0001687932false00016879322024-12-132024-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 13, 2024 |

J.JILL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38026 |

45-1459825 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4 Batterymarch Park |

|

Quincy, Massachusetts |

|

02169 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 617 376-4300 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

JILL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 13, 2024, in order to reward, retain, and further incentivize performance, J.Jill, Inc. (the “Company”), upon approval from the Compensation Committee of its Board of Directors, entered into a retention agreement (the “Retention Agreement”) with Mark Webb, the Company’s Executive Vice President, Chief Financial and Operating Officer. The Retention Agreement is effective as of December 13, 2024 (the “Effective Date”).

Under the Retention Agreement, the Company agreed to pay Mr. Webb a retention payment in the amount of $1,475,800.00 (the “Retention Bonus”) in the form of stock-settled Restricted Stock Units (“RSUs”). Fifty percent (50%) of such RSUs will become vested on the first anniversary of the Effective Date, if Mr. Webb is still employed by the Company on that date. The remaining fifty percent (50%) of the RSUs will vest in equal amounts (i.e. 12.5% of the total RSU grant) on the last day of each quarter that Mr. Webb remains continuously employed by the Company through such quarter, with the first such quarter beginning January 1, 2026 and ending on March 31, 2026. In the event that Mr. Webb’s employment terminates in a Qualifying Termination (as defined in the Retention Agreement) during the two year period from the Effective Date, any unvested RSUs will immediately vest as of the effective date of Mr. Webb’s separation from the Company. If Mr. Webb’s employment with the Company terminates for any reason other than a Qualifying Termination, any unvested portion of the RSUs will be immediately and automatically forfeited for no additional consideration as of the effective date of Mr. Webb’s separation from the Company. Capitalized terms used but not defined above have the meanings ascribed to them in the Retention Agreement.

The foregoing description of the Retention Agreement is only a summary and is qualified in its entirety by reference to the form of Retention Agreement, a copy of which is attached as Exhibit 10.1 hereto and incorporated by reference into this Item 5.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

|

|

Exhibit No. |

|

Description of Exhibit |

10.1 |

|

Form of Retention Agreement |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

J.JILL, INC. |

|

|

|

|

Date: |

December 17, 2024 |

By: |

/s/ Kathleen B. Stevens |

|

|

Name: Title: |

Kathleen B. Stevens

Senior Vice President, General Counsel, Secretary and ESG |

Personal and Confidential

December 13, 2024

Mark Webb

Re: Retention Payment

Dear Mark:

On behalf of J.Jill, Inc. (the “Company”), I am pleased to offer you the opportunity to receive a retention payment if you agree to the terms and conditions contained in this letter agreement (this “Agreement”), which shall be effective as of December 13, 2024 (the “Effective Date”).

1.Retention Payment. Subject to the terms and conditions set forth herein, the Company hereby grants you a retention bonus in the amount of $1,475,800.00 (the “Retention Bonus”). The Retention Bonus will be paid in the form of stock-settled Restricted Stock Units (“RSUs”), with the grant occurring on the Effective Date. The RSUs will vest in accordance with the following formula:

(a)50% of the RSUs will become vested on the first anniversary of the Effective Date, if you are employed by the Company on that date.

(b)The remaining 50% of the RSUs will vest quarterly, i.e. 12.5% of the total RSU grant shall vest on the last day of each quarter that you remain continuously employed with the Company through such quarter, with the first such quarter of such period beginning January 1, 2026 and ending on March 31, 2026.

(c)In the event that your employment terminates in a Qualifying Termination during the two year period from the Effective Date, any unvested RSUs will immediately vest as of the effective date of your separation from the Company.

(d)If your employment with the Company terminates for any reason other than a Qualifying Termination, any unvested portion of the RSUs will be immediately and automatically forfeited for no additional consideration as of the effective date of your separation from the Company.

2. Definitions. For purposes of this Agreement:

“Cause” means your (i) your breach of any material provision of your employment agreement or offer letter with the Company; (ii) your failure to follow a lawful directive of your reporting officer; (iii) your negligence in the performance or nonperformance of any of your duties or responsibilities; (iv) your dishonesty, fraud, or willful misconduct with respect to the business or affairs of the Company; (v) your conviction of, or plea of no contest to, any misdemeanor involving theft, fraud, dishonesty, or act of moral turpitude or to any felony; or (vi) your use of alcohol or drugs in a manner that materially interferes with the performance of your duties for the Company; provided, that in the event of a breach, a failure, or negligence described in clauses (i), (ii), or (iii), and in the first instance of a use of alcohol or drugs having the consequences described in clause (vi), in any such case, that can be cured by you, the Company shall provide you with notice of the facts and circumstances which constitute such breach, failure, or negligence or use and shall provide you a 10 day period in which to cure such breach, failure, negligence or use and the Company shall not terminate your employment for Cause if you cure such breach, failure, negligence or use within such 10 day period.

“Disability” means your absence from your duties with the Company on a full-time basis for 90 calendar days as a result of incapacity due to mental or physical illness that is determined to be total and permanent by a physician selected by the Company or its insurers, and acceptable to you or your legal representatives; provided, however, that if there is a definition of disability used in an employment agreement between you and the Company, then the definition of Disability herein shall be the same as that used in such employment agreement.

“Good Reason” means the occurrence of any of the following: (i) a reduction in your level below the level of Executive Vice President; (ii) a material reduction in your base salary (other than pursuant to an equivalent across-the-board reduction applicable to all similarly situated executives); or (iii) the relocation of your principal work location outside of the Quincy, Massachusetts, area without your consent; provided, however, that Good Reason shall not exist unless (A) you give your reporting officer a written statement of the basis for your belief that Good Reason exists, (B) such written statement is provided not later than 60 days after the initial existence of the condition that you believe forms the basis for resignation for Good Reason, (C) you give the Company at least 30 days after receipt of such written statement to cure the basis for such belief (the “Cure Period”), and (D) the Company does not cure the basis for such belief within the Cure Period.

“Qualifying Termination” means the termination of your employment (i) by the Company for a reason other than Cause, (ii) by you for Good Reason, or (iii) due to your death or Disability if, and only if, in the case of any termination pursuant to clauses (i), (ii) and (iii), other than in the case of your death, you execute a release of employment related claims in a form to be provided by the Company (the “Release”), and such Release becomes irrevocable, within 60 days of your termination, in which case the effective date of the Qualifying Termination will be deemed to have occurred on your date of termination. For the sake of clarity, a termination of employment (other than in the case of death) will not be a Qualifying Termination if you do not execute, or if you revoke, the Release.

3.Withholding Taxes. The Company may withhold from any and all amounts payable to you hereunder such federal, state and local taxes as the Company determines in its sole discretion may be required to be withheld pursuant to any applicable law or regulation.

4.No Right to Continued Employment. Nothing in this Agreement will confer upon you any right to continued employment with the Company (or its affiliates, subsidiaries or their respective successors) or to interfere in any way with the right of the Company (or its affiliates, subsidiaries or their respective successors) to terminate your employment at any time.

5.Other Benefits. The Retention Bonus is a special payment to you and will not be taken into account in computing the amount of salary or compensation for purposes of determining any bonus, incentive, pension, retirement, death or other benefit under any other bonus, incentive, pension, retirement, insurance or other employee benefit plan of the Company, unless such plan or agreement expressly provides otherwise.

6.Governing Law. This Agreement will be governed by, and construed under and in accordance with, the internal laws of the State of Delaware, without reference to rules relating to conflicts of laws.

7.Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

8.Entire Agreement; Amendment. This Agreement constitutes the entire agreement between you and the Company with respect to the Retention Bonus and supersedes any and all prior agreements or understandings between you and the Company with respect to the Retention Bonus, whether written or oral. This Agreement may be amended or modified only by a written instrument executed by you and the Company.

9.Section 409A Compliance. The intent of the parties is that the Retention Bonus be exempt from the requirements of Section 409A of the Internal Revenue Code of 1986, as amended, and accordingly, to the maximum extent permitted, this Agreement shall be interpreted in a manner consistent therewith.

[signature page follows]

This Agreement is intended to be a binding obligation on you and the Company. If this Agreement accurately reflects your understanding as to the terms and condition of the Retention Bonus, please sign, date and return to me one copy of this Agreement. You should make a copy of the executed Agreement for your records.

Sincerely,

Maria Martinez

Senior Vice President, Chief Human Resources Officer

J.Jill, Inc.

The above terms and conditions accurately reflect our understanding regarding the terms and conditions of the Retention Bonus, and I hereby confirm my agreement to same.

____________________________

Mark Webb

v3.24.4

Document And Entity Information

|

Dec. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 13, 2024

|

| Entity Registrant Name |

J.JILL, INC.

|

| Entity Central Index Key |

0001687932

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38026

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

45-1459825

|

| Entity Address, Address Line One |

4 Batterymarch Park

|

| Entity Address, City or Town |

Quincy

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02169

|

| City Area Code |

617

|

| Local Phone Number |

376-4300

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

JILL

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

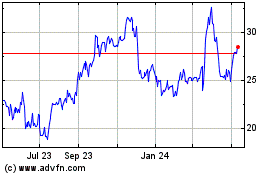

J Jill (NYSE:JILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

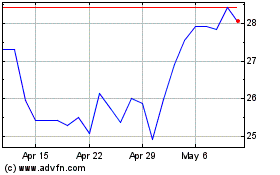

J Jill (NYSE:JILL)

Historical Stock Chart

From Jan 2024 to Jan 2025