attributable to JHG

common shareholders

141.1

131.8

103.5

Weighted-average diluted common shares

outstanding – diluted (in millions)

154.7

155.8

160.9

Diluted earnings per share (in

US$)

0.17

0.81

0.56

Adjusted diluted earnings per share (in

US$)

0.91

0.85

0.64

1

JHG contracts with third-party

intermediaries to distribute and service certain of its investment

products. Fees for distribution and servicing related activities

are either provided for separately in an investment product’s

prospectus or are part of the management fee. Under both

arrangements, the fees are collected by JHG and passed through to

third-party intermediaries who are responsible for performing the

applicable services. The majority of distribution and servicing

fees collected by JHG are passed through to third-party

intermediaries. JHG management believes that the deduction of

distribution and servicing fees from revenue in the computation of

adjusted revenue reflects the pass-through nature of these

revenues. In certain arrangements, JHG performs the distribution

and servicing activities and retains the applicable fees. Revenues

for distribution and servicing activities performed by JHG are not

deducted from GAAP revenue. In addition to the adjustments related

to distribution and servicing activities, other revenue for the

three months ended September 30, 2024, and June 30, 2024, also

includes an adjustment related to an employee secondment

arrangement with a joint venture. The arrangement is pass-through

in nature, and we believe the costs do not represent our ongoing

operations.

2

Adjustments for the three months ended

September 30, 2024, and June 30, 2024, include acquisition related

expenses and the acceleration of long-term incentive plan expense

related to the departure of certain employees. The adjustment for

the three months ended June 30, 2024, also includes a US$4.7

million insurance reimbursement related to a separately managed

account trade error that occurred in 2023. Adjustments for the

three months ended September 30, 2023, include rent expense, rent

income and other rent-related adjustments associated with subleased

office space, and the acceleration of long-term incentive plan

expense related to the departure of certain employees. JHG

management believes these costs are not representative of our

ongoing operations. Additionally, within the reconciliation of

operating expenses to adjusted operating expenses for the three

months ended September 30, 2024, and June 30, 2024, employee

compensation and benefits also includes an adjustment related to an

employee secondment arrangement with a joint venture. The

arrangement is pass-through in nature, and we believe the costs do

not represent our ongoing operations.

3

Investment management contracts have been

identified as a separately identifiable intangible asset arising on

the acquisition of subsidiaries and businesses. Such contracts are

recognized at the net present value of the expected future cash

flows arising from the contracts at the date of acquisition. For

segregated mandate contracts, the intangible asset is amortized on

a straight-line basis over the expected life of the contracts. JHG

management believes these non-cash and acquisition-related costs

are not representative of our ongoing operations.

4

Adjustments for the three months ended

September 30, 2024, and June 30, 2024, consist primarily of the

release of accumulated foreign currency translation adjustments

related to JHG liquidated entities. The adjustment for the three

months ended September 30, 2023, includes a provision for a credit

loss and contingent consideration fair value adjustment related to

the 2022 sale of Intech. JHG management believes these costs are

not representative of our ongoing operations.

5

The tax impact of the adjustments is

calculated based on the applicable U.S. or foreign statutory tax

rate as it relates to each adjustment. Certain adjustments are

either not taxable or not tax-deductible. Adjustments for the three

months ended September 30, 2023, were impacted by the change to our

state tax rate. As a result, the U.S. deferred tax assets and

liabilities were revalued from 23.9% to 23.5%, creating a non-cash

deferred tax benefit of US$8.8 million.

Condensed consolidated balance sheets

(unaudited)

30 Sep

31 Dec

(in US$ millions)

2024

2023

Assets:

Cash and cash equivalents

1,483.8

1,152.4

Investments

305.0

334.2

Property, equipment and software, net

38.8

44.2

Intangible assets and goodwill, net

3,799.8

3,721.6

Assets of consolidated variable interest

entities

749.0

405.9

Other assets

887.4

838.3

Total assets

7,263.8

6,496.6

Liabilities, redeemable noncontrolling

interests and equity:

Long-term debt

698.6

304.6

Deferred tax liabilities, net

576.3

570.8

Liabilities of consolidated variable

interest entities

7.2

3.2

Other liabilities

855.0

762.5

Redeemable noncontrolling interests

493.5

317.2

Total equity

4,633.2

4,538.3

Total liabilities, redeemable

noncontrolling interests and equity

7,263.8

6,496.6

Condensed consolidated statements of

cash flows (unaudited)

Three months ended

30 Sep

30 Jun

30 Sep

(in US$ millions)

2024

2024

2023

Cash provided by (used for):

Operating activities

228.5

223.8

216.9

Investing activities

(215.0

)

(60.4

)

16.0

Financing activities

424.6

(50.9

)

(91.5

)

Effect of exchange rate changes

31.9

—

(25.5

)

Net change during period

470.0

112.5

115.9

Basis of preparation

In the opinion of management of Janus Henderson Group plc, the

condensed consolidated financial statements contain all normal

recurring adjustments necessary to fairly present the financial

position, results of operations, and cash flows of JHG in

accordance with GAAP. Such financial statements have been prepared

in accordance with the instructions to Form 10‑Q pursuant to the

rules and regulations of the SEC. Certain information and footnote

disclosures normally included in financial statements prepared in

accordance with GAAP have been condensed or omitted pursuant to

such rules and regulations. The financial statements should be read

in conjunction with the annual consolidated financial statements

and notes presented in Janus Henderson’s Annual Report on Form 10‑K

for the year ended December 31, 2023, filed with the SEC

(Commission File No. 001‑38103). Events subsequent to the balance

sheet date have been evaluated for inclusion in the financial

statements through the issuance date and are included in the notes

to the condensed consolidated financial statements.

FORWARD-LOOKING STATEMENTS DISCLAIMER

Past performance is no guarantee of future results. Investing

involves risk, including the possible loss of principal and

fluctuation of value.

Certain statements in this press release not based on historical

facts are “forward-looking statements” within the meaning of the

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended, and Section 27A of the

Securities Act of 1933, as amended. Such forward-looking statements

involve known and unknown risks and uncertainties that are

difficult to predict and could cause our actual results,

performance, or achievements to differ materially from those

discussed. These include statements as to our future expectations,

beliefs, plans, strategies, objectives, events, conditions,

financial performance, prospects, or future events, including with

respect to the timing and anticipated benefits of pending and

recently completed transactions and expectations regarding

acquisition opportunities. In some cases, forward-looking

statements can be identified by the use of words such as “may,”

“could,” “expect,” “intend,” “plan,” “seek,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,”

“likely,” “will,” “would,” and similar words and phrases.

Forward-looking statements are necessarily based on estimates and

assumptions that, while considered reasonable by us and our

management, are inherently uncertain. Accordingly, you should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made and are not guarantees of future

performance. We do not undertake any obligation to publicly update

or revise these forward-looking statements.

Various risks, uncertainties, assumptions, and factors that

could cause our future results to differ materially from those

expressed by the forward-looking statements included in this press

release include, but are not limited to, risks, uncertainties,

assumptions, and factors discussed in our Annual Report on Form

10-K for the year ended December 31, 2023, and in other filings or

furnishings made by the Company with the SEC from time to time.

Annualized, pro forma, projected, and estimated numbers are used

for illustrative purposes only, are not forecasts, and may not

reflect actual results.

The information, statements, and opinions contained in this

document do not constitute a public offer under any applicable

legislation or an offer to sell or solicitation of any offer to buy

any securities or financial instruments or any advice or

recommendation with respect to such securities or other financial

instruments.

Not all products or services are available in all

jurisdictions.

Janus Henderson is a trademark of Janus Henderson Group plc or

one of its subsidiaries. © Janus Henderson Group plc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031516517/en/

Investor enquiries: Jim Kurtz Head of Investor Relations

+1 303 336 4529 jim.kurtz@janushenderson.com Or Investor Relations

investor.relations@janushenderson.com

Media enquiries: Candice Sun Global Head of Media

Relations +1 303 336 5452 candice.sun@janushenderson.com

Nicole Mullin Media Relations Director, UK, EMEA, LatAm &

APAC +44 (0)20 7818 2511 nicole.mullin@janushenderson.com

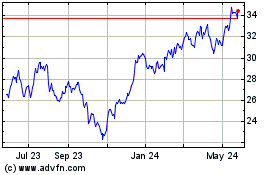

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From Dec 2024 to Jan 2025

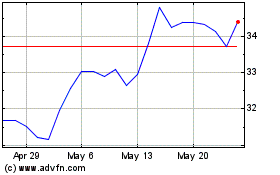

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From Jan 2024 to Jan 2025