/C O R R E C T I O N -- CommScope, Inc./

December 06 2007 - 3:49PM

PR Newswire (US)

In the news release, CommScope Reaches Agreement with Department of

Justice to Complete Acquisition of Andrew (NYSE: CTV), issued

earlier today by CommScope, Inc. over PR Newswire, there were a

number of changes that were not reflected in the version issued

incorrectly by PR Newswire. Complete, corrected release follows:

HICKORY, N.C., Dec. 6 /PRNewswire-FirstCall/ -- CommScope, Inc.

(NYSE:CTV), a global leader in infrastructure solutions for

communications networks, announced today that it has reached an

agreement with the U.S. Department of Justice (the "DOJ") that will

allow it to complete its proposed acquisition of Andrew Corporation

(NASDAQ:ANDW). Under the terms of the agreement with the DOJ, which

was filed today in the U.S. District Court for the District of

Columbia, the companies will be required to divest certain non-core

assets, including Andrew's non-controlling minority interest in

Andes Industries, Inc., a supplier of last-mile products for

broadband communications networks, and other related assets. The

carrying value of the assets to be divested was less than $25

million as of September 30, 2007. It is expected that the

divestitures will be completed after CommScope completes the

acquisition of Andrew. This agreement is subject to the Court's

approval. In addition to the DOJ, the proposed Andrew transaction

was cleared by the European Commission as well as other required

regulatory authorities. The Andrew stockholders will vote on the

transaction on December 10, 2007. CommScope expects to close the

transaction by year end, subject to the satisfaction of other

customary conditions. About CommScope CommScope, Inc. (NYSE:CTV)

(http://www.commscope.com/) is a world leader in infrastructure

solutions for communication networks. Through its SYSTIMAX(R)

Solutions(TM) and Uniprise(R) Solutions brands CommScope is the

global leader in structured cabling systems for business enterprise

applications. It is also the world's largest manufacturer of

coaxial cable for Hybrid Fiber Coaxial applications and one of the

leading North American providers of environmentally secure cabinets

for DSL and FTTN applications. Backed by strong research and

development, CommScope combines technical expertise and proprietary

technology with global manufacturing capability to provide

customers with high-performance wired or wireless cabling

solutions. Forward-Looking Statements This press release includes

forward-looking statements that are based on information currently

available to management, management's beliefs, as well as on a

number of assumptions concerning future events. Forward-looking

statements are not a guarantee of performance and are subject to a

number of uncertainties and other factors, which could cause the

actual results to differ materially from those currently expected.

For a more detailed description of the factors that could cause

such a difference, please see CommScope's filings with the

Securities and Exchange Commission. In providing forward-looking

statements, the company does not intend, and is not undertaking any

obligation or duty, to update these statements as a result of new

information, future events or otherwise. Additional Information In

connection with the proposed merger, CommScope filed a registration

statement with the SEC on Form S-4 (File No. 333-145398) containing

a proxy statement/prospectus and CommScope and Andrew mailed a

definitive proxy statement/prospectus to Andrew's stockholders

containing information about the merger. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY

STATEMENT/PROSPECTUS CAREFULLY. The registration statement and the

proxy statement/prospectus contain important information about

CommScope, Andrew, the merger, and related matters. Investors and

security holders may obtain free copies of these documents through

the web site maintained by the SEC at http://www.sec.gov/. In

addition to the registration statement and the proxy

statement/prospectus, CommScope and Andrew file annual, quarterly,

and special reports, proxy statements, and other information with

the SEC. Printed copies of these documents can also be obtained

free of charge (other than a reasonable duplicating charge for

exhibits to our reports on Form 10-K, Form 10-Q and Form 8-K) by

any stockholder who requests them from either CommScope or Andrew's

Investor Relations Department: CommScope, Andrew and their

respective directors and executive officers and other members of

management and employees may be deemed to be participants in the

solicitation of proxies from Andrew stockholders in connection with

the proposed transaction. Information about CommScope's directors

and executive officers and their ownership of CommScope common

stock is set forth in the definitive proxy statement for

CommScope's 2007 annual meeting of stockholders, as filed by

CommScope with the SEC on Schedule 14A on March 16, 2007.

Information about Andrew's directors and executive officers and

their ownership of Andrew common stock is set forth in the

definitive proxy statement for Andrew's 2007 annual meeting of

stockholders, as filed by Andrew with the SEC on Schedule 14A on

December 29, 2006. Other information regarding the participants in

the proxy solicitation is contained in the proxy

statement/prospectus and other relevant materials filed with the

SEC when they become available. DATASOURCE: CommScope, Inc. Web

site: http://www.commscope.com/

Copyright

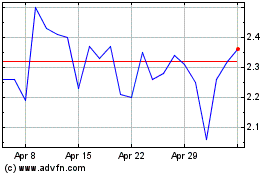

Innovid (NYSE:CTV)

Historical Stock Chart

From Jun 2024 to Jul 2024

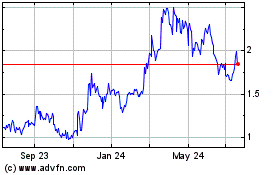

Innovid (NYSE:CTV)

Historical Stock Chart

From Jul 2023 to Jul 2024