0001501134false00015011342023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: November 8, 2023

(Date of earliest event reported)

Invitae Corporation

(Exact name of the registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36847 | | 27-1701898 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. employer |

| incorporation or organization) | | File Number) | | identification number) |

1400 16th Street, San Francisco, California 94103

(Address of principal executive offices, including zip code)

(415) 374-7782

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.0001 par value per share | | NVTA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 8, 2023, Invitae Corporation (the "Company") issued a press release announcing financial results for its fiscal quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| |

| | Press release issued by Invitae Corporation dated November 8, 2023. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 8, 2023

| | | | | | | | |

| | |

| INVITAE CORPORATION |

| |

| By: | | /s/ Ana J. Schrank |

| Name: | | Ana J. Schrank |

| Title: | | Chief Financial Officer |

Invitae Reports Third Quarter 2023 Financial Results

Reported revenue of $121.2 million, a year-over-year decrease of 9%; on a pro forma basis, taking into account exited businesses and geographies, revenue increased approximately 4%

Gross margin of 32.2% and non-GAAP gross margin of 52.4%; continued improvement in non-GAAP gross margin for nine consecutive quarters

Reaffirming 2023 financial guidance

SAN FRANCISCO – November 8, 2023 – Invitae (NYSE: NVTA), a leading medical genetics company, today announced results for the third quarter ended September 30, 2023.

“The Company executed well on key operating and financial metrics in the third quarter, and remains on track to meet or beat annual guidance,” said Ken Knight, president and chief executive officer of Invitae. “On the operational front, we added key executive talent and achieved a number of clinical milestones that should strengthen the health of our business, deliver continuing market expansion and further differentiate our testing portfolio from competitors.”

Third Quarter 2023 Financial Results Third quarter revenue decreased 9% to $121.2 million compared to $133.5 million in the same period in the prior year, primarily reflecting the impact of exited businesses and geographies completed in 2022. After adjusting for revenue of $17.2 million in the prior year period related to the discontinued businesses, third quarter revenue increased approximately 4% on a pro forma basis, with U.S. hereditary cancer testing volume achieving double-digit percentage growth compared to the prior year period.

•Gross profit was $39.1 million in the quarter, compared with $16.6 million in the same period of 2022, or 135.6% year-over-year growth. Non-GAAP gross profit was $63.6 million in the quarter, compared with $61.2 million in the third quarter of 2022, representing a year-over-year growth rate of 3.8%.

•Gross margin was 32.2% in the third quarter, compared with 12.4% a year ago. Non-GAAP gross margin was 52.4% compared with 45.9% in the third quarter of 2022. This represents Invitae’s ninth consecutive quarter of non-GAAP gross margin improvement.

•Operating expense for the third quarter of 2023 was $1.0 billion, compared with $306.5 million in the third quarter of 2022. Operating expense in the third quarter includes $877.3 million in restructuring, impairment and other costs primarily related to an impairment charge of the Company’s long-lived assets, compared with $125.2 million in the prior year period. Non-GAAP operating expense was $122.1 million for the third quarter of 2023, compared with $150.0 million for the third quarter of 2022. Non-GAAP operating expense as a percentage of revenue was 101%, compared with 112% in the third quarter of 2022.

•As of September 30, 2023, Invitae had $264.7 million of cash, cash equivalents, restricted cash and marketable securities compared to $557.1 million as of December 31, 2022.

•Net decrease in cash, cash equivalents, restricted cash and net changes in investments in the quarter was $72.2 million. Cash burn in the quarter was $64.1 million.

•Total patients served as of September 30, 2023 was approximately 4.4 million with 64% available for data sharing.

•Third quarter net loss per basic and diluted share of ($3.42) included impairment and losses on disposals of long-lived assets, net, employee severance and benefits and other restructuring costs of $877.3 million primarily related to fair market value assessment of the Company’s intangible assets. Third quarter non-GAAP net loss per basic and diluted share of ($0.10) excludes this charge. Compared to a year ago, net loss per basic and diluted share and non-GAAP net loss per basic and diluted share were ($1.27) and ($0.42), respectively.

Operational improvement efforts and expense control have resulted in margin expansion and stronger financial performance. In addition, the Company is engaging with stakeholders to strengthen the balance sheet, and the Board of Directors has formed a special committee focused on improving the Company’s capital structure. The Company is exploring a number of options, including, but not limited to, raising capital, asset sales, business and R&D refocusing efforts, capital expenditure and operating expense reductions and addressing its debt obligations.

Reaffirming Fiscal 2023 Outlook

For the full year, Invitae is reaffirming its fiscal 2023 outlook. The Company expects revenue in the range of $480-$500 million and non-GAAP gross margin in the range of 48-50%.

Ongoing cash burn includes cash, cash equivalents, marketable securities and restricted cash and excludes certain items. The Company continues to expect ongoing cash burn to be in the range of $220-$245 million in 2023. In 2023, cash burn will be higher than ongoing cash burn as a result of the Company’s voluntary repayment of its $135 million term loan in the first quarter of 2023.

Webcast and Conference Call Details

Management will host a conference call and webcast today at 4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time to discuss financial results and recent developments. To access the conference call, please register at the link below:

https://www.netroadshow.com/events/login?show=62d0dec5&confId=56925

Upon registering, each participant will be provided with call details and access codes.

The live webcast of the call and slide deck may be accessed here or by visiting the investors section of the company's website at ir.invitae.com. A replay of the webcast will be available shortly after the conclusion of the call and will be archived on the company's website.

About Invitae

Invitae (NYSE: NVTA) is a leading medical genetics company trusted by millions of patients and their providers to deliver timely genetic information using digital technology. We aim to provide accurate and actionable answers to strengthen medical decision-making for individuals and their families. Invitae's genetics experts apply a rigorous approach to data and research, serving as the foundation of their mission to bring comprehensive genetic information into mainstream medicine to improve healthcare for billions of people.

To learn more, visit invitae.com and follow for updates on Twitter, Instagram, Facebook and LinkedIn @Invitae.

Safe Harbor Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the company’s mission; the company’s future financial and operating results; the company’s focus, strategy, and roadmap; the company’s financial guidance for 2023; the company’s belief that the addition of executives and achievement of clinical milestones will strengthen the health of the company’s business, deliver continuing market expansion and differentiate the company’s testing portfolio from competitors; the objectives of the special committee; and the company’s beliefs regarding engagement with stakeholders and plans to explore various options. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: the availability of and need for capital; the ability to service the company’s debt obligations; the ability of the company to successfully execute its strategic business realignment and achieve the intended benefits thereof on the expected timeframe or at all; unforeseen or greater than expected costs associated with the strategic business realignment; the risk that the disruption that may result from the realignment may harm the company’s business, market share or its relationship with customers or potential customers; risks related to the various options the company is exploring, including the fact that certain options may not be available to the company; the impact of inflation and the current economic environment on the company’s business; the company's ability to grow its business in a cost-efficient manner; the company's history of losses; the company’s ability to maintain important customer relationships; the company’s ability to compete; the company's need to scale its infrastructure in advance of demand for its tests and to increase demand for its tests; the risk that the company may not obtain or maintain sufficient levels of reimbursement for its tests; the applicability of clinical results to actual outcomes; risks associated with litigation; the company's ability to use rapidly changing genetic data to interpret test results accurately and consistently; laws and regulations applicable to the company's business; and the other risks set forth in the reports filed by the company with the SEC, including its Quarterly Report on Form 10-Q for the quarter ended June 30, 2023. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

Non-GAAP Financial Measures

To supplement the company’s consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States (GAAP), the company is providing several non-GAAP measures. These non-GAAP financial measures exclude certain items that are required by GAAP. In addition, these non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Management believes these non-GAAP financial measures are useful to investors in evaluating the company’s ongoing operating results and trends. Management uses such non-GAAP information to manage the company’s business and monitor its performance.

Other companies, including companies in the same industry, may not use the same non-GAAP measures or may calculate these metrics in a different manner than management or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of these non-GAAP measures as comparative measures. Because of these limitations, the company’s non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the non-GAAP reconciliations provided in the tables below and on the company’s website.

In addition, this press release includes the company’s non-GAAP gross margin and cash burn guidance, non-GAAP measures used to describe the company’s expected performance. The company has not presented a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, because the reconciliations could not be prepared without unreasonable effort. The information

necessary to prepare the reconciliations are not available on a forward-looking basis and cannot be accurately predicted. The unavailable information could have a significant impact on the calculation of the comparable GAAP financial measures.

Invitae Contacts:

Investor Relations

Hoki Luk

ir@invitae.com

Public Relations

Amy Hadsock

pr@invitae.com

INVITAE CORPORATION

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 158,007 | | | $ | 257,489 | |

| Marketable securities | 96,566 | | | 289,611 | |

| Accounts receivable | 82,507 | | | 96,148 | |

| Inventory | 21,627 | | | 30,386 | |

| Prepaid expenses and other current assets | 19,692 | | | 19,496 | |

| Total current assets | 378,399 | | | 693,130 | |

| Property and equipment, net | 65,446 | | | 108,723 | |

| Operating lease assets | 61,639 | | | 106,563 | |

| Restricted cash | 10,100 | | | 10,030 | |

| | | |

| Intangible assets, net | — | | | 1,012,549 | |

| | | |

| Other assets | 19,531 | | | 23,121 | |

| Total assets | $ | 535,115 | | | $ | 1,954,116 | |

| Liabilities and stockholders’ (deficit) equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 25,185 | | | $ | 13,984 | |

| Accrued liabilities | 84,729 | | | 74,388 | |

| Operating lease obligations | 17,650 | | | 14,600 | |

| Finance lease obligations | 3,948 | | | 5,121 | |

Convertible senior notes, net current portion | 26,907 | | | — | |

| Total current liabilities | 158,419 | | | 108,093 | |

| Operating lease obligations, net of current portion | 134,945 | | | 134,386 | |

| Finance lease obligations, net of current portion | 855 | | | 3,780 | |

| Debt | — | | | 122,333 | |

| Convertible senior notes, net | 1,127,830 | | | 1,470,783 | |

| Convertible senior secured notes (at fair value) | 196,244 | | | — | |

| Deferred tax liability | — | | | 8,130 | |

| Other long-term liabilities | 226 | | | 4,775 | |

| Total liabilities | 1,618,519 | | | 1,852,280 | |

| | | |

| Stockholders’ (deficit) equity: | | | |

| Common stock | 29 | | | 25 | |

| Accumulated other comprehensive income (loss) | 25,378 | | | (80) | |

| Additional paid-in capital | 5,061,131 | | | 4,931,032 | |

| Accumulated deficit | (6,169,942) | | | (4,829,141) | |

| Total stockholders’ (deficit) equity | (1,083,404) | | | 101,836 | |

| Total liabilities and stockholders’ (deficit) equity | $ | 535,115 | | | $ | 1,954,116 | |

INVITAE CORPORATION

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | | |

| Test revenue | | $ | 117,561 | | | $ | 128,839 | | | $ | 346,127 | | | $ | 381,518 | |

| Other revenue | | 3,680 | | | 4,697 | | | 13,002 | | | 12,331 | |

| Total revenue | | 121,241 | | | 133,536 | | | 359,129 | | | 393,849 | |

| Operating expenses: | | | | | | | | |

| Cost of revenue | | 82,186 | | | 116,956 | | | 258,102 | | | 324,412 | |

| Research and development | | 58,336 | | | 87,177 | | | 184,138 | | | 330,559 | |

| Selling and marketing | | 37,999 | | | 49,193 | | | 127,241 | | | 172,086 | |

| General and administrative | | 45,619 | | | 44,939 | | | 160,826 | | | 147,221 | |

| Goodwill and IPR&D impairment | | — | | | — | | | — | | | 2,313,047 | |

Restructuring, impairment and other costs | | 877,289 | | | 125,222 | | | 1,010,843 | | | 130,039 | |

| | | | | | | | |

| | | | | | | | |

| Total operating expenses | | 1,101,429 | | | 423,487 | | | 1,741,150 | | | 3,417,364 | |

| Loss from operations | | (980,188) | | | (289,951) | | | (1,382,021) | | | (3,023,515) | |

| Other income (expense), net: | | | | | | | | |

Gain (loss) on extinguishment of debt, net | | 229 | | | — | | | (10,593) | | | — | |

| Debt issuance costs | | (845) | | | — | | | (20,704) | | | — | |

| Change in fair value of convertible senior secured notes | | 33,463 | | | — | | | 72,386 | | | — | |

| Change in fair value of acquisition-related liabilities | | 70 | | | (527) | | | 337 | | | 15,666 | |

| Other income, net | | 4,843 | | | 2,399 | | | 15,105 | | | 3,971 | |

| Total other income, net | | 37,760 | | | 1,872 | | | 56,531 | | | 19,637 | |

| Interest expense | | (5,850) | | | (14,145) | | | (23,366) | | | (42,149) | |

| Net loss before taxes | | (948,278) | | | (302,224) | | | (1,348,856) | | | (3,046,027) | |

| Income tax benefit | | 6,171 | | | 1,068 | | | 8,055 | | | 39,551 | |

| Net loss | | $ | (942,107) | | | $ | (301,156) | | | $ | (1,340,801) | | | $ | (3,006,476) | |

| Net loss per share, basic and diluted | | $ | (3.42) | | | $ | (1.27) | | | $ | (5.09) | | | $ | (12.91) | |

| | | | | | | | |

| Shares used in computing net loss per share, basic and diluted | | 275,604 | | | 237,974 | | | 263,210 | | | 232,889 | |

| | | | | | | | |

INVITAE CORPORATION

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited) | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (1,340,801) | | | $ | (3,006,476) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Goodwill and IPR&D impairment | — | | | 2,313,047 | |

| Impairments and losses on disposals of long-lived assets, net | 1,012,360 | | | 60,317 | |

| | | |

| Depreciation and amortization | 100,403 | | | 104,726 | |

| Stock-based compensation | 85,554 | | | 164,314 | |

| Amortization of debt discount and issuance costs | 5,483 | | | 11,676 | |

| Loss on extinguishment of debt, net | 10,593 | | | — | |

| Debt issuance costs | 20,704 | | | — | |

| Change in fair value of convertible senior secured notes | (72,386) | | | — | |

| Remeasurements of liabilities associated with business combinations | (337) | | | (15,666) | |

| Benefit from income taxes | (8,055) | | | (39,551) | |

| Post-combination expense for acceleration of unvested equity and deferred stock compensation | 1,789 | | | 4,980 | |

| Amortization of premiums and discounts on investment securities | (6,259) | | | 603 | |

| Non-cash lease expense | 9,309 | | | 6,832 | |

| Other | 2,211 | | | (1,314) | |

| Changes in operating assets and liabilities, net of businesses acquired: | | | |

| Accounts receivable | 13,641 | | | (22,903) | |

| Inventory | 8,759 | | | 3,614 | |

| Prepaid expenses and other current assets | (196) | | | 9,012 | |

| Other assets | (139) | | | 2,740 | |

| Accounts payable | 8,135 | | | (6,345) | |

| Accrued expenses and other long-term liabilities | (6,966) | | | (540) | |

| Net cash used in operating activities | (156,198) | | | (410,934) | |

| Cash flows from investing activities: | | | |

| Purchases of marketable securities | (231,044) | | | (789,622) | |

| Proceeds from maturities of marketable securities | 430,440 | | | 541,313 | |

| | | |

| | | |

| Purchases of property and equipment | (4,669) | | | (48,385) | |

| Proceeds from sale of property and equipment | 332 | | | — | |

| | | |

| Net cash provided by (used in) investing activities | 195,059 | | | (296,694) | |

| Cash flows from financing activities: | | | |

(Loss) proceeds from public offerings of common stock, net of issuance costs | (55) | | | 9,658 | |

| Proceeds from issuance of common stock, net | 2,170 | | | 6,267 | |

| | | |

| | | |

| Proceeds from issuance of Series B convertible senior secured notes due 2028 | 30,001 | | | — | |

| | | |

| Payments for debt issuance costs and prepayment fees | (25,974) | | | — | |

| Repayment of debt | (135,000) | | | — | |

| | | |

| | | |

| | | |

| Finance lease principal payments | (3,886) | | | (4,184) | |

| Settlement of acquisition obligations | (5,529) | | | (10,582) | |

| Net cash (used in) provided by financing activities | (138,273) | | | 1,159 | |

| Net decrease in cash, cash equivalents and restricted cash | (99,412) | | | (706,469) | |

| Cash, cash equivalents and restricted cash at beginning of period | 267,519 | | | 933,525 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 168,107 | | | $ | 227,056 | |

Reconciliation of GAAP to Non-GAAP Cost of Revenue

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | | $ | 82,186 | | | $ | 116,956 | | | $ | 258,102 | | | $ | 324,412 | |

| Amortization of acquired intangible assets | | (24,082) | | | (27,711) | | | (77,122) | | | (73,618) | |

| Acquisition-related stock-based compensation | | (44) | | | (146) | | | (146) | | | (425) | |

| Acquisition-related post-combination expense | | — | | | (162) | | | — | | | (1,053) | |

| | | | | | | | |

| Restructuring-related retention bonuses | | (7) | | | (170) | | | (145) | | | (170) | |

| Inventory and prepaid write-offs | | (388) | | | (16,467) | | | (1,362) | | | (16,467) | |

| Non-GAAP cost of revenue | | $ | 57,665 | | | $ | 72,300 | | | $ | 179,327 | | | $ | 232,679 | |

Reconciliation of GAAP to Non-GAAP Gross Profit

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 121,241 | | | $ | 133,536 | | | $ | 359,129 | | | $ | 393,849 | |

| Cost of revenue | | 82,186 | | | 116,956 | | | 258,102 | | | 324,412 | |

| Gross profit | | 39,055 | | | 16,580 | | | 101,027 | | | 69,437 | |

| Amortization of acquired intangible assets | | 24,082 | | | 27,711 | | | 77,122 | | | 73,618 | |

| Acquisition-related stock-based compensation | | 44 | | | 146 | | | 146 | | | 425 | |

| Acquisition-related post-combination expense | | — | | | 162 | | | — | | | 1,053 | |

| | | | | | | | |

| Restructuring-related retention bonuses | | 7 | | | 170 | | | 145 | | | 170 | |

| Inventory and prepaid write-offs | | 388 | | | 16,467 | | | 1,362 | | | 16,467 | |

| Non-GAAP gross profit | | $ | 63,576 | | | $ | 61,236 | | | $ | 179,802 | | | $ | 161,170 | |

Reconciliation of GAAP to Non-GAAP Research and Development Expense

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Research and development | | $ | 58,336 | | | $ | 87,177 | | | $ | 184,138 | | | $ | 330,559 | |

| Amortization of acquired intangible assets | | — | | | (306) | | | (90) | | | (1,338) | |

| Acquisition-related stock-based compensation | | (14,921) | | | (18,695) | | | (43,448) | | | (65,719) | |

| Acquisition-related post-combination expense | | (141) | | | (1,962) | | | (1,825) | | | (7,186) | |

| Restructuring-related retention bonuses | | (669) | | | (646) | | | (2,052) | | | (646) | |

| Restructuring-related accelerated depreciation | | (125) | | | (3,311) | | | (341) | | | (3,311) | |

| Non-GAAP research and development | | $ | 42,480 | | | $ | 62,257 | | | $ | 136,382 | | | $ | 252,359 | |

Reconciliation of GAAP to Non-GAAP Selling and Marketing Expense

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Selling and marketing | | $ | 37,999 | | | $ | 49,193 | | | $ | 127,241 | | | $ | 172,086 | |

| Amortization of acquired intangible assets | | (1,569) | | | (1,610) | | | (4,707) | | | (4,856) | |

| Acquisition-related stock-based compensation | | — | | | (806) | | | (750) | | | (2,374) | |

| | | | | | | | |

| Restructuring-related retention bonuses | | (105) | | | (115) | | | (565) | | | (115) | |

| Non-GAAP selling and marketing | | $ | 36,325 | | | $ | 46,662 | | | $ | 121,219 | | | $ | 164,741 | |

Reconciliation of GAAP to Non-GAAP General and Administrative Expense

(in thousands)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| General and administrative | | $ | 45,619 | | | $ | 44,939 | | | $ | 160,826 | | | $ | 147,221 | |

| Change in fair value of contingent consideration | | — | | | — | | | — | | | 1,850 | |

| Acquisition-related stock-based compensation | | (1,181) | | | (3,438) | | | (3,524) | | | (6,656) | |

| | | | | | | | |

| Restructuring-related retention bonuses | | (1,149) | | | (300) | | | (2,402) | | | (300) | |

| Restructuring-related accelerated depreciation | | — | | | (111) | | | — | | | (111) | |

| Non-GAAP general and administrative | | $ | 43,289 | | | $ | 41,090 | | | $ | 154,900 | | | $ | 142,004 | |

Reconciliation of Operating Expenses to Non-GAAP Operating Expenses

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Research and development | | $ | 58,336 | | | $ | 87,177 | | | $ | 184,138 | | | $ | 330,559 | |

| Selling and marketing | | 37,999 | | | 49,193 | | | 127,241 | | | 172,086 | |

| General and administrative | | 45,619 | | | 44,939 | | | 160,826 | | | 147,221 | |

| Goodwill and IPR&D impairment | | — | | | — | | | — | | | 2,313,047 | |

Restructuring, impairment and other costs | | 877,289 | | | 125,222 | | | 1,010,843 | | | 130,039 | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses | | 1,019,243 | | | 306,531 | | | 1,483,048 | | | 3,092,952 | |

| Goodwill and IPR&D impairment | | — | | | — | | | — | | | (2,313,047) | |

Restructuring, impairment and other costs | | (877,289) | | | (125,222) | | | (1,010,843) | | | (130,039) | |

| | | | | | | | |

| Change in fair value of contingent consideration | | — | | | — | | | — | | | 1,850 | |

| Amortization of acquired intangible assets | | (1,569) | | | (1,916) | | | (4,797) | | | (6,194) | |

| Acquisition-related stock-based compensation | | (16,102) | | | (22,939) | | | (47,722) | | | (74,749) | |

| Acquisition-related post-combination expense | | (141) | | | (1,962) | | | (1,825) | | | (7,186) | |

| Restructuring-related retention bonuses | | (1,923) | | | (1,061) | | | (5,019) | | | (1,061) | |

| Restructuring-related accelerated depreciation | | (125) | | | (3,422) | | | (341) | | | (3,422) | |

| Non-GAAP operating expenses | | $ | 122,094 | | | $ | 150,009 | | | $ | 412,501 | | | $ | 559,104 | |

Reconciliation of Other Income, Net to Non-GAAP Other Income, Net

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Other income, net | | $ | 37,760 | | | $ | 1,872 | | | $ | 56,531 | | | $ | 19,637 | |

| Change in fair value of acquisition-related liabilities | | (70) | | | 527 | | | (337) | | | (15,666) | |

| Non-GAAP other income, net | | $ | 37,690 | | | $ | 2,399 | | | $ | 56,194 | | | $ | 3,971 | |

Reconciliation of Net Loss to Non-GAAP Net Loss and Non-GAAP Net Loss Per Share

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | | $ | (942,107) | | | $ | (301,156) | | | $ | (1,340,801) | | | $ | (3,006,476) | |

| Goodwill and IPR&D impairment | | — | | | — | | | — | | | 2,313,047 | |

Restructuring, impairment and other costs | | 877,289 | | | 125,222 | | | 1,010,843 | | | 130,039 | |

| | | | | | | | |

| Change in fair value of contingent consideration | | — | | | — | | | — | | | (1,850) | |

| Change in fair value of acquisition-related assets and liabilities | | (70) | | | 527 | | | (337) | | | (15,666) | |

| Amortization of acquired intangible assets | | 25,651 | | | 29,627 | | | 81,919 | | | 79,812 | |

| Acquisition-related stock-based compensation | | 16,146 | | | 23,085 | | | 47,868 | | | 75,174 | |

| Acquisition-related post-combination expense | | 141 | | | 2,124 | | | 1,825 | | | 8,239 | |

| Restructuring-related retention bonuses | | 1,930 | | | 1,231 | | | 5,164 | | | 1,231 | |

| Restructuring-related accelerated depreciation | | 125 | | | 3,422 | | | 341 | | | 3,422 | |

| Inventory and prepaid write-offs | | 388 | | | 16,467 | | | 1,362 | | | 16,467 | |

| Acquisition-related income tax benefit | | (6,180) | | | (1,390) | | | (6,810) | | | (40,195) | |

| Non-GAAP net loss | | $ | (26,687) | | | $ | (100,841) | | | $ | (198,626) | | | $ | (436,756) | |

| | | | | | | | |

| Net loss per share, basic and diluted | | $ | (3.42) | | | $ | (1.27) | | | $ | (5.09) | | | $ | (12.91) | |

| | | | | | | | |

| Non-GAAP net loss per share, basic and diluted | | $ | (0.10) | | | $ | (0.42) | | | $ | (0.75) | | | $ | (1.88) | |

| | | | | | | | |

| Shares used in computing net loss per share, basic and diluted | | 275,604 | | | 237,974 | | | 263,210 | | | 232,889 | |

| | | | | | | | |

Reconciliation of Net (Decrease) Increase in Cash, Cash Equivalents and Restricted Cash to Cash Burn

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | March 31, 2023 | | June 30, 2023 | | September 30, 2023 | | | | September 30, 2023 |

| Net cash used in operating activities | $ | (34,398) | | | $ | (54,905) | | | $ | (66,895) | | | | | $ | (156,198) | |

| Net cash provided by investing activities | 73,878 | | | 116,064 | | | 5,117 | | | | | 195,059 | |

| Net cash (used in) provided by financing activities | (135,768) | | | 876 | | | (3,381) | | | | | (138,273) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (96,288) | | | 62,035 | | | (65,159) | | | | | (99,412) | |

| Adjustments: | | | | | | | | | |

| Net changes in investments | (75,202) | | | (117,146) | | | (7,048) | | | | | (199,396) | |

Loss from public offerings of common stock, net of issuance costs | — | | | — | | | 55 | | | | | 55 | |

| Proceeds from issuance of Series B convertible senior secured notes due 2028, net of issuance costs | (22,435) | | | 1,763 | | | 8,016 | | | | | (12,656) | |

| Cash burn | $ | (193,925) | | | $ | (53,348) | | | $ | (64,136) | | | | | $ | (311,409) | |

| | | | | | | | | |

| • Cash burn for the three months ended March 31, 2023 includes $135.0 million repayment of debt, $8.1 million of prepayment fees, $3.7 million in restructuring-related cash payments, and $1.5 million of acquisition-related payments. |

• Cash burn for the three months ended September 30, 2023 includes $4.1 million of acquisition-related payments. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

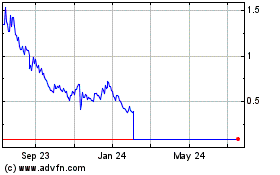

Invitae (NYSE:NVTA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Invitae (NYSE:NVTA)

Historical Stock Chart

From Dec 2023 to Dec 2024